Stocks have rebounded since Trump’s tariff backpaddling and concessions. But there are still signs of strain in the bond market.

Summary

After weeks of mounting tension, the US and China opted to de-escalate over the weekend, marking a potential turning point in a trade war that has shaken markets and frayed diplomatic ties. This shift signals renewed pragmatism and a reminder of what built America’s economic strength: Not isolationism, but open trade and global engagement. Smart, targeted policy—not blunt instruments like sweeping tariffs—is what will secure US influence in the decades ahead.

Markets welcomed the news. Equities have rebounded since President Donald Trump began walking back tariff threats and offering concessions. However, strain lingers in the bond market. Yields on 10-year U.S. Treasuries have climbed back to +4.5%, highlighting persistent concerns around long-term fiscal sustainability. Unlike short-term rates, which the Federal Reserve can manage, longer-term yields are shaped by inflation expectations and fiscal credibility—particularly important in a country carrying growing debt burdens.

With fears of tariff-driven inflation now easing, the door is opening wider for the Fed to resume interest rate cuts. And while markets have rallied sharply, history suggests this isn’t necessarily the end of the move. Since 1953, when the S&P 500 has risen +10% or more in a month—especially following a prior sharp drop—continued gains have often followed.

If catalysts like interest rate cuts, lighter regulation, tax relief, renewed trade flows, and stronger global growth remain in play, there’s every reason to believe the rally has more room to run.

Decoupling Delayed: US & China reassess economic separation

So much for a clean break—Washington and Beijing seem to be reconsidering just how far this “decoupling” dance really goes.

After months and years of tough talk and the recent tariff escalations, signals suggest both the US and China are edging back from the brink, opting instead for a more pragmatic, if uneasy, economic coexistence. The weekend’s “tariff truce” points to a shift in tone, if not policy—a recognition that fully unwinding the world’s most important trade relationship is easier said than done.

More on these developments a little further down.

As we ease into the long days of summer, it’s hard to believe this chaos all belongs to the same year!

We’ve got the first American Pope (yes, really)—and if you have young kids and know your way around Paddington Bear lore, you might notice some parallels. Pope Leo XIV is not only a naturalized Peruvian, but he’s also been conducting services in Quechua, the language of the Incas. Somewhere, Paddington is probably nodding in approval.

“DeepSeek” has gone viral, taking a sledgehammer to the supposedly unbreachable moats of AI giants like OpenAI—prompting some frantic footwork, hasty feature drops, and even deal renegotiations with Microsoft. It’s also thrown cold water on Nvidia’s chip-fuelled money machine, sparking doubts about how durable that growth story really is—concerns Nvidia is answering well so far.

US President Donald Trump, never one to shy away from theatrics, cranked tariffs on China up to 145%, as if he were swapping Pokémon cards with China’s President Xi Jinping—then turned around and called Fed Chair Jerome Powell a “fool” for not slashing rates on command. Markets, naturally, responded with drama: A sharp correction, a whiplash recovery, and April 2’s so-called “liberation day,” which mostly liberated investors from their gains—and in many cases, their sanity.

And just when you thought things couldn’t get any more surreal, the US and China spent the weekend agreeing to a 90-day tariff cooldown. Apparently, even trade wars need a timeout.

Meanwhile, for football fans, Manchester United and Spurs— who are hanging just above the relegation zone at 15th and 16th in the Premier League—are now on track to sneak into the Champions League next season, depending on who wins the Europa League Final. And then there’s Kylian Mbappé, who left PSG for Real Madrid to chase European glory, only to watch his former team reach the final. It seems that, just like markets, trying to “time the move,” doesn’t work in football either.

So in summary, all of this—Popes, Paddington, tariffs, football and AI panic—feeds into a market environment that feels less like a rational pricing mechanism and more like a reality show with a Bloomberg terminal.

Back in March’s Market Viewpoints, I wrote “It’s time for Trump to make up his mind [on tariffs]—before the market does it for him, by selling off U.S. equities and bonds.”

Well, the market didn’t wait. April saw a sharp -13% drop, followed by a full rebound as Trump changes tone making the April 2nd “liberation day” sell-off, feel like a fever dream.

