Republicans could control both the House and Senate following upcoming Midterm elections in the US. What impact would this have on fiscal policy, on inflation and ultimately on bond and equity markets.

Summary

It’s now universally accepted that the US Federal Reserve waited too long to begin raising interest rates. The Fed cannot make up for that mistake by overcompensating and tightening rates too far. US mortgage rates topped +7% for the first time in more than two decades, extending a string of steep increases that have stymied housing demand. US mortgage demand has fallen to nearly half what it was a year ago. A housing slowdown sets a chain reaction of a slowdown in the economy. Recent earnings reports indicate that businesses are already factoring in a recession for 2023. No wonder then that the talk of a “Fed pivot” has started surfacing.

The Fed, however, can’t take anything for granted, as headline inflation is still over +8%. The Fed’s hands are tied by the loose fiscal policy thus far of the US administration. The Fed may be in luck however, and about to get some help. Polls indicate the Republican party is set to take control of both the Senate and the House of Representatives in the midterm elections in early November. A Republican-controlled Senate and House will not approve any more stimulus bills. That’s good news for inflation, as the over $4.9 trillion in stimulus over the last two years, has been a key driver of high inflation in the US.

Equity markets have seen a nice rally this month with the S&P 500 (SPX) and Dow Jones Industrial Average (DJIA) up+7.5% and +11.6% respectively. The talk of the “Fed pivot” has helped, as has the realisation that equities are oversold, and the earnings season has not been as bad as many thought it could be. Therefore, it is not time to dump equities but to build a position in them. Granted that bond yields are attractive again as well. Investors, once again, have the luxury to build both a bond and equity portfolio.

Mid-term elections and a “Fed Pivot” on the horizon

US economist and Nobel Laureate, Milton Friedman once said – “It always takes 6-12 months to quantify a move in rates impact on the underlying economy.”

The US Federal Reserve (Fed) has raised interest rates by 300 basis points (100 basis points = 1%) over the last six months i.e. the Fed has tightened significantly and the impact of this will only be fully felt over the next six months.

We are already seeing signs of it in the US housing market. As high rates crimp demand, and home prices have started to rollover sharply.

The longer-dated Case-Shiller home price index data released earlier this week for August, indicated US home prices falling by -9.81% month-over-month (annualized rate). That marks the first back-to-back monthly declines since the start of 2012. The Case-Shiller index looks across 20 different key metro regions in the US.

Furthermore, US mortgage rates have topped +7% for the first time in more than two decades, extending a string of steep increases that have stymied housing demand. US mortgage demand has now fallen to nearly half what it was a year ago, according to the Mortgage Bankers Association (MBA).

Housing numbers are a very important data to gauge the health of the US economy. The American fetish of home ownership doesn’t stop at buying a house – as “keeping up with the Joneses” often then takes over. Associated spending starts adding up, which is good for the growth figures of the economy – buying furnishings, manicuring the lawn (i.e. spending at Home Depot), upgrading the car to match the house (or better the neighbour’s car), and joining the same country club as the neighbours!

A housing slowdown, therefore, sets a chain reaction of a slowdown in the economy. High interest rates also raise rents, as house mortgage affordability, and hence house ownership, decline.

No wonder then the talk of a “Fed pivot” has started surfacing.

Last Friday, Wall Street Journal (WSJ) reporter, Nick Timiraos – widely regarded as the mouthpiece of the Fed – published an article titled “Fed set to raise rates by 0.75% and debate size of future hikes.”

The key lines from the article are as follows – “Some officials have begun signalling their desire both to slow down the pace of increases soon and to stop raising rates early next year to see how their moves this year are slowing the economy. They want to reduce the risk of causing an unnecessarily sharp slowdown.”

It is now universally accepted that the Fed waited too long to begin raising interest rates. The Fed can’t make up for that mistake by overcompensating and tightening rates too far. At the same time, the Fed can’t take anything for granted, as headline inflation is still over +8%.

The twelve districts of the US Federal Reserve

Source: US Federal Reserve

The Fed’s hands are tied by the fiscal policy moves of the current government, which is still largely expansionary, and the impact of the Student Loan Forgiveness Initiative has not yet been factored in.

The program promises to cancel up to $20,000 of student debt for individuals who make less than $125,000 a year, or married couples who make less than $250,000 a year. The program has been challenged in the US courts by Republican-run states. If the courts allow the administration of US President Joe Biden to proceed, debt cancellation could begin almost immediately for the more than 22 million borrowers who have already signed up for the program. At a minimum, this would mean an over $400 billion boost to spending, as loan repayments are ploughed back into consumer spending.

Recent earnings reports indicate, that businesses are already factoring in a recession for 2023, which means they are adjusting forecasts, changing buying patterns and delaying big purchases. They are also not as desperate to hire as they were nine months ago, as the monthly US jobs report indicates. The US economy is a massive ship, it won’t turn on a dime, but ratcheting up interest rates has already changed the course. Raising rates much more from here, would be reckless and lead to economic damage, the extent of which we don’t know yet.

Besides, this is not the Paul Volcker Fed of the 1970s and nor can it afford to be. In the 1970s, the US debt to GDP was approximately 40%. Today, it’s well over 100%. Debt service cost adds up very fast if rates stay too high. Unlike his academic predecessors, the current Fed Chair Jerome Powell has a background in investment banking and Private Equity. Powell worked at the investment bank Dillon Reed, specialising in financing, merchant banking, and M&A from 1984-90 and at the Carlyle Group, the Private Equity and asset management giant, from 1997-2005. Nobody knows better than the Private Equity guys what debt and debt service costs can do to a business, and a nation for that matter.

The problem of inflation has been complicated as the Fed has received little help from the fiscal side. The Fed tightens while the Biden administration spends like there’s no tomorrow. The total stimulus under the Biden administration is over $5 trillion. The US Congress has raised the debt ceiling more than 45 times. There are hardly any US lawmakers willing to stop deficit spending. The current US national debt of $31 trillion can easily climb to $40 trillion by the end of the decade and all this debt needs servicing.

Until fiscal spending slows, raising rates will have very little effect on inflation. Passing the “Inflation Reduction Act” and expecting inflation to come down is akin to throwing soup at an Old Master painting and expecting the climate change issue to be solved. The Fed may be in luck however and about to get some help.

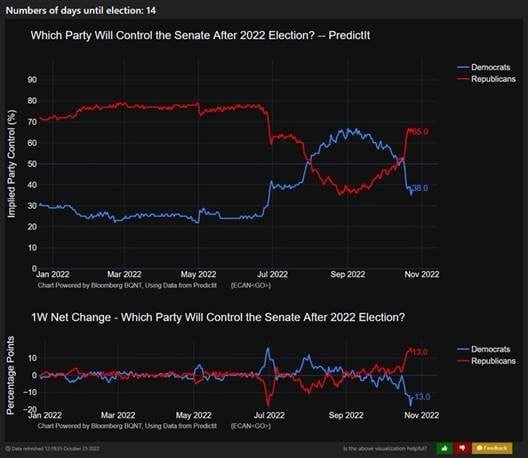

The recent Republican surge to control the US Senate may be levelling off, but the gap the Republicans have opened up on the Democrats remains substantial (see chart below).

Mid-term election betting odds: Who will control the US Senate?

Source: Predictit

Tuesday night’s debate in the key Senate seat in Pennsylvania didn’t go well for Democrat nominee John Fetterman. He opened his first answer by saying, “Hi, good night, everybody,” rather than “Hi, good evening.”

In the debate, Fetterman was asked to state his view on Natural-Gas fracking, an important economic driver in parts of Pennsylvania. In the past, Fetterman has opposed fracking. On the night he said – “I do support fracking, and I don’t, I don’t—I support fracking and I stand, and I do support fracking.” Make of that what you will. It seems it’s good night and goodbye to Fetterman in Pennsylvania after that debate, which was more like an Amtrak derailment than a car crash. The debate outcome has further boosted the Republicans with mid-term elections less than 2 weeks away.

In the House of Representatives, Republicans need to pick up just five seats to take control of the House. A Real Clear Politics (RCP) poll of polls predicts that the Republicans could pick up +12 to +47 seats with an average of +29.5 seats.

With the Republicans controlling both the House and the Senate, fiscal stimulus will be checked and more oil and gas production will be back on the agenda. The adoption or the expectation of adoption of the two policies will exert downward pressure on inflation. In a nutshell, fiscal policy is about to get restrictive in the US.

Therefore, I believe that the Fed will be well-placed to change its stance before the end of the year. However, we are not going to the low rates of the past decades anytime soon.

One thing that is often overlooked is how much globalization played a part in taming inflation in the 1980s-90s. China’s cheap labour and Saudi Arabia’s cheap oil were key to bringing down costs from the double-digit inflation rates we saw in the 1970s. China’s cheap labour is gone, and the Saudis want to keep energy prices high.

Only a concentrated effort to increase oil and gas production in the US and globally can change the energy supply balance and bring inflation down to the +2% that the Fed targets.

The world needs and will always need cheaper energy supply to preserve lives and livelihoods. Energy is the lifeblood on which the world runs and hence life is sustained. Therefore, we need more and cheaper energy supplies now, and less talk of how we are going to get to “net zero” by 2050.

