The bond market sell-off is overdone. Given the drop in equities this month, the case for equities, particularly growth and technology stocks gets stronger. The pessimism on growth/tech names is overdone and cannot last.”

Summary

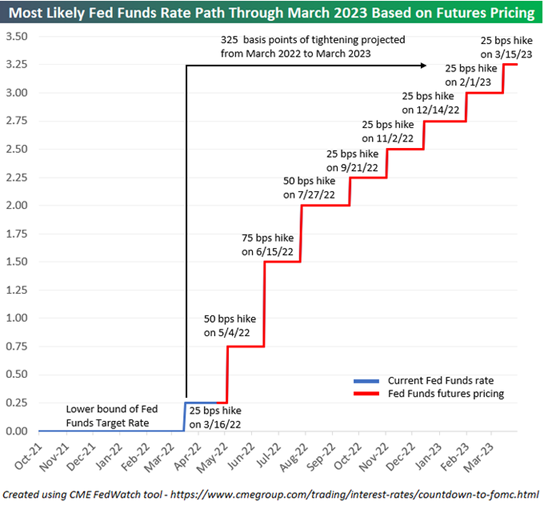

The US Fed Funds futures market is now pricing in an interest rate increase of 175 basis points over the next three Federal Open Market Committee (FOMC) meetings in May, June and July. Only 6-months ago, markets were pricing two interest rate hikes in 2022 i.e. a 50 bps increase.

If the current pricing plays out (and it often doesn’t), the year-over-year period from March 2022 to March 2023, would become the most aggressive tightening cycle conducted by the Fed since March 1988-1989 period. Also, bear in mind, that the economic impact of a +0.50% rate increase today, is equal to a +1% move in 2008, because since then, total public debt has more than doubled. If core inflation decelerates, the conversation will shift very quickly to a 25 bps tightening or even a pause in tightening later this year.

Corporate revenues and earnings growth in the US, in general, remain solid, but the market is focused on bond yields, interest rates and other macro factors. I understand market concerns around inflation and geopolitics. However, investors will also do well to remember – if inflation and supply chain issues do start to subside (and they undoubtedly will), a lower-risk course towards neutral rates could be adopted very quickly and it would substantially reduce the odds of a Fed-induced recession. The Fed is not in the business of causing recessions. Far from it and it’s not a choice the politicians (who appoint and mandate Federal Reserve members) would like the Fed to make.

In my view, the bond market sell-off is overdone and a rebound in bond prices is around the corner. Particularly the 5y mark is where bond yields will tighten the most, while the long end may still get buffeted by inflation, with more bond issuances coming down the line. Given the drop in equities this month, the case for equities, particularly growth and technology stocks, gets even stronger. The pessimism on growth and technology names is overdone and cannot last.

Is the Bond market sell-off overdone?

If you think you are nursing a loss holding technology stocks this year, and bonds would have been a safer place to be, then sample this:

A 30 year US Treasury bond bearing a coupon of +1.25%, issued on 15 May 2020, and trading at 90% as recently as December, now trades at 67%. That’s a paper loss of a third of your capital, on arguably the “safest paper” in the world.

While technology and growth stocks have been the “pain” trade, it has been even worse in the fixed income market on a risk-return adjusted basis, where long-dated Treasuries have plummeted, as interest rates expectations have spiked.

The TLT US (the Exchange-Traded Fund (ETF), which tracks a market-weighted index of debt issued by the US Treasury, with remaining maturities of 20 years or more, is down -18% since the beginning of the year and down -30% since August 2020, when bond yields hit a record low.

The tech-heavy National Association of Securities Dealers Automated Quotations (NASDAQ) 100 index in comparison is down -18% YTD and up +16% since August 2020.

The “Total Bond Market” ETF (BND) is down -9.0%, junk bonds (HYG) are down -7.6% and short-term Treasuries (SHY) are down -2.8%.

The Yield on the 10-Year US Treasury (USGG10YR Index) hit a low of +0.5% in August 2020 as Covid-19 raged. It now sits at +2.8% (see chart below), as the market has raced over the last quarter to price in aggressive interest rate rises by the US Federal Reserve (Fed). Mind you, the US Federal Funds Target Rate (FDTR) over the same period has moved from +0.25% to +0.5% i.e. a 1/10th increase compared to the increase in the yields on 10Y US Treasury bonds (see chart below)

iShares 20+ Year Treasury Bond ETF (TLT US): 5-year Price chart

Source: Bloomberg

Bond yields have increased (prices move in the opposite direction to yield) sharply this year.

The Fed Fund futures market is now pricing in (see table below), an interest rate increase of 175 basis points (1 basis point = 0.01%) over the next three Federal Open Market Committee (FOMC) meetings in May, June and July.

If current futures pricing plays out (which it often doesn’t), the year-over-year period from March 2022 to March 2023, would be the most aggressive tightening cycle conducted by the Fed since the March 1988 to March 1989 period. Also, bear in mind, that the economic impact of a +0.50% rate hike today, is equal to a +1% move in 2008, because since then, total public debt has more than doubled.

So, the question of the day is: – has the sell-off in the bond market gone too far? Is it time for bonds to rebound? The short answers are: Yes and yes.

Surveys of purchasing managers conducted over recent weeks, indicate a loss of steam in major economies such as Germany, the US and the UK in April. The IMF has downgraded the global growth outlook for the year from +4.4% to +3.6%, down from +6.1% last year. Economic growth is indeed slowing in large parts of the globe, as businesses feel the impact of Russia’s invasion of Ukraine, pandemic-prompted lockdowns in China and a sustained high level of inflation.

The Dow Jones Transportation Average (TRAN), which tracks 20 large US companies ranging from delivery giant United Parcel Service to railroad operator Union Pacific, tumbled -12% this month, whereas the 30 stock benchmark Dow Jones Industrial Average (DJIA) index was down only -3%. Changes in transportation demand, reflect changes in the demand for goods and services. For example, in periods of economic expansion, the demand for goods and services typically increases, which in turn increases the demand for transportation.

The Fed would be playing with fire, by moving as rapidly as the interest rate futures suggest.

Frankly, some of the comments I’ve heard over last few days from Fed speakers and market commentators have been ludicrous. Talks of multiple 75 bps hikes, are not just insane but frankly reckless.

In my opinion, it’s way too soon to talk about what the future holds for rates, based on two months of price action and with many of the Covid-induced supply disruptions still around.

The Fed is caught in a bind and the issue as ever is SUPPLY and DEMAND

- The fact is, less goods are being made globally due to Covid-induced disruptions and changes to production and supply chain, yet demand has recovered and accelerated

- Inflation is high, yes, however, will GDP growth keep up?

- Until supply catches up to demand, we are going to see inflation. However, higher interest rates can create a barrier to increasing supply and therefore the Fed has to move carefully. That is a big reason why the Fed is talking a big game on raising rates, but falling short of delivering it. It’s the right approach.

As we often see in financial markets, the market prices in “news” much sooner and quicker than the actual turn of events.

The Fed has a tough balancing act to follow, tighten too far with supply issues still in place and the economy will be in a perilous stagflation (slow growth/recession coupled with high inflation) zone.

In my opinion, the bond market sell-off is overdone and a rebound in bond prices is around the corner. Particularly the 5y mark is where bond yields will tighten the most, while the long end may still get buffeted by inflation with more bond issuances coming down the line.

Markets and the Economy

I talked about the weakness in the Japanese Yen in last month’s Market Viewpoints. The Japanese Yen (JPY) has continued to weaken and at 130 JPY per USD, JPY is down over -13% so far this year.

A few years ago, such a move in JPY would have alarmed the market, but this time around, there seems to be an indifference of sorts.

One reason for that is Japan’s relevance to the world. The rise of China has eclipsed Japan more than any other country. Corporate Japan living off old glories and riding the weak JPY wave, has failed to reward and spur innovation in Japan for over a decade if not more. JPY is -66% weaker (chart below) now than it was in 2012. The Chinese Yuan (CNY) is essentially flat over the same period.

A weaker currency is a nice thing to have, but it can soon spiral out of control and become a headache. A strong economy often leads to a strong currency, which was the case with Japan and which is the case with China today. Former Fed Chairman Paul Volcker put it best, “a nation’s exchange rate is the single most important price in its economy; it will influence the entire range of individual prices, imports and exports, and even the level of economic activity.”

Volcker’s point was that a strong economy doesn’t shy away from having a strong currency. Dealing with supply-side problems, by just tolerating currency weakness, is bound to lead to more troubles. A re-tooling of the Japanese economy and businesses, now seem inevitable, or Japan will permanently be consigned to the lower ranks of global leadership.

Today, India, Brazil and Indonesia are producing more unicorns (companies valued at over $1bn) than Japan. India is home to 54 unicorns, Brazil 12, Indonesia 7 and Japan 6. China has over 300 unicorns. Therefore, the world rightly seems to be more focused on China’s zero-Covid policy than Japan’s policy to engineer inflation in its economy. This trend is unlikely to change and JPY is likely to weaken further.

Japanese Government Bond (JGB) holders may finally realise that a +0.25% yield on 10Y JGB is not a fair compensation, given the weakness in the currency and the lack of growth prospects. Japan’s Prime Minister Fumio Kishida has a tough job at hand.

10-year price chart for Japanese Yen (JPY) and Chinese Yuan (CNY)

Source: Bloomberg

Moving on to US equity markets.

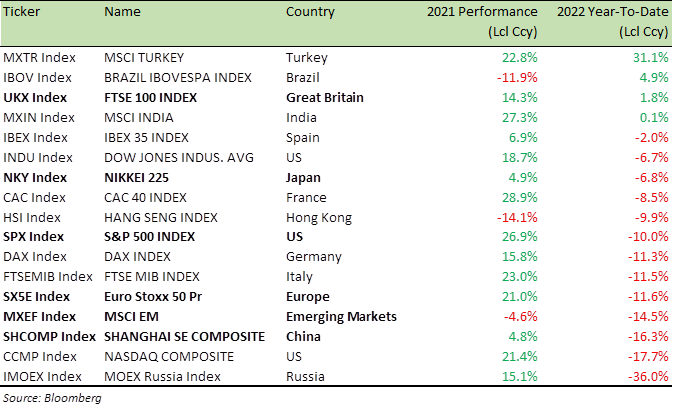

As bond yields have increased, equities have borne the brunt (table below).

The S&P 500 index (SPX) is down more than -5.4% month-to-date (MTD) and the tech and growth stock heavy NASDAQ composite is down -9.5% MTD.

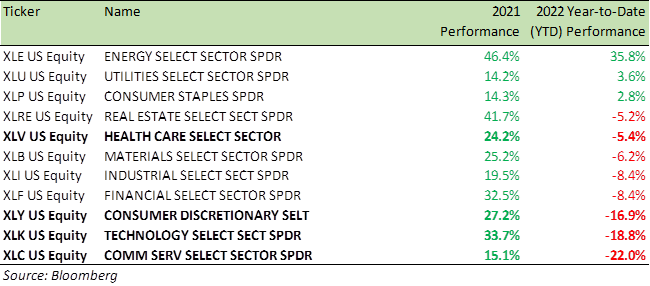

April is the third month where the SPX has been down over -5% on an intra-month basis. This just goes to show how volatile the year has been so far. Technology (XLK), Consumer Discretionary (XLY), and Communication Services (XLC) are the most severely punished sectors as the table below indicates with many stocks now trading at their 52-week lows.

Benchmark Global Equity Index Performance (2021 and 2022 YTD)

US Corporate earnings season is in full swing and some notable earnings this week were:

- Microsoft (MSFT) reported revenue ($49.4B vs $49.09 expected) and earnings per share ($2.22 vs $2.19 expected) that were above estimates despite an incremental $302 million revenue impact from currency and a $130 million operating income impact from halting operations in Russia. Dissecting earnings further, the personal computing, intelligent cloud, and commercial cloud segments all beat estimates. Revenues for MSFT’s cloud business Azure and the broader Commercial Cloud business exceeded $23 billion, +35% YoY growth

- Alphabet (GOOG) Q1 revenues were in line with estimates, but the company posted an operating margin of 30.0%, which surpassed estimates by 120 bps. EPS of $24.62 missed estimates by $1.14, and the board of directors authorized a share repurchase program for up to $70 billion. Ad revenue, cloud revenue and other bets beat expectations, while services and other revenues missed and cloud posted a larger operating loss than expected.

- Visa (V) saw payment volume increase +17% YoY, leading to a beat in processed transactions. The Q1 revenues totalled $7.2B vs expectations of $6.8 billion, while adjusted EPS was $1.79, which was 14 cents above consensus. Cross-border volume rose by +38% YoY while service revenue increased by +24%. Profit jumped by +21% due to a rebound in consumer spending.

Revenue and earnings growth, in general, remains solid, but the market is focused on bond yields, interest rates and other macro factors.

Only 6-months ago, markets were pricing two rate hikes in 2022 i.e. a 50 bps increase. Today, they are pricing an increase of 150 to 200 bps.

I understand market concerns around inflation and geopolitics. However, investors will also do well to remember – if inflation and supply chain issues do start to subside (and they will), a lower-risk course towards neutral rates could be adopted very quickly and it would substantially reduce the odds of a Fed-induced recession, that is the greatest threat to risk assets and economic growth.

The Fed is not in the business of causing recessions. Far from it and it’s not a choice the politicians (who appoint and mandate the Federal Reserve members) would like the Fed to make.

What we have now is a combination of – a strong economy, high inflation, supply chain issues, and the expectation of a much tighter monetary policy.

What the stock market needs in order to resume the rally, is a combination of – a strong economy, lower inflation, supply chain predictability and stability, and a more dovish monetary policy.

Economic surveys indicate that the US economy is showing signs of weakness and is bound to dampen inflation. Year-over-Year (YoY) inflation prints are likely to slow in the coming months given that the April 2021- July 2021 core Consumer Price Index (CPI) prints, were the fastest month-on-month readings in decades. In March, the core CPI rose +4% annualized, but that represented a big slowdown from the over +6% prints of recent months.

If the core inflation decelerates, the conversation will shift very quickly to a 25 bps tightening or even a pause in tightening later this year.

Benchmark US equity sector performance (2021, 2022 YTD)

The markets may have priced in three 50bps hikes but rising mortgage and corporate bond yields, combined with a stronger US Dollar, are bound to slow down the US economy. The Fed therefore will very unlikely not match the market’s hawkish expectations.

The lockdown in China is also set to weigh on inflation, as Chinese growth slows down and with it demand for commodities. China will eventually abandon the zero-Covid policy, but the 20th Party of Congress Chinese Communist Party (CCP) is due in September and President Xi Jinping will not risk anything. The net result is low growth in China, weakness in commodities and fall in inflation. It might be just the respite that growth stocks and bond markets are waiting for.

Given the drop in equities this month, the case for equities, particularly growth and technology stocks gets stronger. The pessimism on growth/tech names is overdone and cannot last.

In this period of elevated market volatility and geopolitical anxiety, structured products, which offer a degree of capital protection, continue to be a good way to invest. Structured products also help an investor clip coupons, if economic growth is going to disappoint, leading to limited upside for equities.

For specific stock recommendations and structured product ideas please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA