“Nurture your mind with great thoughts, for you will never go any higher than you think.”

– Benjamin Disraeli, UK Prime Minister (1874-80)

Summary

The US-China Phase I trade deal requires China to increase its purchases of American goods and services by +100% over the next two years. That is a huge ask. Will China be able to meet the additional purchase targets and does it ultimately matter?

The answer to the first question – I don’t believe so and the answer to the second question – no, it doesn’t matter, at least not in the short term. The official US trade statistics for 2020 won’t be available until March 2021 i.e. US voters will be unable to evaluate the success or failure of US President Donald Trump’s China deal before they go to the polls in November. This deal allows Trump to talk about his deal-making prowess endlessly, without any way to challenge those claims.

Elsewhere, in less than ten days’ time the UK will leave the European Union (EU) and chart its path in a fast-changing world. One hopes it will be time for a Thatcher-era like revolution of the 1980s. Then, Britain broke the shackles of trade unionism and the belief that the state was the answer to every question. A post-Brexit UK should adopt economic and competition policies which are solely in the long term national interest. Not having the EU shackles will be a great help in achieving this.

Global equities had an excellent 2019 – the best in a decade. Just a few weeks into the new near and the S&P 500 Index is already topping some strategists’ year-end targets. There is still a lot of cynicism about this rally, however, bear in mind, just because the market has rallied doesn’t necessarily mean it has to now fall. The US economy has been mixed with more good news than bad. Housing has led the way, while manufacturing data remains weak and inflation pressures remain non-existent.

US-China trade: A Delicate Truce

After months of wrangling, threats, tariffs, counter-tariffs, and false dawns, last week, the US and China finally signed a Phase I trade deal that promises to call a temporary truce to the 19-month-long US-China trade war. This deal pledges that China will buy an additional $200 billion of American goods and services over the next two years, further open Chinese markets to US firms—especially in financial services—as well as provide strong new measures for US companies operating in China to safeguard their trade secrets and intellectual property.

China, on the other hand, hopes to continue exporting over $600bn of Chinese goods per annum to the US without any risk of an additional increase in tariffs. Crucially, however, the agreement doesn’t alter US President Donald Trump’s 25% tariffs on $250 billion of Chinese imports or China’s retaliatory tariffs on US goods. Both levies stay.

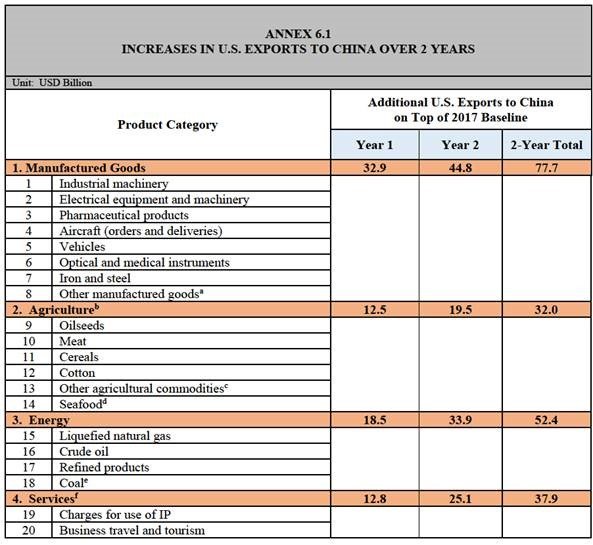

The table below details is the crux of the deal: Over the next two years China is to buy $200 billion of additional product and services compared to 2017 levels.

US-China Trade deal: Increases in US exports to China over 2 years

Source: United States Trade Representative (USTR)

The US export of goods and services to China in 2017 stood at $188 billion. However, the sectors covered in this deal (as indicated in the table above) amounted to only $134.2 billion.

Therefore, the deal requires China to increase its purchases of goods and services to $210.9 billion by 2020 and $257.5 billion in 2021. That is an increase of +57% and +91% i.e. a doubling by 2021. That’s not all. If you take into account the slump in US-China trade as tariffs came into effect – US exports to China through 2019 are currently estimated to be $20 billion lower than in 2017. Therefore, the increased purchase targets for China are +100% over the next two years. That is a huge ask.

On Monday, I spoke on CNBC regarding the US-China trade deal and its impact on the markets. You can watch the interview here.

The key questions are: Will China be able to meet the additional purchase targets and does it ultimately matter?

The answer to the first question – I don’t believe so and the answer to the second question – no, it doesn’t matter, at least not in the short term.