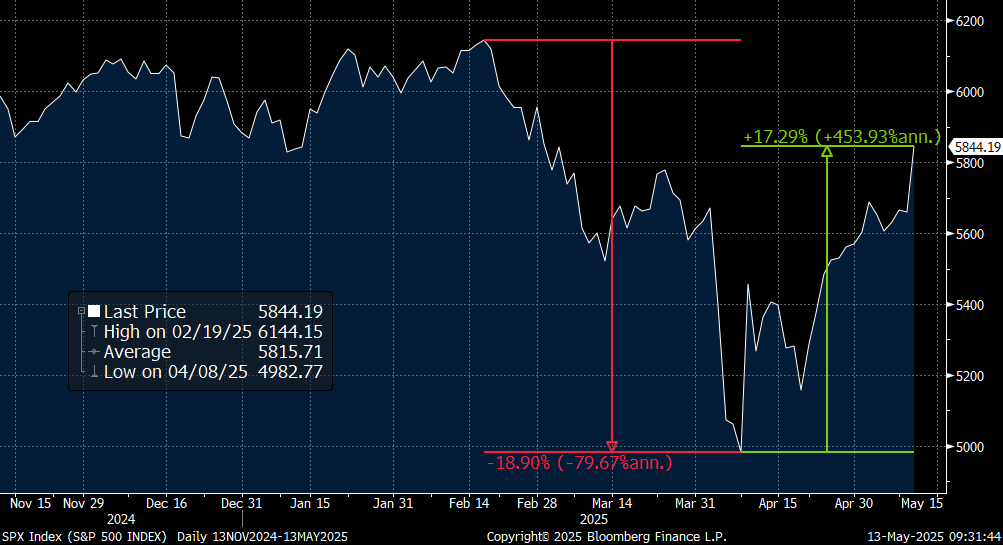

S&P 500 Price Chart: Last 6 months

Source: Bloomberg

Such is the lack of conviction among the market bears: They know all too well that Trump can pivot faster than a meme stock on Reddit—and sure enough, he did just that. As late as Friday, he was still floating an 80% tariff on China; by the weekend, we had a truce. Classic.

The result?

A handshake deal that amounts to a “tariff truce,” for now.

Sometimes, as the market reminded us yet again in April, the smartest way to handle non-cyclical, man-made (or Trump-made, if you prefer) crises, is to sit on your hands and let the chaos unfold—rather than place bets on known unknowns, unknown unknowns, and everything else we think we understand just because we went to a top university and paid handsomely for the privilege. Regret tends to cost more.

After weeks of escalating tariffs and strained relations, over the weekend, the United States and China chose to de-escalate . This development signals a potential thaw in the ongoing trade war, that has disrupted global markets and strained bilateral ties.

US Treasury Secretary, Scott Bessent said at a briefing in Geneva on Monday. “Neither side wants a decoupling. We want more balanced trade, and I think both sides are committed to achieving that.”

Source: White House

China released the joint statement with the US simultaneously. “This move meets the expectations of producers and consumers . . . aligning with the interests of both nations and the common global interest,” China’s Ministry of Commerce said.

“No decoupling,” is a welcome news as the US and China trade and economic relations hold the fortune of global growth and peace.

The trade conflict intensified earlier this year when Trump imposed tariffs exceeding 145% on Chinese goods. China retaliated with tariffs of up to 125% on U.S. exports, leading to significant disruptions in trade flows and economic uncertainty. A shared concern over the fentanyl crisis has opened channels for renewed dialogue. China’s recent efforts to address the issue, including crackdowns on chemical precursors, have been met with cautious optimism from the US administration. This common ground paved the way for the talks over the weekend.

The urgency to a do deal with China on tariffs, is evident and deteriorating data puts it in perspective too.

US productivity slipped at a -0.8% annual rate in Q1, marking its first drop since mid-2022. Over the past year, productivity has inched up just +1.4%, the slowest pace since early 2023.

Meanwhile, unit labour costs—basically wages—spiked +5.7% in the first quarter, more than double the +2.0% increase in the previous quarter. In short: workers are costing more and producing less. Not exactly the combo you want on your economic scoreboard.

Just over a week ago at his annual Berkshire conference in Omaha, Warren Buffett emphasized that trade should not be used as a weapon and that we should be looking to engage with the rest of the world. Buffett is absolutely right: Trade is not a weapon.

It’s a bridge — a long-term tool for building influence, prosperity, and yes, empires.

History backs this up.

Spain, France, the Dutch, Britain, and eventually the United States, all leveraged trade as a foundation for global expansion. Their economic networks supported military, cultural, and political influence far beyond their borders. Trade enabled not just economic growth but strategic reach. China, the latest entrant to this centuries-old game, is pursuing a similar path — using trade as a cornerstone of its rise.

The irony is that the US, having built much of its global position through open markets and economic engagement, now risks undermining that very legacy.

By turning trade into a zero-sum, tit-for-tat battlefield, Trump is playing a short-term game with long-term consequences. Yes, there are structural imbalances and real issues that need addressing — from intellectual property to market access. But the solution isn’t to break the system; it’s to outsmart within it.

Smart, targeted policy — not sweeping tariffs and trade wars — is what will keep America competitive and respected.

Because if the US wants to extend its influence into the future, it must remember what built its empire in the first place: Not isolation, but connection.

Not threats, but trade.

Markets and the Economy

Stocks have rebounded since Trump’s tariff backpaddling and concessions. But there are still signs of strain in the bond market.

The equity market recovery rally is easy to explain — Trump imposes punitive tariffs, the market drops. Then Trump gives waivers, rolls back some of them and signals that most of the tariffs may be lifted. The market rebounds.

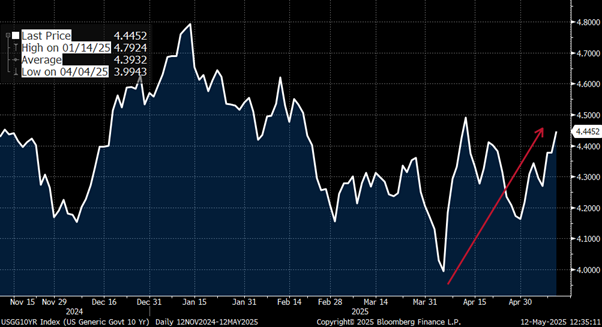

Yields on US 10-year Treasuries, however, refuse to go down and are now back to +4.5% level (see chart below)

Longer-term yields, which are critical in determining borrowing costs for long-term projects and, more importantly, for the fiscal health of a country with ongoing debt to service, renew, and repay, are primarily driven by expectations of inflation and fiscal policy. While the Federal Reserve (Fed) has control over short-term rates through its monetary policy, its ability to directly influence long-term yields remains limited.

6-month chart: US Treasury 10-year yield

Source: Bloomberg

The US House and Senate Republicans have been working for months on major tax-cut legislation, which may or may not include significant spending reductions. Meanwhile, the Department of Government Efficiency (DOGE) has had limited success in identifying and cutting wasteful spending. Additionally, tariff collections are expected to fall, as the US reduces its tariff levels. While budget concerns have existed long before Trump took office, if he moves forward with unfunded tax cuts, the market is unlikely to look kindly on it.

Investors are expected to remain cautious about purchasing longer-term Treasuries, due to fears that the growing supply of bonds needed to fund the federal budget deficit, could put downward pressure on prices.

If long-term rates don’t decline or, conversely, rise, it will keep mortgage rates and other forms of debt elevated—just when the central bank might try to encourage borrowing by cutting short-term rates to stave off any signs of recession.

The US-China deal struck over the weekend is certainly welcome, but given it’s more of a pause than a permanent resolution, its impact on long-term yields is likely to be limited.

Going forward, both sides have agreed to hold regular talks—alternating between the US, China, or a neutral third country—to negotiate more comprehensive trade terms. Notably, the joint statement appeared to shut down any serious discussion of a full-scale trade rupture between the world’s two largest economies, whose bilateral relationship—though heavily skewed in favour of Chinese exports—remains the most significant in global trade.

The fears of inflation due to tariffs, is now alleviated and it should open room for the Fed to cut rates.

These two points from Bessent’s comments at the press conference in Geneva, is very telling. There’s room for a grand deal.

- “The consensus from both delegations this weekend is that neither wants a decoupling”

- “What occurred with these very high tariffs was the equivalent of an embargo. Neither side wants that.”

In April, the US economy added 177,000 jobs — better than many had feared. The S&P 500 responded with a +1.5% jump, pushing it above its April 2 closing level, the day the president announced his “reciprocal tariffs.”

That marked the index’s ninth straight daily gain — its longest winning streak since 2004.

Getting back to how much difference a month can make—consider this: just a month ago, US stocks were staggering under the weight of the “Liberation Day” tariffs announced by Trump in the White House Rose Garden.

On April 8, the S&P 500 had fallen nearly -19% from its February highs, teetering on the edge of a bear market.

Fast forward to today, and the index is up over +17.3% from that low—marking the strongest one-month rally since April 2020, when markets were clawing their way back from the COVID crash. It’s rare enough to see a +10% monthly rally. It’s even rarer for such a surge to follow so closely on the heels of a 10%+ monthly decline.

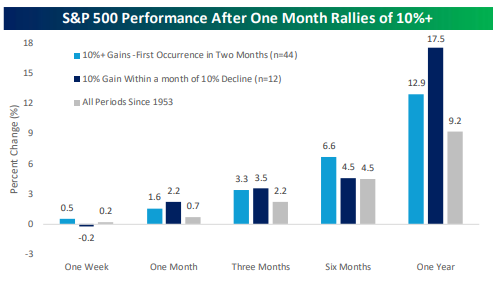

Source: Bespoke Invest

While the market has rebounded sharply, history suggests that strong rallies don’t necessarily imply an imminent reversal.

The data backs this up (see table above). Since 1953, following one-month gains of +10% or more—or such gains occurring within a month of a 10%+ decline—the S&P 500 has historically continued to post solid returns over the following weeks and months. Charts on the next page show median returns and the frequency of positive outcomes in the 1-week, 1-month, 3-month, 6-month, and 12-month periods that followed.

So don’t be surprised if the rally has more legs—especially if the underlying catalysts strengthen rate cuts, easing inflation, tax cuts, lighter regulation, revived trade flows, and an improving global growth outlook.

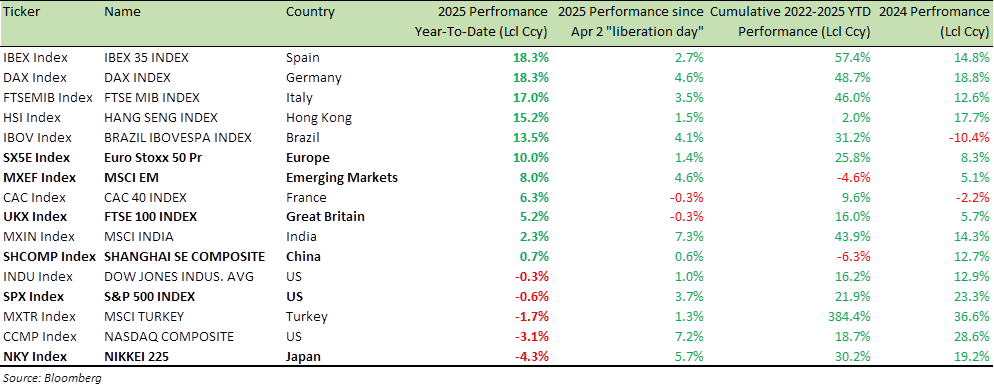

Global Equity Index Performance (2025 performance YTD, since Apr 2 “Liberation Day”, 2022-2025 YTD and 2024)

Meanwhile, over in Europe—and closer to home in the UK—the Bank of England (BoE) finally delivered a 0.25% rate cut last Thursday.

Fair enough.

Something is better than nothing, especially given how far behind the curve the BoE has been in pivoting toward looser policy. For context, the Eurozone’s central bank rate now sits at 2.25%—nearly half of the UK’s still-lofty 4.25%.

But what really turned heads was the vote split on the Monetary Policy Committee (MPC).

Five members voted for the modest quarter-point cut. Two pushed for a deeper, 50-basis-point reduction. And—brace yourself—two voted to hold rates steady.

Hold rates? In this environment? Seriously?

At this point, you have to wonder: Are they setting monetary policy or just treating the UK economy like a petri-dish for academic theory?

Because the data isn’t subtle.

The UK’s Purchasing Managers’ Index (PMI) tells a clear story: growth is sputtering, and the £26 billion hike in employers’ national insurance contributions is about to hit like a brick.

Job losses are looming.

And while falling oil prices (down over 15% in recent weeks) are good news for inflation, tariffs and weaker global trade are piling on new risks to growth.

Given all this, you have to ask: Should the Bank of England be doing more—and faster?

GBP/USD strength is masking the weakness of the UK economy. I expect BoE to cut rates by at least 100 bps by the end of the year.

Finally, a lesson from market history:

In 2008, BlackBerry (then Research In Motion) was worth more than Amazon, Nvidia, Netflix, AMD, Salesforce, and Starbucks combined. With a market cap near $80 billion, BlackBerry was the global smartphone leader.

At the time in 2008, those now-dominant names were still emerging:

Amazon: ~$30B

Nvidia: ~$10B

Netflix: ~$3B

AMD: <$4B

Salesforce: ~$6–7B

Starbucks: ~$15B

Fast forward to 2025, and the reversal is staggering:

Nvidia: >$3T

Amazon: >$2.2T

Netflix: > $450B

AMD, Salesforce: each >$200B

Starbucks: ~$100B

BlackBerry: acquired by Fairfax Financial Holdings for $4.7B in 2013

The takeaway:

Markets—and fortunes—can change drastically.

If you’re ahead, don’t get complacent.

If you’re behind, keep pushing.

Success (in investing, sports or life) isn’t owned—it’s rented, and rent is due every day.

In last month’s Newsletter, I wrapped up with this: “Come May, I suspect President Trump will strike a broad deal with China, take a victory lap, and we all can take respite that we survived the trade war.”

Well, here we are in May, a US–China deal is on the table (with more likely to follow), and markets are breathing a little easier. The balance of risk for equities now tilts to the upside, and any meaningful signs of a US recession remain elusive.

For specific stock ideas or structured product strategies, feel free to reach out to me directly—or connect with your relationship manager. We’re happy to guide you through it.

Best wishes,

Manish Singh, CFA