Europe has a tough winter ahead, but it seems the energy problem may start early. The Nord Stream pipeline gas supply not coming back on later this week, will push Germany into a very tenuous situation and a deep recession.

Summary

Germany’s political decision to distance itself from the US (and the UK for that matter) and follow Ostpolitik (German for “new eastern policy”) to build a greater Europe it thought it could shape and then benefit from – has been its greatest post-WWII miscalculation. Even more inexplicable, has been Germany’s failure to change course as the Soviet Union disintegrated at the end of the 1990s. Instead, Germany chose to rely even more on Russia and provided Russia with the leverage that it now has over energy supplies to the European continent.

Russia is constraining gas supplies right now to ensure that European countries cannot fill their storage for winter months. The Nord Stream pipeline is now shut for regular maintenance and is due to reopen on July 21. Russia may well decide to ratchet up the pressure and not reopen the Nord Stream pipeline, or at least not turn it on for a few days or weeks, thus cutting supplies to zero. Russia is suffering economically and not turning the taps back on may move Russia’s suffering level from 6 to 7 but, in Europe, the pain level could jump from 2 to 7, and that will have catastrophic outcomes economically, socially, and politically. Is Europe prepared for this?

Inflation in the US hit a new high of +9.1%, yet the bond market does not seem in any way panicked. The yield on the 10y US Treasury is now down to +2.9%. It was at +3.5% a month ago. The long end of the bond market is screaming what’s coming after the interest rate hikes – rate cuts. Commodity prices continue to weaken. Base metals (Copper and Aluminium) prices have fallen by a third or more from their highs. Oil prices have fallen by almost -20% over the last six weeks. Growth concerns and recessionary fears are growing.

In a directionless equity market such as the present, volatility abounds, and structured products are the perfect vehicle to monetise income and retain a participation in market performance.

Wandel durch Handel (“Change through trade”) has had its day

As is becoming evident with every passing month, Germany’s decision over the last two decades to shut down German nuclear plants and replace them with more Russian gas and coal is proving to be a case of economic vandalism on a continental scale. Former German Chancellor Angela Merkel has a lot to answer to, for the disaster that Germany’s industry faces if Russia were to cut-off energy supplies.

However, Germany’s decision to work closely with Russia is not Merkel’s doing alone. It goes back to the 1970s when Germany’s Chancellor was Willy Brandt. Since then, successive German Chancellors have put German business interests above all else. Ironically, that same hardnosed policy risks being Germany’s undoing.

In the post-World War II world, since at least the 1970s, Germany has aggressively pursued the policy – Wandel durch Handel or “Change through trade” which has seen it embrace autocracies (China), kleptocracies (Russia), and theocracies (Iran) in the name of doing business or as Jörg Lau in an article in the German weekly Die Zeit put it “Die deutsche Liebe zu den Diktatoren (The German love for Dictators)” . Strikingly, this approach to value “stability”, and achieve “change through trade” above all else, has remained dominant for the last 50 years and has earned Germany rich dividends. However, the present energy crisis brought on by the Russia-Ukraine war, suggests that the approach has had its day and is quite dangerous in the longer term for Germany (and by extension Europe’s) interests.

In my opinion Germans, particularly the Social Democrats, have mistakenly given this policy more credit than it deserves, for Germany’s unification and success over the last 50 years. Indeed, West Germany’s acceptance of the post-war territorial order and the renunciation of German claims for the lost lands in the East, persuaded then USSR President Mikhail Gorbachev to accept that Germany was no longer a threat to the Soviet Union, and hence West and East Germany could unite. However, without the support of the United States, Article 5 of the North Atlantic Treaty Organization (NATO) which states that – an attack on one member of NATO is an attack on all of its members – German unification would not have happened or indeed succeeded.

Germany’s political decision to distance itself from the US (and the UK for that matter) and follow Ostpolitik (German for “new eastern policy”) to build a greater Europe it thought it could shape and then benefit from – has been its greatest post-war miscalculation. Even more head scratching and inexplicable, has been Germany’s failure to change course as the Soviet Union disintegrated at the end of the 90s. Instead, Germany chose to rely even more on Russia and provided Russia with the leverage that it now has over energy supplies to the European continent.

The Nord Stream pipeline runs 760 miles under the Baltic Sea from Vyborg, Russia to Lubmin, Germany

Last Monday, the Nord Stream pipeline, which supplies the bulk of Russian gas to Europe, closed down for 10 days for routine annual maintenance. The maintenance runs from July 11-21. Repairs that are routine in times of peace, would not be a subject of discussion. However, these are not peaceful times.

The EU (and the West) have made it very clear that they want to suffocate the Russian economy into submission over its transgression in Ukraine. Cast off as a pariah, Russia is only too willing to use its Natural gas supply to Europe as a weapon. Moscow has already cut gas deliveries by more than half of the Nord Stream pipeline’s capacity. Russia is constraining supplies right now to ensure that the EU countries cannot fill their storage tanks for the winter months. Russia may well decide to ratchet up the pressure and not reopen the pipeline, or at least not turn it on for a few days or weeks, thus cutting supplies to zero.

Bear in mind Russia squeezed gas supplies to Europe throughout last year leaving the continent’s gas inventories at multiyear lows as winter approached. Russia reduced flows through Ukraine to persuade Germany and the European Commission (EC) to accelerate the Nord Stream 2 signoff and they did achieve it, even though the pipeline now lies unused. Russia has already cut gas supplies to Poland, Bulgaria, the Netherlands, Denmark, and Finland over their refusal to comply with a new payment scheme of paying for Russian gas imports in the Russian currency Ruble (RUB).

Russia is suffering economically and not turning the taps back on may move Russia’s suffering level from 6 to 7 but in Europe, the pain level could jump from 2 to 7, and that will have catastrophic outcomes economically, socially and politically.

Is Europe prepared for this? The next few days and weeks will tell.

We are not even in the winter months and the pain is clear. France is nationalizing nuclear giant Electricite de France SA (EdF), and Germany is in talks to bail out one of its largest energy providers, Uniper SE, as the stand-off with Moscow chokes the finances of the company. Europe has a tough winter ahead, but it seems the energy problem may start early. Nord Stream supply not coming back on, will push Germany into a very tenuous situation and a deep recession, as industries get devastated. German industries rely entirely on gas and most German homes use gas for heating. A recession and economic destruction would have major consequences on the whole of the Eurozone economy, given Germany’s importance to the Eurozone.

The German think tank, Agora Energiewende calculates that by investing in energy efficiency and renewable energy alone, 80% of Russian gas imports could be replaced by 2027. If combined with alternative gas supplies such as LNG, it could even be 100%, the think tank suggests.

There is just a small matter of dealing with the winters between now and then…

Russia is using winter as part of their military strategy. Oh! No! Not again… wait, right, they have done this before, haven’t they?

The stringent “Climate goals” in the face of the energy crisis represent the West’s – have your cake and eat it too – dilemma.

I am all for clean energy and “net zero”. However, it must be weighed against reality. Not budging on “net zero,” as some are suggesting and not embracing fossil fuels for longer in the face of a crippling energy crisis, would be akin to New Yorkers in 1890 killing all of the horses and burning all of the buggies,10 years before the invention of the auto, in a relentless drive to replace horses and carriage, just because they had had it with the clattering sound that horse carriages made on the cobbled streets.

Losing control of the energy supply, fuelling inflation, and inviting economic misery, is sadly the likeliest path to the historical ugliness that Germany was so desperate to avoid when it chose to pursue Wandel durch Handel in engaging with Russia. Life always comes a full circle, and sometimes things that may look good in the short term, could prove to be an epic disaster in the long term.

For everyone’s sake, let’s hope before winter arrives, a resolution is in place, with all sides seeing the value of compromise, however imperfect it may be for each party.

As the damage to Europe’s economy unfolds it could force European leaders to increasingly push Ukraine to seek a peace deal – some like France, already are.

If all else fails, perhaps Frau Merkel can refer to her friendship with Russia and write a polite “Dear Vladimir” letter to President Putin asking him to delay his aggression until Germany becomes energy independent.

Markets and the Economy

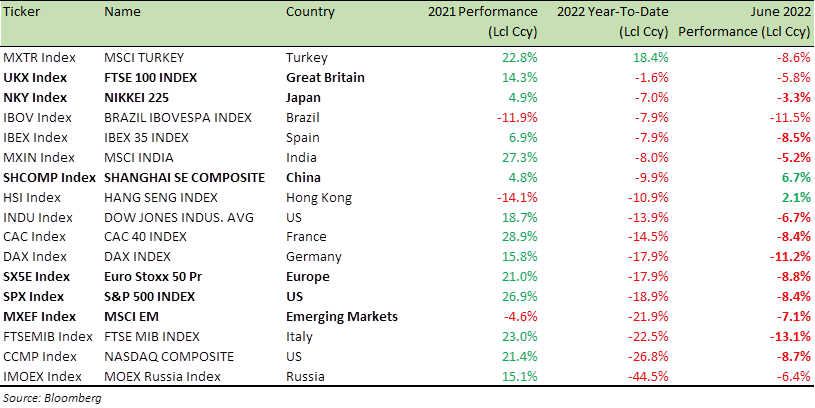

The equity market has seen a bounce in July after having a bad June (see table below) which saw the S&P 500 index (SPX) lose -8.4%. The index is down -19% for the year i.e. nearly half of the year’s decline has come in June.

Two factors have played a significant role in the swings of asset markets throughout the year – expectations for economic growth and expectations for the path of interest rates. In the first half of the year, the concerns about growth were a much smaller factor, than concerns about how high the Fed Funds Rate (FFR) could go in the US.

The expectations of the FFR hitting +4.5% by mid-June next year have moderated over the last four weeks, and the expectation now is for FFR to be at +3.5% in June next year. However, as rate rise expectations have shifted downwards, growth concerns abound,, with talk of an impending recession in the US.

Karl Otto Pöhl, President of Germany’s Bundesbank from 1980 to 1991 once said – “Inflation is like toothpaste. Once it’s out, you can hardly get it back in again.”

US Consumer Price Index (CPI) data out last week, showed that inflation reached +9.1% in June, higher than May’s +8.6% and the highest rate in nearly 40 years.

US Federal Reserve (Fed) Chairman Jerome Powell must certainly feel like he is trying to squeeze toothpaste back into the tube, as he tries to contain inflation. The percentage of items in the CPI basket whose YoY prices are increasing by over +4% is now at a new record high of over 70% i.e. inflation is very broad-based and at over +4% for the majority of items in the basket. This will concern the Fed.

Core inflation, which strips out volatile food and energy components, however, increased by +5.9% in June from a year ago. A slightly slower pace than May’s +6% increase. It indicates that the core inflation has levelled off and has started to come down ever so slowly.

Another interesting piece of recent data is US real earnings, which keep dropping. Real average hourly earnings decreased by -3.6%, seasonally adjusted, from June 2021 to June 2022. This does not bode well for consumption. Consumers are getting increasingly squeezed both in magnitude and overtime when it comes to their purchasing power, and this means the Fed’s hawkishness is working.

Benchmark Global Equity Index Performance (2021 and 2022 YTD)

Amongst all this high inflation data and the expectations of more interest rate hikes, the bond market does not seem in any way panicked.

The front-end yields (3 months to 2-year maturity) have increased as Fed hawkishness is re-priced, but long-end yields (10 years plus) fell on the day we got a record CPI print of +9.1%. The yield on 10y US Treasury is now down to +2.9%. It was at +3.5% a month ago. Bond yields move in the opposite direction to prices.

Well, the long end of the bond market is screaming what’s coming after the interest rate hikes – interest rate cuts.

Bond futures show over a 100 bps of cuts are now priced between Dec 2022 and Jun 2024. It will be the fastest cutting cycle ever immediately after the Fed finished hiking. This is what is helping long-dated bonds rally.

On Tuesday, Japanese bank Nomura Holdings became the first major bank to forecast rate cuts next year. Nomura expects the US Federal Reserve (the Fed), the Bank of England (BoE) and the European Central Bank (ECB) all to begin rate cuts as soon as the middle of next year. In my opinion, the recent set of economic data indicates that, while the near-term inflation numbers may remain high, more rate rises now, only mean more rate cuts next year.

The FFR may get to over +3.5% this rate hike cycle, as some expect. However, over the medium term, the state of debt, deficit and economic growth in the US, mean the FFR will stabilise in the +2.25% to +2.5% range.

Inflation above +9% was cue enough for some in the market to price a 100bps at the July 27 Fed meeting.

A word of caution – the Fed does have its vreputation and credibility to protect. The Fed did not look good last time when it raised rates by +0.75% at its June 14-15 meeting. The Fed’s rationale for its more aggressive tightening stance was leaked in a Wall Street Journal (WSJ) article. So, worried was the Fed about a particular set of data – the preliminary University of Michigan (UMich) Sentiment report that showed rising inflation expectations, that the Fed saw it wise to signal a +0.75% rate hike ahead of the actual hike.

During the press conference that followed the June Fed decision, Fed Chair Powell remarked, “…one of the factors in our deciding to move ahead with 75 basis points today was what we saw in inflation expectations….the preliminary Michigan reading, it’s a preliminary reading. It might be revised. Nonetheless, it was quite eye-catching, and we noticed that. We’re absolutely determined to keep them anchored at 2%.”

In an interesting twist, less than two weeks later, the uptick in inflation expectations in the UMich data, was revised away. The fact that the Fed changed the trajectory of its tightening path on a preliminary report that proved to be a ‘false alarm,’ is disconcerting and shows the chances of a monetary policy error by the central banks in the febrile economic situation that the world finds itself in. It makes the job of forecasting rates even more difficult. Therefore, please take every extreme/sensational forecast with a huge dollop of salt.

Last week, the International Monetary Fund (IMF) cut its forecast for US GDP growth down to +2.3% from +2.9%. This news is notable for two reasons.

First, it comes less than a month after the IMF downgraded its growth forecast in the US to +2.9%.

Second, given the indication from the Atlanta Fed’s GDPNow model, which is calling for a Q2 contraction of -1.2% following Q1’s decline of -1.6%, the US economy would need to grow by +3.2% in the second half to reach that goal. Based on the trend in recent data and the Fed’s tightening bias, that level of US GDP growth seems optimistic i.e. the IMF will cut its forecast again. So, we have a clear case of economic slowdown, and the Fed will not ignore this. A +9.1% inflation print, however, has sealed at least a +0.5% increase in the FFR later this month, no matter how weak the data over the next two weeks.

Even if the Fed knows inflation has peaked or is near peak, the Fed will use every opportunity to get rates as high as it can without breaking the economy to give itself the headroom it will need once growth concerns return and they already are. The Q2 US GDP print is likely going to be -1% or worse. That will confirm the US economy is in a recession.

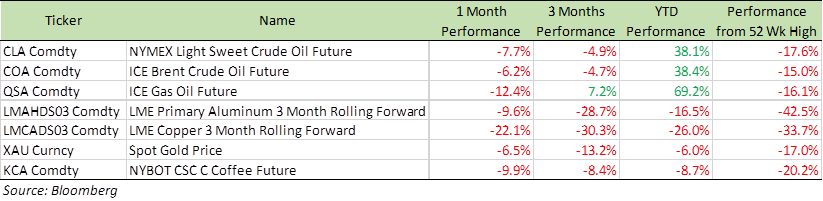

Even as prices have moved marginally up, commodity prices continue to weaken (table below). Base metals )Copper and Aluminium) prices have fallen by a third or more from their high. Oil prices have fallen by almost -20% over the last six weeks. Growth concerns and recessionary fears are growing.

Commodity performance over the last 12 months

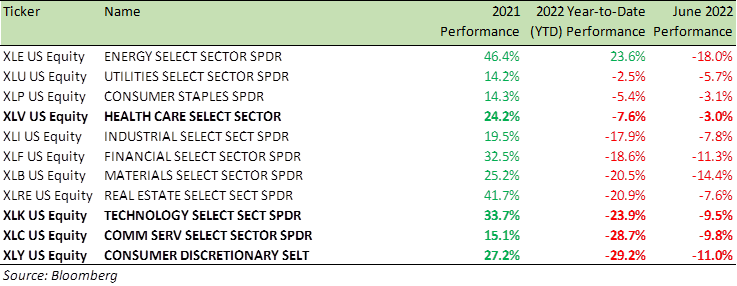

Benchmark US equity sector performance (2021, 2022 YTD)

Investors’ nerves are still frayed as equity benchmark indexes are still down over -15% across the board and sector indexes (table above) by over -20% in many cases.

The headline US Consumer Price Index (CPI) report has rarely come in weaker than expected complicating matters for equity bulls like me to take/recommend directional trades with a high degree of conviction. In the two years through May’s report, there have only been two weaker-than-expected headline CPI reports, which is easily the lowest number over a two-year span in at least twenty years.

In such a situation it is best to invest wisely. Therefore, my insistence throughout the year for income strategies using structured products.

In a directionless market such as the present, volatility abounds, and structured products are the perfect vehicle to monetise income and retain an upside in market performance. Structured products also help an investor clip coupons, if (and it certainly looks like it) economic growth is going to disappoint, leading to the limited upside for equities.

There are plenty of high-quality stocks in the consumer, tech, industrial and health care sectors that are trading at -10% to -15% on a YTD basis, and present a good opportunity to invest using a structured product. Just last week, we structured and traded one such basket on industrial names with a coupon of +12.75%.

For specific stock recommendations and structured product ideas please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA