“Germany’s policy to prioritise “trade” over everything else, has come back to bite hard, as Europe faces its winter of discontent. With EUR/USD at parity, Europe’s exports would be so much more competitive only if it had the oil & gas at reasonable price”

Summary

Not long ago, Europe (read the European Union) was concerned about the direction in which the US was going. Phrases like “terminal decline,” “too divided” and “too dysfunctional” appeared regularly in the European press and diplomatic channels. Many in Brussels openly questioned the international order led by the United States and ridiculed its then President Donald Trump. In September 2018, in a speech at the United Nations General Assembly, when Trump accused Germany of becoming ‘totally dependent’ on Russian energy, German diplomats were caught on camera laughing and German Foreign Minister Heiko Maas could be seen smirking alongside his UN colleagues. EU leaders considered America’s decline as inevitable and started to distance themselves from the US. Then Russia invaded Ukraine, and everything changed.

Germany’s policy to prioritise “trade” over everything else has come back to bite hard, as Europe faces its winter of discontent. Europe’s delusion of independence was a sand castle, as in reality, it depended on Russia for its energy, China for its trade and the US for its trade and security. With the EUR/USD exchange rate at parity, Europe’s exports would be so much more competitive only if it had the oil & gas at the reasonable price needed to run manufacturing, industries, agriculture or even its tourism industry. Everything is underpinned by energy. Energy is responsible for at least half the industrial growth in a modern economy, while representing less than one-tenth of the cost of production.

US Fed Chair Jerome Powell’s comments at the Jackson Hole summit last week, highlighted that the Fed is preparing to shift from a phase of rapid and large interest rate increases, to potentially smaller increases, focusing on slowing demand and then holding the rates instead of cutting them too soon. Unfortunately, Powell can’t take the most meaningful step to tame inflation – prevent the fiscal authorities from increasing spending by hundreds of billions of dollars in spending programs once every few months. This is also a mid-term election year in the US. Seasonality indicates that the S&P 500 (SPX) could be in for a nice rally as we head into the final quarter of the year. In a mid-term election year, the SPX bottoms by the end of Q3 and has a real flourish in the last quarter with the index up +6.0% on average, so big year-end rallies are common.

“German irrationality” is Europe’s Achilles’ heel

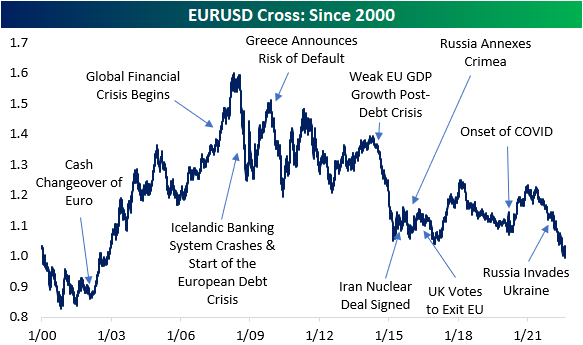

The EUR/USD exchange rate stood at 1.60 in the summer of 2008. Last week, the Euro fell below parity and there it remains. For the first time in nearly twenty years, the US dollar is more valuable than the Euro.

The last time the Euro traded at this level versus the dollar, we all printed out directions from MapQuest for our long drives, there was no such thing as social media with MySpace still six years away yet everyone was starting to chat on MSN messenger, the iPhone was still a dream in Steve Jobs’ eyes, Nokia 3310 was the bestselling phone with everyone playing Snake (the unwieldy and addictive game that came as standard with every handset), and all you could do with your phone was make calls and send SMS messages, the Baha men and everyone else was asking ‘Who Let the Dogs Out’, the first MP3 had just been launched and we were all using a website called Napster to download music and it took forever on that dial-up internet which went Screeeech . . . hisss . . . squawk (interspersed with whistles and chirps), the frustration, however, no way diminished the excitement of getting online.

The chart below summarizes the major events that have impacted the Euro since the turn of the century. It’s been a wild ride!

Source: Bespoke Research

One would expect that with such a weak currency, the Eurozone would be printing record trade surpluses and the economy would be growing at over +3%, instead, the Eurozone is moribund, inflation is running at over +10% and the region is staring at a recession. The European Central Bank (ECB) is forced to raise rates precisely when the economy is suffering and it has also morphed into a “political lender” as it helps to keep the lid on the Eurozone’s sovereign debt crisis from flaring again.

Not long ago, Europe (read the European Union) was concerned about the direction in which the US was going. Phrases like “terminal decline,” “too divided” and “too dysfunctional” appeared regularly in the European press and diplomatic channels. EU leaders considered America’s decline as inevitable and were preparing for this eventuality, by taking measures to be less dependent on the US.

Many in Brussels openly questioned the international order led by the United States and ridiculed its then President Donald Trump. In September 2018, in a speech at the United Nations General Assembly, when Trump accused Germany of becoming ‘totally dependent’ on Russian energy, the German diplomats were caught on camera laughing. German Foreign Minister Heiko Maas could be seen smirking alongside his UN colleagues.

There’s a reason why everyone in Europe is terrified of Germany. If this is the attitude when they are weak and vulnerable, then you can imagine what it would be when they are in a position of strength. Well, you don’t have to imagine it, just read about it in history. The fear of Germany has shaped Europe’s policy and all the consequences flow directly from it.

Then Russia invaded Ukraine, and everything changed. Europe’s grand thinking of building ever closer trade ties with rival global powers China and Russia are in tatters, and American strength has reasserted itself. Europe discovered it had in fact become more dependent on America and not less.

Germany has made a series of mistakes in its (and by extension the EU’s) foreign policy, yet nobody dared to stand up and criticise – barring Poland and Hungary who know their history lessons well.

History tells us that “German irrationality” is Europe’s real Achilles’ heel and it seems nothing has changed in over a century. In 1897 Europe was, collectively, the hegemon and goliath of the world in almost every sense – economic, trading and military power. Europe covers roughly 7% of the land mass of the Earth, but by 1800 it ruled 35% of the globe and by 1914 a staggering 84%. Even America was still an emerging and localised power mostly concerned with completing its conquest and colonisation of its own continent. Germany, put paid to Europe’s dominance spectacularly as German jealousy of the British Empire blew things up in Europe and led to two world wars, that devastated the continent.

Europe’s delusion of independence was a sand castle, as in reality it depended on Russia for its energy, China for its trade and America for its trade and security.

In pursuing a policy of “independence from America”, Europe found itself in the worst of all worlds and in a desperate attempt to save itself, has rushed back to clinging even more closely to Washington than ever before. The very leviathan it ridiculed and derided, is now its saviour, as an energy crisis and a belligerent Russia threatens to ravage the continent. The US has increased its military presence on the continent, and Europe has started importing American gas.

The new world order is more about security than trade, something EU-philes don’t seem to understand. The EU is an empire that can’t protect itself. It is trade-focused and that is what has led to its military weakness.

Wrong policy choices always come home to bite. In last month’s Market Viewpoints I highlighted German folly concerning its trade policy and that is pretty much the story of the continent – reliance on cheap energy to ramp up exports and no efforts to secure energy independence. Europe’s exports would be so much more competitive with a weak Euro, only if it had the oil & gas needed to run manufacturing, industries, agriculture or even its tourism industry. Everything is underpinned by energy. This is the reason China is so focused on securing its energy supply and the US is in an enviable position of being energy abundant, so much so, that they can export energy.

Energy is a foundation stone of the modern industrial economy. Energy provides an essential ingredient for almost all human activities – cooking, heating, lighting, health, food production, storage, mineral extraction, industrial production, transportation etc. Energy is the engine of economic and social development. The history of industrialisation has shown us that if a nation has to move beyond subsistence, then access to energy, for its broad section of the population, is the necessary condition.

Research has indicated that energy is responsible for at least half the industrial growth in a modern economy, while representing less than one-tenth of the cost of production.

Europe therefore has tough days and cold winter nights ahead. Humility and long-term planning will serve it well. However, for now, the Euro is likely headed lower and the international order if anything, is more dependent on the American military, economic, and financial might now than ever before.

Like any sell-off, the Euro will rebound and I see 0.84 as that rebound level. If the US Federal Reserve (Fed) pivots, then the rebound could be sooner, but the Euro will likely spend a long spell below or close to parity, given the economic and political mess that’s facing the Eurozone.

As for “dysfunctional America”, the social unrest today in the US is nothing like what it was during the 1960s when the Vietnam War and the Civil Rights movement caused social upheaval. What Europeans simply don’t understand is that America has never been “orderly” or “restrained.” Switzerland it isn’t. Americans have always been loud, divisive and more concerned with individual rights than with collective responsibility, as in Europe. But the difference between the US and the rest of the “dysfunctional/divisive” democracies (say Latin America) is that when the chips are down, Americans know how to forget any differences, save the nation and re-build to a new level of strength.

Markets and the Economy

The S&P 500 (SPX) has had quite an impressive run lately, with a +10% gain since the mid-June low. However, the index remains more than 15% below its all-time high seen on the first trading day of 2022.

A fall in headline inflation from +9.1% to +8.5% added more legs to the rally in August. This was the first negative surprise to headline inflation in over 6 months.

Gas prices in the US have moved down to $3.95/gallon (national average), $1.06 below their all-time high in mid-June and at their lowest levels in over 5 months.

Regular readers of this newsletter will know my view that the US cannot afford to have higher rates due to the high level of debt in the US economy.

I repeated this on CNBC two weeks ago – There is no way the U.S. can sustain an interest rate beyond 2.5% in the long term

We will likely see another +0.50% hike in the Federal Fund Rates (FFR) at the September 21 meeting of the US Federal Open Market Committee (FOMC) which will take the FFR to +2.75%. However, over the medium term, the state of debt, the deficit and economic growth in the US means that the FFR will stabilise in the +2.25% to +2.5% range.

Benchmark Global Equity Index Performance (2021 and 2022 YTD)

In terms of data:

- 1. US consumer spending barely rose in July, but inflation as indicated by Personal Consumption Expenditure (PCE) – which the US Federal Reserve prefers to the CPI – eased considerably, which should give the Fed room to sound less hawkish. The PCE price index decreased by -0.1% in July, the first MoM negative print since April 2020

- 2. On an annual basis, PCE rose +6.3% in July from a year earlier, down from +6.8% in June. The core PCE which excludes volatile food and energy prices—increased +4.6% in July from a year ago, down from +4.8% in the year through June

- 3. World Container Index (WCI) publishes weekly indices on the cost to move containers between ports around the world on a spot basis. The latest data published by WCI indicate there has been a significant easing in the freight cost. Pre-pandemic shipping costs ran around $1600 per 40-foot box from Shanghai to Los Angeles. That number rose by nearly a factor of 10 through the peak in 2021 but it’s fallen by half since that peak. On average across a range of shipping routes, container costs have fallen by -42% from the peak. This is just the latest data confirming that supply chains have eased dramatically over the last six months.

- 4. At the current level of 34.4, the Prices Paid component of the Dallas Fed report is now at its lowest level since October 2020, and besides the Richmond survey, every other Prices Paid component is at its lowest level since at least January 2021. This month was the second month in a row, that all five Prices Paid components of the regional Fed surveys declined on a month-over-month basis.

Last week, US President Joe Biden announced that he will cancel $10,000 in US federal student loan debt for borrowers making under $125,000 a year or for couples making less than $250,000 a year. Biden is playing Santa Claus again as the US mid-term elections are around the corner.

US taxpayers will pay for this. Thanks to Biden, now every American will become saddled with student debt.

If you worked your way through school, you received nothing, and now you will pay for others who cannot or will not pay off their student loans. If your parents saved for you to attend college, they don’t receive a refund and will now pay for the student loans of others via taxes.

The irony of Biden’s policy is there are over 11 million unfilled jobs in the US. That means there are millions of opportunities for those with student debt to earn the money to pay off their debts. Next time, Biden will be better off offering everyone a free college degree, and the US will save billions on the cost of issuing and then cancelling loans.

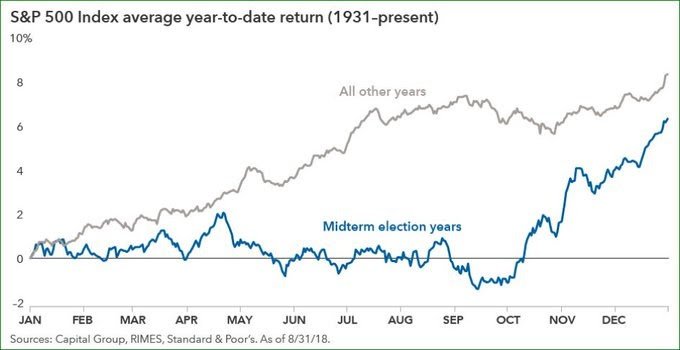

The reason I bring up the mid-term elections for discussion, is the seasonality of SPX returns during a mid-term election year.

In the post-WWII period, the SPX has gained +5.03% on average in mid-term years, but it pales in comparison to the average gain of +8.95% for all years.

Further, in a mid-term election year, the SPX bottoms by the end of Q3 (see chart below from Capital Group) and has a real flourish in the last quarter with the index up +6.0% on average, so big year-end rallies are common. One to watch out for.

The adage that markets don’t like uncertainty, seems to apply here. Early in the year, there is less certainty of the election’s outcome and the subsequent effects on future policy changes therefore the markets tend to oscillate for most of the year, gaining little ground until shortly before the elections. Markets tend to rally when results are easier to predict, in the weeks leading up to the election and continue to rise after the polls finally close and the winners are declared.

S&P 500 index performance and US midterm election year seasonality

Fed Chair Jerome Powell’s address at the Kansas City Fed’s annual symposium in Jackson Hole, Wyoming was the most eagerly awaited event last week and he didn’t disappoint. He offered enough to both the hawks and the doves.

Powell said the economy “continues to show strong underlying momentum” and added “we are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2%.”

The hawkish part was – while the Fed’s current rate setting is in a “neutral” zone, such a level of rates is “not a place to stop or pause” when inflation is so high and the labour market is so tight. Bringing inflation down was likely to “require maintaining a restrictive policy stance for some time,” he said. “The historical record cautions strongly against prematurely loosening policy.”

The dovish part was – the next rate decision “will depend on the totality of the incoming data and the evolving outlook,” he said. “At some point, as the stance of monetary policy tightens further, it will likely become appropriate to slow the pace of increases.”

Powell’s comments highlighted that the Fed is preparing to shift from a phase of rapid and large rate increases, to potentially smaller increases focusing on slowing demand and then holding the rates instead of cutting them too soon.

Unfortunately, Powell can’t take the most meaningful step to tame inflation – prevent the fiscal authorities from increasing spending by hundreds of billions of dollars in spending programs once every few months.

Inflation is ultimately a political choice, even though we look to central banks to tame it. It’s easy to create inflation – just print and give away lots of money to everyone. By the same measure, it’s easy to create deflation too – raise taxes. The key to the future outlook for inflation, therefore, is not an economic model, but the political choices, desires and wants of the population.

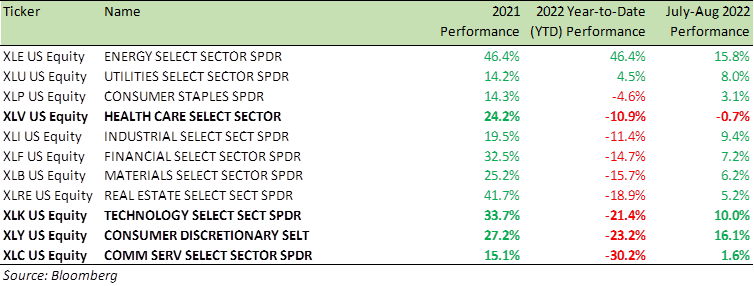

Despite the sharp declines last week in response to Powell’s comments at Jackson Hole, most sectors remain above their 50-day moving averages (DMA) with the only two exceptions being Communications Services and Health Care.

It remains to be seen whether last week was a pause in the sharp rally off the June lows or a resumption of the bear market, but if the majority of sectors can stay above their 50-DMAs, the bulls still have hope to cling to.

Benchmark US equity sector performance (2021, 2022 YTD)

Since both the bears and bulls seem vindicated, volatility abounds, and structured products are the perfect vehicle to monetise income and retain an upside in market performance.

Seasonality indicates that the S&P 500 could be in for a nice rally as we head into September/October. So, please bear that in mind.

There are plenty of high-quality stocks in the consumer, tech, industrial and health care sectors that are trading at -15% to -20% on a YTD basis, and present a good opportunity to invest, be it directly or via structured products.

For specific stock recommendations and structured product ideas please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA