“With the US job creation still strong, inflation down from highs of +9.1% to +3%, and the stock market in a bull run, US consumers are more confident than they have been at any point in the last two years. US Federal Reserve has managed to squeeze in another rate hike, 11th of this cycle”

Summary

This week, the US Federal Reserve made its 11th interest rate increase since March 2022, raising the target range for the Federal Funds Rate by 25 basis points to +5.25% to +5.5%. This move brings the Federal Funds Rate to its highest level in 22 years. The questions we must ask – are these ever more restrictive rate hikes really helping, or, are they storing a problem for another day, when their impact begins to bite?

Currently, interest rate hikes haven’t had a significant impact on consumers, despite their increasing restrictiveness. However, when fixed-rate loans and mortgages come up for renewal, that will likely be the day of reckoning for the hawks at the Federal Reserve.

Recent data released by China’s National Bureau of Statistics (NBS), indicates a significant decline in China’s Producer Prices Index (PPI), which fell at the fastest pace in over seven years. Additionally, China’s Consumer Prices Index (CPI) is teetering on the edge of deflation. The impact of China’s economic situation is not confined within its borders; it has a ripple effect that percolates to the US and the rest of the world. The implications of these negative figures are clear – discussions about rate easing and the implementation of additional measures to stimulate growth will soon become the topic of the day.

US consumers are more confident than they have been at any point in the last two years. With US job creation still strong, inflation at 3% and the stock market in a bull run, you can’t fault US consumers for being more confident. Bull markets typically last much longer than bear markets and if the current bull market were to match the performance of the average bull market, the S&P 500 would need to increase another +68% from its current level, over a timeframe that extends until July 2025.

Barbie Shines Bright; Bears Surrender and Disinflation Nudges the Economy

Barbie has infiltrated every nook and cranny of our lives – from billboards to paper cups, hats, and even window decorations. The all-encompassing Barbie marketing campaign has swept through like an unstoppable force of “pink fluff,” bombarding our senses relentlessly for days on end, to the point of melting our eyeballs.

My seven-year-old, who could only endure 20 minutes of Frozen II, embraced the Barbie movie wholeheartedly, proudly proclaiming, “I saw the whole movie, daddy!” Another Barbie enthusiast for the Mattel cash register.

The movie made $155milion in its opening weekend in the US.

Inflation? What inflation. Recession? What recession.

I haven’t personally seen the Barbie movie (you couldn’t pay me enough), so I’ll withhold any comments. Nevertheless, it’s worth noting that Barbie is not exactly what she appears to be. Contrary to the image of an all-American girl next door, she is not originally American, but German. In reality, Barbie’s true name is Lilli. Her journey began in 1952, near Nuremberg in post-war Germany. Initially, Lilli was a cartoon character featured in the daily German newspaper Bild Zeitung. The paper’s editor, facing a gap in content due to a dropped story, tasked the German cartoonist Reinhold Beuthin with creating something, anything, to fill the space. That’s how Lilli came to life.

Soon after, polystyrene Lilli dolls emerged, available in 7-inch and 12-inch versions and were sold in tobacco and newspaper kiosks. However, in 1956, everything changed, when Ruth Handler, the co-founder of Mattel toy company, came across Lilli while vacationing in Germany with her children, Barbara (Barbie), and Kenneth (Ken). Impressed by the doll, she purchased several and reimagined it, eventually launching it as Barbie—a beloved toy for little girls all over the world. Notably, Rolf Hausser, the creator of the original Lilli doll and owner of the German toy company, later sued Mattel. Eventually, Mattel acquired the rights to Bild-Lilli for £21,600 and solidified Barbie’s iconic status in the toy industry.

The surge of “pink fluff” appears to have lifted spirits not only in movie theatres, but also at the International Monetary Fund (IMF). On Tuesday, the IMF revised its outlook for the world economy this year, predicting a more robust expansion. The estimate for global Gross Domestic Product (GDP) now stands at +3.0% in 2023, an improvement from the +2.8% projection made in April.

According to the IMF’s Chief economist, Pierre-Olivier Gourinchas, there is an increased likelihood of a “soft landing” in the US economy. This scenario entails reducing inflation without causing significant job losses, and the chances of achieving this outcome have risen due to a recent easing of price pressures. Currently, US inflation, as gauged by the US consumer price index (CPI), is running at an annual pace of +3%, a significant drop from the +9.1% level observed a year ago.

