“America will never be destroyed from the outside. If we falter and lose our freedoms, it will be because we destroyed ourselves.”

– Abraham Lincoln, 16th US President

Summary

Presidential transitions in the US have existed in one form or another since 1797, when George Washington handed over the Presidency to John Adams. As per tradition, every four (or eight years for two-term Presidents), the clock hits noon on January 20 and the nation learns whether the outgoing President has accepted the legitimacy of the incoming President. Most transitions have gone well except a few. So what of the next one on January 20, 2021?

Opinion polls have proven untrustworthy and postal ballots, a bone of contention in the best of times, are going to play a very important role in the November US elections. This election cycle is set to see a dramatic increase in mail-in votes on account of Covid-19, from a normal 4-5% of the electorate voting by mail to a massive 20% by one estimate. President Donald Trump is fiercely critical of postal balloting and sees it vulnerable to voter fraud. This lays the groundwork for questioning the result of the election, if the contest is close. A close electoral loss for Trump is a nightmare that nobody in Washington is prepared to deal with, as it could most certainly lead to a constitutional crisis. Yet, recent war-gaming by the Transition Integrity Project indicates that “in three out of four scenarios the US Republic will hit constitutional impasse by the conclusion in January 2021.” Only a decisive win for Joseph Biden will avert a constitutional crisis that may yet befall on the United States in January next year.

The S&P 500 index (SPX) is down only -1.4% year-to-date (YTD). The federal stimulus programs – unemployment payments to supplemental lost income from layoffs – are still in place and there’s talk of extending them beyond the July 31 deadline. There could also be a second stimulus check for individuals and families. Yet, given the rise in the number of new cases and lack of a cure so far, US authorities will practise caution, and therefore the chances of a speedier re-opening are unlikely. Therefore, the summer months will unlikely get us a new high in the SPX. There is room however for a rally in European equities which have fared badly this year and have seen less of a recovery compared to their US brethren. The UK and European Union (EU) nations have managed to beat back the virus and this allows their governments to speed up their economic re-openings. In particular, travel for summer vacations is resuming and the spending it brings, will help the overall economy and the bounce in economic sentiment.

US Presidential transitions, will the next one go smoothly?

Congratulations to us all. We made it through to the second half of the year!

Presidential transitions have existed in one form or another since 1797, when George Washington handed over the Presidency to John Adams. As per tradition, every four (or eight years for two-term Presidents), the clock hits noon on January 20 and the nation learns whether the outgoing President has accepted the legitimacy of the incoming President. Most transitions have gone well, except for two noteworthy ones:

President Adams to President Thomas Jefferson in 1800-01: The first transfer of power between political parties and a turn away from the rule by the aristocratic elite to democratically elected leaders. Adams turned the transition into a display of personal pique, refusing even to accompany Jefferson to the Capitol for the inauguration. In later years they renewed their friendship through an exchange of 158 letters. “You and I,” Adams told Jefferson in 1813, “ought not to die before we have explained ourselves to each other.” Adams and Jefferson famously died on the same day, July 4, 1826, the 50th anniversary of the Declaration of Independence.

President James Buchanan to President Abraham Lincoln in 1860-61: Arguably the most catastrophic transition in American history. It was a time when sectional strife and division rose to such a high level that it split the Democratic Party and caused many to worry that the President-elect would not live to see his inauguration. With the country sliding toward civil war, outgoing President Buchanan sat passively as state after state seceded from the union. On the way to his inauguration, travelling by train from his home in Springfield, Illinois, Lincoln addressed crowds and legislatures along the way. He evaded possible assassins in Baltimore, who were discovered by Lincoln’s head of security, Allan Pinkerton. By the time Lincoln was inaugurated, seven states had left the Union to form the Confederate States of America and the stage was set for a conflict that would claim the lives of more than 600,000 Americans before peace and the Union were restored in 1865.

Source: National Museum of American History

So, just for a moment, let’s imagine it is the morning of January 20, 2021, at the White House in Washington DC and it’s all set for the transition of power. President Donald Trump is writing a letter for incoming President Joseph Biden. Later, President Trump and his wife, Melania welcome President-elect and his wife, Jill Biden at the North Portico of the White House. The couples exchange greetings and gifts and head inside for coffee. Later, they leave the White House in separate cars to meet again on the Capitol for the swearing-in ceremony. Swearing-in done, solemn words spoken and the 45th and 46th presidents say their final goodbyes as Trump salutes and boards the waiting helicopter on the South Lawn, or maybe not.

Now, you may think “maybe not”, is far-fetched but some in Washington are war-gaming this exact scenario – What if President Trump doesn’t accept the legitimacy of a Biden victory? (Particularly if it’s a close contest)

Don’t be fooled by Biden’s nine point lead, as some polls are indicating. We all remember what happened to Hillary Clinton’s 10-12 point lead, which she held on to until Election Day. If those polls had been right, Clinton would be up for re-election and not sitting on the side-lines hoping for Trump to be kicked out of the White House this November.

