“’Market timing’ is unappealing to long-term investors. As in hunting deer or fishing for rainbow trout, investors have learned the importance of ‘being there’ and using patient persistence – so they are there when opportunity knocks.”

– Charles Ellis, Passive Investor & Author

Summary

With the outbreak of the Covid-19 virus raising the sceptre of a GDP contraction of between -10% and -20% in the US and Europe, the time for fiscal policy to take charge has well and truly arrived. The US Federal Reserve can always handle issues that affect the liquidity of the banking system. However, interest rate cuts when rates are already very low, don’t do much – particularly, when the problem is not the supply of credit but the demand for it, as both economic activity and consumption collapse. Boosting growth to a higher level can only be achieved when both monetary and fiscal policy work in tandem. The work done by the US Federal Reserve during the 2008 financial crisis may have just prevented a 1929-like Depression. The creation of many new facilities then, were also useful this time. The Fed was able to act quickly, supersize existing programs as well as create new ones. Fiscal authorities are now set to follow suit.

The bear case for equities, as outlined by some, is based on the view that the selling has been relentless and indiscriminate, that markets have given up 3 years of gains in just a month, and that no one has a clear idea of the true fundamental value, all whilst policymakers are flailing. These are also the very arguments for how the bull case for stocks starts. Fear is indeed palpable but it’s also the reason to start buying. Calling a bottom to the equity market is never an easy call to make. In an internal note to my colleagues last week, I indicated Friday March 20 as the market bottom when the low on the SPX was 2,295. The Fed and US fiscal authorities are stepping in as they have no other option. Of course, economic data will worsen further in the coming months, but I believe that most of this is already priced into the market.

Those concerned about the end of capitalism are again being emotive and are over-reacting. Moving the US Dollar off the gold standard, as then US President Richard Nixon did in 1973, changed the very face of capitalism. In a fiat monetary system, such as the one that most nations operate under today, the reference to government expenditure being “financed” by taxes or debt-issuance is redundant. A sovereign government is never revenue-constrained, because it is the monopoly issuer of the currency, and can print money at will. There is no gold standard to constrain it.

The global economy is in the ICU; fiscal help is on its way

Give a virus a scary name, start talking about how it came from somebody eating bat soup in China, cut interest rates to zero and the fear it unleashes is inevitable. Perception is everything. A global recession, once unthinkable in 2020, is now a foregone conclusion. The fight is now on to stop this recession from deepening and taking hold for more than two quarters, as the Western world goes into synchronised lockdown to deal with the outbreak.

Coronavirus (or COVID-19) has inflicted such fear, that the world is willing to impose an economic shutdown to deal with it. Supply chains disrupted, travel restricted, schools closed and people confined to their homes have all now been seen the world over – leading to a sudden halt to the global economy -while the manufacture of masks, ventilators and other necessary equipment is ramped up.

Granted, COVID-19 is not the ordinary flu. For the ordinary flu, there is a flu vaccine and more importantly “herd immunity” (a form of indirect protection from infectious diseases that occurs when a large percentage of a population has become immune to an infection). However, I just wonder whether the number of cases we are currently seeing reported is accurate. For instance, let’s look at Italy: 63,927 cases, 6,077 death and 7,432 recovered. The fatality rate in Italy, therefore, is close to 10%. That’s quite scary. However, the fatality rate could be vastly overestimated if the number of cases reported is fewer than the actual number. If there were more testing kits we would likely be looking at the right number of cases and interpreting the fatality rate as it should be.

COVID-19 will very likely change economic policymaking forever. A new consensus has emerged among policymakers and economists in favour of bold new fiscal measures. In the very same way that the financial crisis of 2008 changed everything for monetary policy and international financial systems (banks were made safer and therefore during this crisis we are not talking about them going under), COVID-19 change for fiscal policy and way the economies are run in the future. The US Federal Reserve can always handle issues that affect the liquidity of the banking system. However, interest rate cuts when rates are already very low, don’t do much – particularly, when the problem is not the supply of credit but the demand for it, as both economic activity and consumption collapse. Boosting growth to a higher level can only be achieved when both monetary and fiscal policy work in tandem.

