“The desire to perform all the time is usually a barrier to performing over time.”

Robert Olstein

Summary

Around this time last year, Covid-19 was threatening to run amok and that it did, causing hundreds of billions of dollars in economic damage globally, the deepest recessions since WWII and record job losses. Yet here we are,12 months later, thanks to the rapid success of virologists and vaccine science, we now have a choice of vaccines to inoculate ourselves against Covid-19. The 10-Year US Treasury that cratered and reached a new low of +0.5% is now back at +1.4% and threatening to head higher. Inflation, not disinflation, is suddenly the talk of the market.

Rising yields are grounds for anxiety, but not yet a cause for alarm. Rising bond yields are more an indicator of things heading back to normal – as the vaccination program achieves its intended outcome – stopping infection and achieving “herd immunity” against the Covid-19 virus. The equity risk premium (ERP) – how much stocks will outperform risk-free investments over the long term – is at a still very attractive level of over +3.1%. During the 1990s dotcom boom, at the time of the market crash, the ERP was negative. At that time, there was the alternative of keeping money in cash, as yields were a chunky +4-5%. No such alternative exists today, with the base rate standing at zero and central banks determined to keep it low for the next 12-24 months at least.

A hot housing market in the US is churning out job opportunities for blue-collar workers. Jobs in residential construction, package delivery and warehousing exceed pre-pandemic levels—and many companies are struggling to find enough workers to keep up with demand. The job gains largely result from the growing adoption of online shopping during the pandemic, which is likely to last permanently.

In a recent survey by the technology company Pitney Bowes, consumers said they are conducting close to 59% of their shopping online, and they expect to do 56% online after the pandemic ends. Before the coronavirus hit, the shopping online percentage stood at 39%. This is a signification change in consumer behaviour and one that will have a profound effect on productivity and GDP numbers in the medium and long term.

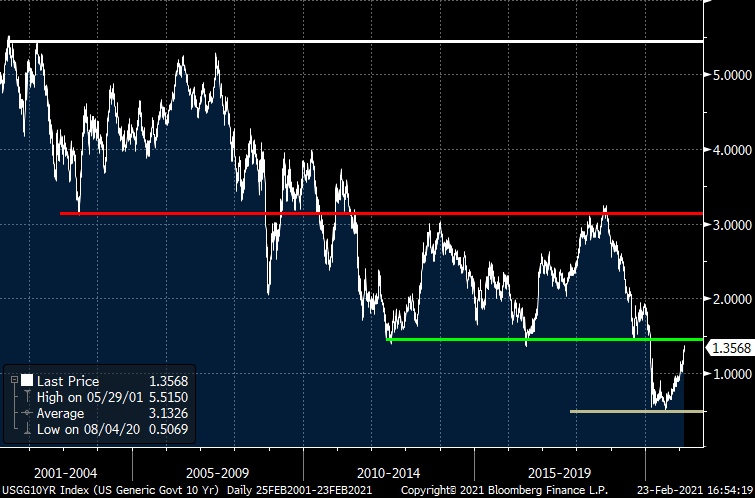

Herd immunity and rising bond yields

Around this time last year, as the fears of Covid-19 rampaging the globe grew, an already historically low yield on 10-Year US Treasuries of +1.6% – cratered and reached a new low of +0.50%. Barring a few false dawns in early summer 2020, when the virus looked defeated, resurgent infections led to more (and longer) lockdowns, and the yield stayed at the +0.5% level.

All that changed on November 9, when Pfizer (PFE) and BioNTech (BNTX) announced that their vaccine candidate demonstrated evidence of efficacy against Covid-19 in participants without prior evidence of an infection. Bond yields started rising and a month later when Margaret Keenan, 91, a UK grandmother became the first person in the world to be given the Pfizer Covid-19 jab as part of a mass vaccination programme, yields took off and they are now approaching the +1.5% level fast.

Should we be worried about rising bond yields? Are higher yields bad news for equity markets?

In short: No we shouldn’t be worrying and No it’s not all bad news. We must however watch the yields carefully.

Rising bond yields in themselves are not a problem and they are more an indicator of things heading back to normal – as the vaccination program achieves its intended outcome – stopping infection and achieving “herd immunity” against the Covid-19 virus.

