“Employment risks now overshadow inflation challenges, a 50-basis point rate cut this Wednesday could be a prudent adjustment.”

Summary

As US job openings revert to pre-COVID levels, employment risks now overshadow ongoing inflation challenges. Amid this shift, businesses serving lower and middle-income groups face increasing pressures, and the personal savings rate has dipped to 2.9% in July, its lowest since 2007. This context places the US Federal Reserve at a crossroads: Continue the stringent measures of the current tightening cycle or ease up as the unemployment rate surpasses expectations and the road to +2% inflation appears clear. A 50-basis point rate cut this Wednesday could be a prudent adjustment.

While the U.S. economy reportedly grew around +3% last quarter, not all segments of the population are experiencing prosperity. Potential further softening in the labour market might necessitate larger rate cuts, potentially at odds with the Fed’s long-term objectives. Regardless of whether the cut is 25 or 50 basis points, market sentiment is tilting towards additional reductions over the coming year, as evidenced by the 2-year Treasury yield dropping to +3.54%, significantly below the current upper boundary of the Fed Funds Rate.

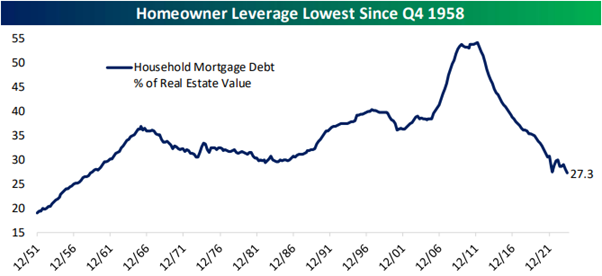

Contrary to some expectations of a looming US recession and market downturn, several factors suggest resilience. Households are seeing the lowest mortgage debt relative to property values in nearly seven decades, bolstered by rising home values and consistent mortgage payments. Additionally, the restrained cash-out refinancing and low turnover in mortgages have lessened real estate leverage. This robust financial footing, combined with gains from high home prices, stock market improvements, and steady incomes—all amplified by high interest rates—continue to drive consumer spending.

Meanwhile, a U.S. fiscal deficit nearing 10% of GDP offers substantial support, reducing the likelihood of a sharp demand drop. With consumer spending remaining strong, the probability of a recession appears low, suggesting equities still have room to grow.

Why the US Fed must cut rates in a “Healthy” Economy

In 1959, economist Milton Friedman addressed a joint session of the US Congress, explaining that monetary policies “operate with a long lag and with a lag that varies widely from time to time.” He compared changes in US Federal Reserve (Fed) policy to “a water tap that you turn on now, and it only starts to flow six, nine, 12, or 16 months later.”

Friedman further stressed the uncertainty of these lag effects, stating, “…we know too little about these lags or what the economic situation will be months or years from now, when the chickens we release come home to roost, to effectively counteract the myriad of factors causing minor fluctuations in economic activity.”

Today, with the Federal Funds target rate (FDTR) held at +5.25% for 14 months, following the steepest interest rate hike cycle seen in over four decades (see chart below), Fed Chair Jerome Powell and his colleagues on the Federal Open Market Committee (FOMC), face the challenge of navigating these “long and variable lags.”

The task, however, is not how much to raise rates to combat inflation but determining when and by how much to cut rates, without tipping the economy into a future recession.

All signs point to a rate cut starting this Wednesday. Current market pricing indicates a 70% probability of a 50 bps rate cut.

We have a flurry of communications from “Fed surrogates.”

Last Friday, two strikingly similar articles were published in The Wall Street Journal (link) and The Financial Times (link) written by Nick Timiraos and Colby Smith respectively.

If you know the Fed meeting coverage well, you will know Nick Timiraos and Colby Smith are two well-respected members of the Federal Reserve press corps. Timiraos, in particular, has often been viewed as a key channel through which the FOMC indirectly communicates its thinking to the market.

Both articles focused on the rate-setting decision—whether to cut rates by 25 basis points (bps) or 50 bps—and both articles presented a clear and balanced discussion of the arguments for a 25 bps versus a 50 bps rate cut, highlighting the risks and benefits associated with each option. Notably, neither story cited an explicit source within the FOMC, indicating a preferred direction for the decision.

Change in the Federal Funds Target Rate (FDTR) during the last five rate-hiking cycles

These were followed by a headline on Bloomberg the same day – [Bill] Dudley Sees Case for Half-Point Fed Rate Cut Next Week.

Speaking at a forum organized by The Bretton Woods Committee in Singapore, the former NY Fed President, Bill Dudley said – “I think there’s a strong case for 50. I know what I’d be pushing for.”

I strongly agree with Dudley.

Last week’s US jobs report revealed that the focus must shift to jobs and economy.

With job openings returning to pre-COVID levels, the risk to employment now outweighs the persistent challenges of inflation, which is projected to reach +2%.

- The hiring rate has decreased from 4.5 to 3.5

- Job openings have dropped from over 11 million to 7.6 million

- Job openings per unemployed worker have halved, from over 2 to 1.07

- Layoffs are trending upward, rising from 1.2 million to 1.7 million

- The unemployment rate has climbed by 0.5% since the start of the year.

Any tolerance that leads to further weakness in the labour market, could prompt more substantial rate cuts down the line, which is not ideal for the Fed.

The housing market has been soft in recent months, and while the construction sector added jobs in August, declines in new residential construction, point to another source of potential weakness ahead for hiring.

Businesses and financial companies that cater to low- and middle-income consumers are pointing to signs of greater strain, and the personal savings rate fell to +2.9% in July, near its lowest level since 2007.

Let us look at the data (see chart below):

- Federal Funds Target Rate (FDTR) Upper Bound (White) is at +5.5%

- US inflation, as measured by US Consumer Price Index (CPI) is currently at +2.5%

- US 2y Treasury Yield is at +3.57%

- Spread 1 (Yellow): US 2y yield – FDTR is at -190 bps

- Spread 2 (Green): US Inflation – FDTR is at -300 bps

The spreads are at historic levels and point to how high the Fed fund rate is with respect to other key data.

The last time, US 2-year Treasury yield traded 190 basis points below the upper bound of the Fed Funds Rate was on January 18, 2008. Just four days later, on January 22, 2008, the Fed made an unscheduled 75 bps rate cut, followed by another 50 bps cut eight days later, on January 30, 2008.

We are not in such a crisis, so we will not get a 75 bps cut.

Whether it is 25 or 50 bps cut on Wednesday, the market is now expecting a lot more rate cuts in the next year or so. The 2-year Treasury yield is a good measure of where the market expects the Fed Funds Rate to be in the next year or two, and this week the 2-year yield ticked down to +3.57%.

Price chart: Federal funds rate (FDTR) , Spread between US inflation and FDTR, Spread between US 2y yield and FDTR

Source: Bloomberg

I’ve heard arguments against cutting rates in a “healthy” economy, but what defines “healthy”?

For those benefitting from deficit spending or in the upper and middle classes, the economy may seem robust—where inflation is minor, and lifestyles are stable. Yet, many aren’t seeing these benefits.

Essential costs have surged 20-30% recently, with Dollar General (DG) noting sales declines among customers averaging $35k a year. CEO Todd Vasos attributed weak sales to financially strained core customers.

Moreover, the end of pandemic-era food stamp benefits in March 2023, alongside two years of inflation, has pushed consumers to focus on necessities over discretionary items.

Despite a +3% GDP growth last quarter, the economy isn’t “healthy” for all, highlighting the disparity in economic health across different societal segments.

As per the New York Fed’s Survey of Consumer Expectations (see chart below), the mean probability of missing a debt payment, hit its highest level since April 2020.

Source: Bespoke Invest

For those worried about inflation if the Fed cuts rates, consider this:

Rate cuts are unlikely to hit historic lows soon. I anticipate about 200 basis points in reductions over the next year or more. Contrary to some beliefs, low rates alone don’t drive inflation. Instead, inflation ties more directly to the M2 money supply, heavily influenced by government spending and debt levels. Over the last four years, the cumulative effects of Trump’s tax cuts and Biden’s stimulus significantly increased the U.S. deficit.

Moreover, high rates can trigger recessions or even depressions, as seen in the late 1920s. Economists broadly agree that the Fed’s sharp rate hikes in 1928 and 1929 contributed to the subsequent global economic collapse.

During the Great Depression, the Fed’s reluctance to cut rates exacerbated the crisis. From 1929 to 1933, consumer prices fell by -27%, yet the Fed kept rates at 3 to 5%, with mortgage rates at about 6%. This resulted in effectively +32% real interest rates during deflation, suggesting that negative rates would have been more appropriate.

Now, with rates significantly above neutral and inflation decreasing towards a 2% target, a more substantial cut than the typical 25 bps may be warranted. We need to question whether it’s justified for the Fed to maintain its most restrictive stance during a clear move towards 2% inflation.

Lastly, considering the massive U.S. federal debt—now at $35.7 trillion—do big rate cuts make sense? Given the circumstances, they do.

Markets and the Economy

Some people think a new high for the S&P 500 (SPX) and the National Association of Security Dealers Automated Quotations (NASDAQ) indices, means we are in “bubble” territory and the equity markets must correct.

Far from it.

It must be emphasised that while the stock market has been trending upward over the past couple of years following the 2022 bear market, the current environment is far from a “bubble,” when viewed through a long-term lens.

- Cap-weighted indices like the S&P 500 and Nasdaq 100, driven by mega-cap stocks, have shown strong performance. In contrast, their equal-weighted counterparts have been consolidating sideways since late 2021

- Charts of the S&P 500 Equal Weight ETF (RSP) and the Nasdaq 100 Equal Weight ETF (QQQE) show this extended consolidation over the past five years

- The S&P 500 Equal Weight ETF recently surpassed its early 2022 all-time highs, whereas the Nasdaq 100 Equal Weight ETF is still just below its late 2021 highs

- Both equal-weight indices might see significant upward movement if they break out of this multi-year consolidation phase

5-year price chart: S&P 500 Equal Weight ETF (RSP) and the Nasdaq 100 Equal Weight ETF (QQQE)

Source: Bloomberg

Last week, Nvidia (NVDA) CEO Jensen Huang declared: “We’re at the beginning of a new industrial revolution.”

While NVDA sceptics may not want to hear it, the surge in tech spending on Artificial Intelligence (AI) is driving what many are calling the 4th Industrial Revolution.

Oracle founder Larry Ellison’s recent insights on AI demand and Oracle’s expanding pipeline are particularly revealing. Ellison noted that a few major tech companies—and potentially even a country—will be vying for AI model “technical supremacy” in the coming years, each planning to spend $100 billion.

Ellison emphasized that the AI boom shows no signs of slowing down anytime soon. “If you’re looking at the next five to ten years, there’s no need to worry,” Ellison said during Oracle’s earnings call. “This business is growing bigger and bigger. There is no slowdown or shift on the horizon.”

The most significant news is that Oracle’s AI infrastructure efforts now have full backing from Nvidia.

Nvidia’s chips are in extremely high demand across the tech industry. During a dinner with Tesla (TSLA) founder Elon Musk, Ellison personally appealed to Huang to secure more GPUs for Oracle’s AI supercluster.

“I’d describe the dinner as Elon and me begging Jensen for GPUs. ‘Please take our money. No, take more of it. We need you to take more,’” Ellison said. “It went well. It worked.”

At the Oracle CloudWorld conference on Wednesday, the two companies – Nvidia and Oracle – announced that Oracle Cloud Infrastructure (OCI) will deploy the largest-ever GPU compute cluster. Set to be available in the first half of 2025, this cluster will feature up to 131,072 Nvidia Blackwell GPUs, enabling customers to train and run AI workloads on an unprecedented scale. Oracle stated that the cluster would be six times larger than what any other cloud provider currently offers.

For context, Meta used just 16,000 Nvidia GPUs to train its latest Llama 3 model, highlighting the massive leap Oracle is making in AI infrastructure.

So, all looks good on tech and AI stock front, but the talk of “bubble” will not go away.

Those expecting a recession and hence a market correction are going to be disappointed.

Households have the least mortgage debt relative to their property value in almost 70 years, with appreciation of those homes and steady amortization of mortgage debt (alongside low cash-out refinancing activity and low turnover in mortgages overall) driving down the leverage in real estate. Consumer balance sheets are rock solid, which is another reason to question the narrative of impending recession.

Source: Bespoke Invest

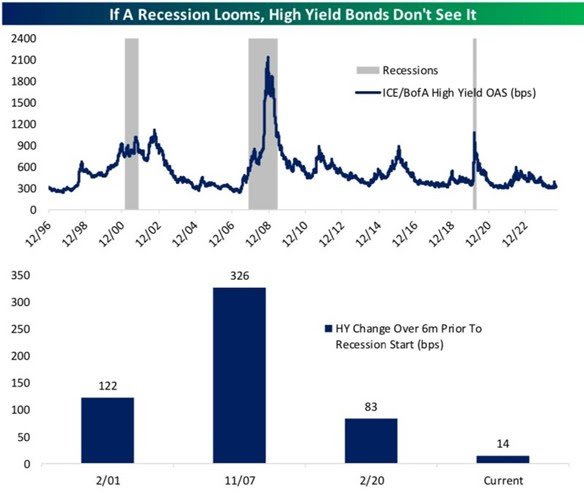

Unlike past recessions, yields on high-yield bonds have shown minimal movement so far (see Chart below). As long as consumer spending remains strong, the likelihood of a recession stays low.

While recent jobs reports indicate early signs of weakness, the unemployment rate remains historically low. The wealth effect from high home prices, stock market gains, and steady income driven by high interest rates continues to support consumer spending.

In August, the US federal deficit hit $380.1 billion, on a non-seasonally adjusted basis, significantly above the $292.5 billion expected, driven by a +9% increase in expenditures. Only a few periods have recorded larger deficits.

Relative to GDP, the deficit is approaching +10%. With this level of fiscal accommodation, it is hard to believe that final demand will slow significantly. Federal deficits are propping up strong real income growth and investment, regardless of what the payroll numbers indicate.

Furthermore, in Washington, there is a broad consensus that deficits can be expanded when needed. No politician wants to champion a balanced budget or spending cuts—it would be political suicide. As a result, the reckoning for US yields and the dollar keeps getting pushed further into the future.

Source: Bespoke Invest

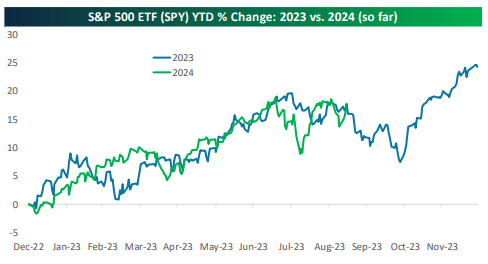

2024 is eerily like 2023… Is a dip next? or a rally with a Fed cut on the horizon?

I am expecting a 50 bps cut on Wednesday.

S&P 500 (YTD): +17.95%

As I have mentioned above, I do not anticipate a recession taking hold within the next 6 months.

A Fed rate cut would boost sentiment, and the US economy is showing no signs of a recession.

While the un-inversion of the yield curve is often seen as a worrying indicator, the effects of COVID and the policy responses have disrupted all historical models.

So, be cautious about relying too heavily on past patterns and models.

Source: Bespoke Invest

A magazine advertisement placed by The Teachers Insurance and Annuity Association of America (TIAA) and College Retirement Equities Fund (CREF) from 1996, predicted that people would pay:

– $16 for a burger and fries

– $12,500 for a vacation

– $65,000 for a “basic car”

The ad continued:

“No problem.

You’ll eat in. You won’t drive.

You won’t go anywhere.”

Reality is:

We eat out more than ever.

We drive more than ever.

We go anywhere more than ever.

So, do not get bearish on life in general. Hold on to your long equity positions. Recession is not on the horizon and equities have further to run.

For specific stock recommendations and insights related to structured products, please do not hesitate to reach out to me or your dedicated relationship manager.

Best wishes,

Manish Singh, CFA