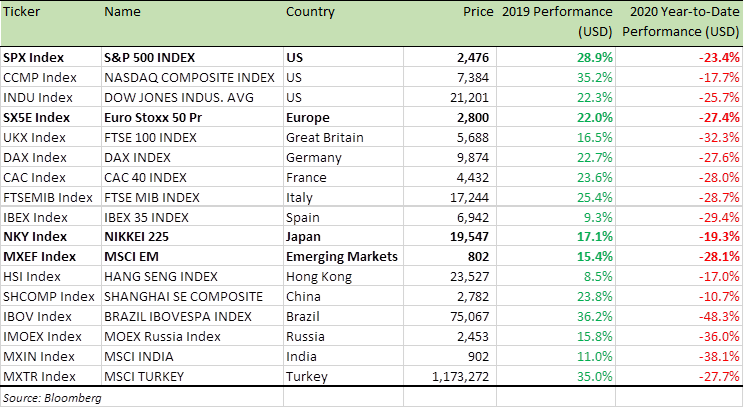

With the outbreak of the Covid-19 virus raising the sceptre of a GDP contraction of between -10% and -20% in the US and Europe, the time for fiscal policy to take charge has well and truly arrived. On Sunday, March 15, the Fed slashed its benchmark interest rate to near zero and said it would buy $700 billion in Treasury and mortgage-backed securities, in an urgent response to the pandemic. The equity markets, however, didn’t see this as relief or indeed the right course of action. Negative sentiments continued and the S&P 500 (SPX) index continued its slide. The SPX is now nearly -9% lower than its close that weekend after falling by as much as -19% at one stage. (see table below):

Benchmark Equity Index Performance (2019, YTD)

The US Congress has finally stopped bickering and is set to agree a sizeable Coronavirus Stimulus Bill just as the UK, Germany and France are doing. Early indications are that the stimulus bill could be as much as large as $2 trillion. A deal was reached in the Senate early Wednesday morning and the US congressional officials continue to finalise the bill. On Tuesday, the Dow Jones Industrial Average (Dow) was up 2,093 points, or +11.3%. It is the Dow’s largest single-day gain since 1933, driven by news that a deal was coming together.

The stimulus bill will provide direct financial help – one-time checks worth $1,200 to many Americans, with $500 available to children, increase current unemployment assistance by $600 a week for four months, offer hundreds of billions of dollars in loans to both small and large businesses, and provide health care providers with additional resources as the virus spreads. Senate Majority Leader Mitch McConnell remarked – “This is a wartime level of investment into our nation.” Senate Minority Leader Chuck Schumer remarked: “To all Americans I say: Help is on the way, big help and quick help.”

A timely and welcome help. However, I do fear an overstimulation of the US economy. Keep an eye on inflation down the line if, as I expect the fatality rate from COVID-19 to be over-estimated, the stimulus is likely excessive. US policy to deal with any crisis is very simple – print money and particularly now when the interest rates are at zero. If printing money doesn’t work, well there’s – printing even more money.

US household debt now amounts to $14 trillion. Here’s the breakdown:

- • Mortgage debt: $9.5 trillion

- • Student debt: $1.5 trillion

- • Auto loan debt: $1.3 trillion

- • Credit card debt: $950 billion

Therefore, the risk of a rapid rise in unemployment from the economic shutdown couldn’t come at a worse time. US fiscal authorities will do all that is required to avert a deep crisis and will print as much money as needed, and then some. Of course the US is not alone in this. Printing money has been the official policy of Japan for over two decades now.

Markets and the Economy

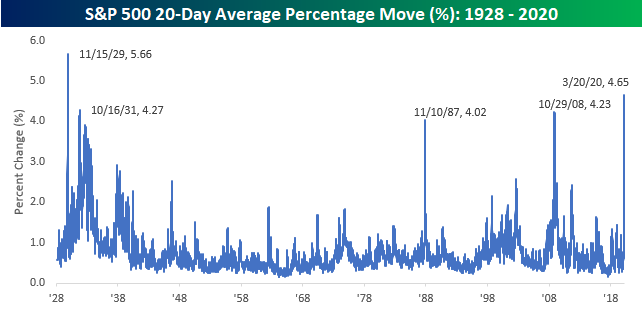

The chart below shows the SPX’s average daily percentage move, on a 20-day rolling basis, going back to 1928. The SPX’s four-week average daily move is now greater than any other time since the weeks following the 1929 crash. Moves of this magnitude are quite unprecedented in the history of the stock market.

While I don’t want to minimize the significance of the market declines, the circumstances surrounding 1929 and the present – in terms of the reasons for the decline – aren’t all that similar to one another. Calling a bottom to the market is never an easy call to make. In an internal note to my colleagues last week, I indicated Friday March 20 as the market bottom.

The low on March 20 on the SPX was 2,295, and after more selling on Monday March 23, the SPX is now above the 2,470 level. A range on the SPX of 2,250-2,350 feels like a bottom, particularly with US fiscal action pending. Additionally, on March 20, we saw some dispersion: 47% of the stocks in the Index finished positive, whilst the index as a whole finished negative. That’s a very good sign.

Source: Bespoke Invest

The bear case for equities, as outlined by some, is based on the view that the selling has been relentless and indiscriminate, that markets have given up 3 years of gains in just a month, and that no one has a clear idea of the true fundamental value, all whilst policymakers are flailing. These are also the very arguments for how the bull case for stocks starts. With a correction of -25% and more in some cases, fear is indeed palpable but it’s also the reason to start buying.

I feel more assured that the market is bottoming. That is not to say the index won’t dip to 2300 again. However, the $2 trillion stimulus plan is a powerful weapon which short-sellers won’t want to face and buyers won’t want to miss.

The work done by the US Federal Reserve during the 2008 financial crisis may have just prevented a 1929-like Depression. The creation of many new facilities then, were also useful this time. The Fed was able to act quickly, supersize existing programs as well as create new ones. Fiscal authorities are now set to follow suit.

This market sell-off has once again brought the perma-bears (in hibernation since the recovery started in Q1 2009) back on to our television screens and into our living rooms. It’s the end of capitalism some say, buy gold, buy Bitcoin, buy guns and so on. Those concerned about the end of capitalism are again being emotive and over-reacting. Moving the US Dollar off the gold standard as then US President Richard Nixon did in 1973, changed the very face of capitalism. In a fiat monetary system such as the one that most nations operate under today, the reference to government expenditure being “financed” by taxes or debt-issuance is redundant. A sovereign government is never revenue-constrained, because it is the monopoly issuer of the currency, and can print money at will. There is no gold standard to constrain it.

Let’s take a step back for a second, and see how we got to a world of money-printing:

- • During World War II, the US supplied the Allies and got paid in gold, propelling the US to the largest holder of gold. The Bretton Woods Agreement of 1944 established the US Dollar as the global reserve currency and international commodities were priced in US dollars

- • The condition that was imposed on the US – US dollars would remain redeemable for gold at $35/ounce and the US promised not to print money

- • Rising economic growth, insatiable demand for goods and raw materials, defence expenses to maintain the US hegemony in the post-WWII era and the Vietnam War, meant the temptation to not print was too much to resist. The Fed refused to allow audits or supervision. The US had come out as the winner of WWII, so there was not much to stop them from having their way. Japan was vanquished, the UK was indebted and Europe was being helped by the Marshall Plan. The rest of the world just didn’t matter

- • In the years leading up to the 1970s and the Vietnam War, it became obvious to others that the US was printing money to meet its vast war expenditures and other liabilities. The currency began to devalue. Also, by the 1970s the once ravaged economies of Europe, Japan and Asia were on firmer ground and in a position to call the US out

- • With growing concerns over the stability of the US dollar, countries began to ask the US to exchange their dollar reserves into gold. Nixon refused and “temporarily” suspended the convertibility of the dollar into gold. That “temporary” suspension of course became permanent

- • The US then moved on to next way to maintain the dollar hegemony – the Petrodollar. In 1973, Nixon asked Saudi Arabia to accept only US Dollars as payment for oil and to invest any excess profits in US Treasury bonds, notes, and bills. In return, Nixon offered military protection for the Saudi oilfields and US Navy kept the sea routes safe for Saudi oil cargos

- • By 1975, every member of the Organization of the Petroleum Exporting Countries (OPEC) had agreed to sell their oil only in US dollars. The dollar thus had moved off the gold standard and became tied to oil, thereby forcing every oil-importing country to maintain the constant supply of US dollars. The US was back at the top again. The US printed dollars and gave them to everyone as manufactured goods poured into the US

With oil prices under renewed pressure and the threat to the Petrodollar increasing – as China and Russia flex their muscles – we are at the beginning of another phase, and it is unclear how it will pan out. What the US plotting this time around to keep the US dollar at the top – we shall find out in the not so distant future. For now, further money-printing is guaranteed in the US. Asset prices therefore, will keep heading higher. Therefore, those who predict the demise of US capitalism are forgetting that US capitalism is based on the supply of the dollar – and the US has the printing machines to achieve this.

The US dollar has continued to strengthen as the crisis has mounted. With the US opening the monetary and fiscal spigots, there are concerns about the US dollar and its future. In my opinion, those concerns are for another day. For now, the US dollar will hold its value as well as its strength versus other currencies, so long as we are in a crisis.

I expect the US dollar to weaken later this year, when the risk subsides, as it did back in 2008-09 (see chart below)

The US Dollar Index indicating the international value of the USD (2008-09)

Source: Bloomberg

Last week, the largest US investment-grade bond Exchange-Traded Funds (ETF), LQD (see chart below) gave up a decade’s worth of gains in a matter of days. It’s as if LQD took a parachute and jumped. Of course, there is more to the sell-off in LQD than meets the eye. The fear of corporate downgrades for one – LQD would have to sell its holding of BBB investment-grade bonds if they were downgraded. However, one has to question the logic of selling bonds (which trade over-the-counter) in a wrapper of ETFs. In general, I much rather hold single bond names than bond ETFs, if and where possible.

iShares Corporate Bond ETF (LQD US) – last 10 years

Source: Bloomberg

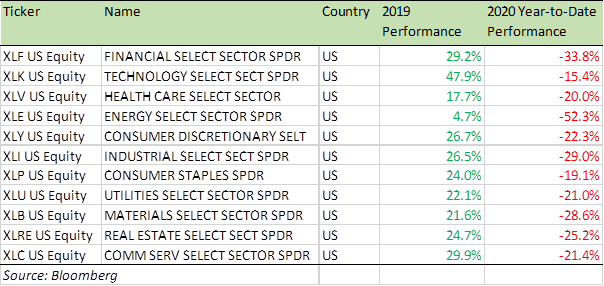

The Consumer Staples (XLP) and Healthcare (XLV) sectors are a good bet at this time, although big gains will likely come from the Consumer Discretionary (XLY), Communication Services (XLC), Technology (XLK) and Financial (XLF) sectors. For specific stock recommendations, please do not hesitate to get in touch.

Benchmark US equity sector performance (2019 & YTD)

Finally, I have been asked this often recently – should I buy gold?

My advice is always the same – buy gold as an insurance and not as an investment. Gold is your ultimate insurance if the world goes off keel. It’s like buying house insurance and hoping you will never have the need to use it. And when you are losing money on your gold position, then take comfort from the fact that the world is likely fine when gold drops, and equities and other assets in your portfolio are rising.

Best wishes,

Manish Singh, CFA