“More money has been lost trying to anticipate and protect from corrections than actually in them.”

– Peter Lynch

Summary

The US is in deep angst. It’s youth is in rebellion and they are marching to the tune of the “Pied Piper” from Vermont – Senator Bernie Sanders who is promising them a lot of free stuff. Sanders is the “Trump of the Democrats,” albeit with more pleasant manners. Detractors of Sanders, a self-avowed democratic socialist, can say “socialism doesn’t work” and “look at Venezuela” as much as they want, but Sanders’ core policy positions are now more mainstream in the US than ever. I am increasingly of the view that the US will have to experience a bout of socialism in the coming years to convince the young and “woke” voters, that everything in life is not free and it comes at a cost.

Over the last few days, global markets have been hit by fear of the so-called Coronavirus. I can understand the rush to safe haven assets such as Gold and government bonds, for those who are forced to buy such assets per their mandate. However, for others who choose to buy them, it’s worth making a mental note that government policy both in the US and Europe, explicitly seeks to have inflation of +2% i.e. in buying 10Y US Treasuries you are lending money to the US government at +1.31%, when it has told you explicitly that it is their stated goal to debase the value of money by +2% per year. I expect yields to go lower, but I am not a buyer of such bonds. I’d much rather make that return as a dividend on blue chip stocks (plus any upside from buybacks or earnings increases) and not have a risk of a rate rise or inflation fear to destroy capital on the bond exposure. I am not revising my target, and I still expect the S&P 500 to finish the year at 3,420.

Sanders, the Pied Piper from Vermont

Last Saturday, US Senator Bernie Sanders won the Nevada caucus in a landslide, securing 47% of the vote. Former Vice President Joseph Biden was a distant second with 19.6% and Mayor Pete Buttigieg was third. America is in deep angst, its youth is in rebellion and they are marching to the tune of the “Pied Piper” from Vermont – Senator Bernie who is promising them lots of free stuff.

In the 2016 primaries, Sanders won 23 states and 46% of the elected delegates. It’s hard to see how he won’t do better this time. Sanders has now built a solid support base on the left, as opposed to the other candidates who have their votes fragmented. The Democratic Party establishment fears that Sanders could even wrap up the nomination by Super Tuesday, (March 3) when 14 US States go to polls, including the large electoral states of California, Texas, Massachusetts and the swing states of Minnesota, North Carolina, Virginia. At that point, it would be too late for moderate Democrats to stop Sanders’ march forward.

Sanders is the “Trump of the Democrats” albeit with more pleasant manners. Like Trump, however, Sanders’ is harvesting the power of social media, small donations as well as volunteers for his campaign. Donations are flowing in and the Sanders 2020 campaign has over 1 million volunteers working for it. As a lifelong social democrat, Sanders has always been against – Wall Street greed, the military-industrial complex and social injustice and for – free healthcare for all, free tuition and higher minimum wage. Sanders also says all the correct things on – climate change, gay, lesbian and transgender issues and you can understand why he makes the millennials swoon. They find him endearing, “cool” and “retro.”

Detractors of Sanders, a self-avowed democratic socialist, can say “socialism doesn’t work” and “look at Venezuela” as much as they want, but Bernie’s core policy positions are now more mainstream in the US than ever:

- • Last January, a Harris poll for the American news website, Axios found that 50% of Americans under the age of 38 would “prefer living in a socialist country”

- • The preference for socialism is even higher among Generation Z (18-24 year olds) which includes first time voters. In that cohort, 61% have a positive reaction to the word “socialism”

- • Another Harris poll for Axios in June last year found even more revealing stats: 55% of women between 18 and 54 would prefer to live in a socialist country than a capitalist country

Millennials (born between 1981 and 1986) and Generation Z (born between 1997 and 2012) will make up 37% of the 2020 electorate and 53% of all American voters are women. Centrists in the US will do well to listen and address the angst of all such voters.

Last time Socialism was popular in America was in the 1960s and 70s. However, even then those in favour of socialism were a minority. In 1974, pollster Daniel Yankelovich found that three-quarters of Americans between the age of 25 to 34 felt the country had “moved dangerously close to socialism.”

Source: Bruce Plant, Tulsaworld.com

I don’t believe those in favour of socialism this time around, want it and I suspect, most of them don’t even understand what it would entail. Burdened with – working longer hours for small wages, high healthcare cost, high tuition fees and student loans, and worsening prospect – what they are yearning for is a change. Not the slogan that former President Barrack Obama sold to them – but real change. Obama’s failure to deliver on his promise of change is exactly why a “socialist” like Sanders is leading in the polls. Democratic socialists like Congresswoman Alexandria Ocasio-Cortez and Sanders have brought a new life and meaning to those looking at the government to solve their problems.

As they say, there is never a greater danger of war than when a generation has grown up never having suffered its horrors. The same philosophy translates to those who have grown up never having been aware of the misery of Socialist rule. The philosopher George Santayana summed it all up in his memorable saying: “those who do not remember the past are condemned to repeat it.” The trouble is that young people see the Left as being trendy, defying authority and exciting – especially when it mixes in its faux message of equality for all. Offering people something free at someone else’s cost isn’t kindness, it’s a curse.

I increasingly feel America will have to experience a bout of socialism in the coming years to rid the young and “woke” voters that everything is not free and comes at a cost. Governments in the Western world (increasingly in Europe) have severed the link between tax, debt and spending and built a utopia on the sand of colossal debt. With every new debt added the sand-castle gets shakier. Debts can’t go on increasing for ever and as spending is cut or taxes increase, the clamour for socialism will rise.

While it’s too early to tell and chances of Sanders causing an upset in the November election is not insignificant, I still believe Trump will get re-elected as long as the economy and jobs both remain strong. As someone who foresaw and predicted both Brexit and the Trump victory in 2016, my eyes are firmly on the trends in the US and you will read more about my thoughts on the US election in subsequent newsletters over the summer.

Markets and the Economy

Over the last few days, global markets have been hit by fear of the so-called Coronavirus (COVID-19). Equites have sold off and the safe haven assets – Gold, US Treasuries have rallied. The 30-Year US Treasury yield dropped to a record low +1.79% and the 10-Year to +1.31%. Gold prices have broken out not only to 52-week highs but to their highest levels since 2013. Meanwhile, the VIX index – the measure of the expectation of volatility of the S&P 500 Index (SPX) – while nowhere near historically high levels, briefly topped 30 this week, which is a level we haven’t seen since the December 2018 sell-off.

US Treasury Yields (2y, 10y and 30y)

Source: Bloomberg

So what’s the prognosis for equity markets?

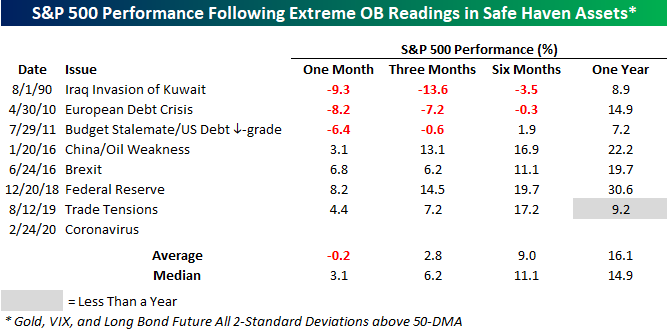

First, a handy chart and calculation by the team at Bespoke Invest that looks at similar market stresses of the past.

There have only been seven other periods where all three asset classes – US Treasuries, Gold and the VIX, were simultaneously at least two standard deviations above their 50-Day Moving Average (DMA). The table below lists the first day in each of the prior periods, where all three asset classes were at least two standard deviations above their 50-DMA. Before the current period, the last time this occurred was in August 2019. Looking ahead, equity market performance over the following one and three months has been mixed, but the further you move out from the initial shock, it’s more likely for equities to stabilize and rebound. One year later, the SPX was higher, all seven times, by an average of +16.1% (median: +14.9%).

Source: Bespoke Invest

I can understand the rush to safe haven assets for those who are forced to buy such assets per their mandate. However, for others who chose to buy them, it’s worth making a mental note that government policy both in the US and Europe explicitly seeks to have inflation of +2% i.e. in buying 10Y US Treasurys you are lending money to the US government at +1.31% when it has told you explicitly that it is their stated goal to debase the value of money by +2% per year.

The state of bond yields is even worse in the Eurozone, as is the economy. Germany, its largest economy grew by just +0.6% last year, its slowest rate since 2013—the height of the Eurozone’s debt crisis. Detailed GDP numbers reveal that Germany came to standstill in Q4 2019 with 0.0% Quarter-on-Quarter (QoQ) growth from +0.2% in Q3.

Germany’s weakness is bad news for the European Union (EU). Germany’s Gross Domestic Product (GDP) accounts for around 20% of the EU’s total GDP. More importantly, German manufacturers are also tightly integrated on the Continent, particularly Central and Eastern Europe (CEE), where German-owned plants and suppliers to German companies account for a large share of jobs.

It is no surprise then, that the German Bund yield curve is negative from 1 month to 30 years i.e. you pay to lend your money out to the borrower. As a result, we get to see a funny headline like this – France’s Richest Man Gets a Free Lunch From the ECB. Two of the five Euro tranches in the recent €7.5 billion debt issuance by Moet Hennessy Louis Vuitton (LVMH) to finance its purchase of Tiffany were placed at negative yields, meaning investors were paying single A-rated LVMH to borrow their money.

One day we will look back and marvel how Quantitative Easing (QE) was offered as panacea for house price declines, stock market declines, low inflation, low growth, climate change, virus outbreaks…you name it. The only thing QE hasn’t been offered up for yet, is to cure hair loss!

The news out this afternoon indicates that German Finance Minister Olaf Scholz is considering a move that could open an avenue for limited fiscal stimulus in Europe’s largest economy. Germany stands out as the only G7 nation with a budget surplus, and a relatively low debt burden. It has long been the target of calls by various bodies to increase fiscal spending. Will Germany listen ? They just might.

I am not a buyer of Eurozone or US government bonds that are now trading at ridiculously low yields, no matter how volatile the equity markets. I expect yields to go lower, but I am not a buyer of such bonds.

If +1.31% yield goes to 1%, on a 10y duration US Treasury – one stands to make approximately +3.1%. I’d much rather make that as a dividend on JP Morgan (JPM) stock or Microsoft (MSFT) (plus any upside from buybacks or earnings increases) and not have a risk of a rate rise or inflation fear to destroy capital on such exposure.

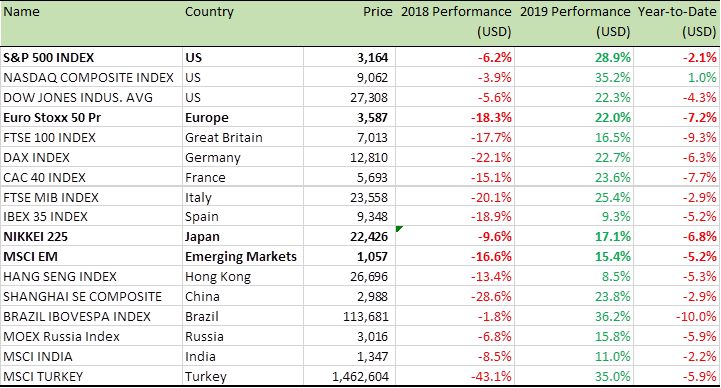

Benchmark Equity Index Performance (2018, 2019, YTD)

Source: Bloomberg

Of course, volatility will continue and it could easily get worse. The market sell-off this week was triggered by the Centers for Disease Control and Prevention (CDC) warning that the US should prepare for social distancing measures including cancelled public events, school closures, and suspended business activities. There is no way to know how mild or severe a coronavirus outbreak would be until it happens, but some sort of disease cluster cropping up seems inevitable at this point given how widespread the virus is around the world.

The good thing is total net cases continue to decline as recoveries in China rise to 37% of all cases. Deaths are rising relative to the total infected count, but falling relative to recoveries; more than 10x as many people have recovered than have died, compared to 4x as-of February 10. Eventually, seasonal warmth should naturally reduce the spread of the virus and the likely development of vaccines should help as well.

Benchmark US equity sector performance (2018, 2019, YTD)

Source: Bloomberg

In economic data, US new-home sales soared +7.9% in January to an annualized pace of 764,000, well above the consensus estimate. Low mortgage rates have helped to lift homebuying activity.

The markets are so used to the US Federal Reserve’s verbal intervention in cases of a market sell-off – but have yet to hear anything soothing from the Fed Governors. Fed Vice Chairman Richard Clarida said in a speech on Tuesday – “it is still too soon to even speculate about either the size or the persistence of these [ coronavirus] effects, or whether they will lead to a material change in the outlook.”

Fed Chairman Jerome Powell has said that the Central Bank will want to see evidence that disruptions are persistent and material for the US economy before cutting interest rates. The market, however, is already pricing in an 85% likelihood of at least +0.25% rate cut at the Fed’s July meeting. I do not see more than one rate cut this year, and if it is to come, it will come by June/July by which time the impact of any slowdown from COVID-19, or otherwise, will have become clear. The Fed would not like to tamper with rates post the summer, to avoid any accusation of impacting the outcome of the November US Presidential elections.

In the December newsletter, I wrote that “I expect the SPX to finish next year [2020] at 3,420 i.e. +10% higher from today’s [December 5, 2019] level of 3,117”. It’s eerie that as I type this line on my keyboard the SPX is at the December 5, 2019 level yet again. I am not revising my target and I still expect the SPX to finish the year at 3,420.

In the US, I prefer to be long Financials (XLF), Consumer Discretionary (XLP), Healthcare (XLV) and Industrials (XLI) stocks, with an overweight position in Consumer Discretionary and Healthcare. Individual stocks in the Technology (XLK), Communication Services (XLC) also offer good upside. For specific stock recommendations, please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA