“Scepticism often spikes at the top — but it also tends to keep investors from participating in ongoing structural shifts.”

Summary

Investor scepticism tends to peak when markets are making new highs. But history shows that doubt alone doesn’t protect capital — it often sidelines it. Even the most seasoned investors can misread complex market cycles. The real challenge is not being wrong – it’s refusing to adapt. As Marcel Proust observed, “The real voyage of discovery consists not in seeking new landscapes, but in having new eyes.” That’s increasingly true in today’s market. The advantage now belongs to investors who can look at familiar conditions with a fresh lens, not those clinging to outdated assumptions.

As headlines warn of market froth, institutions are positioning for a multi-decade transformation. JPMorgan’s CEO may express caution publicly, but the firm is committing over $10 trillion to future-focused sectors – AI, quantum computing, and cybersecurity. It’s a clear signal: beneath the noise, capital is flowing into the technologies reshaping global growth. Corrections will come – they always do — but history has consistently rewarded those who stay invested, manage risk, and evolve with the cycle rather than exit it.

Digital assets, meanwhile, continue to offer rare optionality — asymmetric return potential, innovation at the edge, and exposure to structural change. But fundamentals still apply: Disciplined sizing, risk management, and cycle awareness. Bull markets may flatter, but true investing skill is proven through drawdowns. As Warren Buffett reminds us, “Only when the tide goes out do you discover who’s been swimming naked.” In crypto, that tide moves quickly – and often. Staying solvent, informed, and opportunistic will matter more than ever.

From Tariff panic to Tech Euphoria

US GDP surged +3.8% in Q2, up from the earlier +3.3% estimate, marking the strongest growth since Q3 2023.

The engine? Robust consumer spending and a surge in AI-driven tech investment.

As one prominent Wall Street analyst quipped, “Without tech spending, the U.S. economy would be close to recession.”

I always smile at these “without” GDP analyses — they miss the point.

Is Superman still Superman if he can’t fly? Is James Bond still Bond without his gun? Or Taylor Swift still Taylor Swift without her songs?

Technology is the US economy — its defining strength and the envy of the world.

Without it, America would resemble the Eurozone — minus the cheese, the wine, and perhaps with a few too many guns.

But let’s add some perspective.

In December 1981, when recession fears were thick in the air, the Blue-Chip Economic Indicators survey showed forecasts for 1982 ranging from +4.0% growth to a –1.7% contraction, with profit expectations swinging between –19.9% and +19%.

The consensus gloom proved misplaced: The economy rebounded sharply, ushering in the Reagan-era boom. Back then, there was no AI revolution to lean on — just tight monetary policy, an inflation fight, and a resilient private sector.

History reminds us that forecasts are guesses wearing ties, and humility is the economist’s most underrated skill.

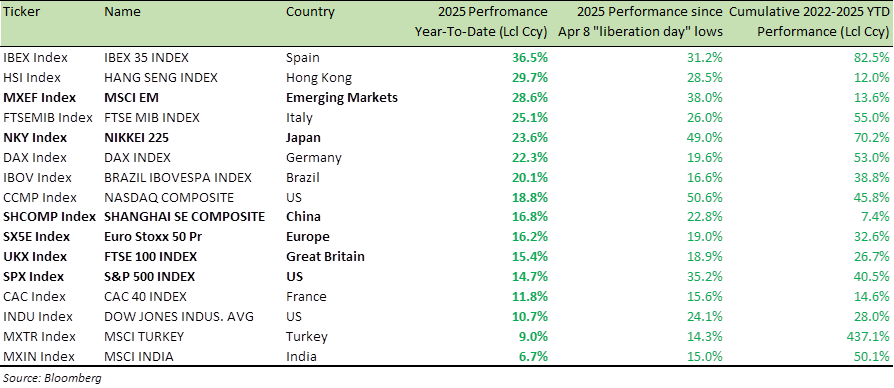

Early October gave investors two big milestones — and a reminder of how fast sentiment can shift. October 8 marked six months since the “tariff crash” bottomed, while October 12 celebrated three years since the current bull market began in late 2022 — just before the AI revolution transformed everything.

”Liberation Day” tariffs market collapse now feels like a distant memory. The S&P 500 plunged -10% in two days amid tariff panic, falling nearly -19% from its February’s highs. Yet, true to form, markets recovered with stunning force. Since those April lows, the S&P 500 has surged +34% (see chart below), while the Nasdaq 100 — boosted by AI, semiconductors, and data-centre exuberance — has rocketed almost +50%.

Global Equity Index Performance (2025 YTD, since April 4 YTD and 2022-25 YTD)

Step back further, and the numbers tell an even bigger story. Since the October 2022 bear-market bottom, the S&P 500 has climbed nearly +90%, and the Nasdaq 100 over +125% — one of the most powerful recoveries in modern market history.

It hasn’t been a straight line, though. The rally has seen three full-blown corrections over 10% across the S&P, Dow, and Nasdaq:

- October 2023: A -10% drop driven by inflation and rising yields.

- July–August 2024: A 10–12% pullback on recession fears.

- March 2025: A -13% slide amid Trump’s tariff shock and China’s retaliation.

Each dip sparked new waves of doubt — and each has been followed by record highs. As the bull enters its fourth year, scepticism is rising again, with the word “bubble” making the rounds. Yet it’s often when investors grow most certain of doom that markets climb higher.

Scepticism often spikes at the top — but it also tends to keep investors from participating in ongoing structural shifts.

Even market legends stumble here: Paul Tudor Jones warned in May that stocks would fall “to new lows.. even if Trump dials back China tariffs by 50%.”

At the time, the S&P 500 stood at 5,606. Today, it’s above 6,700

Markets are complex systems — rarely obeying clean narratives or linear logic. The costliest mistake isn’t being wrong; it’s staying wrong because ego overrides evidence.

As JPMorgan’s CEO Jamie Dimon sounds alarms about “market froth,” his bank is simultaneously pledging $10.5 trillion towards long-term US. economic renewal — investing in AI, quantum computing, and cybersecurity.

The paradox is clear: While many worry about bubbles, institutions are preparing for the next decade of transformation.

The labour market, while still resilient with unemployment around +4.2–4.3%, has softened at the edges. The ADP report showed private payrolls falling 32k in September, the weakest print since March 2023, with August’s gain revised down sharply. With the Employment Situation Report delayed by the government shutdown, that weak ADP reading makes October rate cut of 25bps next Wednesday a formality.

Inflation remains sticky but cooling — headline CPI at +2.9%, core around +3.1% — keeping the US Federal Reserve (Fed) cautious but aware that credit conditions are tightening and growth momentum is fading. The Fed’s data-dependent approach means it will follow the labour signals more than the rhetoric, and on current trends, a 50bps rate cut before year-end wouldn’t surprise me at all.

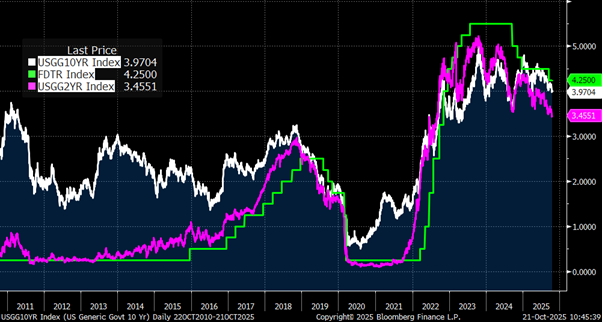

As the chart below shows, the 10-year U.S. Treasury yield (USGG10Y), typically moves in lockstep with the 2-year yield (USGG2Y), as one would expect, and generally trades above the Fed funds target rate (FDTR).

US Treasury 10-year yield (USGG10Y), 2-year yield ( USGG2Y) and Fed fund target rate (FDTR) – 15-year price chart

Source: Bloomberg

Today, however, the 10-year yield sits firmly below the policy rate — the bond market’s quiet way of signalling that it expects the Fed to cut rates more deeply, and soon. That shift in expectations tends to be supportive for equities, particularly small-cap and growth stocks, which are most sensitive to falling rates and an improving liquidity backdrop.