Source: CNN, Time

Opinion polls have proven untrustworthy and postal ballots, a bone of contention in best of times, are going to play a very important role in the November elections. This election cycle is set to see a dramatic increase in mail-in votes on account of Covid-19, with many state legislatures and governors, who tend to oversee election rules, sending out more, given the risks of in-person voting. Norman Ornstein, a scholar with the think tank American Enterprise Institute and a member of the National Task Force on Election Crises, a bipartisan body doing worst-case election planning says that normally states conduct approximately 4-5% of their electorate voting by mail, but this year that figure could be a massive 20%. It could take a week or more to count them and the uncertainty would make it worse, if it were a close election.

Trump is fiercely critical of postal ballots. He recently tweeted that mail-in ballots “will lead to the most corrupt election in US history”, a message he has echoed repeatedly in recent weeks and months. Trump sees mail-in ballots vulnerable to voter fraud whilst his critics claim Trump’s views on postal ballot as more driven by his belief that voting by mail will more likely result in a Democratic vote.

This lays the groundwork for questioning the result and could lead to a constitutional crisis if the contest is close. Trump could look to contest the results and claim he’d won. Remember he’d still have control of the government machinery including the Department of Justice (DOJ) for 11 weeks after Election Day, unlike in the UK, where the newly elected leader could be in power as early as the day after election results are declared. Those 11 weeks leave a lot of room for complications and uncertainly to arise.

A close electoral loss for Trump is a nightmare that nobody in Washington is prepared to deal with, as it could most certainly lead to a constitutional crisis. Yet, recent war-gaming by the Transition Integrity Project – created by two academics- Nils Gilman, a historian who has run scenario planning exercises for the US government for years, and Rosa Brooks, a former Pentagon official in the Obama administration and now a law professor at Georgetown University – indicates that “in three out of four scenarios the US Republic will hit constitutional impasse by the conclusion in January 2021.”

Only in one scenario, a massive Biden victory, did Trump not seek to remain in power. The bipartisan group’s focus has been the 78 days between the election on November 3 and the inauguration on January 20, when at noon the US Constitution demands that a president leaves office.

The identities of those who took part in the Transition Integrity Project war-gaming is closely guarded. However, as per reports, it is understood members include two former Governors, a former US cabinet Minister, ex-chiefs of staff to a US President and Vice President as well as retired members of the Pentagon and Congress – a sign of how seriously its work is taken.

Only a decisive win for Biden will avert a constitutional crisis that may befall on the United States in January next year.

Markets and the Economy

The S&P 500 index (SPX) wrapped up the second quarter of 2020, up + 20%, its biggest percentage gain since the last three months of 1998. A remarkable rally given the pessimism of March, when many were predicting new lows and a deeper correction, even as the index had fallen by -35%. Of course, the bears, in their enthusiasm to outdo the most bearish of predictions, completely overlooked the possibility of a fiscal response and the determination of the authorities to help and support people, jobs and the broader economy. An unprecedented $1.6 trillion stimulus package from the Federal Reserve (the Fed) and the US Congress set a fire under the rally, as investors bought back what they had sold and more.

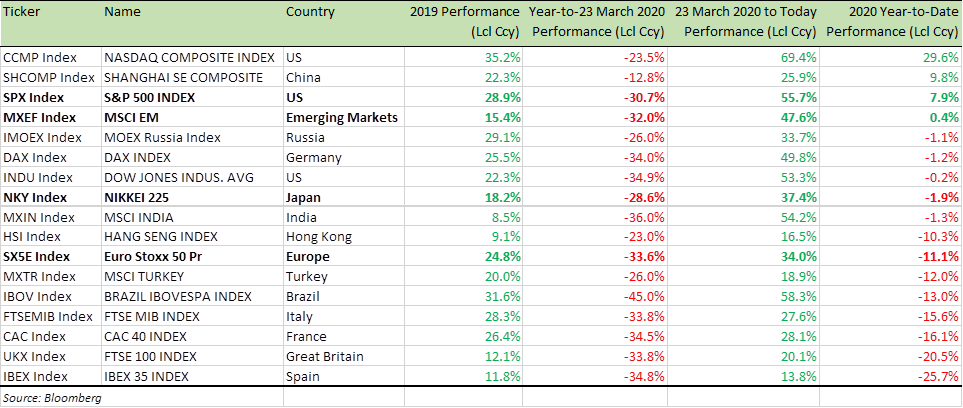

The SPX as of today is down only -1.4% year-to-date (YTD). Only the tech-focused National Association of Securities Dealers Automated Quotations exchange (NASDAQ) index and the Shanghai Composite (SHCOMP) index have done better than the SPX. While the NASDAQ has rallied steadily all through the second quarter reaching new all-time highs, the SHCOMP surged by +16% in the last 10 days, as economic numbers in China continue to get stronger. Just five tech stocks – Apple, Microsoft, Amazon, Alphabet, Facebook make up over 20% of the SPX and that has certainly helped the index.

Benchmark Equity Index Performance (2019 & YTD)

Covid-19 will continue to be the focus this quarter as the number of cases in the US are surging. However, what matters the most is the number of deaths. As long as the number of death do not increase appreciably, and I hope they don’t, the markets will continue to stay positive and edge higher slowly as the economy continues to reopen. Also, remember the federal stimulus programs – unemployment payments to supplement lost income from layoffs – are still in place and there’s talk of extending them beyond the July 31 deadline. There could also be a second stimulus check for individuals and families.

These measures together with an improving economy will continue to keep the US consumer’s balance sheet in good health.

Based on the evidence so far (see chart below), even as the 7-day moving average (MA) of the number of new cases has surged from 20,000 to over 50,000 over the last four weeks, the number of deaths continues to tick down to new lows. This is encouraging. This virus didn’t come with a manual, so one can’t be certain that the number of deaths won’t tick up. However, it will be a mistake to pre-empt and implement lockdowns, in a haste, given the damage these can do to the economy and overall mental health.

The essence is that the US economy is moving in the right direction, as many economic data points are coming in substantially better than what economists expected. From the May job gains coming in more than 10 million higher than expected and retail sales soaring a record +18%, how quickly the economy is bouncing back has surprised nearly everyone. However, before one gets too bullish, one ought to bear in mind that the federal stimulus programs cannot continue to go on forever, and businesses will have to pick up the full tab before year end and, for that, they need to see the demand for their product/service grow.

As I wrote in the May newsletter, a 3,100-3,200 level on the SPX seems a fair range for me, where the index will hover barring a big economic surprise on the upside coming from speedier re-opening of the economy due to a breakthrough on a vaccine. Given the rise in the number of new cases and lack of a cure so far, the authorities will practise caution and therefore the chances of a speedier re-opening are unlikely. I suspect the summer months will unlikely get us a new high in the SPX.

There is room however for a rally in European equities and indeed UK equities, which have fared badly (as the table above indicates).

After failing badly at the start of the Covid-19 crisis, the UK and the European Union (EU) nations have managed to beat back the virus, help people to keep their jobs and wages, ready the healthcare system to deal with any new wave of the virus and lay the ground for economic growth.

In the UK, last week, Chancellor Rishi Sunak announced a stimulus package of £30 billion that amongst other things will help pay for people’s meals in restaurants and pubs, cut Value Added Tax (VAT) from 20% to 5% until January and raise the threshold at which people start paying stamp duty from £125,000 to £500,000 when buying property, meaning nine in ten people will be exempt from the levy.

Meanwhile, in the Eurozone, the years of austerity policies (as advocated by Germany) are history and the only disagreement among EU nations is – how to spend, not how much to spend. Germany’s embrace of fiscal stimulus is a welcome change in a Eurozone starved of growth and with China showing signs of recovery and acceleration, Eurozone stocks look to have a good summer ahead. It’s also aided by the excellent work Europe has done – relative to the US – and Emerging Markets in controlling the virus. This allows European governments to speed up their economic re-openings. In particular, travel for summer vacations is resuming and the spending it brings will help the overall economy and the bounce in economic sentiment. We are seeing signs of it already in the recent Purchasing Manager Index (PMI) data for services and manufacturing.

This will undoubtedly be positive for EUR/USD as foreign capital comes back chasing returns. A rally to above 1.15 is possible however I see EUR/USD stays in the 1.12 to 1.15 for next few months. The same goes for the GBP/USD which I also see range-bound in 1.25 – 1.30 even as data and sentiment in the UK improve. There is no appetite for big directional move given the overhang of the US elections, the uncertainly of GDP loss due to Covid and global economic growth which will be hamstrung due to fear of a new wave of coronavirus in the winter months.

Benchmark US equity sector performance (2019 & YTD)

In terms of sectors, the rally in Tech stocks looks overdone and a shift to more cyclical sector stocks in Energy (XLE), Industrial (XLI), Consumer Discretionary (XLY) and Materials (XLB) are a better bet. I am however not bearish on the Tech sector, I just advocate more stock-specific investing rather than buying the Tech sector index (XLK) as the way forward. I am particularly bullish on the payment services stocks and semiconductor stocks.

As I’ve mentioned before, I am in the camp that believes inflation and nominal growth will be engineered as a way out this recession and growth crisis and, therefore, I continue to be long floating rate bonds and financial stocks – both of which will benefits from shift in the steepening of the yield curve as economic data improves and market rushes to second guess the monetary tightening.

I’d also like to highlight the Biotech (XBI) sector which has broken out after 5 years of range-bound existence (chart below) and offers upside as the search for drugs to deal with coronavirus continues and we see a secular shift in increased healthcare spending globally.

SPDR S&P Biotech ETF (XBI) price chart

Source: Bloomberg

According to a survey of 190 fund managers by Bank of America in June, a second wave of coronavirus cases was cited as the most prominent risk facing stocks for a fourth consecutive month, followed by permanently high unemployment and a Democratic sweep of the election. These surveys are useful, but one also has to bear in mind that, if you ask traders about coronavirus you are essentially asking them to opine on a medical problem, which some may have no clue about.

So in these conditions, it is best to buy high quality stocks that one understands and hold your position through sell-offs or indeed if you have cash, then buy some more of the same good names.

For specific stock recommendations, please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA