With the Federal Reserve signalling no further rate hikes, additional risk taking will return and equity markets will respond favourably to this shift over the next quarter.

Summary

The US Federal Reserve’s rationale for the “higher for longer” narrative, rests on the belief that the US economy has displayed a greater ability to withstand elevated borrowing costs, than previously anticipated. The significance of the Federal Funds Rate isn’t solely based on its level, but also on the duration it remains elevated. The longer interest rates stay high, the greater the potential challenges it poses for the future.

A close examination of an interest-rate sensitive sector, such as US housing construction, suggests that although there might be a delayed response between policy actions and their impact in this economic cycle, it would be unwise for the Fed to assume that the US economy can sustain higher rates for extended periods.

Over the past decade, September has consistently been the weakest phase of the late summer and early autumn consolidation period for equities. This year, September seasonality has stayed true to form, with the S&P 500 index declining by -5.17% so far this month.

However, there’s reason for optimism when it comes to seasonality. The last quarter of the year typically brings about more stable and favourable trends. Seasonal indicators make a significant shift from a predominantly bearish outlook to a strongly bullish tone. Historically, October, November, and December have consistently ranked among the most favourable months for the equity market.

The global monetary policy cycle has pivoted toward easing, led by central banks in Latin America and other Emerging Markets. Developed markets are likely to follow suit, and despite some slowing in the US consumer sector, aggregate demand remains robust. With the Federal Reserve signalling no further rate hikes, additional risk taking will return and equity markets will respond favourably to this shift over the next quarter.

The fabled “soft landing” is still on

With inflation having receded by two-thirds from its peak, a resilient job market, and the economy maintaining a solid +2% growth rate, the US economy appears tantalizingly close to achieving the fabled “soft landing” scenario – tightening monetary policy to fight inflation, without causing a recession.

This outcome has left almost everyone perplexed, especially considering that US interest rates, currently at +5.25%, stand at their highest point in 22 years.

The US Federal Reserve (Fed) is so emboldened, that it not only rejects the idea of any interest rate cuts, but also communicates that any relief from high borrowing costs, will not be swift nor substantial. “Higher for longer” is the phrase touted on newswires.

Fed Chair Jerome Powell remarked that “at some point, and I’m not specifying when,” it may become appropriate to consider rate cuts. This could occur due to “real rates rising as inflation subsides” or due to “various factors observed in the economy.” However, Powell emphasized that there is “considerable uncertainty” surrounding the timing of such a move.

The recently unveiled Fed projections, represented by the “dot plot” of individual interest rate estimates, indicate that the Federal Funds Rate is expected to peak between +5.5% and +5.75%, followed by a much slower pace of rate reductions in 2024 and 2025.

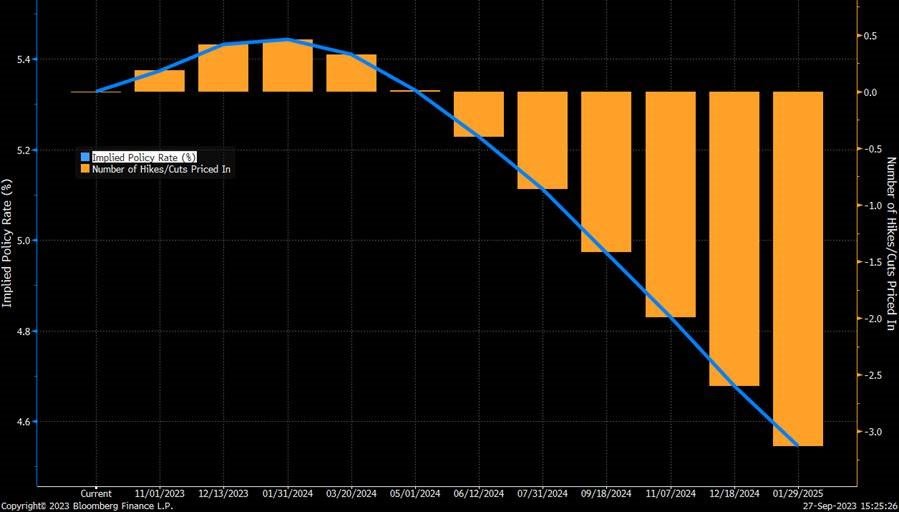

Current market expectations regarding the trajectory of the Fed Funds Rate are as follows:

- Nov 1, 2023: Pause

- Dec 13, 2023: Pause

- Jan 31, 2024: Pause

- Mar 20, 2024: Pause

- May 1, 2024: Pause

- Jun 12, 2024: 25 bps cut to 5.00-5.25%

- Dec 18, 2024: rate of +4.75%

Implied Overnight Rate & Number of Hikes/Cuts in Fed Funds Rate

Source: Bloomberg

Despite maintaining a stance of tight monetary policy, with a commitment to keeping rates higher for an extended period, the Fed projected that the US economy would continue to exhibit notable resilience, with no significant uptick in the unemployment rate.

The rationale behind the “higher for longer” approach, rests on the belief that the US economy has displayed a greater ability to withstand elevated borrowing costs than previously anticipated.

However, I am somewhat concerned that the Fed appears overly confident in its growth and unemployment rate forecast, asserting that the US economy requires and can endure prolonged periods of high interest rates.

This concern arises because, if we look back at the Summary of Economic Projections (SEP) from September 2021, the US Consumer Price Index (CPI) had already surpassed the +5% mark, and yet the Fed’s projections pointed to rate hikes of just +1% by the conclusion of 2023. We are now at +5.25% and could go 25 bps higher. That’s an astounding 4.5% between the forecast and the actual outcome

Therefore, it’s always worth bearing in mind that Fed “forecasts” and assurances are considerably less reliable than you might think, and they can change course at quite short notice.

The significance of the Fed Funds Rate, isn’t solely based on its level, but also on the duration it remains elevated. The longer interest rates stay high, the greater the potential challenges it poses for the future.

A close examination of an interest-rate sensitive sector, such as housing construction, suggests that although there might be a delayed response between policy actions and their impact in this economic cycle, it would be unwise for the Fed to assume that the US economy can sustain higher rates for extended periods.

Here are some key observations:

- The National Association of Home Builders (NAHB)/Wells Fargo homebuilder sentiment index, depicted in the chart below, declined to 45 this month from a reading of 50 in August. This drop in builder sentiment, marks the first decline in nine months (see chart below)

- Traditionally, when US interest rates and mortgage rates rise, it adversely affects US housing affordability, leading to reduced demand for new housing and, consequently, a decline in residential construction. However, the current situation deviates somewhat from this pattern. Homeowners who secured low-rate mortgages prior to 2022 have been hesitant to sell their homes, resulting in a reduced supply of homes available for sale in the secondary market. This phenomenon has, to some extent, supported new construction activity, giving rise to the erroneous belief that housing demand remains strong despite higher interest rates

- Nevertheless, the tide appears to be changing. Recent data indicates that the recovery has lost momentum, and the underpinning for new construction is beginning to erode. The sentiment index, a gauge of homebuilders’ confidence, has now declined for two consecutive months, after rising for seven consecutive readings. The index has dipped below the 50-point threshold, signalling that more builders perceive conditions as unfavourable than favourable

- Notably, 32% of builders reported reducing home prices in September, an increase from the 25% reported in August. Since the Fed initiated interest rate hikes in March 2022, mortgage rates have climbed and remained above 7% since early August, marking their highest level since 2002.

The National Association of Home Builders/Wells Fargo US homebuilder sentiment index

Source: Bloomberg

Having achieved its goal of bringing inflation down, will the Fed tempt its fate and cause a recession?

It wouldn’t be wise to dismiss this possibility.

Monetary policy is highly restrictive globally.

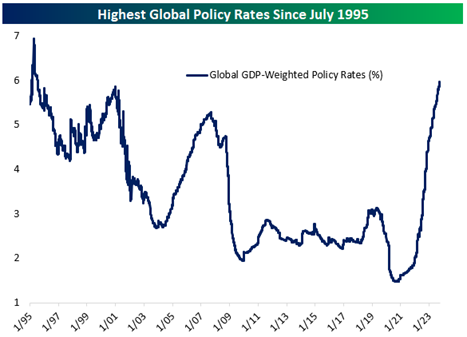

Displayed below is a chart illustrating GDP-weighted global monetary policy rates, which encompasses 38 central banks spanning across frontier, emerging, and developed markets. Following a significant rate hike by the Turkish central bank just last week, accompanied by similar moves from Sweden and Norway, policy rates have now reached their highest collective level since July 1995.

Source: Bespoke Invest

A notable shift is beginning to take shape, and it’s a welcome development.

Just last Wednesday, Brazil took the step of reducing interest rates for the second time in two consecutive meetings, resulting in a cumulative reduction of 100 basis points. This move is in line with actions taken by several other emerging market central banks, including Chile, Peru, and Poland.

It’s worth highlighting that among the central banks that opted for rate hikes, Turkey stood as the lone exception, by not signalling an impending peak rate in the near future. In contrast, countries like the United Kingdom and Switzerland refrained from raising rates, despite market expectations to the contrary. These instances of signalling terminal rates and resisting rate hikes against market expectations collectively indicate a global shift towards easing in the overall monetary policy cycle.

Finally, there’s growing recognition within the Bank of England (BoE) that the current challenge lies in addressing cost-push/supply side inflation rather than inflation driven by consumer spending. Consumers are not the primary drivers of these inflationary pressures. Consequently, raising borrowing costs and constraining consumer spending is unlikely to be an effective strategy for combating inflation. It might just tip the economy into a recession.

Let’s hope US Federal Reserve gets that message too. Thus far, the full weight of interest rates has not been experienced by the economy as households and corporations are sitting pretty on cheap mortgages rates and borrowing costs respectively struck prior to the hiking cycles. This extension of debt maturities has deferred the impact of interest rates on the real economy. Nevertheless, over the next 12 months, we can anticipate a broadening of the refinancing cycle, which means that interest rates will begin to exert their effects more prominently and central banks will have to step in and ease interest rates or risk a recession.

Markets and the Economy

In last month’s Market Viewpoints, I wrote: “August proved to be a month of consolidation for US equities. As September approaches, further consolidation might be in the offing, due to historical seasonal patterns. Over the past decade, September has consistently been the weakest phase of the late summer and early fall consolidation period.”

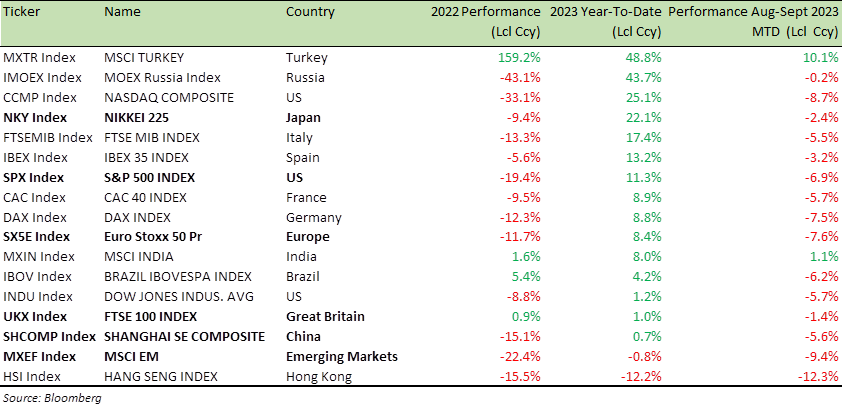

The August-September seasonality has held true to form, as is evident in the table below.

Historically, September has proven to be the most challenging month of the year for equities. So far this September, the S&P 500 (SPX) is down just over -5% (and -6.85% over August-September)

However, it’s not nearly as bad as last year where the SPX was down -4.24% in August, and -9% in September for a cumulative Aug-Sept decline of over -13%.

Benchmark Global Equity Index Performance (2022; 2023 YTD and 2023 Aug-Sept MTD)

So, does it get better from here?

According to historical patterns, the answer is a resounding yes.

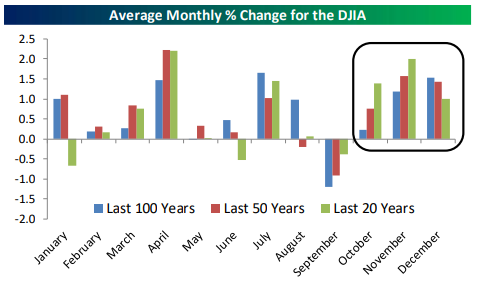

The final three months of the year typically exhibit smoother and more positive trends. Seasonal indicators shift from strongly bearish to strongly bullish, as illustrated in the chart below. October, November, and December have traditionally been among the most favourable months for the equity market.

However, a word of caution is warranted – October has witnessed some of history’s most spectacular market crashes. Events such as the Bank Panic of 1907, the Stock Market Crash of 1929, and Black Monday in 1987 all unfolded in this month. Seven of the Dow’s ten worst days occurred in October.

Nonetheless, it’s worth noting that, despite the fear often associated with October in news reports, September has historically seen more downturns than October. Furthermore, as the data below illustrates, October has, on average, delivered positive price gains over the past 20, 50, and 100 years.

Source: Bespoke Invest

Furthermore, we find ourselves in the third year of the presidential cycle, a point I previously emphasized in February’s Market Viewpoints

The third year of a Presidential cycle tends to be the most bullish for US equity markets, with a median return of +17% and with positive returns an incredible 95% of the time. Intuitively, this makes sense, as US Presidents begin eyeing re-election, in the third year of their first term, and promote growth and market-friendly policies to boost their chances of re-election.

Whatever the reason, going back to 1932, when Democrat Franklin D. Roosevelt defeated Republican Herbert Hoover in the race for the White House, the stock market’s performance in the third year of the Presidential cycle has been impressive. This is a statistic that mustn’t be ignored.

Now, shifting our focus to Europe:

In Germany, the Producer Price Index (PPI) has plunged, by -12.6% (as depicted in the chart below), marking the most significant decline since this statistic’s inception in 1949. This sharp decline signifies a rapid dissipation of inflationary pressures in the largest European economy.

Following the recent rate hike by the European Central Bank (ECB), the market currently assigns a probability of less than 20% of another rate increase in the Eurozone during this cycle.

Germany’s energy-intensive industries are experiencing severe impact, akin to what was witnessed during COVID lockdowns, exacerbated by elevated energy prices compared to the pre-war in Ukraine era. This piece in the Financial Times ‘Everything is tired here’: gloom spreads through German manufacturing is very telling

Per the reports, corporate insolvencies in Germany are on a notable rise:

- In the first half of 2023, German district courts reported 8,571 corporate insolvencies, representing a substantial increase of +20.5% compared to the same period in 2022

- In June 2023 alone, 1,548 companies filed for bankruptcy, marking a substantial year-on-year increase of +36%

It’s hardly surprising that German Finance Minister Christian Lindner, has strongly criticised politicians in Brussels for pushing for stricter clean energy regulations for buildings. Lindner has cautioned that such measures could lead to a dangerous backlash among voters and contribute to the rise of far-right political movements.

Lindner acknowledged that the controversy surrounding Germany’s heating law, had served as a valuable lesson that informed his stance on the EU’s building directive. He stated that these mandates unquestionably played a role in the ascent of the far-right Alternative for Germany (AfD) party, which is currently polling at 22%, making it the second-most popular party in the country.

German Producer Price Index (PPI) and Consumer Price Index (CPI) YoY

Source: Bloomberg

There’s growing pushback on the “Net Zero” (the balance between the amount of greenhouse gas (GHG) that’s produced and the amount that’s removed from the atmosphere) targets as they get more scrutiny.

In the UK, PM Rishi Sunak ignited a backlash and a Conservative civil war on the environment, as he announced a series of U-turns on critical policies to meet “Net-zero” targets. Sunak is not the only European leader watering down his net zero ambitions, in the face of a cost-of-living crisis, caused by high inflation and the war in Ukraine.

There’s a rethink across the European Union (EU) nations too. A number of EU member states are pushing for new emission rules to be eased, before the bloc’s ban on the sale of petrol and diesel cars enters into force. France, Italy and the Czech Republic, are among a group of EU nations calling for the new emissions limits to be weakened.

It’s encouraging to see some common sense and pragmatism return to policy discussions with the focus back on – health of the economy and the population.

Shifting our focus back to the US:

In the United States, a season of strikes is underway, with writers, actors, and auto workers among those involved. Threats of strikes have already led to significant contracts for airline pilots and package workers. Strikes pose a potential negative impact on consumer spending, especially in the auto industry. Additionally, student loan repayments are poised to divert nearly $10 billion per month from consumer incomes. Furthermore, the possibility of a US government shutdown looms.

However, as mentioned in the previous section, it’s essential to maintain a long-term perspective rather than reacting to short-term volatility.

While the S&P 500 index has risen by +11% year-to-date (YTD), a closer examination reveals that several sectors have not yet reached their 2021 highs.

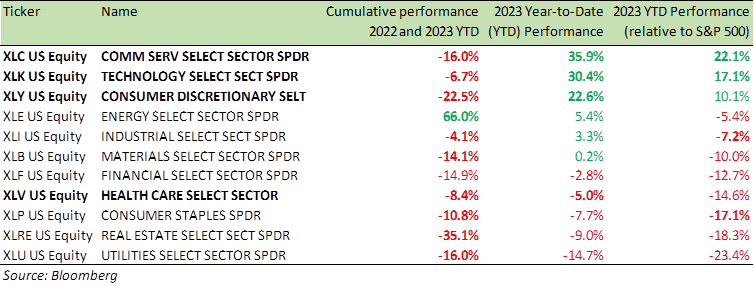

The first column of the table below illustrates cumulative returns for 2022-2023 YTD.

Apart from the energy sector, no other sector has experienced a complete recovery, despite the impressive YTD rallies witnessed this year.

The Consumer Discretionary, Communications, and Technology sectors may appear strong on a 2023 YTD basis, but the picture changes when you consider the returns from 2022 as well.

Benchmark US equity sector performance (2022 and 2023 YTD; 2023 YTD and 2023 YTD relative to S&P 500 Index)

At the end of July, the new bull market was in full swing, with the S&P 500 showing remarkable strength, up exactly +20% year-to-date and a staggering +28.3% from its bear market low on October 12th, 2022.

However, a subsequent drawdown of -6.85% since its peak on July 31st has left the S&P 500 still showing a solid +22% gain from its October 2022 low and a respectable +11% increase year-to-date.

While these performance figures accurately reflect the performance of large-cap index ETFs, a closer examination reveals a more nuanced picture. Without the exceptional performance of a handful of mega-cap stocks that have surged by over +30% this year and even more since their 2022 lows, the rally would appear considerably weaker.

The key takeaway here is that equities, when viewed in a broader context, are not overvalued. The apparent stall in the recovery can be attributed to the significant increase in interest rates.

Over the past three months, an impressive 70% of earnings reports have exceeded estimates, ranking in the 93rd percentile of all 90-day periods since 2001. This is a significant improvement from the 61% rate observed last January, highlighting the momentum this year.

Additionally, the rate at which guidance is being raised has started to rise indicating that US companies are in sound financial shape. It’s also worth noting that official data on interest costs shows that the effective rate on corporate debt is the lowest it’s been since 1956, as per the Q2 Z1 Flow of Funds report of the US Federal Reserve Board.

The global monetary policy cycle has pivoted toward easing, led by central banks in Latin America and other emerging markets. Developed markets are likely to follow suit, and despite some slowing in the US consumer sector, aggregate demand remains robust. With the Federal Reserve signalling no further rate hikes, additional risk taking will return and markets will respond favourably to this shift over the next quarter.

Best wishes,

Manish Singh, CFA