The US is not considering lowering any tariffs on Chinese exports and therefore China will not lower the tariffs it has imposed on US exports to China. The chart below from Chad Brown shows how US tariffs on Chinese exports and China’s tariff on US exports have evolved over the last two years and stand at an average of 20%. You can be sure that China is not going to buy from the US at a worse price, just to meet the targets of the deal, if it can get the same product and services at a better price from Europe or elsewhere. Such a practice may be barred under the World Trade Organisation (WTO) rules as it would be seen as an unfair trade practice.

China not meeting its target as per the deal may not matter in the short term as far as the US Presidential elections are concerned. The official US trade statistics for 2020 won’t be available until March 2021 i.e. US voters will be unable to evaluate the success or failure of Trump’s China deal before they go to the polls in November. This deal allows Trump to talk about his deal-making prowess endlessly, without any way to challenge those claims.

Source: PETERSON INSTITUTE FOR INTERNATIONAL ECONOMICS (PIIE)

The deal also contains a unique and unprecedented dispute settlement chapter – bilateral consultations and no outsourcing of disputes to third party arbitrators, as would be standard in other similar agreements, such as the World Trade Organization (WTO) or the US-Mexico-Canada Agreement (USMCA). Therefore, if the United States Trade Representative (USTR) determines China not to have purchased the amounts as per the deal, then the USTR may retaliate unilaterally by any means adequate. China cannot take the matter to any court to delay the action. Expect Trump to use this clause and double down on tariffs for political gains if he finds himself behind in the polls as we get close to November.

On the other hand, the agreement does contain a termination clause. China can pull out of the deal if it feels the USTR has pushed disputes too far. Therefore the deal is a delicate truce that can be shattered with little notice or forewarning. This fight is far from over.

Is there anything good about the deal? Well, yes.

The deal, with its risk notwithstanding, is a welcome one. Both sides have made compromises and both sides want to maintain the truce for domestic policy concerns. For China. 2019 was supposed to focus on celebrating the 70th anniversary of Communist Party rule and its success in lifting hundreds of millions of people out of poverty. Instead, the trade war took the bulk of that joy away and hurt growth. For the US, China which had largely stopped buying US crops to retaliate against tariffs hit Trump supporters in farm states and therefore his future in the White House. Getting China to agree to increased purchases of US farm goods is a major win for Trump, as is the enforcement mechanism in the deal. The financial liberalization promise in the deal is another plus. The pace of financial opening is faster than previously announced, with ownership restrictions in all financial sectors to be removed by April 1, a big boost to US financials looking to increase their business in China.

This deal will help markets and corporates breathe a sigh of relief. No more new tariffs (at least for now) or forced relocation of US manufacturing away from China in a very short time. Recall Trump’s tweet on Aug. 23, in which he “hereby ordered” US firms “to start immediately looking for an alternative to China, including bringing…your companies HOME.” None of that is welcome news and it will allow corporates to plan their capital expenditures better as also allow businesses to lobby and influence future decisions as the crucial Phase II talks get underway. A China that grows is not only good for China and the US but for the rest of the world too.

The world’s two largest economies – the US and China – have their fates inextricably linked. In a way, they complement and need each other. China cannot compete (yet) with the US when it comes to product design or research and development capabilities and the US cannot compete with China when it comes to manufacturing. The world’s most cost-competitive and largest electronics industry supply chain has taken shape in Shenzhen, China. China’s manufacturing capacity is so well-honed and organised that it accounts for more than 25% of global manufacturing. China is the leading producer of 220 of the world’s 500 major industrial products and is the only country that has all the industrial categories in the United Nations Industrial Classification.

In the future, don’t be surprised if you see the US companies play a bigger role in China’s Belt and Road Initiative (BRI) as the talks get more harmonious. China has built some of the world’s best infrastructure and America’s infrastructure is crumbling. There is plenty for these two nations to co-operate and work on. As the US and China increasingly see the merits of working with each other, both will target the European Union (EU) and this will make the EU vulnerable to aggressive trade practises by both China and the US.

Markets and the Economy

In the December newsletter, I forecast that Boris Johnson’s Conservative party would win a majority of 25-40 seats (with risk to the upside). That risk to the upside materialised as the Conservatives won a landslide 80 seat majority, their largest win since 1987. In less than ten days’ time the UK will leave the European Union (EU) and chart its path in a fast-changing world. One hopes it will be time for a Thatcher-era like revolution of the 1980s. Then Britain broke the shackles of Trade Unionism and the belief that the state was the answer to every question. A post-Brexit UK should adopt economic and competition policies which are solely in the long term national interest. Not having the EU shackles will be a great help in achieving this.