The vaccination program in the UK has been running for over 10 weeks now, with over 18 million – 34% of adults – having received at least a first dose of the vaccine. Three UK studies released this week by Public Health England (PHE) all indicate that vaccination against Covid-19 provides high levels of protection against infection, illness and death. The PHE scientists reported that the Pfizer-BioNTech vaccine reduced the risk of infection by more than 70% three weeks after the first jab, rising to 85% after the second dose.

Coloured transmission electron micrograph (TEM) of a SARS-CoV-2 coronavirus particle

Source: Public Health England (PHE)

One of these studies was particularly significant, given the controversy in France and Germany regarding the effectiveness of the Oxford-AstraZeneca vaccine. The study, based on data from 1.14 million vaccinations (over 60% of whom received the Oxford-AstraZeneca vaccine) administered in Scotland, indicates that both the Pfizer-BioNTech and Oxford-AstraZeneca vaccines are highly effective and that by the fourth week after receiving the initial dose, the risk of hospitalisation from Covid-19 was reduced by up to 85% and 94%, respectively.

Shame therefore on President Emmanuel Macron of France, the German government and all those who have erroneously tried to undermine confidence in the Oxford-AstraZeneca vaccine and thereby reducing the uptake of the vaccine on the Continent.

There is good reason to now believe that the world is accelerating towards a “herd immunity” against Covid-19 at a rapid pace – except for the European Union (EU) for now. Having said that, we are already seeing signs of a U-turn in Germany. Germany has now launched a public relations push to reassure the people about the Oxford-AstraZeneca vaccine. Chancellor Angela Merkel’s chief spokesman Steffen Seibert said: “The vaccine from AstraZeneca is both safe and highly effective. The vaccine can save lives.”

European Commission Chief Ursula von der Leyen has also sought to quell doubts by saying that she would take the Oxford-AstraZeneca jab. “I would take the AstraZeneca vaccine without a second thought, just like Moderna’s and BioNTech/Pfizer’s products,’ von der Leyen told The Augsburger Allgemeine.

In yet more encouraging news, the US health regulator, the Food and Drug Administration (FDA) is set to relax requirements for the Pfizer-BioNTech vaccine to be stored at ultra-low temperatures, potentially allowing it to be kept in pharmacy freezers. This will be a big boost for the distribution and availability of the Pfizer-BioNTech vaccine.

US 10-Year Treasury Yield (USGG10YR Index) – last 20 years

Source: Bloomberg

Covid-19 cases in the US and UK are already down by more than -75% over the last six weeks, as vaccination programs have accelerated, and both the nations are racing towards a very low level of infection and indeed ‘herd immunity” by end of April, allowing people to resume a normal life. Professor Devi Sridhar, Chair of Global Public Health at the University of Edinburgh, said: “There’s no reason we have to live with this virus, or even see it as a seasonal flu because we’re seeing with a vaccine as effective as this – a better analogy is probably measles, which is a virus that’s endemic in parts of the world.But we don’t accept living with measles here – we vaccinate against it.”

This is all good news but what this means for the financial markets is: Bond yields are heading higher.

Rising yields are grounds for anxiety, but not yet a cause for alarm. Higher yields might call for a judicious tilt towards long-dated bonds in a balanced portfolio, as yields get attractive again, but not much more. The equity risk premium (ERP) – how much stocks will outperform risk-free investments over the long term – is at a still very attractive level of over +3.1%

Of course, if bond yields rise further, or stock prices rise much faster than earnings, the ERP will fall. Over the past 20 years, the ERP has been in a range of +3-4%. During the 1990s, during the dotcom boom, the ERP was negative. At that time, there was the alternative of keeping money in cash as yields were a chunky +4-5%. No such alternative exists today, with the base rate standing at zero and central banks determined to keep it low for the next 12-24 months at least. Real interest rates today, despite the increase in yield, are still negative i.e. bonds and cash still don’t offer a good enough hiding place from riskier assets like equities.

Higher bond yields are good news if they are prompted by an improvement or expectations of improvement in economic data. The latter is certainly the case this time. The National Bureau of Economic Research (NBER) has not yet announced the end of the recession in the US, but clearly, the recent set of retail, housing and industrial production data suggest that the US economy is leaving the 2020 slump in the rear-view mirror. Improving economic conditions despite the volatility (as we have seen this week for technology and growth stocks) make investors more confident about owning equities, and less keen on the safety of government bonds.

The big question is whether the very long bull market in government bonds is over? My answer to that is an emphatic Yes – at least as far as US Treasury bonds are concerned. Eurozone government bonds are a different kettle of fish and the economic malaise in the Eurozone is far from over, even if the Eurozone eventually manages to inoculate itself against Covid-19.

Markets and the Economy

As per my comments above, I am firmly of the view that the multi-year rally in US government bonds is over.

In recent days, we have seen the inflation measures in the UK print far above forecasts, despite the continued lockdown and the rising currency. We see a similar case in Canada where the Consumer Price Index (CPI) for January jumped to +1% versus the previous month’s +0.7% increase. The US Producer Price Index (PPI) data came in above expectations too and saw the biggest surge since 2009. All these are still backward-looking, as they do not take into account the recent rise in energy prices (especially pronounced in the US). Of course, we still have to look for more data before we conclude that the dis-inflation fear is gone. However, the recent press readings and commentaries tell us that the “zeitgeist” on inflation is changing.

In such a scenario, bond yields in the US will only rise if we see a change in fiscal policy in the US – of which there are absolutely no signs, and this policy continues to be expansionary. A monetary policy change – a hike in interest rates – still lies ahead – so that’s another negative for bonds. Of course, when the yields do get attractive, a new set of bond investors will get drawn into US Treasuries again or, if there is a new crisis in the world, US Treasuries will again become the asset of choice.

In summary therefore, there is little to take investors interest away from the equity markets for now.

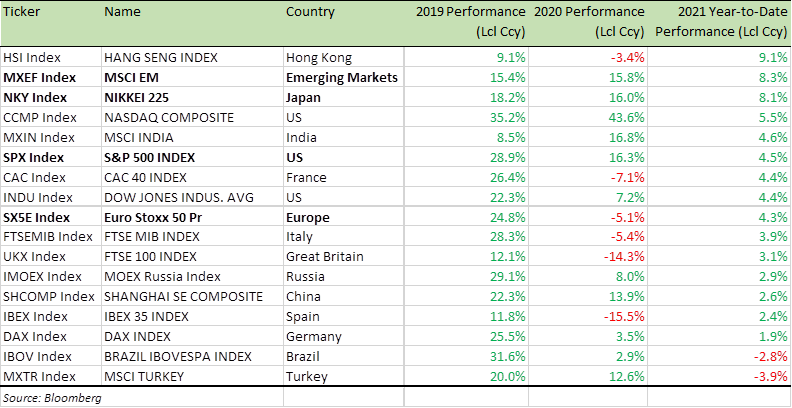

As the table below indicates, equities have performed well so far this year despite the volatility in recent days. Keep an eye on the non-US equity market, particularly Europe (including the UK), which have a lot of catching up to do, as sentiment and global growth turns positive.

Emerging market equities have shown also great strength in recent weeks and this strength is set to continue, as vaccination drives re-open the world once again to consumer demand and stellar GDP numbers in the US.

Benchmark Equity Index Performance (2020 & YTD)

This week, US Federal Reserve (Fed) Chairman Jerome Powell reaffirmed his commitment to keeping easy-monetary policies unchanged for the foreseeable future. His comments stemmed the slide we were witnessing in growth and technology stocks.

“The economy is a long way from our employment and inflation goals,” Powell said in testimony to the Senate Banking Committee, a statement he has repeated in recent weeks. The Fed will therefore continue to support the economy with near-zero interest rates and large-scale asset purchases until “substantial further progress has been made.” This should put a floor for market moves to the downside, as every dip is bought back. This has been the case over the last two months as the re-opening and reflation trades have become the talk of the markets.

A hot housing market in the US is churning out job opportunities for blue-collar workers in the US as this report in The Wall Street Journal (WSJ) indicates. Jobs in residential construction, package delivery and warehousing exceed pre-pandemic levels—and many companies are struggling to find enough workers to keep up with demand.

The report further highlights that the blue-collar job gains largely result from the growing adoption of online shopping during the pandemic, which is likely to last permanently. You will recall in last month’s Market Viewpoints I discussed this transition to digitisation – “during the 1920s, the US transitioned from an agrarian to an industrialized nation. Now, along with the rest of the world, it is transitioning to an era of “digitisation.” “

Furthermore, in a recent survey by the technology company Pitney Bowes, consumers said they currently conduct around 59% of their shopping online, and they expect to do 56% online after the pandemic ends. Before the coronavirus hit, 39% of their shopping was conducted online. That’s a signification change in consumer behaviour.

So now that we have more evidence of the effects of digitisation and the change in consumer behaviour in the US, I feel even more confident about my – “Are the second Roaring ‘20s on their way?” thesis as outlined in last month’s newsletter. Productivity gains and high GDP numbers are down the line.

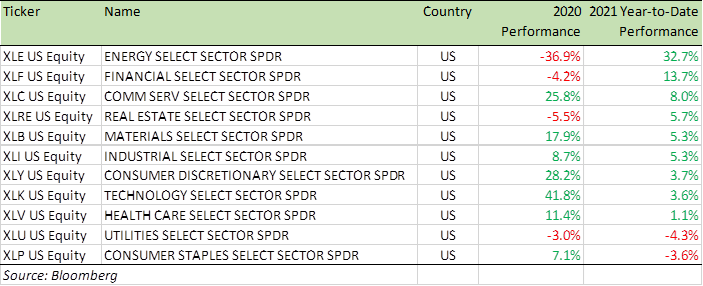

In terms of sectors – consumer sectors have always been my favourite ones to pick stocks from and I continue to maintain this bias.

The interest that banks pay on deposits – the short end of the interest rate curve – is anchored at zero as the Fed is in no mood to raise interest rates. While the interest that banks charge for lending – often linked to the longer end of the interest rate curve – keeps on increasing as yields rise. The banks therefore will keep churning out better earnings.

I am also not too concerned about equity market corrections. There are still record levels of cash on the side-lines. Anecdotally, there are still many people who regret being in cash over the past 6 months (if not longer) and want to get back into the stock market – but are deterred by all-time high levels. Any dips in the market will get these investors back in.

Benchmark US equity sector performance (2020 and YTD)

Stocks linked to Electric-Vehicles (EV) are another good bet to focus on as the industry grows.

Last week we learnt that luxury car and Sports Utility Vehicle (SUV) maker Jaguar will become an all-electric brand by 2025. The first all-electric Land Rover vehicle is due to be launched in 2024 and Jaguar will phase out diesel engines by 2026 and ditch the internal combustion engine entirely by 2036.

General Motors (GM) – an icon of the “old auto” industry has also announced it is going all-electric by 2035. GM will end production of all diesel and gasoline-powered cars, trucks, and SUVs by 2035.Other traditional names like Ford, BMW, Volkswagen are also pumping in billions of dollars and euros in their drive to have EV supremacy.

Source: Jaguar Motors

This is a big moment for EV and battery stocks that have a head start if they deliver on the promise – Tesla (TSLA), NIO (NIO), QuantumSpace (QS), Blink charging (BLNK), and Lucid motors (CCIV) to name but a few.

Globally, around 60 million new passenger cars were sold in 2020. Of those, only 5% or just under 3 million were electric vehicles. Considering that even GM is going all-electric by 2035, it’s quite likely that nearly 75% (if not all) of new car sales globally will be electric by 2036. Let’s assume that total new passenger car sales over the next 15 years increase by +2.5% p.a. (a conservative estimate given China and Emerging market growth), that puts total passenger car demand at 77 million and the demand for EV at 57 million i.e. a dizzying growth of nearly 20x from the 3 million unit sales in 2020.

The above calculation doesn’t take into account the demand for electric trucks and other commercial vehicles, which will also be significant drivers of EV demand. Last month, US President Joe Biden signed an executive order that will require the replacement of the entire fleet of federal vehicles with US-built electric cars, vans and trucks; in all, some 645,000 nationwide.

On June 29, 2010, Tesla (TSLA) made its debut as a public company — the first initial public offering of a domestic automaker in a half century. The IPO price was $17 a share. TSLA today trades at $720 after reaching an all-time high of $880.

Since its IPO, TSLA has declined:

10% – 21 times

20% – 14 times

30% – 8 times

40% – thrice

50% – twice

60% – once

EV sector stocks deserve the attention of investors – but don’t expect a smooth ride!

Best wishes,

Manish Singh, CFA