It took two centuries before coal overtook wood as the world’s top energy resource and it took oil a century to replace coal. The global economy depends on fossil fuels for 84% of its energy. The pursuit of “net-zero” is both an opportunity and a risk.

Summary

On September 6, two coal-fired generators had to be fired up to meet the UK’s electricity demand, in a move that usually only happens during the winter months. For several hours that day, coal went from zero to more than 5% of the UK’s energy mix, as warm, still, autumnal weather, meant wind farms had not generated as much power as normal. Coal, the unloved power source, had come in from the cold to the rescue! Energy is the lifeblood of the modern economy. It is one of the most important inputs for economic development and is central to almost every economic activity and integral to any country’s development. Policymakers ought to be very careful in their pursuit of “green energy” at any cost.

History shows that energy transitions don’t happen quickly. It took two centuries before coal overtook wood and waste as the world’s No. 1 fuel and it took oil a century to replace coal as the world’s top energy resource. Of course, in those days, there was no government policy for energy transition or technical innovation and climate activism that are all pushing today’s energy, but nor was the demand for energy as high as it is now. The global economy stands at over $90 trillion and it depends on fossil fuels for 84% of its energy. The pursuit of “net-zero” is both an opportunity and a risk.

The S&P 500 Index had a bumpy month and a half over September and early October, but it has recovered since and is back in touching distance of all-time highs, last seen on September 2. The tech-heavy NASDAQ Index has fared similarly. Concerns had started to build up over inflation and slowing growth, but a strong start to the third-quarter earnings season has alleviated some of that uneasiness and bullish sentiments have returned. Demand is strong and it’s only the supply that is holding the economy back. Investors have started looking past the supply shortages and expect these to be worked through eventually.

Coal comfort

Last month, an interesting report in The Times of London caught my attention. It read like a script for a potential new movie, let’s call it, “How coal came in from the cold:”

“It was 3 a.m. on Monday, 6th September and staff at National Grid’s central control room had a problem. Arrayed before them were dozens of computers tracking the UK’s energy supply and demand. Overhead was a huge screen displaying, second by second, Britain’s whole electricity generating and supply network. The giant bear pit of a room is the nerve centre of Britain’s complex power grid…the 20 engineers on shift in the ESO (electricity system operator) control room realised there would be a shortfall of power before the morning rush. They sprang into action…The solution was to turn to a rather unloved power source – coal. The order to fire up the station, one of only two remaining coal plants in the UK, was sent electronically from Wokingham. Just in case the message didn’t get through, operators still have a green phone on their desks to send instructions the old fashioned way.”

On that Monday, the 6th of September, as temperatures surged giving Britons one last glimpse of summer, the wind turbines up and down the country had slowed to a crawl in the still air. Britain’s wind power dipped to just 2.5% (down from 21% at the same time the week before) and this is when coal came in from the cold to the rescue!

Two coal-fired generators had to be fired up to meet Britain’s electricity demands, in a move that usually happens only in the winter months. For several hours that day, coal went from zero to more than 5% of the UK’s energy mix.

The West Burton A coal plant, Lincolnshire, UK

Source: EDF

Earlier this week, UK Prime Minister Boris Johnson said that Britain will become the “Qatar of hydrogen”, as he laid out his Government’s green agenda ahead of the Cop26 climate summit in Glasgow at the end of this month.

My knowledge of chemistry from school days tells me that hydrogen is not a primary fuel. It is an energy vector, i.e. a means of storing and transporting energy. You need electricity/energy to make hydrogen.. Also, for hydrogen fuel to have green credentials, the energy/electricity used to generate it, has to be from a renewable or a nuclear source. When we don’t have enough renewable sources of energy as is, so it is unclear to me where the renewable energy is going to come from in order to split water and generate hydrogen? One wonders…

In September, Johnson said he wants to turn Britain into the “Saudi Arabia of wind”.

I am fast losing track of “green energy” promises made by Johnson and other climate change champions.

The UK Labour party’s late Deputy Leader, Aneurin Bevan, told the party’s 1945 conference, “This island is made mainly of coal and surrounded by fish. Only an organising genius could produce a shortage of coal and fish at the same time.”

Over the last few weeks, Britain has faced a shortage of both fish and energy. Of course, energy shortages and empty shelves are not a uniquely British phenomenon and I am not accusing Johnson of lying or even of incompetence. The UK is still forging ahead with decommissioning its coal-burning power station West Burton A from September 2022, leaving just Uniper’s Ratcliffe-on-Soar burning coal beyond 2022.

Does this rush to meet its carbon goals, risk power blackouts in the UK? Only time and maybe a few days of dipped wind power will tell.

History shows that energy transitions don’t happen quickly. The key moment in the first major transition—from wood to coal—was in January 1709, when an English metalworker named Abraham Darby used coal as a fuel for brass and cast iron manufacturing. But it took two centuries before coal overtook wood and waste as the world’s No. 1 fuel. Oil was discovered in western Pennsylvania in 1859, but it was not until a century later, in the 1960s, that oil replaced coal as the world’s top energy resource.

Of course, in those days, there was not the government policy, climate activism, or technical innovation that is pushing today’s energy transition, but nor was the demand for energy as high as it is now. The world’s urban population has increased four-fold from 1 billion in 1960 to 4.4 billion today.

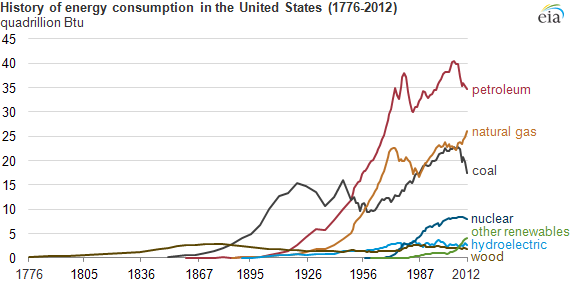

The chart below from the US Energy Information Administration (EIA) shows how a typical American family’s energy source has changed since the United States was founded in 1776. Wood was the primary energy source until the mid-to-late-1800s. Early industrial growth was powered by water mills. Coal became dominant in the late 19th century before being overtaken by petroleum products in the middle of the last century, a time when natural gas usage also rose quickly.

Source: US Energy Information Administration (EIA)

Energy is the lifeblood of the modern economy. It is one of the most important inputs for economic development and is central to almost every economic activity – manufacturing, transport, schooling, communication and so on, and is thus integral to any country’s development. Policymakers ought to be very careful in their pursuit of “green energy” at any cost. The world economy is over $90 trillion and it depends on fossil fuels for 84% of its energy.

The world is setting ambitious “green energy” targets. The “net-zero” emissions pledges aim to bring global energy-related carbon dioxide emissions to “net-zero” (refers to a state in which the greenhouse gases going into the atmosphere are balanced by their removal out of the atmosphere) by 2050. The chart below from the International Energy Agency (IEA) highlights the adjustment to sources of energy supplies needed to achieve that goal.

Clean energy’s contribution to total energy demand has to go up nearly nine-fold over the next 30years from its current level now. It’s an ambitious goal and a mammoth task. The pursuit of “net-zero” is both an opportunity and a risk.

Opportunity: To meet global energy demand, as well as climate aspirations, investments in clean energy would need to grow from around $1.1 trillion this year to $3.4 trillion a year until 2030, according to the IEA. The investment would advance technology, transmission and storage, among other things.

Risk: Cut fossil fuel supplies too soon and face future energy shortages threatening life and livelihoods and indeed ever higher energy prices. Once a deep coal mine is decommissioned, it quickly fills with gas and water and one cannot get coal from it again.