This Tuesday, the US Conference Board’s Consumer Confidence Index jumped to its highest level in nearly two years. The increase comes as no surprise, considering that wages are currently growing at a faster pace than prices, which has positively impacted consumer confidence.

No wonder then that even the staunchest Bears have thrown in the towel.

Earlier this week, one of Wall Street’s renowned bears, Mike Wilson of Morgan Stanley, admitted defeat. He stated, “We were wrong. 2023 has been a tale of higher valuations than we anticipated, alongside declining inflation and cost-cutting measures. We firmly believe that inflation is now decreasing at a rate even faster than what the consensus had expected.”

5-Year price chart: Producer Price Index (PPI) and Consumer Price Index (CPI) for US and China

Source: Bloomberg

The S&P 500 index (SPX) is up +27% since its October 2022 lows.

This impressive equity rally has surprised (and disappointed) many experts who were deterred by concerns over inflation and the fear of it surging even higher, preventing them from endorsing risk-taking. However, it appears that the Bears have finally come to accept the notion that inflation is indeed transitory.

Yet, they might be in for another surprise, as the conversation shifts towards disinflation in the very near future, particularly taking note of the developments in China.

Recent data released by China’s National Bureau of Statistics (NBS), indicates a significant decline in China’s Producer Prices Index (PPI), represented by the pink bars in the chart above, which fell at the fastest pace in over seven years, plunging -5.4% YoY (year-on-year) in June. Additionally, China’s Consumer Prices Index (CPI), indicated by the green line in the chart above, is teetering on the edge of deflation.

The impact of China’s economic situation is not confined within its borders; it has a ripple effect that percolates to the US and the rest of the world.

In any economy, there are two significant measures of inflation – the Consumer Price Index (CPI) and the Producer Price Index (PPI).

The CPI gauges the total value of goods and services purchased by consumers within a specific period, reflecting the changes in retail prices from the consumer’s perspective. On the other hand, the PPI assesses inflation from the viewpoint of producers, measuring the costs associated with producing consumer goods. Given that commodity and food prices directly impact retail pricing, the PPI is considered a reliable leading indicator of future changes in the CPI.

Regular readers of this newsletter are likely aware of my optimistic stance on US equities and my outlook for the US Consumer Price Index (CPI), which I consider to be disinflationary.

At the beginning of the year, in Skate to where the puck is going to be…not where it has been I wrote – “The US headline inflation at +6.5% doesn’t convey the full picture of where inflation is headed. Inflation is crashing. The new bull run may already be here.”

My attention was specifically drawn to the month-on-month data for the US CPI, which had started to turn, along with the anticipated reopening of China, which would alleviate concerns related to supply chain disruptions. Now, I am focused on China PPI and recent China data is deflationary.

The US Producer Price Index (PPI), represented by the yellow line in the chart above, is currently at -3.1%, pouring even more cold water on the prospects of future US inflation.

The implications of these negative PPI figures are clear – discussions about rate easing and the implementation of additional measures to stimulate growth will soon become the topic of the day.

Markets and the Economy

The US is breaking records again for crude oil production.

In April 2023, the country produced an impressive 12.6 million barrels per day (mbpd) of oil, surpassing any previous April in history, including the previous record of 12.15 mbpd set in 2019. Notably, the US has increased its oil production by approximately 1 mbpd compared to the previous year.

Despite growing calls for environmental sustainability and promises of a greener agenda, the reality is that the US continues to produce fossil fuels at an unprecedented rate. Senator Joe Manchin of West Virginia, is among those advocating for even more oil production, urging the US administration to add millions of additional barrels per day. Manchin criticized the administration for seeking new oil supplies from Iran and Venezuela during a time of global challenges, such as Russia’s invasion of Ukraine and soaring energy prices. “Our friends and our allies were hurting, and we couldn’t come to your rescue quick enough,” he said and added that the US increasing energy production now would help lower energy prices, and said he wished it could have been done last year.

The chart below perfectly exemplifies – all the gain without the pain. Inflation (green line) down from +9% to +3%, the S&P 500 (yellow line) ramped up over 1,000 points, without any noticeable uptick in US unemployment rate (white line).

1-year price chart: US unemployment rate, US inflation and S&P 500 index

Source: Bloomberg

All very bullish and sentiments positive. So, let me introduce some caution (else I wouldn’t be doing it justice)

In the first section above, I referred to the US Conference Board’s Consumer Confidence Index (chart below).