This week the International Monetary Fund (IMF) upgraded UK’s growth and the UK is now set to outperform the Eurozone over the next two years. No publication was bigger or better than The Financial Times (FT) when it came to trumpeting the risk Brexit posed to the UK economy. It published every scare story and prediction and repeated them ad nauseam. So imagine my surprise to read an op-ed in the FT recently, titled How Britain can prosper after it leaves the EU. What a welcome change of tune! Not only that, it seems a Truth and Reconciliation Commission may not be necessary. The FT’s outgoing editor Lionel Barber now claims he always “felt a bit ambivalent about it [Brexit]” and he “never denied there are huge opportunities for Britain outside the EU.” Bless Mr Barber. It seems he has reached the “acceptance” stage of the Kübler-Ross model of grief.

Reuters reported this week that A thousand EU financial firms plan to open UK offices after Brexit. Despite all the positive news, the final deal is yet to be done. Given the signs and progress so far, the chances of a tariff-free trade deal between the UK and the EU look brighter for the simple reason that the EU benefits from it at least as much, if not more, than the UK. I look forward to the UK Budget on March 11. The budget is likely to focus on a stamp duty cut for property transactions, tax cuts in the shape of an increase in the threshold of National Insurance (NI) as well as increased government spending. Do not expect the GBP/USD to rally even if good economic data starts piling up. A decisive move up in GBP/USD will not happen until at least Q4 when the contours of a Brexit trade deal will be clearer.

Across the Atlantic, Trump became the third president in US history to be impeached by the House of Representatives, formally charged with 2 articles of impeachments for abuse of power and obstruction of Congress. The vote passed in a Democrat-controlled House, but still needs to be passed by the Republican-controlled Senate (which is highly unlikely). No president in the 243-year history of the US has been removed from office by impeachment. The impeachment trial and the vote, therefore, have been a non-event for the markets.

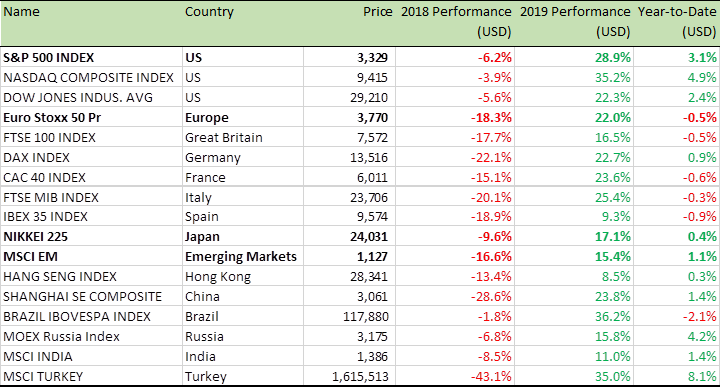

As the table below indicates, equities had an excellent 2019 – the best in a decade. Just a few weeks into the New Year and the S&P 500 index is already topping some strategists’ year-end targets. There is still a lot of cynicism about this rally. However, bear in mind just because the market has rallied doesn’t necessarily mean it has to now fall. The US economy has been mixed with more good news than bad. Housing has led the way while manufacturing data remains weak and inflation pressures remain non-existent.

Benchmark Equity Index Performance

Source: Bloomberg

In the August newsletter, I wrote that in the next 6 months the SPX “would have risen to 3,360 or better (that is up +13% from current levels)”. It seems we are on target to get there with a month to spare. Meanwhile, the US Federal Reserve (Fed) has continued to expand its balance sheet (chart below). The Fed is buying assets at a rate of over $60bn/month. It will likely continue doing so through 1Q20, before slowing to an “organic” $10-20bn/ month. Inflation expectations in the US have rebounded enough over the last three month to deter further interest rate cuts, but not nearly enough to warrant a return to rate hikes. All major economies – US, Japan, UK, Eurozone are in easing mode and China has also indicated an intent to join them with growth-supporting policies. The combination of a trade truce and policy easing is bullish for equities and the rally is set to continue at least for the first half of the year.

US Federal Reserve Banks Total Assets ( in USD (m))

Source: Bloomberg

In continuing positive signs, the New York Fed’s recession probability model (discussed in September’s newsletter) which reached 38% in Q3 last year has continued its downward trend and is now at 23.6% in its latest update. This model uses the difference between 10-year and 3-month Treasury rates to calculate the probability of a recession in the US, twelve months ahead. As I said in the December newsletter, the NY Fed’s recession indicator has likely peaked and a recession has been averted for at least two quarters, if not more.