Projected market share of energy supply to reach zero emissions

Source: IEA, WSJ

More green energy? Yes, but not at the cost of turning blue when sources of renewable energy fail in times of unprecedented weather conditions.

Climate is unpredictable no matter how much we try to model and predict the future of climate change. Energy supply and energy security are essential to our survival. The way to ensure progress for everyone, better living standards in all societies and protect the environment, which should be the job of the government, is to supply affordable, reliable, efficient energy for domestic consumption and industry. It’s pragmatic to not decommission fossil fuel sources entirely in pursuit of green energy.

Let’s hope the renewables will be able to fill the gap in time and if not we will have to take up knitting. Woolly knickers, vests, scarves and jumpers. Sustainable, renewable, a bit scratchy but they will keep us warm when energy supplies fail.

Markets and the Economy

Last week, the US Federal Reserve (Fed) released its September Federal Open Market Committee (FOMC) meeting minutes. The committee meets in two weeks’ time for the November FOMC policy meeting.

The FOMC participants worried about disrupted supply chains and risks of more persistent inflation. The minutes indicate a stronger consensus over scaling back the $120 billion per month bond-buying program amid signs that higher inflation and strong demand could call for tighter monetary policy next year. When presented with a plan to reduce purchases of Treasuries at a pace of $10bn per month and mortgage-backed securities (MBS) at a pace of $5bn per month, “participants generally commented that the illustrative path provided a straightforward and appropriate template that policymakers might follow”, which suggests that $15bn reduction in bond buying per month should be the baseline assumption for tapering.

At this suggested “taper rate,” July 2022 will likely be the first month of no asset purchases. The big question is will an interest rate hike follow?

A rate hike is not a done deal and “various” FOMC members believe the Fed Funds rate should be kept “at or near its lower bound over the next couple of years”.

During a moderated discussion on Sept. 29, Fed Chairman Jerome Powell conceded that the Fed was facing a situation it hadn’t encountered in a very long time, in which there was tension between the central bank’s two objectives of low, stable inflation together with high employment. Powell remarked – “Managing through that process over the next couple of years is…going to be very challenging because we have this hypothesis that inflation is going to be transitory. We think that’s right. But we are concerned about underlying inflation expectations remaining stable, as they have so far.”

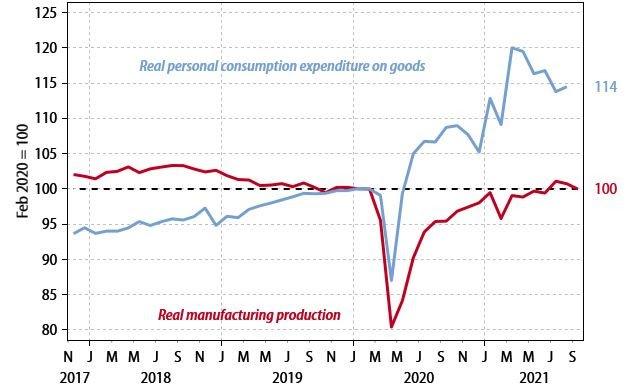

Below is a chart from Gavekal Research, on US manufacturing production and US consumption. Those concerned about inflation may wish to take a closer look. The US manufacturing production data for September released this week was a double disappointment. The -0.7% month-on-month decline, down from a growth of +0.2% in August, not only fell short of consensus expectations for +0.1% growth, but also dampened hopes that manufacturing was set to emerge as a significant driver of US economic growth. This raises questions over the future strength of the US expansion.

The chart indicates that the early stages of the US rebound were powered almost entirely by personal consumption growth (the blue line). However, since March, consumption has plateaued, with September data for US retail sales published last Friday confirming the sideways trend.

US goods production has lagged the rebound in consumption

Source: Gavekal Research/Macrobond

With business confidence and capacity utilization both high, there were reasonable grounds for expecting the acceleration in capital expenditure over recent months to drive robust growth in US manufacturing output. Yet the recovery in US manufacturing production continues to lag far behind the recovery in consumer demand. Material shortages, hiring slowdown, and weak competitiveness – are the principal reasons behind lacklustre performance in US manufacturing.