Markets and the Economy

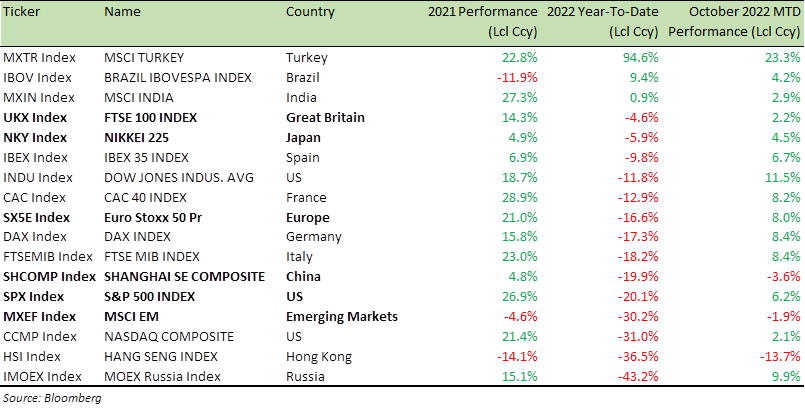

Markets have seen a solid rally this month with the S&P 500 (SPX) and Dow Jones Industrial Average (DJIA) up+7.5% and +11.6% respectively (table below)

The talk of a “Fed pivot” has helped, as has the realisation that equities are oversold and the earnings season has not been as bad as many thought it could be.

With the US likely heading into a recession (more on this below), equity bears have had a change of heart and are happy to deploy more cash and start building a long position in equities, with the main indices still down more than -20% from their highs.

A bright spot is that the 3,600 level on the SPX is holding up well and we have seen three tests of that level already since June.

We got to 3,600 in June and it’s October now. The SPX hitting the 3,600 level in June also coincided with the peak US Consumer Price Index (CPI) print of +9.1%.

The SPX index doesn’t spend much time around the 3,600 levels and bounces back very sharply. It’s back to 3800 as of now, a quick +7% rally in a week.

Benchmark Global Equity Index Performance (2021,2022 YTD and MTD)

A silver lining seems to be appearing on the horizon as far as US CPI is concerned. All the big Month-on-Month (MoM) prints in Q4 2021 will start dropping off as Q4 2022 prints start coming in. Starting with the next CPI monthly print, any headline MoM print below +0.7%, gets the YoY CPI number into the 7.5%-7.7% level. That will be cheered by the markets.

Fiscal policy is about to tighten in the US, as a Republican-controlled Senate and House will not approve any more stimulus bills. That’s good news for CPI from here on as the over $4.9 trillion in stimulus over the last two years has been a key driver of high inflation in the US.

The $1.9 trillion stimulus package in March 2021 was preceded by almost $3 trillion in stimulus the previous year. The US economy received over +20% of the Gross Domestic Product (GDP) in increased public spending. That dwarfed the early 2021’s output gap of around +4% of GDP.

With several different areas of the US bond yield curve becoming inverted this year, the probability of a US recession has been on the rise. One part of the yield curve, that has remained positively sloped, is the spread between the 10-year and 3-month US Treasury yields. That was the case until Wednesday. The 3-month/10-year yield spread — historically the most accurate predictor of recessions on the yield curve — has now inverted.

Yield curve inversion is not in itself bearish for equities. Per the table below (from True insights), US equities have realized a return close to the long-term average between Yield curve inversion and the start of the recession.

One more key point to note: the SPX performance in the year leading up to the yield curve inversion.

Historically, the SPX’s median change in the year leading up to an inverted yield curve has been a gain of +7.9%. In the current period, the SPX has declined over -18% in the year leading up to today’s inversion, which would be the weakest performance leading up to an inversion of any period in at least the last 60 years.

So, it’s not time to dump equities but to build a position in them. Granted that bond yields are attractive again too. Therefore, investors once again, have the luxury to build both a bond and equity portfolio.

If you want to see what high energy costs are doing to the world, then look no further than Europe.

The energy crisis has sowed seeds of political disharmony in the European Union (EU), caused energy-intensive businesses to downsize “permanently” and relocate operations and is set to cause a recession in Germany and Italy in 2023 as predicted by the International Monetary Fund (IMF).

From French tiremaker Michelin to German chemical giant BASF, European industry is starting to crack under the weight of record energy and raw material prices. Chemical/Industrial companies need natural gas and petrochemicals at a reasonable price and not preaching on “net zero” and “climate change.” If Europe doesn’t secure energy at reasonable prices, companies are going to relocate to regions with more secure access to energy.

This week, BASF announced plans to “permanently” downsize in Europe due to high energy costs in the region. The statement from BASF comes after it opened the first part of its new €10bn plastics engineering facility in China. Spot gas prices are five to six times higher in Europe than in the United States. BASF bemoaned a triple burden of – sluggish growth, high energy costs and over-regulation. BASF bosses have thrown their weight behind a planned expansion in China.

This week, German Chancellor Olaf Scholz put his foot down to approve a contentious deal by China’s state-run shipping giant Cosco to acquire a 35% stake in a container terminal in Hamburg, where he used to be mayor. In doing so, Scholz is brushing aside opposition from six of his ministries and 81% of Germans (as per a poll in Der Spiegel) who are opposed to the Chinese investment.

Scholz is also about to embark on a trip to China with a delegation of German business leaders, much to the annoyance of President Emmanuel Macron of France. Macron bemoaned the lack of a unified EU approach in dealing with China, saying the EU was acting as an ‘open supermarket’ to China. Scholz will become the first Western leader to visit China since the start of the Covid pandemic.

So, it seems, Germany has learnt nothing from overly relying on Russia for cheap energy. It is now putting more of its eggs in the “China basket.”

Another way to look at it is – what choice does Germany have?

China is Germany’s key market. Germany’s trade surplus has disappeared, energy costs are getting prohibitive and debt will mount up. The last thing Germany can afford to do, is make an enemy of China.

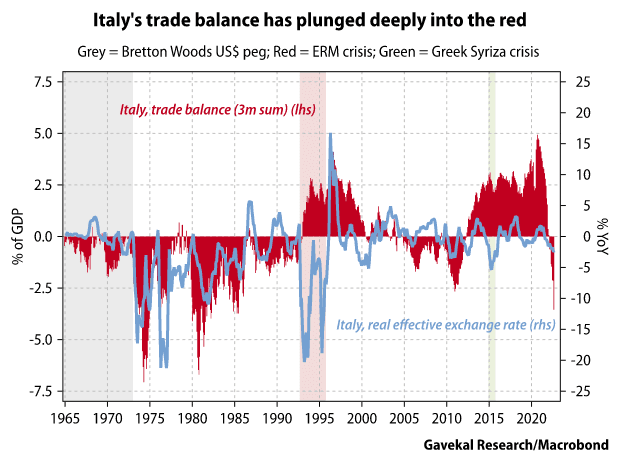

And what about Italy?

A new Prime Minister is in place, but the country faces the same old problems of debt and stagnation. Add to that mix – an energy crisis. The energy crisis is more severe for Italy, where in recent years imported natural gas has made up almost +40% of the primary energy mix. Without gas imports from Russia, it is likely that Italian energy users will have to make deep voluntary consumption cuts this winter or face forced energy rationing. Either way, it means economic activity in Italy is set to suffer.

Increased energy import costs have helped to push Italy’s monthly current account balance from a surplus equivalent to +5% of GDP in April 2021 to a deficit of -4% in August this year (see chart above). The swing has been compounded by depressed demand for Italy’s exports. With around half of exports going to other European economies, which are facing similar headwinds, Italy’s non-energy trade surplus has contracted by around -2.5% of GDP over the last two years. This combination will continue to weigh on growth over the winter and possibly beyond.

A deep recession in Italy now seems a certainty.

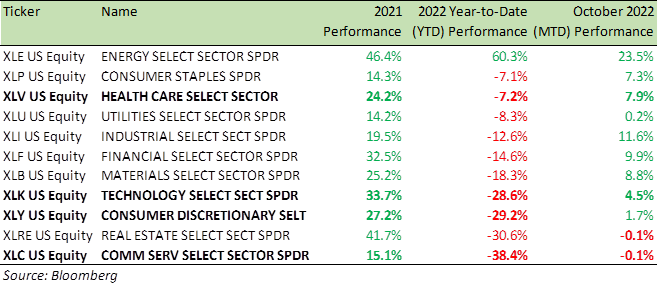

Benchmark US equity sector performance (2021, 2022 YTD and MTD)

The October seasonality I mentioned in my August Market Viewpoints seems to have kicked in already (see the MTD performance in the table above).

Historically it has led to a solid rally starting in October, that lasts until the end of the year. It might dovetail nicely with signs of dovishness from the Fed. So, please bear this in mind.

As I’ve been saying since June at least, there are plenty of high-quality stocks in the Consumer, Technology, Industrial and Healthcare sectors that are trading at -20% to -25% on a YTD basis, and present a good opportunity to invest in, be it directly or via Structured Products.

The reason I keep recommending the use of Structured Products in investment portfolios is that they offer an investor the opportunity to benefit from prevailing market volatility. The stocks and/or indices underlying the products do not necessarily have to rally for one to earn 10-12% in income from the products annually.

For instance, this week, we launched a 5-Year product on a basket of (Apple, Amazon, Google and Microsoft) where the coupon was +15.3% per annum, the protection barrier was set at 60% at maturity and the losses don’t accrue from 100% but from the 60% levels, if the barrier is reached at maturity. In summary therefore: Equity exposure, solid income and good downside protection.

For specific stock recommendations and Structured Product ideas please do not hesitate to get in touch with me or your relationship manager.

Best wishes,

Manish Singh, CFA