“Far more money has been lost by investors preparing for stock market corrections, than from the corrections themselves.”

-Peter Lynch

Summary

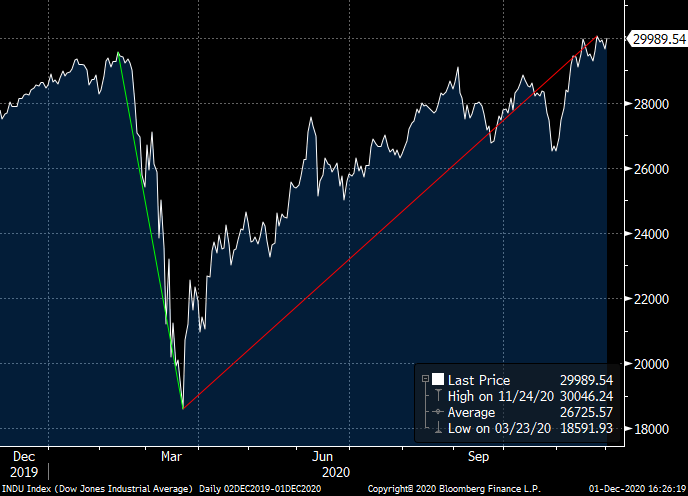

The Dow Jones Industrial Average (DJIA) hit the 30,000 mark in November for the first time in its history and it just had its best month since January 1987. The Index is up +60% from its March lows. By any yardstick, this is a V-shaped recovery in the equity market. Two doses of positivity are responsible for this – the positive news on the Covid-19 vaccine front and the prospect of a smooth transition at the White House. In the last few days, vaccines developed by Pfizer-BioNTech, Moderna and Oxford-AstraZeneca have opened up the possibility that the economic disruption that started in March this year is nearing its end.

The discovery of a vaccine is only half the battle however. Getting the vaccine to market is just as important. The discovery of Penicillin in 1928, was a major medical breakthrough. However, it remained a lab curiosity for over a decade, due to lack of funding to continue the research or to manufacture Penicillin for medical use. It was not until 1941 that a successful public-private partnership between the US and UK governments as well as the pharmaceutical industry, led to the development of a way to mass-produce Penicillin. While the vaccine has come too late to save President Donald Trump’s second term in the White House, Operation Warp Speed – the Trump Administration’s vaccine effort to assist with the development and distribution of medical innovations to address Covid-19, has been a big success.

The Year 2020 is when monetary policy and fiscal policy merged. Decades of separation of church and state between an independent central bank and the Treasury, have just disappeared. Nothing underlines the manifestation of this better than the person expected to take charge at the US Treasury under President-elect Joe Biden – Janet Yellen, the former Chair of the US Federal Reserve. The printing money playbook of the last few years is set to continue and get even bigger. Equities therefore will continue their upward trend in 2021.

V for Vaccine and a V-shaped recovery

Stocks have soared during November, pushing the Dow Jones Industrial Average (DJIA) over the 30,000 mark for the first time in its history and it just had its best month since January 1987.

By any yardstick, this is a V-shaped recovery in the equity market and with monetary policy remaining accommodative for the foreseeable future – the Fed Fund Futures market is currently pricing interest rates of 0% out to 2025, the equity markets have more upside over the next 12 months.

Dow Jones Industrial Average (DJIA) Index: 12-month price chart

Source: Bloomberg

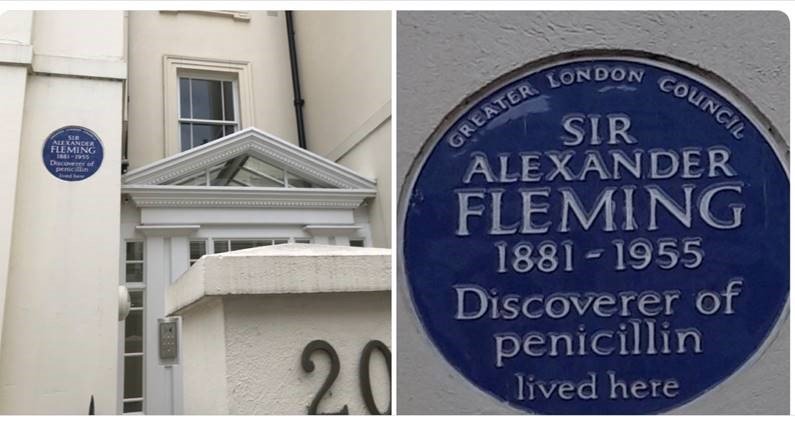

Two doses of positivity are responsible for this – the positive news on the Covid-19 vaccine front and the prospect of a smooth transition at the White House. On my morning run down Chelsea Embankment from Battersea Bridge, when I turn left into Danvers Street, a quaint side street just off the Thames River, to my right I see a English heritage blue plaque (see below)

commemorating Sir Alexander Fleming, discoverer of Penicillin. It was the first antibiotic invented that killed bacteria.

The discovery of Penicillin in 1928, was a major medical breakthrough. However, it remained a lab curiously for over a decade, as Fleming did not have the money or the facilities to continue his research in order to manufacture Penicillin for medical use. Over a decade later, two Oxford scientists, Ernst Chain and Howard Florey revived Fleming’s work and the first person to receive Penicillin was an Oxford policeman Albert Alexander, who was suffering from a bacterial infection. After five days of penicillin injections, Alexander began to recover. But Chain and Florey did not have enough pure Penicillin to eradicate the infection, and Alexander ultimately died. The supply of Penicillin in the US was similarly limited.

Discovery is only half the battle, however getting the drug to market is just as important.

It was not until 1941 that a successful public-private partnership between the US and UK governments as well as the pharmaceutical industry that led to the development of a way to mass-produce Penicillin. It was also spurred by the urgent need to aid war efforts on the battlefields of Europe during World War II, where many soldiers were dying not from combat but from bacterial infections to their open wounds.

Alexander Fleming (1881-1955) lived on Danvers Street from 1929 until his death in 1955

Photo: Manish Singh

Charles Pfizer & Co. – a relatively small chemical company at the time, based in Brooklyn and hitherto better known for making vitamins and the citric acid used in Coca-Cola, took on the challenge (and the government funding) and pioneered the deep-tank fermentation process by which Penicillin could be mass-produced. Thus, a public-private partnership took Penicillin out of the laboratory and onto the market, as highly refined Penicillin began to be manufactured not in pans and milk bottles but in 10,000-gallon tanks. Today, Pfizer is a giant in pharmaceuticals and has a Covid-19 vaccine in development.

While the vaccine has come too late to save President Donald Trump’s second term in the White House, Operation Warp Speed – the Trump Administration’s vaccine effort to assist with the development and distribution of medical innovations to address Covid-19 has been a big success. Operation Warp Speed, founded in May 2020, has spent more than $10 billion to advance vaccine clinical trials, manufacturing and distribution. The US allocated $1.5 billion to support the manufacturing and delivery of Moderna’s vaccine candidate in return for 100 million initial doses.

In the last few days, three vaccines developed by Pfizer-BioNTech, Moderna and Oxford-AstraZeneca have opened up the possibility that the economic disruption that started in March this year is nearing its end. The vaccines could be approved for use as early as this month (the Pfizer vaccine was just approved in the UK). It’s a great testament to the advances in vaccinology (and the helping hand of capitalism) that a vaccine is in production in under 12 months from the time the Covid-19 virus struck. Not only that, but one will be spoilt for choice in terms of which vaccine to use!

Covid-19 has so far killed over one and a half million people globally. Based on an estimated R number of 2.5 to 3 (R is the number of people that one infected person will pass on a virus to, on average) scientists estimate that 60% to 70% of the population might need to gain immunity to Covid-19 before “herd immunity” is reached. In New York City, an epicentre of the Covid-19 epidemic in the US, some researchers estimate 25% of the population already have protective antibodies against Covid-19. In other places, it’s much lower. Therefore, a vaccine is the only way to accelerate the build-up of the “herd immunity” against Covid-19 and for life to resume as normal.

Markets and the Economy

This time last year in Market Viewpoints I wrote – “I expect the S&P 500 (SPX) index to finish next year at 3420”.

That target looked overly optimistic in March this year, when the index dropped to 2250 as the Covid-19 led sell-off intensified. Fear was everywhere and some expected worse was yet to come. I went out on a limb to call the market bottom on Friday, March 20 (as outlined in the March Market Viewpoints). The low on March 20 on the SPX was 2,295, and after more selling on Monday, March 23, the SPX reversed course. And what a rally it has been since!

The S&P 500 index (SPX) is up over +60% from its the March lows and for the first time since 1982, the index has logged a double-digit monthly gain twice in a year – April and November. The index is currently at 3665 – well above my 3420 target and is set to go higher next year as monetary and fiscal policy both remain accommodative at least for next twelve months (and possibly many more months after).

The large positive move in equities in November (and indeed for the year) will inevitably lead to a pretty dramatic need for the rebalancing of portfolios both at the single-stock level but also across asset classes. Therefore, expect some sell-offs and sideways moves over this month. However, make no mistake, the trend is still upwards. I expect the SPX to gain at least +8%-10% (and possibly more) next year.

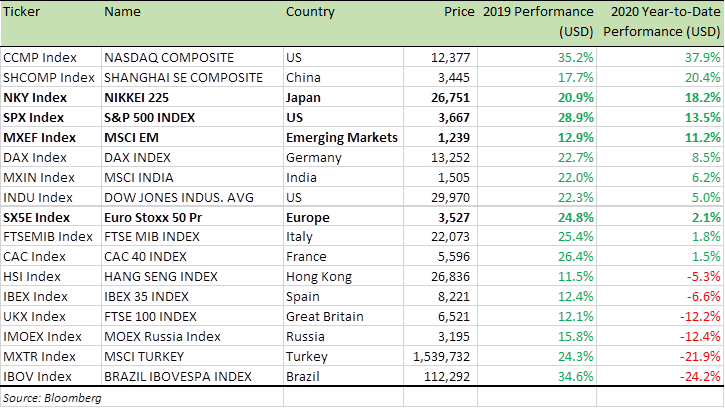

Benchmark Equity Index Performance (2019 & YTD)

This year’s spike in the US money supply has been unprecedented. 21% of all the US dollars that have ever been printed in the history of the United States were printed this year.

The printing of 1/5th of all US dollars in circulation in a single year is mind-boggling but, remember, the US Dollar is not pegged to Gold, so the US Treasury can run debt at their freewill as long as buyers have the confidence to keep buying – and it’s better still if the largest buyer of US debt is a home entity like the US Federal Reserve – with the license to print the money in the first place.

What’s happening in the US is not unprecedented and it has happened in the past during World War II and its immediate aftermath. Then as now, the Fed committed itself to buy as many US Treasuries as necessary to keep yields on US debt in check. Much of that debt once on the Fed’s balance sheet, never made its way back into private hands. In keeping those bonds permanently, the Fed effectively and directly financed much of the US budget deficit simply by printing money.

For the avoidance of any doubt, when a central bank takes permanent ownership of its own government’s debt, that debt “ceases to exist.” For the Fed may own the US government bonds, but it is the US government that owns the Fed. One can’t be meaningfully indebted to oneself. Thus, by buying up its own bonds, the US government can finance itself and avoid the austerity that would accompany, if the financing had occurred via a tax increase or a cut in spending. Japan has been doing the same – financing deficit by money printing- for over a quarter of the century now. The Bank of Japan has no intention of unwinding its balance sheet – not that they would ever admit it publicly.

The only reason money printing is not offered upfront as a policy (and actively dissuaded from being seen as a “tool” that can be readily used) is to discourage politicians from misusing it and causing hyperinflation in their pursuit for votes and power. So here lieth the noble lie– all spending must be paid for via either raising taxes or taking on new debt. Both then become a check on the powers and wanton fiscal profligacy of elected politicians.

The Year 2020 is when monetary policy and fiscal policy merged. Decades of the separation of church and state between an independent central bank and the Treasury have just disappeared. Nothing underlines the manifestation of it better than the person expected to take charge at the US Treasury under President elect Joe Biden – Janet Yellen, the former Chair of the US Federal Reserve.

Professor Janet Yellen teaching at University of California Berkeley Haas (year unknown)

Photo: Bruce Cook/University of California Berkeley Haas

The printing money playbook of the last few years is set to continue and is about to get even bigger.

I wrote in October’s Market Viewpoints “The curious thing is at least on recent evidence, financial markets do not seem to differentiate between a Democrat or a Republican in the White House. Perhaps it’s because the man in the White House at 1600 Pennsylvania Avenue is not in control of the economy as much as the person in the Eccles Building, 20th Street and Constitution Avenue – the Chairman of the Federal Reserve.” With Yellen next at the US Treasury, I have more reasons to be bullish equities and see any year-end sell-off as an opportunity to “buy the dip.” My favourite sectors to pick stocks from – Consumer Staple (XLP) and Consumer Discretionary (XLY) as well as Technology (XLK) and Communications (XLC).

A few things to keep in mind about Janet Yellen:

- As Fed Chair from 2014-18, she navigated to a middle ground between colleagues who were eager to start lifting interest rates and those who, like herself, were reluctant to move more aggressively despite steady growth. She chose to leave rates near zero until late 2015 and then to lift them very slowly to help spur employment gains

- Yellen advocated forcefully for more stimulus during this period. At a December 2012 meeting, some of her colleagues worried that the Fed was inviting political risks with its purchases of Treasury and mortgage-backed securities, which were intended to drive down long-term rates after the Fed had pinned short-term rates near zero. Yellen told her colleagues they should be more concerned about repeating mistakes made over more than a decade by Japan, which had been mired in deflation, by pulling back on stimulus prematurely

- Yellen said on CNBC on April 6, 2020 “I frankly don’t think it’s [give Federal Reserve the authority to buy equities] necessary at this point … but long term it wouldn’t be a bad thing for Congress to reconsider the powers that the Fed has with respect to assets it can own”

- A Wall Street Journal analysis of more than 700 predictions that Fed officials made between 2009 and 2012 showed Yellen had the best record. She warned others that the recovery would be slow and played down the threat of inflation

Yellen is a Keynesian from the James Tobin School, who believes in spending as fiscal stimulus and low-interest rates. Therefore, she is likely to insist on blowout spending, while urging the Fed to monetize it. In the face of this, one has to be naïve not to be long US equities and foolhardy to be short. And if this level of money printing doesn’t scream a real hidden rate of inflation eventually and therefore higher nominal prices, then I don’t know what does. There is also talk of cancelling student debt. The student debt in the US stands at over USD 1 trillion.

Dollar weakness is set to continue and therefore EUR/USD has hit the 1.20 level, despite a worsening economic situation in the Eurozone. A weak dollar will also keep driving commodity prices and Emerging Market equities higher.

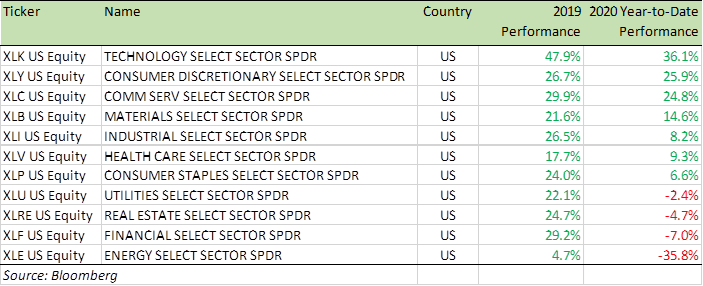

Benchmark US equity sector performance (2019 & YTD)

And if you are not feeling positive enough yet, then here is something else to mull over as you enjoy the Christmas meal and New Year festivities later this month.

This week we learnt that the UK based Artificial Intelligence (AI) Company DeepMind has cracked the 50-year-old problem of biology research – determining a protein’s 3D shape from its amino-acid sequence. DeepMind’s AI program AlphaFold can identify the shape of a protein in mere hours. An overwhelmed Andrei Lupas, biologist at the prestigious Max Planck Institute in Tübingen, Germany noted – “The model from group 427 gave us our structure in half an hour, after we had spent a decade trying everything. This will change medicine. It will change research. It will change bioengineering. It will change everything”. The ability to accurately predict protein structures from their amino-acid sequence would be a huge boon to life sciences and medicine. It would vastly accelerate efforts to understand the building blocks of cells and enable quicker and more advanced drug discovery. Another amazing continuation of the UK’s incredible contribution to computer science since the days of Charles Babbage and Alan Turing.

The Biotech ETF (XBI US) which is up +40% for the year (and up over +100% since its March lows) is best way to participate in any future application of such a research in day to day life. From finding cures for diseases to feeding future generations, there are many areas of day-to-day life that are influenced by biotechnology companies. Exchange traded funds (ETFs) are the best way to mitigate some of the risks that are inherent in investing in early stage, low revenue and high growth individual biotech stocks

And on that note, all that is left for me to say this year is thank you and to wish you and your family all the best for this holiday season as well as a very Happy New Year. And if you celebrate Christmas – hope you have a great one.

Best wishes,

Manish Singh, CFA