At his press conference this week Fed Chair Jerome Powell noted that the inflation situation had gotten worse and the market is in now pricing in five interest rate increases this year. Will this happen? What will the impact be on global equity markets?

Summary

The two-day Federal Reserve Open Market Committee (FOMC) meeting that concluded on Wednesday, was one of the most anticipated ones in recent times. In the end, the committee held short-term interest rates steady at 0-0.25%, yet signalled its intentions to raise rates beginning in March. At his press conference following the meeting, Fed Chair Jerome Powell noted that the inflation situation had “gotten slightly worse,” while also saying that the differences between now and the 2015 hike cycle had “implications for our policy trajectory,” when asked about the possibility of rate hikes at consecutive meetings.

These two comments open the door to potentially four rate hikes this year and the market is in fact now pricing in five rate hikes this year. However, in my view I expect inflation to turn, and thus do not anticipate such aggressive moves by the Fed.

If a tightening of fiscal policy, easing of supply chains as COVID restrictions are loosened, and less accommodative monetary policy restrain inflation, Powell has indicated that the FOMC may not need to continue hiking – as it is not on a pre-set path. Powell categorically refused to commit to any policy path and, in my view, that’s a good thing. The Fed has never been more “data dependent” than now and market participants should take note. My call: only two interest rate increases during 2022.

The UK has cast many of the Covid restrictions aside and the UK economy is set to be the fastest-growing economy in the G7, yet, on the continent, Covid restrictions remain in place and have gotten quite severe, hitting consumer mobility and thus consumer spending on services. This means, that monetary policy in the Eurozone, unlike the US, will remain highly supportive.

Emerging Markets (EM) had a rough 2021. The EMs still face some stiff headwinds, yet there are reasons to be positive and would start building long positions in EM equities.

For 2022, we will likely see +7% to +8% return for the broad S&P 500 Index in the US, so income strategies should be prioritised. Clipping coupons in a flat to negative market, or using structured products to generate income, will be the avenues to follow this year, at least until CPI turns and we know that the Fed is not under pressure to keep raising interest rates.

Boomerang equity markets – Fed signals rate lift-off

Monday saw a stunning reversal in the markets. US equities deep in the red at lunchtime during New York trading hours, staged a mammoth comeback and managed to finish positive for the day. At the lowest point of the day, the S&P 500 (SPX) index was down -3.96%, yet it finished up +0.28% by the time the market closed. The Dow Jones Industrial Average (DJIA), off over 1,000 points, also finished up +0.29% for the day. A truly boomerang market. The Tech heavy NASDAQ (NDX) composite also erased more than -4.9% decline, to finish the day higher by +0.6%.

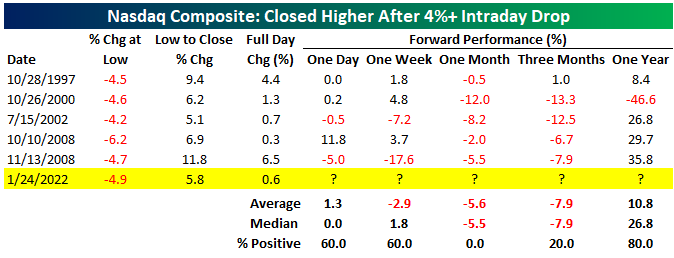

Since 1988, when open/high/low/close data began for the NDX, there have only been five other trading days that have seen the index close higher after an intraday drop of more than -4%. Below is a table from Bespoke Invest, highlighting these five occurrences. Such extreme upside reversals, have not typically marked a short-term low for the index, although 12-month returns have been very positive on four out of the five occasions.

Source: Bespoke Invest

The one occasion that the next-year return was negative, was following the 10/26/2000 upside reversal which was marked by the “Dot-com” bust.

The key lesson to draw from 2000, is that the Nasdaq today is much more robust and made up of companies such as Apple, Microsoft, Amazon, Google, Facebook, Nvidia and Adobe – with a long history of proven revenue and earnings growth. That was not the case in 2000, when the technology boom was in its infancy. Internet hardware and software companies had the largest market cap of any stock in the NDX in March 2000.

Additionally, at the time, the NDX traded at a Price/Earnings (P/E) ratio – based on Bloomberg Best estimates of subsequent 12-month earnings – of well over 100. Today, it trades at a ratio of 25.2. The bottom line is that NDX valuations are not as stretched as they were in 2000, and the index has a very good vintage of tech stocks to invest in at both the broad index and individual stock levels.

On Tuesday and Wednesday this week, the equity markets made a similar boomerang move with the DJIA swinging by over 1,000 points in another wild session for equities. Boomerang markets may be here to stay, as interest rate rise uncertainty plays out.

The two-day Federal Reserve open Market Committee (FOMC) meeting that concluded on Wednesday, was one of the most anticipated ones in recent times. The committee held short-term interest rates steady at 0-0.25% yet signalled intentions to raise rates at the next FOMC meeting to be held in March.

US Federal Reserve Chair Jerome Powell said- “It will soon be appropriate to raise the target range for the federal-funds rate,” and added, “the economy no longer needs sustained monetary-policy support.” The committee plans to start hikes before rolling off the balance sheet, but could start reduced reinvestment of existing holdings as soon as this summer; over the long run, the FOMC anticipates it will “primarily hold Treasuries.”

At his press conference following the meeting, Fed Chair Jerome Powell noted that the inflation situation had “gotten slightly worse,” while also saying that the differences between now and the 2015 hike cycle had “implications for our policy trajectory,” when asked about the possibility of rate hikes at consecutive meetings.

These two comments open the door to potentially four rate hikes this year and the market is in fact now pricing in five rate hikes this year. However, in my view, as I expand on below, I expect inflation to turn, and thus do not anticipate such aggressive moves by the Fed.

If a tightening of fiscal policy, easing of supply chains as COVID restrictions are loosened, and less accommodative monetary policy restrain inflation, Powell has indicated that the FOMC may not need to continue hiking – as it is not on a pre-set path. Powell categorically refused to commit to any policy path and, in my view, that’s a good thing. The Fed has never been more “data dependent” than now and market participants should take note.

Powell also said that the Fed could allow its balance sheet holdings to shrink more quickly than it did between 2017 and 2019, when they fell to around $3.7 trillion from $4.5 trillion – in part because the balance sheet today is twice as large as it was then.

The US Federal Reserve Bank’s total assets (in trillion USD)

Source: Bloomberg

Just give this a thought – the Fed wasn’t able to reduce its balance sheet more than by $0.8 trillion in 2014 when it had $4.5 trillion on its balance sheet, and yet, we expect the Fed to do better now with a balance sheet of nearly $9 trillion?

Economists at Deutsche Bank estimate that if the Fed were to reduce its holdings by around $1.5 trillion between this summer and the end of next year, it could have the effect of an increase of around +0.75% in the Fed Funds Rate. Unwinding this mountain of debt will be far more difficult than it was accumulating it. Part of me says why bother reducing the balance sheet? Instead, label it as “special reserves,” move it off balance sheet and leave it there.

I see the Fed initiating a moderate increase in interest rates over the rest of the year, while slowly reducing the balance sheet before this reduction stalls. My call: only two interest rate increases during 2022. The risk of the Fed doing more than needed is real if inflation forces the Fed’s hand, but the turnaround will be quick if CPI turns and economic conditions deteriorate.

Additionally, with inflation currently running at +7%, the real yield on 10 year US Treasurys is around -5.17%. Real money is not going to own these bonds, unless the Fed monetizes Treasuries. If inflation proves to be sticky and systemic, there will be a sell-off in the bond market and the Fed will be back as a buyer. Bottom line: The Fed is stuck with that balance sheet whether it likes it or not. The Fed can get away with raising rates on the short end but they will not inverse the 10-2 year Treasury curve. One further observation – how far will the Fed go in an election year is anyone’s guess!

Markets and the Economy

On Monday, Markit’s Purchasing Managers’ Index (PMI) for the US, fell sharply, dropping to 50.9 from 57.6, which was the second-largest drop in history (2007) – other than the March/April 2020 COVID shock.

Also, the Chicago Fed National Activity Index (CFNAI) for December fell sharply. The big driver was the huge drop in consumer spending that showed up earlier in January in the massive miss in December retail sales. Other than the February 2021 collapse in economic activity that followed winter storms and an electrical grid collapse in Texas, this was the worst print for the consumption and housing category of the CFNAI since the pandemic began.

On Tuesday, the International Monetary Fund (IMF) downgraded its 2022 global growth forecast to +4.4% from +4.9%. In its World Economic Outlook (WEO) report, the IMF said it expects global Gross Domestic Product (GDP) to grow less than previously estimated. The revised outlook is largely due to growth markdowns in the world’s two largest economies – the United States and China. “The global economy enters 2022 in a weaker position than previously expected,” the report noted.

The US economy is expected to grow +4.0% in 2022, down from +5.2% previously forecast, as the Fed moves to withdraw its monetary stimulus and supply chain disruptions still weigh on the US economy. China, meanwhile, is predicted to grow +4.8% this year, down from an earlier estimate of +5.6%, amid disruptions caused by its zero-Covid policy, as well as “projected financial stress” among China’s property developers.

In January 2021, US bond yields charged ahead (chart below) on the expectation that vaccines would bring the pandemic to an early end. The US 10y yield almost doubled from +0.8% to +1.6% between December-March, before the Delta-variant of the coronavirus sent vast swathes of the global economy into another lockdown. The yield didn’t break to the upside and it reversed to +1.2% by July.

Will this January be a case of deja vu?

Bond yields have now surged again (see chart below) but slowdown concerns are growing. Oil is trading at $90, the Ukraine-Russia crisis is looming large, US President Joseph Biden’s Build Back Better (BBB) plan is stuck in Congress, the service sector recovery has stalled, China is cutting rates amid growth concerns and the global supply chain is still having problems.

US 10-year Treasury yield (2020 – 2022 YTD)

Source: Bloomberg, past performance is not indicative of future returns.

I believe bond yields will have a tough time breaking out above current levels.

As I wrote in the December newsletter – low bond yields are a reality that we will have to live with, given the amount of debt in both the public and private sectors. In the face of mounting debt, the conundrum that the Fed (and other central banks) face is this: Tighten and the existing debt pile becomes more expensive to service, hampering economic growth. Don’t tighten and the debt across households, companies and the government continues to grow, making it even tougher for tightening in the future. Only inflation can force the Central Bank’s hand to tighten aggressively and this will inevitably bring on a recession.

So, the key data to look out for is the Consumer Price Index (CPI). The last print for US CPI was +7%, and any sign that is retreating and the Fed will have no reason to keep raising interest rates.

Stimulus checks, beefed-up unemployment insurance and expanded child tax credits boosted US personal savings by over $2tn during the 2021, as per Congressional Budget Office (CBO), but these are not going to be annual income-booster events.

Also, low-income earners who got an income “boost,” typically spend a great proportion of any income increase on consumption. Savings will be drained soon. All or most of the excess savings could be exhausted in the next three months. The income boost and consequent “increased savings” was one of the top three reasons given by the US unemployed for not seeking a job. As savings dry up, those that dropped out of the labour market, will return to seek jobs, thus boosting the labour supply and easing wage pressures and therefore prices. We are likely heading into a period of weaker inflation ahead.

The week also saw the first major tech stock earnings of this earnings season from Microsoft (MSFT), the second-largest stock in the SPX. Microsoft surpassed analysts’ estimates on both the top and the bottom lines by +1.7% and +7% respectively. Yet, in keeping with the boomerang moves in the markets, the stock fell -5% in the extended hours before rallying back quickly to a gain of more than +1%, after the company issued its outlook for the current quarter.

For the first quarter of 2022, Microsoft expects sales of $48.5 billion to $49.3 billion, compared with analyst expectations of $48.1 billion, according to FactSet. Microsoft’s overall cloud revenue for the quarter increased +32% YoY to $22.1 billion. Its cloud-infrastructure service, called Azure, grew by +46%, down slightly from the prior quarter’s +48% growth. This bodes well for Amazon’s (AMZN) earnings, who report next Thursday. Microsoft is the second-largest player in the industry with a nearly 20% share of the global cloud-computing market after Amazon, who dominates the sector with more than a 40% share, according to Gartner Inc.

The cloud-services business is one of the fastest-growing in tech and could expand from $385 billion in 2021 to $809 billion by 2025, according to research firm International Data Corporation (IDC).

On Wednesday, in another encouraging sign, Tesla (TSLA) the fifth largest stock in the SPX, reported Q4 adjusted EPS +7.6% higher than expected on revenues +6.5% above estimates; free cash flow beat estimates by +66%, and while there were major supply chain problems, automotive gross margins were +30.6% versus +29.9% estimated. The company said factories are running “below capacity” and that is “likely to continue” through 2022; guidance was still for “50% average annual growth in vehicle deliveries”.

On Thursday, Apple (AAPL) the largest stock in the S&P 500 index, reported its largest single quarter in terms of revenue ever, $123.9 billion vs. $118.66 billion estimated, up +11% year-over-year, and Earnings per share (EPS) of $2.10 vs. $1.89 estimated, up +25% year-over-year. Margins also beat with operating margins topping forecasts by +2.24% and an impressive +33.3% pre-tax margin, the highest since 2012. These figures provide evidence that raw materials and logistics costs aren’t slowing down the company’s operations.