Markets need both optimism and fear to function. Bulls and bears, in a sense, should thank each other. Because without that tension — that push and pull — there would be no market at all.

Yes, this bull market will correct — all of them do. But history has been far harsher on sideline-sitters than on disciplined investors who adapt rather than abandon.

There’s a difference between being cautious and being paralyzed. The intelligent approach is to stay invested, manage risk, and evolve with the cycle, not against it.

Structured products and adaptive strategies remain essential tools for balancing participation and protection.

Markets need both optimism and fear to function. Bulls and bears, in a sense, should thank each other. Because without that tension — that push and pull — there would be no market at all.

The AI and frontier-tech boom will one day slow — but it’s still shaping the next generation of growth. For investors, the key is to stay on the field, not in the stands.

“The real voyage of discovery,” Marcel Proust wrote, “consists not in seeking new landscapes, but in having new eyes.”

The same applies here. The future of investing will belong not to those who predict perfectly, but to those who can see the same market — through new eyes.

Markets and the Economy

The US federal government has been shut down since Oct 1, 2025, after Congress failed to pass a 2026 funding bill amid deep partisan rifts over spending, foreign aid, and healthcare. Now in its 22nd day, it’s the third-longest shutdown in US history.

About 750,000 workers are furloughed, and another 700,000 are working unpaid in essential roles. Critical agencies like the NIH, CDC, and WIC have scaled back operations, while courts are running out of funds. Markets are feeling the pinch as key data releases are delayed, adding uncertainty to already fragile sentiment.

Economists estimate each week of closure shaves 0.02 percentage points off GDP, with risks compounding if the stalemate drags on.

Political dynamics remain frozen: President Donald Trump and House Speaker Mike Johnson refuse to negotiate on healthcare or foreign spending, while Senate Democrats push to preserve ACA subsidies. A growing group of moderates from both sides is now urging compromise to reopen the government.

This week’s 11th Senate vote on a short-term funding bill will be pivotal—but expectations for a breakthrough are low. With another missed federal payday looming Oct 24, pressure on Capitol Hill is set to intensify.

The bankruptcy of First Brands Group — an auto-parts supplier — has triggered alarm bells. Its liabilities are reported more than $11 billion, with investigations into alleged accounting irregularities and “vanishing” funds.

Moreover, Tricolor Holdings — a sub-prime auto lender — also collapsed, raising broader questions about credit quality in the auto & consumer-finance sectors.

Leading banking executives, including Dimon of JPMorgan Chase, have publicly warned that “when you see one cockroach, there are probably more,” signalling heightened concern about hidden exposures in non-bank or private-credit channels.

These developments underscore why the sub-prime story has leapt back into the spotlight: It’s not just about distressed borrowers anymore — it’s about how that stress interfaces with credit markets, shadow banking, and downstream exposures.

While the consumer credit weakness is real and should not be ignored, the structural risk to the financial system appears contained for now.

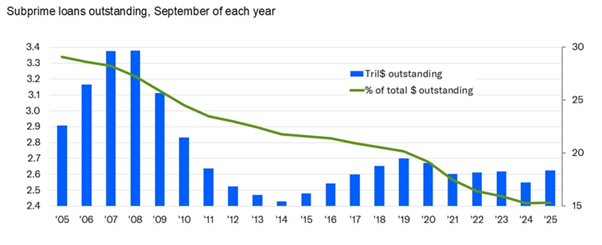

There has been much handwringing lately about the increasing credit problems among sub-prime borrowers and what the fallout might mean for the broader economy. And make no mistake: Sub-prime borrowers are indeed under serious strain. The delinquency rate on loans to borrowers with a Vantage score below 660 jumped to 8.3% in September — the highest September reading since 2010, in the wake of the Global Financial Crisis. That’s just more evidence of how hard-pressed lower- and middle-income Americans have become.

However, the notion that losses on sub-prime loans will deal a brutal blow to banks or the financial system appears overdone (see chart below).

Outstanding sub-prime loans currently total about $2.63 trillion, or roughly 15.3% of all household debt. By contrast, at the 2007 peak they were over $3.38 trillion, or approximately 28.2% of debt. Sub-prime first mortgages are a shadow of their former size per data from Moody’s analytics.

Even though sub-prime auto loans have grown — with over $400 billion outstanding — that’s still relatively modest in the context of the system. Not enough, in my view to bring down the economy or the financial sector. That said, the First Brands/Tricolor saga underscores that we are further into the cycle, underwriting standards are thinning, and subtle cracks may presage larger issues. In short: Watch with respect and discipline.

Source: Moody’s analytics, Equifax

I don’t often talk about crypto in these pages, so let me spend some time on it, as the digital asset world is growing and becoming more popular and acceptable than ever as mainstream institutions move in with large investment and plans for the sector. Even BlackRock’s Larry Fink, once a sceptic, now speaks of crypto with the conviction of a convert. His shift is telling. It’s a sign that the centre of gravity in finance is moving — quietly, steadily — toward the digital frontier.

Last week, I spoke at the Digital Asset Summit (DAS) in London organised by Blockworks. I shared what I called the allocator’s perspective on digital assets. My message was simple: The timeless principles of investing still apply. You understand risk. You weigh reward. You value optionality. You manage the trade with discipline.

But I’ll tell you something more personal. It took me a long time to get here. Years ago, my friend Kelly told me, “Buy Bitcoin.” It was four hundred dollars. I laughed. I thanked her. And I didn’t buy it.

I couldn’t make it fit inside my equity mindset — the one that wants to see cash flow, dividends, tangible proof. Bitcoin had none of that. It felt abstract, speculative, unserious. Another tulip craze, I thought. Another dot-com waiting to burst.

But then time passed. And I watched.

I saw that every great innovation begins as a punchline. The railroad. The telephone. The Internet. They all started in mania, ended in transformation.

So, I stopped asking, “Is this a bubble?” and started asking, “What is this trying to tell us?”

And what it told me was that trust — that fragile, essential thing that underpins all markets — was being rebuilt from the ground up. That money itself was being re-imagined, not by decree, but by design. So yes, I found my way to crypto the old-fashioned way — I ignored it for years, mocked it once or twice, then surrendered.

It’s still a risky asset, of course. But it’s one with immense optionality. And optionality is something to respect, not to leverage. Some learned that lesson again last weekend, when the market turned and liquidity vanished. An asset that can change the world doesn’t need leverage; it needs patience.

There will always be sceptics. There were with NVIDIA, too — remember that? The analysts who called it a bubble and taped a Cisco chart next to it? Sceptics are good for markets. They keep our confidence honest. I’d be worried if everyone were bullish.

The builders I meet in the crypto world today aren’t chasing memes or momentum. They’re tokenizing real-world assets. They’re fixing the plumbing of finance — settlement rails, infrastructure, security. It feels less like a casino and more like the early Internet again. Less noise, more engineering. Less flash, more foundation.

Digital assets remain one of the few corners of the market where you can find real optionality — asymmetric upside, uncorrelated innovation, and a front-row seat to the next market structure.

But one truth will never change. The old rules still apply. Discipline. Research. Sizing. Risk management. Understanding cycles. Anyone can look smart in a bull market — it’s staying solvent through the bear that defines you.

As Warren Buffett likes to say, “Only when the tide goes out do you discover who’s been swimming naked.” And in crypto, the tide goes out often.

Digital Asset Summit 2025, London UK (October 2025)

Source: DAS 2025, Blockworks

This moment feels like the early 2000s — when people said the Internet was finished, and quietly, Amazon and Google were being built. That’s where we are now: The boring but brilliant phase.

Every great innovation begins as a bubble — the railroads, the radio, the Internet, even AI. The bubble isn’t the end of the story; it’s the beginning of adoption.