Shortages of key components, such as microchips, are throwing whole production chains out of kilter.

Since July, most of the temporarily laid-off workers who wanted to return to work have been back in employment. To step up production further, manufacturers must hire new faces, which is a time-consuming process. With US manufacturing sector job openings at a record high, slower payrolls growth is likely to drag on the pace of manufacturing production recovery.

The US dollar has strengthened this year leaving it richly valued. The competitiveness of US producers is poor relative to their foreign counterparts, and US consumers will tend to prefer imported goods. As a result, even when the current supply constraints are resolved, there is little reason to believe the deterioration of the US trade deficit over the last 18 months will quickly reverse, and that the recovery in US manufacturing production will converge with the rebound in consumption.

There’s plenty of food for thought for the FOMC participants to not rush with a rate hike. I would expect the US dollar to weaken from here as manufacturing continues to lag.

You may recall that during the 2009-11 recovery from the Great Financial Crisis (GFC), concerns over recovery-driven inflation during 2010-11 led to a reduction in stimulus, but those price pressures faded and eventually Quantitative Easing (QE) was restarted with rates at zero for almost another half a decade.

In April 2010, hawks such as Philadelphia Fed President Charles Plosser argued – “The risk is really to the upside of inflation over the next two to three years.” Eleven years later, we are yet to see any inflation worries, let alone any meaningful and sticky inflation.

On the other hand, doves like Janet Yellen (then at the Fed) and now US Treasury Secretary, was very prescient in saying: “When unemployment is so high, wages and incomes tend to rise slowly, and producers and retailers have a hard time raising prices. That’s the situation we’re in today, and, as a result, underlying inflation pressures are already very low and trending downward.”

I am very glad that Yellen is a powerful and key voice in current US economic policymaking, alongside FOMC voting members Powell, Governor Lael Brainard and Minneapolis Fed President Kashkari who all remember the 2010-11 episode – given their involvement then as Fed or Treasury officials. They learned the lesson and I expect the Fed to keep monetary policy easy during this post-recession period of temporarily higher inflation before letting the economy run hot as long as possible to expand the labour force. They will likely hold off the hawks.

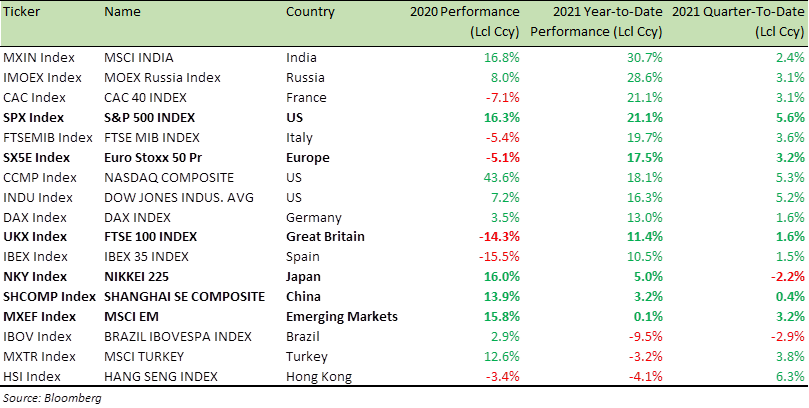

Benchmark Global Equity Index Performance (2020, 2021 YTD and QTD)

The S&P 500 Index had a bumpy month and a half over September and early October but it has recovered since and is back in touching distance of all-time highs last seen on September 2. The tech-heavy NASDAQ Index has fared similarly.

Concerns had started to build up over inflation and slowing growth, but a strong start to third-quarter earnings season has alleviated some of that uneasiness and bullish sentiments have returned. Demand is strong and it’s only the supply that is holding the economy back. Investors have started looking past the supply shortages and expect these to be worked through eventually.

