“If you are filled with pride, then you will have no room for wisdom”

– African proverb

Summary

The difference in approach taken by Sweden and the UK to deal with the COVID-19 outbreak has again led to a debate about basing significant policy action on computer models alone. Whether you are drawn to the Swedish or the UK approach is not a matter of how many more deaths you are willing to accept. The fact is, herd immunity is where we are all heading. We have herd immunity against many diseases and this is achieved via a vaccine or through the controlled spread of a virus. Your choice of one approach over the other is unlikely to be entirely down to your assessment of the science. It’s more likely a complex combination of your mental and physical age, politics, your life experience, as well as your attitude to risk, amongst other factors. Both the Swedish and the UK teams are made up of highly accomplished scientists, doing their best to understand a pandemic. It is down to policymakers to take their advice and make a judgement call which should take into account more than forecasts from a computer model. The epidemiologists and their forecasting models have never been under wider public and social media scrutiny. A vigorous debate is to be had once this is over!

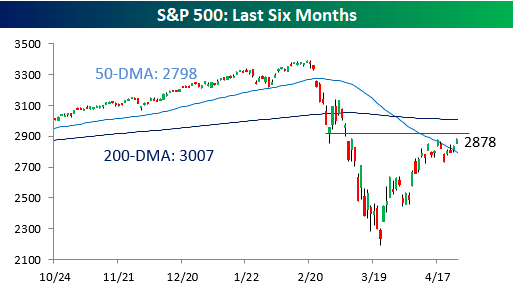

Tuesday marked a key milestone in the US equity market’s rally from its late March lows. It was the first time since February 21 that the S&P 500 (SPX) opened above its 50-day Moving Average (MA) and stayed there the entire trading day. The US monetary and fiscal policymakers’ efforts to preserve household incomes and stop the massive bankruptcies, of the sort which ensured that the crash of 1929 turned into the Great Depression of the 1930s, should be applauded. Beyond the US, we have also seen massive fiscal and monetary action too and all that money will keep flowing into the real economy as activity picks up. So those caught up in a valuation fetish and looking for the March lows to be re-tested, may be in for a massive disappointment. As you may have gathered by now, I feel even more positive about the equity markets today than I did last month.

Trust but verify

Do you remember when IBM’s Watson took part in the quiz show Jeopardy! against two champion players – Brad Rutter and Ken Jennings?

This was nearly ten years ago. Watson, of course, won the contest (and the $1 million), but when Watson gave a wrong answer, it was spectacularly wrong. For instance, in the category “US CITIES,” in response to the question – “Its largest airport is named for a World War II hero and its second-largest, for a World War II battle.”

Watson’s answer was “Toronto,” which as many of you know is not in the US, but in Canada.

What this showed was the flaw of “computer models.” They are good at crunching data and, more often than not, can be right. However, a model or simulation is only as good as the rules used to create it. Putting your full confidence and faith in computer models and acting upon their forecasts, may not always be the best course of action.

The difference in approach taken by Sweden and the UK to deal with the COVID-19 outbreak has again led to a debate about basing significant policy action on computer models alone. Like IBM’s Watson, the forecasts made can be wrong and could lead to a non-optimal course of action being taken.

The UK’s policy response has been guided by the team at Imperial College led by Professor Neil Ferguson. Ferguson described COVID-19 as “a virus with comparable lethality to H1N1 influenza in 1918.” The 1918 virus better known as “Spanish flu” is estimated to have killed 50 million people worldwide. To date, just over 228,000 people have died from COVID-19 worldwide and the growth rate of new cases continues to fall.

Former US President Ronald Reagan used to say: “Trust but verify.” So I have looked into the past predictions of the Imperial College team as reported by The Times newspaper and have found that the Imperial team’s forecasts have previously been as spectacularly wrong as IBM Watson’s response to some questions on the quiz show. For example, Ferguson was behind the disputed research that sparked the mass culling of more than 11 million sheep and cattle during the 2001 epidemic of foot and mouth (FMD) disease, a crisis which cost the UK billions of pounds.

He also predicted that up to 150,000 people could die from bovine spongiform encephalopathy (BSE, or “mad cow disease”) and its equivalent in sheep if it leapt to humans. To date, there have been fewer than 200 deaths from the human form of BSE and none resulting from sheep to human transmission. A subsequent government inquiry was damning of the general approach and said: “The culling policy may not have been necessary to control the epidemic, as was suggested by the models….it must be concluded that the models supporting this decision were inherently invalid.”

Eight years later in 2009, Ferguson, then an advisor to the government and the World Health Organisation (WHO), sounded the alarm over swine flu, warning that it could cost up to four million lives globally and he floated a study on the antiviral benefits of closing all UK schools. In the end, the schools stayed mostly open and the worldwide death toll was 18,500 (not 4 million as predicted). There was again an inquiry — which concluded that ministers had treated modellers as “astrologers”, asking them to provide detailed forecasts when they had too little data.

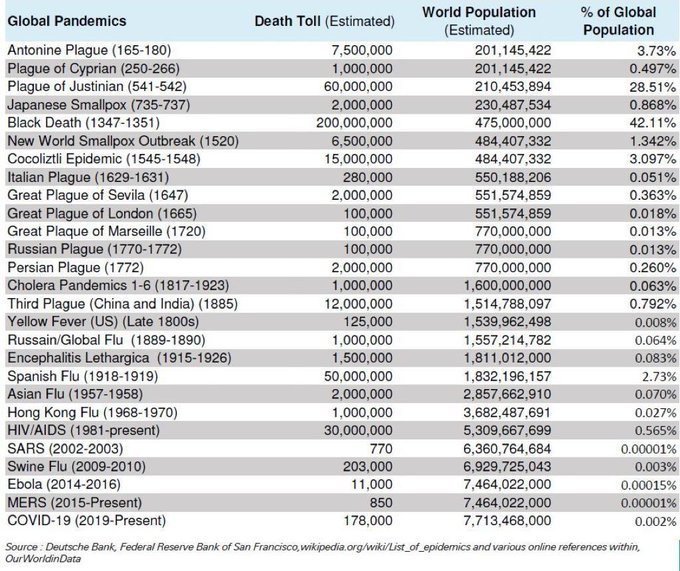

Imperial’s forecasting model is also subject to many challenges in the academic world. Thankfully we do not have a pandemic that often – which also gives you an insight into how few cases the computer models have to learn and forecast from in order to understand their limitations. Diseases and illnesses have plagued humanity since the earliest of days. The table below outlines some of history’s deadliest pandemics, from the Antonine Plague to the current COVID-19.

Global Pandemics over the years

This interview with Professor Johan Giesecke, one of the world’s most senior epidemiologists and an advisor to the Swedish Government is a must-see. Giescke is the brains behind the Swedish COVID-19 strategy and he hired Anders Tegnell, Sweden’s chief epidemiologist, who is currently directing Sweden’s COVID-19 strategy.

In the interview, Professor Giesecke lays out in typically Swedish direct way, why he thinks the UK policy on lockdown (and that of other European countries) is not evidence-based. In his opinion, the correct policy is to protect the old and the frail only, as Sweden has done, and that this will eventually lead to “herd immunity” (an epidemiological concept where a population is sufficiently immune to disease) as a by-product. Herd immunity was the initial UK response, before the “180 degree U-turn” in favour of a lockdown. He also argues that the Imperial College model is “not very good,” far too pessimistic and any such models are a dubious basis for public policy. He has never seen an unpublished paper have so much policy impact. In his opinion, the flattening of the curve is due as much to the most vulnerable dying first as to the lockdown. He concluded that the results will eventually be similar for all countries and it was the novelty of the disease that scared people. The actual fatality rate of COVID-19 is in the region of 0.1%.

A busy park during the Covid-19 pandemic in Stockholm, Sweden, April 22

Source: ANDERS WIKLUND/ASSOCIATED PRESS

Now whether you are drawn to the Swedish or the UK approach is not a matter of how many more deaths you are willing to accept. The fact is, herd immunity is where we are all heading. We have herd immunity against many diseases and this is achieved via a vaccine or through the controlled spread of the virus. Your choice of one approach over the other is unlikely to be entirely down to your assessment of the science. It’s more likely a complex combination of your mental and physical age, politics, your life experience, your attitude to risk and your relationship to authority amongst other things.

Both Giesecke and Ferguson are highly accomplished scientists, doing their best to understand a pandemic. It is down to policymakers to take their advice and make a judgement call which takes into account more than forecasts from a computer model. The epidemiologists and their forecasting models have never been under wider public and social media scrutiny. A vigorous debate is to be had once this is over!

Markets and the Economy

Tuesday marked a key milestone in the equity market’s rally from its late March lows. It was the first time since February 21 that the S&P 500 (SPX) opened above its 50-day Moving Average (MA) and stayed there the entire trading day. That is a big positive, but the SPX has to stay over 50-day MA for a few days in a row to build confidence among the bulls. The next area of resistance for the market is just above 2,900, and then after that the 200-day MA at just above 3,000.

Source: Bespoke Invest

In my March newsletter Market Viewpoints I said: “I feel more assured that the market is bottoming …$2 trillion stimulus plan is a powerful weapon which short-sellers won’t want to face and buyers won’t want to miss.” Fast forward four weeks and we are almost 400 points higher on the SPX as it has eclipsed the 2900 level. The SPX has gained over +30% from its March lows and, on a 12-month basis, the SPX is now down only -0.21%.

The US monetary and fiscal policymakers’ efforts to preserve household incomes and stop the massive bankruptcies of the sort which ensured that the crash of 1929 turned into the Great Depression of the 1930s, should be applauded.

On the household income side, the US has expanded unemployment insurance eligibility at both the State and Federal level, so that almost anyone who cannot work due to COVID-19 disruption, is covered. The over 26 million American workers who have filed jobless claims since mid-March, will get an extra $600 a week from the Federal government through July 31 in addition to State-level benefits. That should raise the average benefit across states to around $1,000 a week and comes on top of other benefits that low-and middle income workers can claim. All this adds up to working full time at $25 an hour.

The Federal minimum wage followed by 21 US states is $7.25 an hour and has been unchanged for a decade. Washington D.C. has the highest minimum wage at $14.00 per hour whilst California, Massachusetts, and Washington have the highest State minimum wage at $13.00 per hour.

What this means is that roughly half of all US workers stand to earn more in unemployment benefits than they did at their jobs before the coronavirus pandemic shut down wide swaths of the US economy. I would call that a powerful stimulus that the market has not yet seen the impact of. As the lockdown eases, the next leg of the rally will be driven by increased consumer spending. With shops and other venues closed and only essential items available to buy, the weekly and monthly outgoings for many was vastly reduced. That saving will find its way into the real economy sooner rather than later.

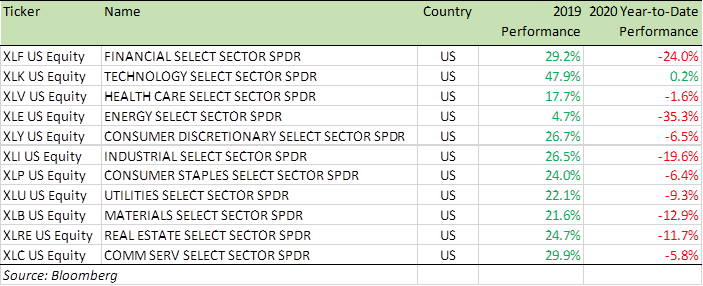

Benchmark Equity Index Performance (2019 & YTD)

On Wednesday this week, we learnt that in Q1 2020, US Gross Domestic Product (GDP) contracted at an annual rate of -4.8%. This is the steepest pace of contraction of US GDP since 2008. The contribution to the percentage change in real GDP from the Services sector was -4.99%, which explains all the decline in GDP. That shouldn’t be a surprise as, like most economies, the US is mainly a Services economy and services were hit hardest given the lockdown. However, guess what the leading contributor to the decline in Services was? Answer: Reduced Healthcare spending.

That’s right. The healthcare spending contribution to the percent change in real GDP was -2.25% i.e. nearly half of all the decline in Q1 GDP. In US Dollar terms, GDP in Q1′ 2020 fell by -$234 billion and US Healthcare Spending fell by -$110 billion. A healthcare emergency leads to GDP contraction/recession – led by – drum roll please -reduced healthcare spending. Who’d have thunk it? Think of all those regular treatments, elective procedures, non-critical operations, cancer scans, preventative visits – all postponed as people were advised to stay away to create capacity (rightfully) so as not to overwhelm the hospital system and give priority to COVID-19 cases. Since these are all delayed spending, one has to be careful and not be too bearish regarding US GDP growth for Q2 and the rest of the year.

Beyond the US, we have also seen massive fiscal and monetary action too and all that money will keep flowing into the real economy as activity picks up. So those caught up in a valuation fetish and looking for the March lows to be re-tested, may be in for a massive disappointment.

Over the weekend, the Bank of Japan (BOJ) replaced its previous target of buying about ¥80 trillion Yen of Japanese Government Bonds (JGB) annually, with a new pledge to buy as many bonds as needed to keep the 10-year JGB yield at zero. The BOJ also increased its limits on purchases of longer-term corporate bonds and short-term commercial paper by ¥15 trillion Yen to a new limit of ¥20 trillion Yen i.e. a three-fold increase to help meet the capital needs of corporates affected by the COVID-19 pandemic. It also doubled its annual limit on purchases of Exchange-Traded Funds and Real-Estate Investment Trusts to ¥12 trillion Yen.

The BOJ’s move is the latest in a flurry of Central-Bank actions to combat the economic damage from the coronavirus. The US Federal Reserve (Fed) which was already buying investment-grade bonds, pledged on April 9 to purchase corporate bonds recently downgraded to junk status. The European Central Bank (ECB) has said it would accept some junk-rated bonds as collateral for its loans and the Bank of England (BOE) has spared no effort to help UK corporates.

The response to COVID-19 by various Central Banks is redefining the role, and remit, of monetary policy – like never before. By lending widely (directly or indirectly) – to businesses, states, municipal corporations, investment funds etc. to insulate the economy and avoid a 1930s-like depression, Central Banks are breaking century-old taboos about who gets money in a crisis and on what terms. Wide-scale direct financing of fiscal deficits isn’t too distant.

It’s worth reflecting how shocked we all were by Quantitative Easing (QE) in 2009. Those extraordinary measures never really faded away despite having been widely viewed as “temporary.” The baseline is – Central Banks and fiscal authorities will do what it takes to keep the system from collapsing. If some gasp, then so be it. There is no external moral authority to run the world system. So blaming Central Banks is an exercise in futility and virtue signalling, when they’ve been tasked with the job to keep the system from disintegrating.

“None of us have the luxury of choosing our challenges; fate and history provide them for us,” Fed Chairman Jerome Powell said in a speech this month. “Our job is to meet the tests we are presented.” The Fed and Powell deserve all the applause for dealing with the fallout of COVID-19 with great timeliness and competence. It is not to say Central Banks should continue to choose losers and winners. In that, I entirely agree with Oaktree Capital’s Howard Marks’ comment – “Capitalism without bankruptcy is like Catholicism without hell.” Securities regulators have their job cut out once the COVID-19 crisis is over.

Meanwhile in the Eurozone, the Italian, French and Spanish demand for a vast issue of “corona bonds” jointly guaranteed by all EU governments has fallen on deaf ears in Germany and Netherlands. One reason French President Emmanuel Macron has put his weight behind the “corona bonds” is that the economic consequences of dealing from COVID-19 could turn France’s debt into another Italy (as the chart below indicates). France’s debt/GDP ratio could vault to over 120%, following Italy’s experience in the aftermath of 2008-09.

France – Government debt projections

Italian public opinion is shifting against the Europe Union (EU), such is the disappointment with the way the EU has handled the COVID-19 crisis. If Germany continues to prevent pan-European “solidarity,” Italy’s departure from the EU may be more likely than ever. The market will then waste no time in pricing more exits. Germany must be aware of this risk and therefore it’s very likely they will show some form of contrition and help mitigate departures from the EU or indeed the very break-up of the Euro.

In this respect, George Soros’ proposal for the EU to raise the over €1 trillion needed for the European Recovery Fund to fight the COVID-19 pandemic by selling “Perpetual bonds” on which the principal does not have to be repaid has made everyone take notice. Particularly those that are bearish on Eurozone assets.

Soros makes a powerful plea in saying – “The EU is facing a once-in-a-lifetime war against a virus that is threatening not only people’s lives, but also the very survival of the Union. If member states start protecting their national borders against even their fellow EU members, this would destroy the principle of solidarity on which the Union is built.” A €1 trillion Perpetual bond with a 0.5% coupon would cost the EU a mere €5 billion per year, less than 3% of the 2020 budget.

It’s worth noting that one of the oldest examples of a Perpetual bond was issued in 1648 by the Dutch water board of Lekdijk Bovendams. It is currently in the possession of Yale University, the interest was most recently paid by the eventual successor of Lekdijk Bovendams.

As you may have gathered by now, I feel even more positive about the equity markets than last month. I also feel that the SPX could ramp up not just over 3000 but set new highs later this year as many investors are still beholden to their bearish bias ignoring the amount of stimulus money that is flowing in or set to flow into the system.

Nobody knows if there will be a second wave of COVID-19 in the winter and should there be one, then the template is very clear: Social distancing, more fine-tuned lockdowns and fiscal support. Debts and deficits may increase and puritans may not like the levels, but this is about the real economy, real life and not academic debates anymore. Besides, the level of debt alone is not the defining factor. The debt service cost is what matters. The Fed’s target Federal Funds rate is effectively zero, and 10-year Treasury yields are below +1% for the first time. Don’t expect this to reverse and increase anytime soon.

The Consumer Staples (XLP) and Healthcare (XLV) sectors are my favourite sectors at this time, although big gains will likely come from the Consumer Discretionary (XLY), Communication Services (XLC), and Technology (XLK) sectors. For specific stock recommendations, please do not hesitate to get in touch.

Benchmark US equity sector performance (2019 & YTD)

A few words on Oil and the Energy sector (XLE). Dysfunction reigned in commodity markets last week as crude oil prices traded at previously unthinkable negative prices thanks to worries over storage capacity. Energy stocks, however, rallied more than any sector this week. The case for bullish energy stocks is building up. Low oil prices will see massive cuts not just in production but also in capital expenditure (Capex) and other long term investments.

Best wishes,

Manish Singh, CFA