Crypto is no different. It may still look strange, volatile, half-formed. But so did every idea that changed the world.

Moving on to one other sector that caught my attention – Biotech.

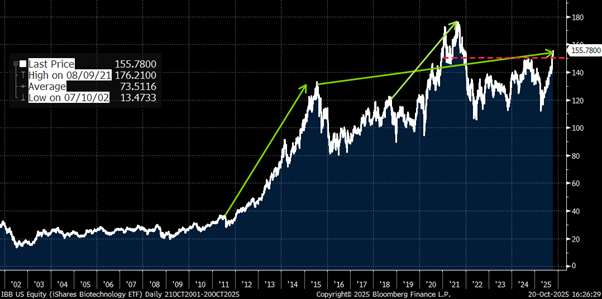

Biotech finally wakes up and IBB breaks out (chart below)

The Biotech ETF (IBB) has staged a notable recovery, advancing roughly 36% since the April 8 “tariff turmoil” low in the S&P 500. That puts the sector broadly in line with the broader market’s rebound. More importantly, last week’s move saw IBB break decisively above its late-2024 highs near $150, clearing a key technical resistance level and signalling renewed momentum.

However, the longer-term picture tells a different story.

Over the past five years, S&P 500 index (SPY) has appreciated nearly +90%, while IBB has gained only +7%. The sector’s last significant rally came during the pandemic, driven by vaccine and mRNA innovation, but since then, investor focus has shifted toward GLP-1 therapies and the technology sector’s AI-driven boom.

Biotech ETF (IBB): Last twenty-three years

Source: Bloomberg

Historically, Biotech’s last major multi-year advance occurred in the early 2010s, following the financial crisis and the passage of the Affordable Care Act (ACA), when capital flowed aggressively into healthcare innovation. The past decade, however, has been marked by relative underperformance and multiple false starts.

With IBB now breaking out in the short term and the integration of AI in drug discovery, clinical design, and data modelling accelerating, the conditions could be forming for a structural re-rating of the sector. While it remains too early to call a sustained cycle, Biotech’s combination of depressed relative valuations and emerging productivity gains from AI warrants closer attention from long-term investors.

Finally, the dot-com comparisons are inevitable — they always surface when tech leads the market. That’s why it’s worth grounding the conversation in data.

On forward earnings multiples today: NVIDIA trades around 26x, Costco about 47x, and Walmart near 40x. For context, in 1998, Cisco was trading at roughly 60x earnings — and by the peak of the bubble, that multiple had soared to 210x.

By that measure, we are nowhere near bubble territory. Still, after the extraordinary rally since the April lows, a correction — for reasons related or unrelated to fundamentals — wouldn’t be surprising. The key is to stay focused on quality: companies with proven earnings power or clear, structural relevance to the future economy.

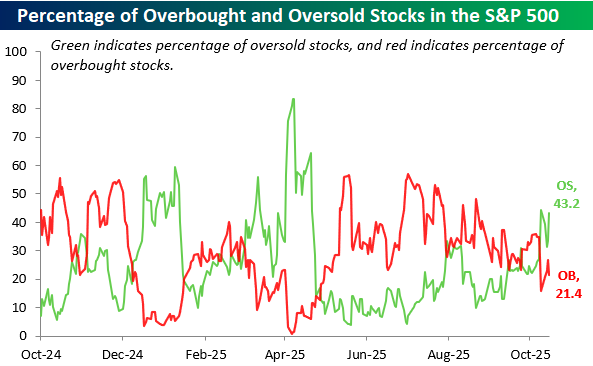

And here’s one overlooked data point: despite endless talk of “overbought” conditions, there are currently twice as many oversold stocks (43%) in the S&P 500 as overbought ones (21%).

Source: Bespoke Invest

As always, disciplined investing through trusted structures that manage downside risk, remains the most reliable way to compound returns over time.

For specific stock recommendations and insights related to structured products, please do not hesitate to reach out to me or to your dedicated relationship manager.

Best wishes,

Manish Singh, CFA