The index shows that US consumers are more confident than they have been at any point in the last two years. With US job creation still strong, inflation at 3% i.e., real wage growth positive, and the stock market in a Bull run, you can’t fault US consumers for being more confident.

With all the debate over whether or not the US economy is in a recession, and if it’s not in a recession, then will it or will it not enter a recession, the pattern of Consumer Confidence in the current period looks very similar to the pattern during the double-dip recession of the early 1980s (circled in the chart below).

Like the current period, back then, there was a sharp drop and subsequent sharp rebound in confidence followed by another decline that failed to make a lower low. The only difference this time around is that following the initial COVID recession of 2020, there wasn’t another recession (shaded region) in the next two years – at least not an officially declared recession.

Price chart: US Conference Board’s Consumer Confidence Index

Source: Bloomberg

This week, US Federal Reserve (the Fed) made its 11th interest rate increase since March 2022, raising the target range for the Federal Funds Rate by 25 basis points to +5.25% to +5.5%. This move brings the Federal Funds Rate to its highest level in 22 years.

During the press conference following the rate hike announcement, Fed Chair Jerome Powell stuck to his usual cautious approach, providing limited details and occasionally repeating himself. Powell said. “We have to be ready to follow the data, and given how far we’ve come, we can afford to be a little patient, as well as resolute, as we let this unfold.”

The Fed’s response to future economic developments is straightforward – if there is a further slowdown in inflation like recent reports, interest rates are likely to remain unchanged. On the other hand, a resurgence of inflation would necessitate further rate hikes. Powell, however, argued that rate cuts “won’t be this year I don’t think,” because, “policy has not been restrictive enough, for long enough, to push growth down. He added – “We think the process still probably has a long way to go.”

Everything from here out is data dependent, and Powell cited the two US Jobs reports, two Consumer Price Index (CPI) reports due before the next Federal Open Market Committee (FOMC) meeting as the drivers of how the FOMC acts in their next policy decision in September. Powell also said the Fed’s influential staff was no longer forecasting a recession to begin this year, as they had in March, May and June, and instead was projecting a “noticeable slowdown” in growth.

The Fed is being extra cautious and doesn’t want to do or say anything that would pull forward market expectations of rate cuts.

The questions we must ask – are these ever more restrictive rate hikes really helping? Or, are they storing a problem for another day, when their impact begins to bite?

I believe it’s the latter.

This article – What Fed Hikes? Much of America’s Consumer Debt Is Still Riding Ultralow Rates in the Wall Street Journal makes a very good point.

Too many Americans were burned on Adjustable-Rate Mortgages (ARM) in 2008. They learnt their lesson and when rates dropped, they locked in ultralow fixed rates on debt such as mortgages and auto loans. While rates on certain loans, like credit cards, are rising in response to the Fed’s rate hikes, a substantial portion of consumer debt still benefits from the low rates available a few years ago. Moody’s Analytics reported that as of the first quarter, only 11% of outstanding household debt had rates tied to benchmark interest rates.

Currently, the rate hikes haven’t had a significant impact on consumers, despite their increasing restrictiveness. However, when fixed-rate loans and mortgages come up for renewal, that will likely be the day of reckoning for the Federal Reserve’s hawks.

So, as leases, mortgages, term borrowing rates etc. come for reset over the next few quarters, will that tip the US economy over?

That’s the trillion-dollar question. I have no doubt that the US Fed will respond with rate cuts and aggressive rate cuts if need be.

One more thing to consider – the China Producer Price Index (PPI) and Consumer Price Index (CPI) are indicating outright deflation. What if there’s a rapid transmission of disinflation/deflation from China to the US economy? Potentially leading to a scenario where the US CPI reaches zero.

What then?

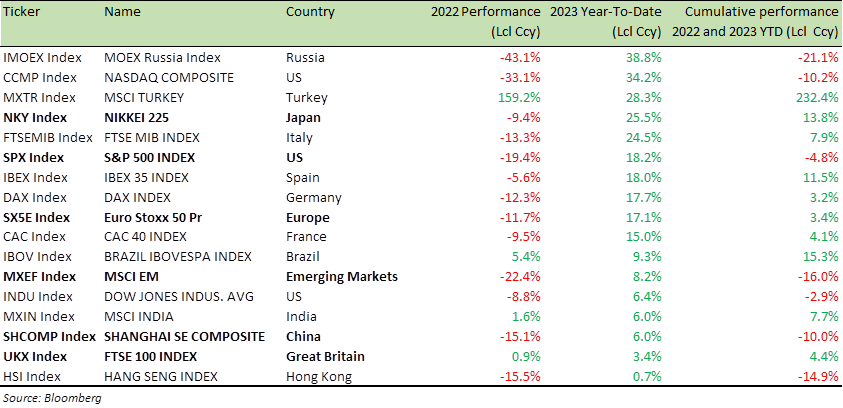

Benchmark Global Equity Index Performance (2022; 2023 YTD)

In my opinion, the Fed was behind the curve on inflation, and now seems to be behind the curve on disinflation. The Fed’s focus on the CPI and its “rent component” is too narrow, and they should adopt a more forward-looking approach. Rate hikes have already achieved their intended purpose, effectively curbing inflation as evidenced by its clear downtrend. However, the recent series of rate hikes might be creating potential issues for the future, akin to storing problems for another day. Hence my point above, regarding the risk of 1980s’ “double dip recession.”

I don’t mean to be Bearish. I just want to highlight that while the Fed may keep repeating stubbornly – more rate hikes are needed and we won’t cut rates anytime soon – the focus should be on disinflation ahead.

Meanwhile, equities continue to ramp up and after an over +25% rally off last year’s lows, market internals still remain strong.

The S&P 500 has surged +18% so far this year (table above), almost erasing all the losses experienced in the previous year. The tech-heavy NASDAQ has performed even better, recording a remarkable +34% gain for the year.

The bottom line is we’re in a bull market based on the standard +20% rally threshold, and bull markets typically last much longer than bear markets.

Looking at data since 1928, bull markets have demonstrated an average gain of +114% over 1,011 calendar days. To reach the average bull market performance, the S&P 500 would need to increase another +68% from its current level (taking it to 7,670) over a timeframe that extends until July 2025.

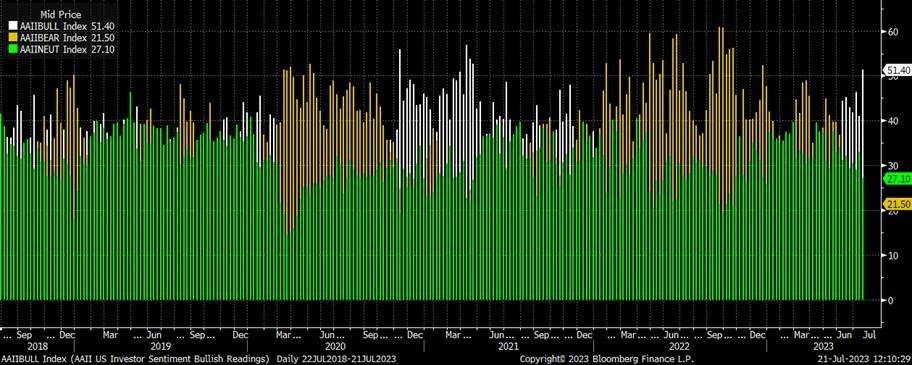

- The latest American Association of Individual Investors (AAII) survey showed, more than half of respondents reported as bullish for the first time since April 22, 2021. Last week’s reading at 51.4% (white bars below) ended an over two-year-long streak without a reading above 50% which was the third longest such streak on record

- Given the elevated reading of bullish sentiment, a minor share of respondents is reporting as bearish. In fact, that reading fell to 21.5% (green bars below) last week which is the lowest reading since June 2021

- Last year saw a record streak of weeks where bearish sentiment outnumbered bullish sentiment. With the total reversal in sentiment, the bull-bear spread now heavily Favors bulls. The spread reached 29.9% last week for the highest reading since April 2021

- The gains to bullish sentiment have not entirely come from bears. Neutral sentiment is also reaching new lows, registering just 27.1% (yellow bars below) last week. Unlike bearish sentiment, that is only the lowest level since the last week of 2022

AAII US Investor Sentiment Readings

Source: Bloomberg

We seem to be in a purple patch and equities still have upside.

Therefore, please stay risk on and like I say every time – whatever your view bullish or bearish, instead of waiting and timing a trade on, it is advisable to utilize structured products for investment purposes. Structured products present a valuable combination of capital preservation and strategic market entry.

For specific stock recommendations and ideas related to structured products, please feel free to reach out to me or your relationship manager.

Best wishes,

Manish Singh, CFA