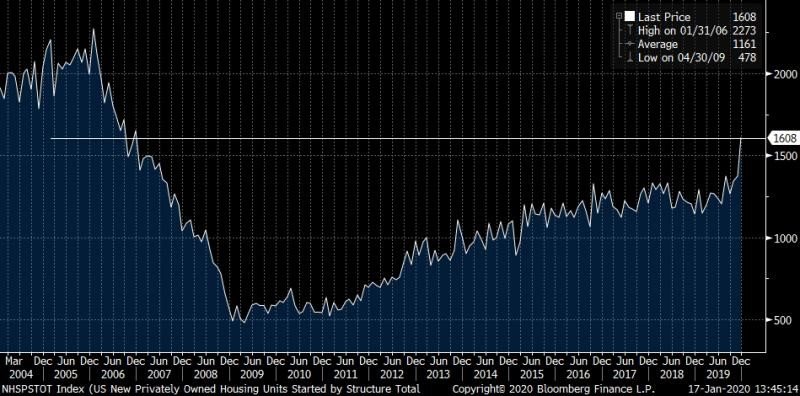

This is also evidenced by the stunning US new privately-owned housing starts report (chart below) which went parabolic at last print. Analysts expected the US new housing starts for December to tick up to an annual pace of 1.37 million up marginally from a month earlier. The actual numbers were 1.6 million, a quarter of a million better. One has to go back to 2006 to the George W. Bush-era to witness such strong numbers. The sale of existing homes also increased +3.6% in December, according to the National Association of Realtors (NAR). Existing-home sales were up +10.8% in December, from a year earlier and this is leading to inventories tightening. “We are facing this dire housing shortage,” said NAR chief economist Lawrence Yun. “We need to build more.”

Trump’s policies and Fed liquidity have lit a fire under the US housing market. Low unemployment and low mortgage rates are propelling the US housing market as it enters a new year. The US unemployment rate remained at +3.5% in December, a 50-year low. Further, borrowing conditions for homeowners are generally better than a year ago. The average US interest rate on a 30-year fixed mortgage is at 3.65% as of Jan. 16, according to Freddie Mac, up slightly from September’s lows but well below from the levels 12-months ago of 4.4%.

US New privately-owned Housing starts

Source: Bloomberg

Meanwhile in the Eurozone, as a disorderly Brexit has been averted, the EU stands to benefit and has one less worry to deal with. Fiscal policy is loosening as German centre-left parties clamour to relax fiscal rules. This week at the World Economic Forum (WEF) in Davos, Robert Habeck the co-leader of Germany’s Green Party sided with the US in demanding more spending from Berlin, saying that Chancellor Angela Merkel should drop her balanced-budget “fetishism.” He added, “I’m not a big fan of Donald Trump, but the US discussion is right — Germany is not doing enough and not spending enough.” Trump, the European Commission, and the IMF have all targeted Germany’s ballooning trade surplus and fiscal restraint, as a drag on European and global growth. Habeck, citing the US debate on a Green New Deal, said a German government with his party would spend more on green infrastructure, education and innovation. It is welcome news for Eurozone starved of growth.

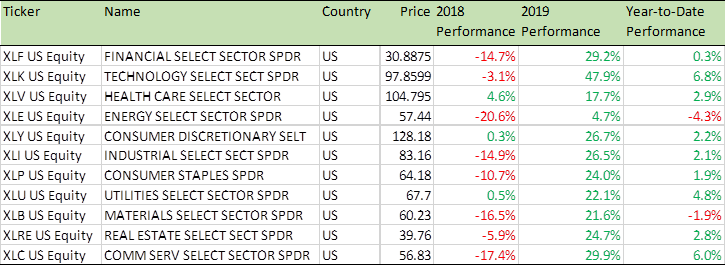

Benchmark US equity sector performance

Source: Bloomberg

Last month I wrote that “I expect the SPX to finish next year [2020] at 3,420 i.e. +10% higher from today’s [December 5, 2019] level”. I am not revising that target yet, although I will highlight that the risk is to the upside and not the downside.

In the US, I prefer to be long Financials (XLF), Consumer Discretionary (XLP), Healthcare (XLV) and Industrials (XLI) stocks, with an overweight position in Consumer Discretionary and Healthcare. Individual stocks in the Technology (XLK), Communication Services (XLC) also offer good upside. For specific stock recommendations, please do not hesitate to get in touch.

Lastly, it’s worth mentioning what’s happening with the mega-cap stocks. Alphabet, Google’s parent company became the fourth US company (after Apple, Amazon and Microsoft) ever to achieve a $1 trillion market value. The massive gains for US technology stocks come with Silicon Valley companies dominating the world economy and flexing their muscles in new areas such as healthcare and transportation. Investors are rewarding companies that grow sales in this low economic growth and low-interest-rate environment. Tech companies do face the risk of anti-trust probes and Google and Facebook are particularly vulnerable. However, they both have continued to grow sales and investors are happy to assign them a higher value.

Best wishes,

Manish Singh, CFA