China’s economy grew +4.9% in the third quarter from a year prior, a sharp slowdown from the second quarter’s +7.9%. The slowdown didn’t come as a surprise to the market. Many market participants expect China’s growth to lose its momentum over the coming years and it’s not a bad thing. I would say it has all been “well planned,” given the long-term thinking that Chinese policymakers deploy.

China was never looking to be a long term supplier of cheap labour to the rest of the planet. The plan all along was to use the cost advantage of cheap labour to manufacture a whole range of goods and achieve export leadership in numerous industries and use the valuable US dollar earned from rising exports, to develop the domestic economy by investing in technology, infrastructure, energy and innovation. The goal was to achieve global export leadership and end up developing a Chinese economy driven by domestic consumption. In that, they have used the playbook used by South Korea and Japan. Exports were simply used to jump-start the moribund Chinese economy, trying to break free of the consequences of the Cultural Revolution.

Now that the infrastructure is in place, domestic consumption will drive the Chinese economy. It’s not all bad news. A growing Chinese consumption will drive growth in the west (particularly in the Eurozone), albeit on terms set by China.

In Europe, the European Central Bank (ECB) has indicated tolerance for a temporary period of higher inflation. ECB President Christine Lagarde has stuck to the ECB’s official view that inflation will ease back below 2% next year but seemed to acknowledge growing that higher price growth might be here to stay. The Eurozone inflation for September came in at +3.4%, a pickup from the +3% recorded in August. It was the highest rate of price increases since September 2008, and well above the ECB’s 2% target. Energy prices accounted for much of the pickup in inflation in September.

Speaking recently to lawmakers at the European Parliament, Lagarde said – “While inflation could prove weaker than foreseen if economic activity were to be affected by a renewed tightening of restrictions, there are some factors that could lead to stronger price pressures than are currently expected.”

ECB policymakers were also open to expanding the ECB’s regular Asset Purchase Programme (APP) for a limited time when emergency bond purchases stop in March of next year. The ECB has also signalled that it will keep interest rates in negative territory through 2023.

Therefore, the risk to equities, be it in the US, Europe or China remains to the upside. Tapering of asset purchase by the Fed will not impact the equity market a great deal, as the market fully expects the Fed to taper and eventually stop asset purchases. Even when asset purchases do end, the Fed is a long way off from raising interest rates.

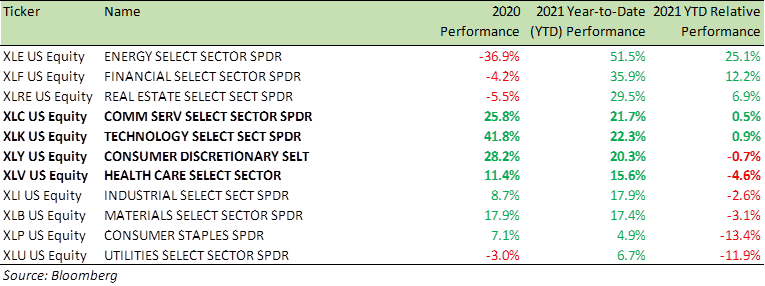

As the table above indicates, Consumer stocks (particularly XLP) have still have quite a way to catch up and present a very good buying opportunity. Energy stocks are flying, and it may be a good idea to trim any holdings in your portfolio. There is no shortage of oil and gas in this world and supply shortage concerns are being addressed rapidly.

Tech and Communication Service sector stocks (XLK, XLC) are in for more upside, as we head into the festivals and holiday period of consumer spending.

In the bond markets, the yield on the 10-year Treasury bond ticked up to +1.64% and is still below the +1.75% reached in March this year. As the Fed tapers, expect yields to rise further.

Benchmark US equity sector performance (2020, 2021 YTD)

For specific stock recommendations, please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA