“A dangerous ambition more often lurks behind the specious mask of zeal for the rights of the people, than under the forbidding appearance of zeal for the firmness and efficiency of Government.”

– Alexander Hamilton, First US Secretary of the Treasury

Summary

By now, it must be abundantly clear to even the most ardent of Europhiles, that the level of debt, particularly that of Italy and Spain (and soon France) is unsustainable. This, especially in light of the ongoing Covid-19 induced global contraction of yet-unknown magnitude. If the Euro currency is to survive, then a European fiscal union has to take place sooner rather than later.

The Franco-German proposal for a €500 billion European Recovery initiative announced last week – financed by bonds issued by the European Union (EU), directly in its name and guaranteed by its revenues has got Europhiles calling it – Europe’s “Hamiltonian moment,” referencing Alexander Hamilton, the first US Secretary of the Treasury. Details remain sketchy and the proposal has already met with opposition from member nations. Additionally, the initiative does not make provisions for a permanent increase in the EU’s meagre annual budget of €165 billion or give the European Commission the ability to raise funds under its name. The Recovery Fund is therefore not a “Hamiltonian moment,” by any stretch of the imagination.

The S&P 500 index (SPX) reached the 3,000 levels this week and is now trading back above its 200-day moving average, for the first time since February 27. Very reassuringly, we are now seeing a broadening out of the rally and a move away from stocks benefiting from a surge in “work from home.” Financial and industrial stocks have rallied this week as have other “re-opening” economy stocks in the leisure, consumer and travel sectors. This means that the SPX could easily get to over 3,100. I would, however, keep an eye on the 3,080 level, where the SPX broke down in March. The technology sector has rallied massively of late and may not have the legs to keep carrying on, particularly as GDP growth will suffer and sentiment and price-earnings (P/E) multiple expansion can only carry stocks so far. Fears of a second wave of coronavirus infections are not going away and the long-lasting economic fallout from stay-at-home orders and escalating trade tensions with China will only weigh on equities over the summer months.

Europe’s Hamiltonian moment? Probably not

Since the introduction of the Euro over two decades ago as the “single currency” of the European Monetary Union, several commentators and economists have pointed to the inherent flaws and fragility of this Union – namely, the lack of shared financial and banking systems or the existence of a common fiscal authority.

After the 2008 financial crisis, some progress was been made on the banking system front, although it still remains an incomplete Union, without a Euro area-wide common deposit insurance scheme.

On the fiscal front, a rescue fund, the European Stability Mechanism (ESM) was created in 2012 – with a maximum lending capacity of €500 billion – to help nations in financial distress. The real help however over the last decade or so has come from the European Central Bank’s (ECB) aggressive monetary easing and asset-buying programs, under the leadership of Mario Draghi, its former President.

Draghi’s “whatever it takes” speech in July 2012, has done more to keep the Eurozone together than any other political initiate before or since.

By now, it’s abundantly clear to even the most ardent of Europhiles that the level of debt particularly that of Italy and Spain (and soon France) is unsustainable, especially in light of the ongoing Covid-19 induced global contraction of yet-unknown magnitude. If the Euro is to survive, then a full fiscal union or a near fiscal union has to take place sooner rather than later.

German Chancellor Angela Merkel holds a joint video news conference with French President Emmanuel Macron, May 18, 2020

Source: Kay Nietfeld/Pool via REUTERS

Therefore, the unveiling at a socially-distanced press conference last week of the Franco-German proposal for a €500 billion European Recovery initiative – financed by bonds issued by the European Union (EU), directly in its name and guaranteed by its revenues, instead of using funds raised by national governments – has got many market and economic commentariat quite excited.

Can this really be the first step to a fiscal union or is it just another episode of an EU muddle-through?

Only time will tell. Details remain sketchy and the proposal has many teething issues to be debated and resolved but it hasn’t stopped the Europhiles from calling it – Europe’s “Hamiltonian moment.” The reference is to Alexander Hamilton (1755-1804), the first US Secretary of the Treasury. I would recommend caution.

Firstly, at this stage, it’s just a proposal and the Frugal Four as they are known- Austria, Netherlands, Denmark and Sweden, were quick out of the blocks to express their opposition to various elements of the plan. Over the weekend, they announced their counter-proposal, binning the key idea of the Franco-German proposal of debt-pooling. German Chancellor Angela Merkel and French President Emmanuel Macron now have to rally the other EU 27 nations to their vision of an EU that can tax, borrow and spend. However, all it takes is just one veto – and the plan collapses.

Alexander Hamilton is one of the few American figures featured on the US currency, who was never actually President. He features on the $10 currency note. George Washington ($1), Abraham Lincoln ($5), Andrew Jackson ($20), and Ulysses S. Grant ($50) are the Presidents that appear on US currency notes.

Alexander Hamilton, First US Secretary of the Treasury

Source: United States Treasury Bureau of Engraving and Printing

When George Washington became the first President of the United States, he made Hamilton the country’s first secretary of the Treasury. Hamilton learned about central banking at an early age, when he read about how the Bank of England (BoE) provided liquid capital as a way to expand commerce – which in turn helped Great Britain become a global trading power. Drawing on readings on political economy, credit markets, and central banking, Hamilton set the ball rolling for a historic constitutional comprise between the northern and the southern states that transformed the young United States nation from a largely rural and agrarian country into a commercial powerhouse.

The key feature of the plan was the US federal government consolidating the debt incurred by the US states during the War of Independence into US Treasury debt, laying the foundation for a strong central federal government, which could tax and issue debt in its name and thus expand the supply of money with the help of the central bank at the time – the First Bank of the United States – which Hamilton helped set up. This is known as the “Hamiltonian moment”

What the EU Recovery initiative does not do, is make provisions for a permanent increase in the EU’s meagre annual budget of €165 billion or give the European Commission the ability to raise funds under its name. Nor will the existing debts of EU nations be subsumed into joint obligations of the union, as done by Hamilton’s plan. The possibility of a new debt shared jointly among all EU countries – the so-called “coronabond” – has already been jettisoned. The Recovery fund is therefore not a “Hamiltonian moment” by any stretch of the imagination. At best, it is an apt historical reference perhaps, but the America of the 1780s and 90s couldn’t be more different than the present-day EU.

The American States then, as they are now, are still far more homogeneous in terms of culture, ideology, and their views of the purpose of money, the role of government in the lives of people collectively and individually – than Europe ever has been or will ever be. That homogeneity of political and economic principles is critical to holding together any sort of fiscal union. The situation of the member states of the EU is vastly different and in many ways is the exact opposite of the US. EU nations were formed over several centuries and throughout that, they have kept their language, currencies, distinct culture and ideologies. So will the EU ever have its “Hamiltonian moment”?

I have always been a sceptic of the EU and I don’t believe there will ever be the United States of Europe. Without a fiscal union however, the Euro cannot survive. Therefore, the bigger risk – the dissolution of the Euro – will focus even the hard-core nationalist German mind, as Germany has been the single largest beneficiary of the Euro.

Markets and the Economy

In the last month’s newsletter, I wrote: “I feel even more positive about the equity markets than last month. I also feel that the SPX could ramp up not just over 3000 but set new highs later this year as many investors are still beholden to their bearish bias ignoring the amount of stimulus money that is flowing in or set to flow into the system.”

The S&P 500 index (SPX) reached the 3,000 levels this week i.e. it is now trading back above its 200-day moving average for the first time since February 27.

Source: Bespoke Investment Group

The 200-day moving average is seen as a classic momentum indicator and some investors view it as a signal to go long above this level, but not below it. Very reassuringly, we are now seeing a broadening out of the rally and a move away from stocks benefiting from a surge in “work from home.” Financial and industrial stocks have rallied this week as have other “re-opening” economy stocks in the leisure, consumer and travel sectors.

This means that the SPX could easily get to over 3,100. I would, however, keep an eye on the 3,080 level, where the SPX broke down big in March. I don’t see such a risk this time.

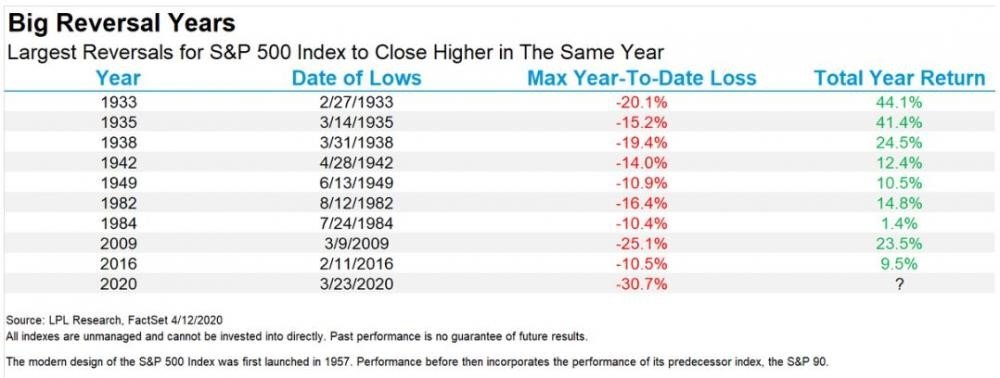

At its lows, the SPX was down more than -30% in 2020 and remains down -6% YTD. All previous reversals of -10% and over (see table below), have finished the year on a positive note. Can 2020 do the same? I suspect it can and it will.

While the rally has been spot on from an oversold position. I do now believe that it may stall over the coming weeks as the SPX reached 3,100. The technology sector has rallied massively of late and may not have legs to keep carrying on, particularly as GDP growth will suffer and sentiment and price-earnings (P/E) multiple expansion can only carry stocks like Shopify (SHOP) so far. Fears of a second wave of coronavirus infections are not going away and the long-lasting economic fallout from stay-at-home orders and escalating trade tensions with China will only weigh on equities over the summer months. Don’t forget that over 30 million Americans are still unemployed and while liquidity is not a concern, solvency of small businesses will be.

Lingering questions remain – Will planes fly half-empty until a vaccine is found? Will we ever be able to try on clothes in the shops again or try on shoes or browse in a bookstore? If not, will that affect our decision to buy? Perhaps it may postpone such a decision until later, thereby keeping GDP growth from getting back to normal.

The road back from today to pre-coronavirus days is going to be long or as Federal Reserve Bank of New York President, John Williams put it – “let’s not forget this is an extreme decline in economic activity, an enormous hardship for people in this country. So even if we are starting to see perhaps stabilization there in terms of the economy and maybe a little pickup, we are still in a very difficult situation.”

A sharp sell-off in the SPX, however, is unlikely. Near-zero interest rates and the US Federal Reserve’s (Fed) buying of corporate bond ETFs are going to carry on. The Fed is also considering what’s called Yield-Curve Control (YCC), where the Central Bank takes action to actively manage borrowing costs across different maturities. The need for a YCC policy may not be urgent as there is little doubt in anyone’s mind that rates will stay low for a long time to come. Also, as various parts of the economy re-open, equities will form a solid base on the downside with earnings estimates starting to increase.

As I have written since calling the March SPX lows, the ramp-up usually is always a slow burn compared to the sell-off, so be careful not to be too bearish. We have seen a near +34% rally in the SPX since the March lows, although it may not feel like that for those still holding on to cash. The rally, of course, has not been broad-based and major US financial stocks such as – Citi (C US), JP Morgan (JPM US), and Bank of America (BAC US) are still down more than -30% year-to-date, as are industrial and energy sector stocks.

The ECB’s ability to purchase bonds under a longstanding program came under fire earlier this month when a top German court demanded to know the justification for the program, prompting concern about the ECB’s ability to backstop the region’s debt markets. However, that concern seems to have been side-lined for now and European stocks are rallying in the wake of the “Hamiltonian moment” hope. I would suggest using the rally to sell long positions and re-position for a sell-off in European equities. My overweight continues to be US equities where both the outlook and return look much better.

I am not bullish on Emerging Markets (EM) equities at all and see them as a significant drag on performance.

I forecast a crisis building up in EMs and particularly in India if the lockdown continues. Listening to India’s Finance Minister Nirmala Sitharaman last week felt as if she was giving an online swimming lesson to someone who was drowning. It’s easy to shut down and economy, but difficult to reboot it and India is heading towards its first recession since 1979. It is one thing to say we will re-open, quite another to get it going. There has been little economic activity in India since March and the fourth phase of the lockdown started a week ago. The fiscal support offered is modest and mostly ineffective and will not have big impact. These factors also easily apply to other EM nations too.

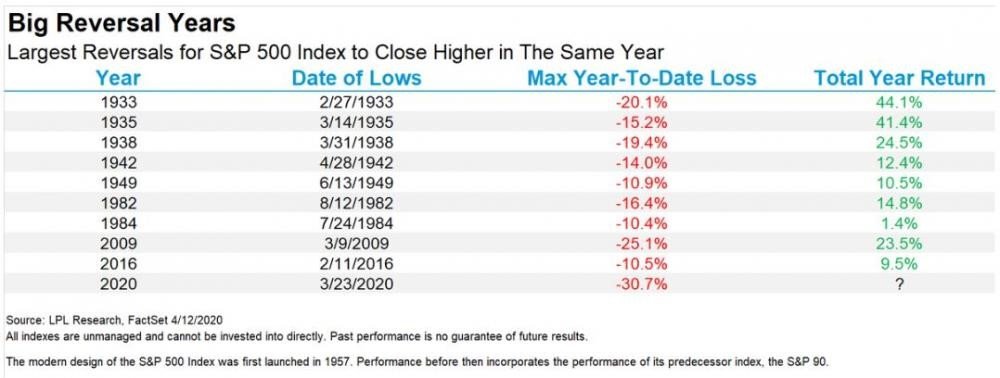

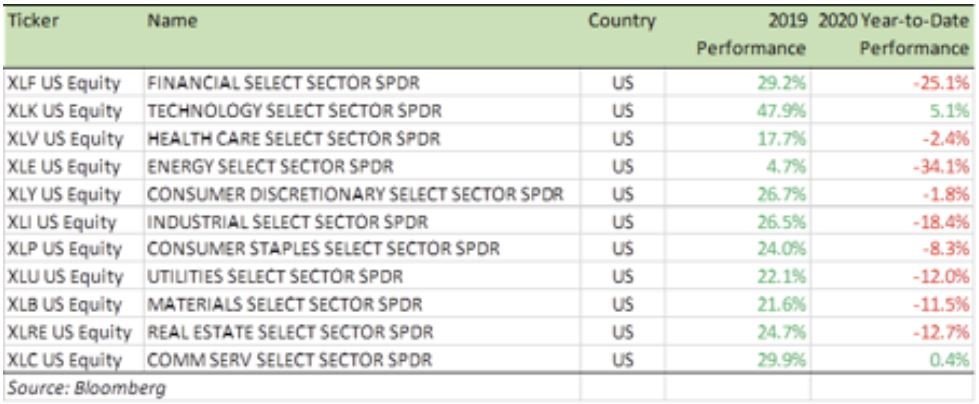

Benchmark Equity Index Performance (2019 & YTD)

From a safety point of view, the Consumer Staples (XLP) and Healthcare (XLV) sectors are my favourites, however, as the economy keeps re-opening the gains are more likely to come from Consumer Discretionary (XLY), Industrials (XLI) Communication Services (XLC), and Technology (XLK) sectors.

For specific stock recommendations, please do not hesitate to get in touch

Best wishes,

Manish Singh, CFA