Heavyweight stocks beating revenue and earnings estimates should serve well in holding up the SPX.

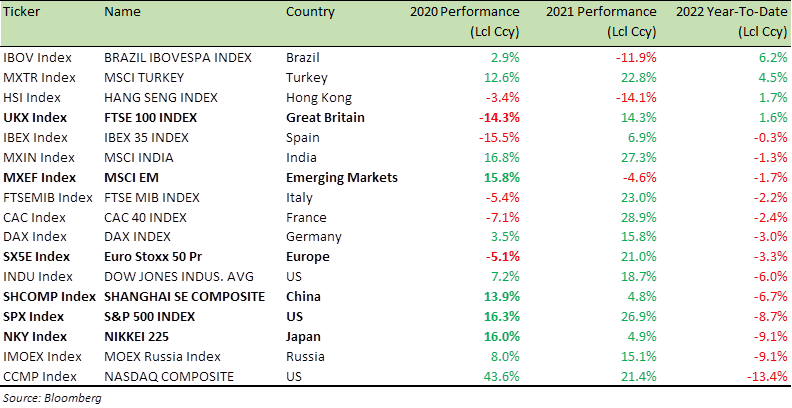

Benchmark Global Equity Index Performance (2020, 2021 and 2022 YTD)

Emerging Markets (EM) had a rough 2021. The MSCI Emerging market index (MXEF) was down –4.6% for the year. Hong Kong, Korea, Brazil, Turkey were all down in double digits with Turkey down over -30%. The EMs are still face some stiff headwinds, yet there are reasons to be positive and starting to build long positions in EM equities .

Fed hawkishness, driving the US dollar higher is always the key risk for EM. Yet, early this month when the US CPI for December hit the +7% level, the US dollar sold off against a basket of EM currencies, suggesting that the market had adequately priced in the risk of Fed’s hawkishness and its impact on the US dollar. And if the Fed doesn’t deliver fully on its hawkish intent, then the EM markets should get an additional boost.

In Europe, while the UK has cast many of the Covid restrictions aside and the UK economy is set to be the fastest-growing economy in the G7, on the continent, Covid restrictions remain in place and have gotten quite severe, hitting consumer mobility and thus consumer spending on services. This means, that unlike the US, monetary policy in the Eurozone will remain highly supportive. The fiscal policy in the Eurozone is very unlikely to return to the policies of austerity and fiscal consolidation that marked the pre-Covid decade under former German Chancellor Angela Merkel’s leadership. The political consensus in the Eurozone has firmly shifted in favour of an expansionary fiscal policy. With bond yields still at a very low levels, expect more government spending, as economies fully reopen.

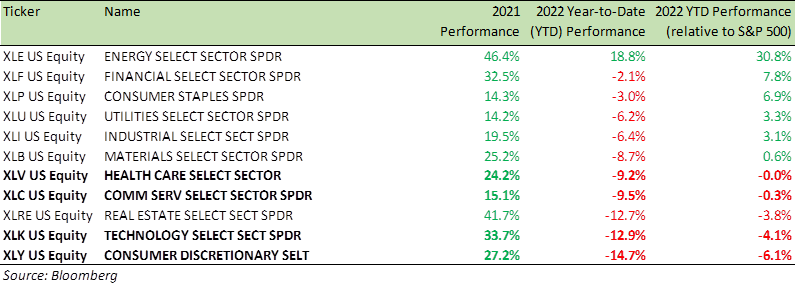

As the table below details, the massive outperformance of the Energy (XLE) sector continues unabated. After stellar returns last year, the sector is up over +30.8% versus the SPX year-to-date. It’s poetic that this performance comes less than two years after crude oil traded at -$37.63 on April 20, 2020.

Oil stocks, and the energy sector as a whole, still have upside as inflation (and the expectations of it) will likely remain elevated for the first quarter of this year. Additionally, with the risk of a Ukraine-Russia clash on the horizon, energy will remain well bid.

Benchmark US equity sector performance (2021, 2022 YTD)

For 2022, we will likely see +7% to +8% return for the broad S&P 500 Index in the US, so income strategies should be prioritised. Clipping coupons in a flat to negative market, or using structured products to generate income, will be the avenues to follow this year, at least until CPI turns and we know that the Fed is not under pressure to keep raising interest rates.

For specific stock recommendations and structured products ideas please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA