Rigid tariff policies may not yield the desired economic invigoration or solidify the legacy Trump wants.

Summary

In a remarkable turn of events, the American electorate has afforded President Donald Trump a rare second chance. Unwavering in his commitment, Trump is poised to intensify his signature “Make America Great Again” (MAGA) agenda, focusing on reshaping trade and immigration policies. His strategy includes employing tariffs to redirect trade flows and deporting illegal migrants to enhance safety, improve wages, and fulfil the prosperity he promised during his campaign.

Despite Trump’s conviction that higher tariffs will bolster the U.S. economy, historical outcomes, particularly with China, suggest a complex reality. Businesses have repeatedly adapted to overcome trade barriers, suggesting that rigid tariff policies may not yield the desired economic invigoration or solidify the legacy Trump aims to establish. A more beneficial approach could involve negotiating a China-U.S. trade agreement—potentially a “Mar-a-Lago Accord”—that emphasizes mutual benefits rather than continuing a protracted tariff dispute. However, any agreement might be preceded by a temporary escalation in tariffs as the administration reassesses its strategy.

While President Trump relishes the rhetoric of protectionism, his preference for a buoyant stock market significantly overshadows it. With the potential shift of the House to Democratic control post-midterm elections, Trump has a narrow window of 18 months to advance his agenda. It is hoped that Treasury Secretary Scott Bessent will guide the administration towards strategies that avoid harmful tariffs, which could undermine economic momentum, reintroduce inflation, and interrupt the Federal Reserve’s cycle of rate cuts.

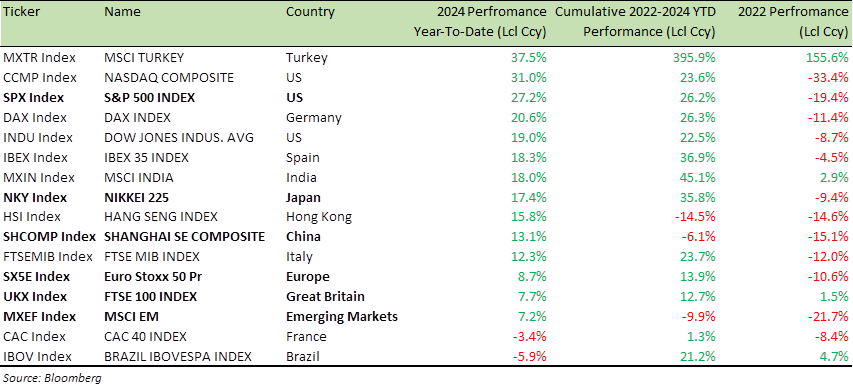

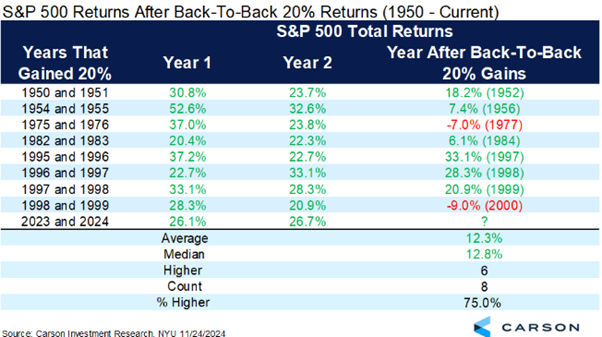

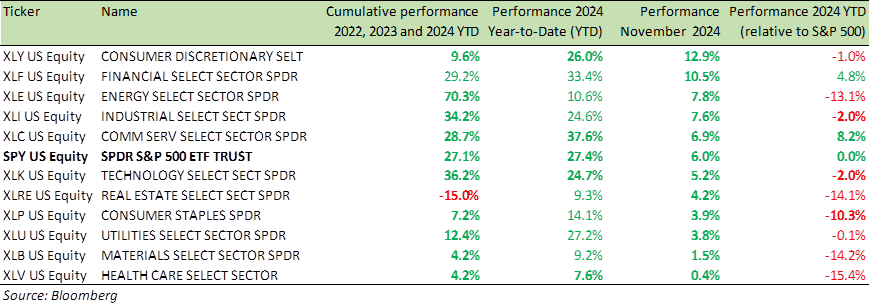

On the markets front, there is substantial cause for celebration. This year, the S&P 500 has achieved an impressive +25% return year-to-date, building on strong performance from the previous year. Even with a -20% dip in 2022, the three-year cumulative return stands at +27%, averaging an annual return of +8.3%. History shows that consecutive +20% gains in equities, such as those seen since 1950, do not necessarily predict a downturn; in fact, in six out of eight such instances, the following year continued to see gains, averaging +12% and a median of +13%.

Holiday Cheer Gives Way to Tariff Season

We’ve had Thanksgiving, Advent is underway, and Christmas is just around the corner.

Thanksgiving— centred around gratitude—is a holiday I believe that deserves more celebration and emphasis. Don’t get me wrong, spreading cheer is wonderful, but as Arthur Brooks, the Harvard professor, columnist, and podcast host, reminds us, it’s gratitude that truly brings lasting happiness.

Gratitude is a kind of psychological superpower. Unlike cheerfulness, which is fleeting, gratitude trains us to focus on what we already have rather than what we lack. The human brain is hardwired to process negative emotions, like resentment, much more efficiently than positive ones—a survival mechanism from when spotting danger meant staying alive. But in modern life, this negativity bias can make us miserable. Gratitude flips this script, grounding us in reality and encouraging us to appreciate what’s good in our lives.

Addiction, by contrast, feeds on emptiness, an endless chase to fill what we think is missing. Gratitude, on the other hand, fills us with contentment for what we already possess. It’s a simple shift in perspective, but one with profound effects—perhaps the best gift we can give ourselves this holiday season.

So, what are we thankful for this year?

There’s plenty to appreciate, but since this is a market commentary, let’s highlight the impressive +27% return on the S&P 500 (SPX) Year-to-Date—building on a similarly robust performance last year (see table below).

However, when factoring in the -20% decline from 2022, the cumulative three-year return comes to +26%, equating to an average annual return of +8.3%.

Global Equity Index Performance (2024 YTD, 2022-2024 YTD and 2022 Performance)

Significantly, a consecutive +20% gain in equities does not necessarily justify a bearish outlook. Since 1950, the SPX has posted +20% gains in two consecutive years on eight occasions. In six of those instances, the third year saw positive returns, with an average return of +12%, and a median return of +13% (see table below).

The US Federal Reserve (Fed) began cutting short-term interest rates in September, as inflation neared its +2% target. Minutes from the latest Fed meeting suggest that policymakers plan to continue gradually lowering rates.

The US economy remains on solid footing, and corporate profits are still rising. Bond yields are falling, like the conditions during the rally of the mid-1990s.

The final S&P Global manufacturing PMI for the US in November came in at 49.7, surpassing the preliminary estimate of 48.8.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence commented, “The mood among US manufacturers brightened in November. Optimism about the year ahead has improved to a level not beaten in two and a half years, buoyed by the lifting of uncertainty seen in the lead up to the election, as well as the prospect of stronger economic growth and greater protectionism against foreign competition under the new Trump administration in 2025.”

How rare it is to be given a second chance. That’s exactly what the American people have offered President Donald Trump. True to his style, Trump isn’t one to dwell on past missteps; instead, he’s likely to double down on his signature policy—Make America Great Again (MAGA). At the heart of this agenda lie trade and immigration—or more precisely, using tariffs to redirect trade and deporting illegal migrants to reduce crime, boost wages, and deliver the prosperity Trump promised on the campaign trail.

As the legendary baseball player, Yogi Berra might say if he were alive today: It’s tough to make predictions, especially about the future—and even more so when it comes to Trump and his tariffs. So, instead of predicting, let me lay out a few key points.

President Trump has unveiled plans to impose a 25% import tariff on goods from Canada and Mexico starting on day one, with an additional 10% levy on Chinese imports. To help implement this strategy, he has appointed Jamieson Greer as his trade representative. A protégé of Trump’s former trade chief, Robert Lighthizer, Greer is determined to bring manufacturing and industry back to the U.S. from China, regardless of the cost.

Trump has appointed Scott Bessent to be the new US Treasury Secretary. A former hedge fund manager at George Soros’s firm and later at his own, Bessent specialized in macro investing, using geopolitical analysis and economic data to make large-scale market predictions.

As an economic historian, Bessent understands the US’s unsustainable trajectory. Steering the nation towards sustainability amid conflicting priorities and entrenched interests will be challenging.

Bessent, a follower of late Japanese Prime Minister, Shinzo Abe, advocates a “3-3-3” policy for President Trump:

- Cut the budget deficit to 3% of GDP by 2028

- Raise GDP growth to 3% via deregulation

- Increase daily oil output by 3 million barrels

This approach, aimed at stimulating the economy and reducing energy costs by boosting oil production, is not about protectionism or free money. Instead, it focuses on free-market principles without excessive government spending, which can lead to debt and perverse incentives. While increasing oil production could help reduce both the current account and fiscal deficits and potentially strengthen the dollar, this may conflict with Trump’s preference for a weaker USD

In addition, cost-cutting measures from the newly established Department of Government Efficiency (DOGE), co-led by Elon Musk and Vivek Ramaswamy, could spur robust growth in the US by allocating capital more effectively, reducing debt and deficits, and boosting productivity.

Bessent has characterized Trump’s tariff threats as a tactical approach to secure concessions, stating, “My general view is that at the end of the day, he’s a free trader. It’s escalate to de-escalate”. Tariff war may gather headlines, but it will not benefit the US or achieve its goal to the extent Trump thinks.

Semiconductors: A Case in Point

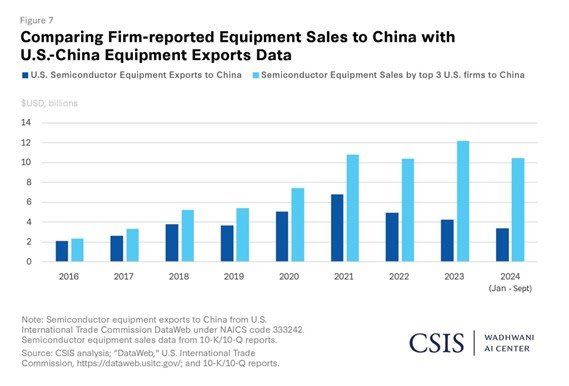

US semiconductor equipment sales to China have remained robust, even under existing tariffs and the threat of further restrictions (see figure below from CSIS).

However, a notable shift has occurred: Since Trump’s election in 2016 and the onset of the tariff war, US firms have increasingly exported semiconductor equipment to China from non-US locations.

Between 2016 and 2020, the ratio of sales to exports rose by 34%, from 1.1 to 1.5. This trend accelerated significantly from 2021 to 2024, with the ratio nearly doubling from 1.6 to 3.1.

In practical terms, this means that while exports to China and sales within China, were almost equal in earlier years, post-2020 sales have far outpaced direct exports. This shift coincides with the imposition of stricter US export controls, underscoring how businesses adapted their strategies to maintain access to the Chinese market despite heightened restrictions.

Trump may believe that increasing tariffs will benefit the U.S., but evidence tells a different story when it comes to China. Businesses consistently find ways to navigate restrictions, adapt, and keep making sales.

Could DOGE cut $2 trillion from government spending?

While it’s an ambitious goal, it’s highly unlikely. In reality, a cut of around a quarter of that amount is more plausible.

“Mandatory” spending—encompassing Social Security, Medicare, and Medicaid—makes up two-thirds of the $6.75 trillion federal budget. Discretionary spending on defence and domestic programs each account for about one-sixth. Given these numbers, it will be a monumental challenge for Musk and the DOGE team to find $2 trillion in cuts from these areas.

Could Trump deport 11 million illegal migrants?

It’s a tall order. The economic impact of removing such a large labour force from the US workforce, potentially driving up wages and limiting the capacity of companies to supply goods and services, is overstated.

Trump would be wise to avoid expending political capital on policies that fail to drive economic growth, bolster markets, or contribute to the lasting legacy he seeks. With the House likely to swing back to Democratic control in the mid-term elections, his window for implementing such policies is limited to just 18 months.

Let’s hope Scott Bessent can talk sense into Trump and steer him away from punitive tariffs. Such measures could disrupt the current economic momentum, bring inflation back to the US, and force the Federal Reserve to pause its rate-cutting cycle.

If Bessent’s fiscal conservatism can temper the President-elect’s protectionist tendencies, we might see a strong equity market in 2025.

Another year of +20% growth for US equities? Don’t bet against it.

Markets and the Economy

Europe is in a pickle and the chart below sums up the extent of problem Germany and the European Union (EU) faces.

Mercedes-Benz hit zero sales for EQE (its all-electric alternative to the E-Class) in China.

The EQE’s inability to compete against Chinese rivals and Tesla’s Model S, even at a reduced cost, highlights the struggle of traditional luxury brands to remain relevant in one of the world’s largest and most competitive EV markets.

Chinese brands like BYD and Nio have set new standards in technology, design, and value, leaving foreign OEMs, particularly in the premium segment, scrambling to catch up.

The auto industry is vital to the European Union, employing 6% of its workforce. However, with the EU’s ban on new Internal Combustion Engine (ICE) vehicles from 2035 and stricter emissions standards, automakers are under pressure. The resulting decline in ICE sales will make the already low-margin auto business even less profitable, raising critical questions:

How will European automakers accelerate model development, find the right partners, and outsource in areas where they lack expertise?

Meanwhile, China’s car exports have surged nearly fivefold over the past 3–5 years, now exceeding 5.7 million vehicles annually. With the capacity to produce over 40 million vehicles a year but domestic sales of only about 22 million, Chinese automakers are leveraging the excess capacity to dominate global markets.

How did China achieve this?

China’s dominance in the new energy vehicle (NEV) sector is largely due to substantial government subsidies. From 2009 to 2022, China invested $173 billion in electric vehicles (EVs) and plug-in hybrids, a strategy that transformed it into a global EV leader despite industry challenges like overcapacity. This state-driven approach provides a complex but instructive model for European automakers facing the dual tasks of adopting EV technology and remaining competitive.

The global influence of China’s model is reshaping international relations, compelling even its critics to engage pragmatically. A notable shift is seen in Argentina’s President Javier Milei, who reversed his stance from rejecting to actively pursuing trade with China, recognizing the complementary nature of the two economies:

“Not only will I not do business with China, I won’t do business with any communists.” – Javier Milei, September 2023

“Relations with China are excellent…They are a fabulous partner…We have economies that are complementary, and the well-being of Argentines requires that I deepen my commercial ties with China.” – Javier Milei, November 2024

Milei’s turnaround underscores the potential benefits of non-ideological engagement with China, especially considering the historical impact of IMF programs in Latin America.

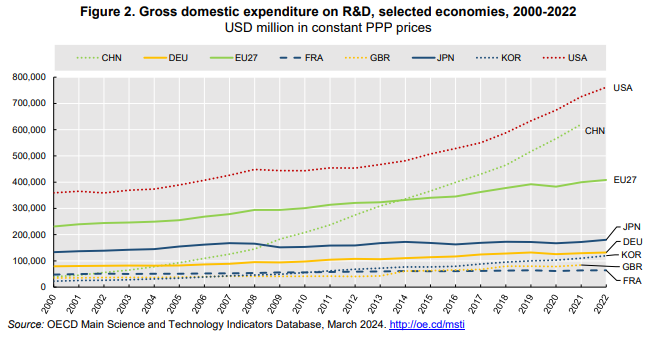

Furthermore, a recent Financial Times report reveals that global R&D spending is now concentrated in the software and computer services sector, led by US firms and surpassing traditional industries like pharmaceuticals and auto manufacturing. China is also making significant investments in tech R&D, with ambitious plans to become a leading AI innovation hub by 2030, supported by substantial venture capital investments, second only to the US.

Gross Domestic expenditure on R&D (2000-2022)

Mergers and acquisitions (M&A) in Europe’s banking sector are expected to experience significant growth in 2025, as banks aim to capitalize on strong profitability to expand and transform their businesses. In the past, large government stakes in banks had limited cross-border M&A activity within the eurozone. However, with European governments gradually reducing their stakes in banks that were rescued since 2008, many of these sales could be completed by the end of 2025, provided market conditions remain favourable, paving the way for more deals.

One of the latest notable developments in European banking M&A is UniCredit’s increase in its stake in Commerzbank. Following the sale of a 4.49% stake to the Italian lender in an accelerated bookbuild in September, the German government now holds a 12.11% stake in Commerzbank.

The rebound in profits, driven by higher interest rates, has bolstered banks’ financial positions. As the rate cycle shifts, many lenders will turn to M&A to counteract lower lending income, sustain earnings momentum, and enhance their global competitiveness.

EURO STOXX Banks Price Index (SX7E)

Source: Bloomberg

A China-US trade deal, call it a “Mar-a-Lago accord” driven by the mutual benefits it promises, is more likely than not.

However, it may first be preceded by a period of tariffs before the Trump White House fully realizes the value of such cooperation.

In my view, President Trump enjoys the rhetoric of protectionism, but he values the US stock market even more.

He is unlikely to pursue policies that risk triggering a major market correction and can be persuaded to abandon contentious positions if stock prices falter. Add to this a likely wave of tax cuts and a rollback of Biden-era antitrust policies—setting the stage for a boom in mergers and acquisitions—and the case for another 12–18 months of gains in US assets becomes strong.

Trump is a President in search of forging a legacy. While I haven’t visited Mar-a-Lago nor claim to be clairvoyant, it’s clear that Trump seeks higher stock prices, lower interest rates, and controlled inflation. To achieve these goals, he may reconsider his stance on tariffs. As we look forward to next year, here are several developments to monitor:

- RFK Jr.’s Senate Approval Unlikely: His confirmation as HHS Secretary appears doubtful, which might uplift healthcare stocks that have lagged recently. Nonetheless, health insurers still face significant unresolved issues.

- Trump’s Tariff Rhetoric May Soften: The possibility of a US-China trade deal is currently undervalued. Trump, with 18 months left to cement his legacy and a House likely to flip during the midterms, may pivot towards securing a significant agreement.

- U.S. Equities Set for Uptick: Predicting specific figures is challenging, but U.S. stocks are well-positioned to see a rise of approximately 10-15% over the next year.

- Renewed Interest in European Equities: Post-February 25 elections, a potential increase in German fiscal spending could spark greater investor interest in European stocks.

- Bearish on Oil Prices: Lower oil prices could serve as an economic stimulus, keeping inflation down and benefiting both the U.S. and emerging markets.

- China’s Equity Market to Rally: Expect a robust rally in Chinese equities later in Q1 or Q2 as China methodically boosts its economy by stimulating domestic demand and addressing its prolonged balance sheet recession.

- Strong Dollar Backed by Bessent’s Policy: Treasury Secretary Scott Bessent’s “3-3-3” fiscal conservative policy is likely to reinforce the strength of the U.S. dollar.

- U.S. Debt Refinancing Challenges: With over $6 trillion in debt refinancing due next year, there might be crowding out effects, potentially restricting credit availability for private and corporate borrowers.

Benchmark US equity sector performance (2022-2024 YTD, 2024 YTD, November 2024, and 2024 YTD relative to the S&P 500 Index)

Looking ahead to 2025, the potential for further rallies in U.S. equities could be driven by several key factors:

- Stable inflation coupled with declining interest rates

- The availability of affordable energy resources

- Expected tax reductions for both individuals and corporations, which should boost household incomes

- An increase in corporate earnings alongside sustained high consumer confidence

- The continuation of President Trump’s “America First” policies, aimed at bolstering the U.S. economy through strategic deals and initiatives.

As we approach the end of the year, I want to thank you for your continued engagement and trust. Wishing you and your loved ones a joyful holiday season and a prosperous New Year. For those celebrating Christmas, may it be a wonderful celebration full of warmth and joy.

Best wishes,

Manish Singh, CFA