Tariffs are once again thrust into the spotlight.. However, there is a silver lining: Bond market volatility is not showing signs of stress

Summary

As April 2 looms, tariffs are once again thrust into the spotlight. President Trump’s ambitious vision to reshape America comes with high stakes, yet intentions alone do not always lead to success. Unchangeable shifts, such as China’s manufacturing supremacy, its advanced STEM workforce, and rapid innovation efforts, stand firm against the backdrop of these plans.

The US economy is wrestling with significant challenges: escalating debt, a widening budget deficit, and an increasing trade gap. Central to America’s economic strategy is its reliance on printing dollars to fund imports—a system that remains viable as long as global partners continue to engage with the dollar. Beyond trade imbalances, the more pressing issue is the sustained global demand for these dollars. The limitations of debt-driven consumption are becoming apparent, and genuine growth will require a boost in productivity—an outcome unlikely to be fostered by a trade war. Ideally, a trade agreement that benefits both the US and China would circumvent these issues. Without such an agreement, we may revert to a cycle of disinflation and stagnant low interest rates as China enhances its production and floods markets with exports, exacerbating the US trade deficit.

Amidst this, President Trump’s erratic tariff strategy adds to market volatility, leaving investors to manage ongoing uncertainty. Despite significant rallies, the S&P 500 has struggled to maintain gains, reflecting persistent bearish sentiment—the second-longest on record since 1987.

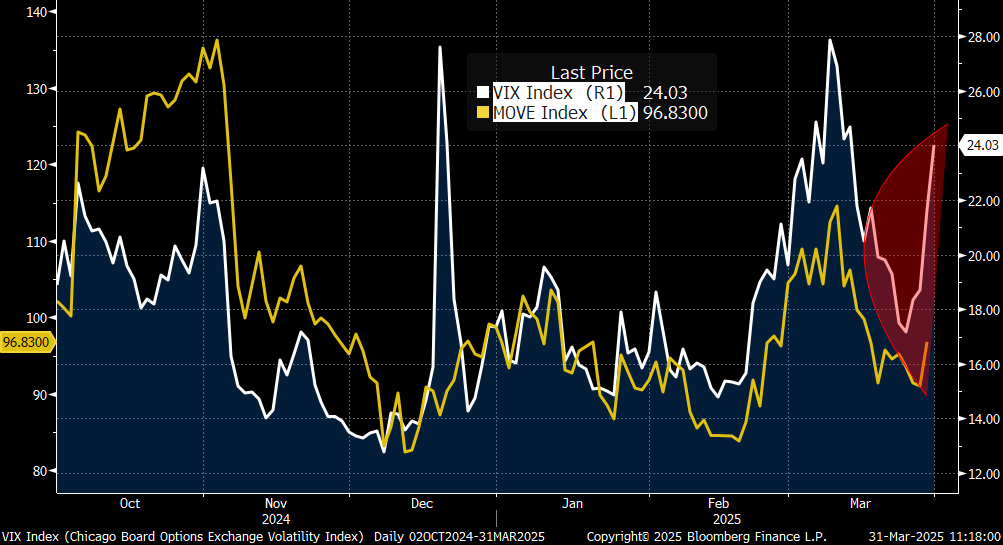

However, there is a silver lining: Bond market volatility is stable and range bound, as evidenced by the MOVE index. Given that the bond market is significantly larger than equities and often a harbinger of financial stress, this tranquillity could be a stabilizing factor in the turbulent weeks ahead.

Back to Tariffs Again, but Credit Markets Remain Calm

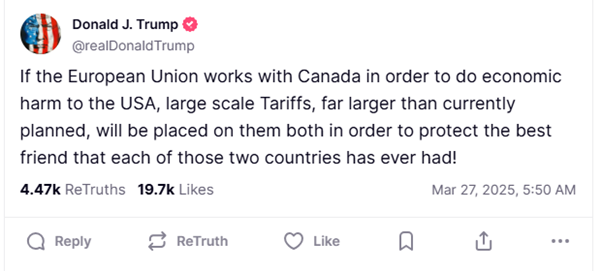

On Wednesday, US President Donald Trump announced a 25% tariff on “cars not made in the United States.”

By Thursday, he escalated this further, warning on Truth Social that he would impose “far larger” tariffs on the European Union and Canada, if they coordinated retaliation against his measures.

It’s as if Trump were playing ball with Canada, took the ball, and walked away—only to now be upset if Canada started playing with Europe instead. It’s clear he is overplaying his hand. The more he threatens allies with tariffs, the more he pushes them to work together—ultimately to the detriment of US interests.

Also last week, Trump floated the idea of lowering tariffs on China—if Beijing approved the sale of TikTok. “China is going to have to play a role in that, possibly, in the form of an approval maybe, and I think they’ll do that. Maybe I’ll give them a little reduction in tariffs or something to get it done,” he said during an Oval Office press conference.

Trump needs to ask himself: What is the actual goal of these tariffs? Because it seems to change by the day.

The US has a trade imbalance with China, and its economy remains heavily reliant on Chinese imports. Tying TikTok into that equation, signals a lack of focus and clear decision-making. This kind of mixed messaging is doing little to help markets.

A more pragmatic approach would be negotiating a deal that addresses Trump’s valid concerns about unfair tariffs on US goods, eliminating the need for reciprocal tariffs in the first place.

With Trump’s tariff strategy shifting as often as a cat chasing a laser pointer, market volatility and investor anxiety remain the only constant—and equities are feeling the impact.

The S&P 500 is right back where it was at the end of October last year, despite rallying more than +6.5% from that level not once, but three times.

This week marks the fifth consecutive week that bearish sentiment has exceeded 50%, tying for the second-longest streak in the survey’s history since 1987.

Similar five-week stretches occurred in October 2022 and January 2008, while the only longer streak was in October 1990, when bearish sentiment dominated for seven weeks straight.

Given the market’s resilience over the past four decades, it’s striking that today’s largely self-inflicted uncertainty has led to one of the most prolonged periods of bearish sentiment on record.

Source: Bespoke Invest

Periods of heightened bearish sentiment typically coincide with a risk-off environment, where investors flock to safe-haven assets.

However, that hasn’t been the case over the past five weeks.

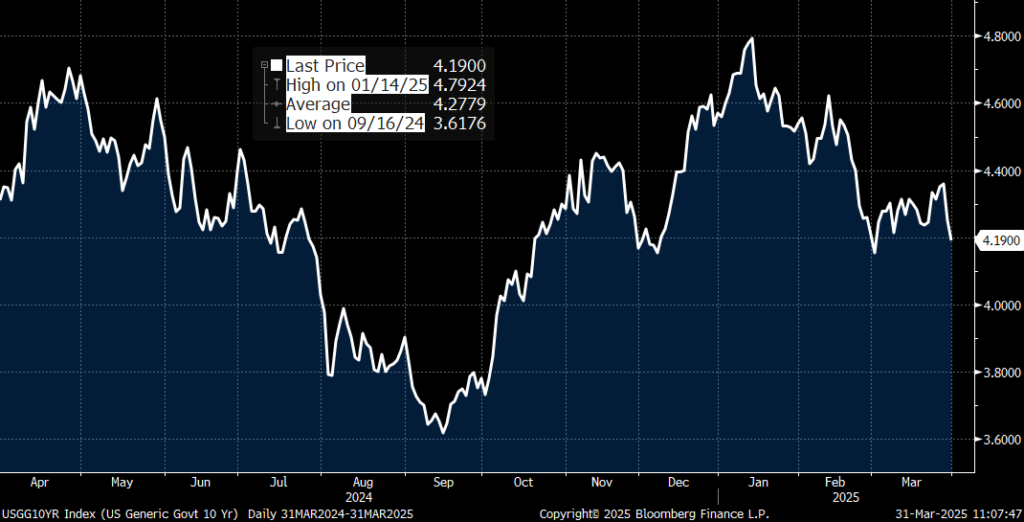

The bearish sentiment first crossed 50% on Feb 27. At the time, the 10-year yield on US Treasuries closed at +4.26%, and as of today, it’s hovering just below +4.20%—a 6 basis point (bps) decrease.

Yields generally drop in risk-off. The five-week streak ending in January 2008, saw yields decline by nearly 50 bps, and during the seven-week streak in 1990, yields dropped by about 20 bps—though back then, yields were in the +8% range, roughly double today’s levels.

10-Year US Treasury Yield: Last 12 months

Source: Bloomberg

The VIX index, which measures expected stock market volatility over the next 30 days based on S&P 500 options, isn’t at extreme levels but it has shown a big jump.

On the bright side, bond market volatility—tracked by the MOVE index (often called the “VIX of bonds”)—continues to remain stable and range bound (see chart below). That’s reassuring, given that the bond market dwarfs equities in size, and financial stress typically shows up in bonds before spreading to other asset classes.

If ever there was a time for the US Federal Reserve (Fed) to be truly “data dependent,” it is now.

At its latest rate-setting meeting on March 18, the Federal Open Market Committee (FOMC) held the benchmark federal funds rate steady at around +4.3% as it evaluates how the Trump administration’s flurry of policy changes could reshape the economic landscape.

Officials now expect inflation to rise to +2.7% this year, up from +2.5% in January. “That’s really due to the tariffs coming in,” Fed Chair Jerome Powell said, adding that progress on reducing inflation “is probably delayed for the time being.”

“We think it’s a good time for us to wait for further clarity,” Powell stated at the post-FOMC press conference last Wednesday.

Policymakers also revised their 2025 GDP growth forecast down to +1.7%, from the+ 2.1% they projected in December.

6-month price chart: VIX index and MOVE index

Source: Bloomberg

Looking ahead, the Fed faces a binary choice: Hold rates steady for the rest of the year or cut them twice in quick succession. But no monetary policy decision can fully offset unpredictable executive actions from the White House. While lower energy prices could help mitigate some risks, the broader picture remains highly uncertain.

The Summary of Economic Projections (SEP) released last week showed a narrower majority of Fed officials expecting rate cuts—11 of 19 policymakers now anticipate at least two cuts this year, down from 15 in December.

Projections rely on a stable policy backdrop. But with Trump’s tariff strategy shifting almost daily, the Fed is left with little certainty.

It’s time for Trump to make up his mind—before the market does it for him, by selling off US equities and bonds.

Markets and the Economy

European equities have taken off this year, as you can see in the table below, with the EuroStoxx (SX5E) outperforming the S&P 500 (SPX) by 13% year-to-date.

However, it will be wrong to turn off US equities, as risks still lurk that could derail the rally in European equities.

On March 14, Germany’s Bundesrat approved a €500 billion spending plan to boost growth and expand the military, marking a historic shift away from fiscal conservatism. The legislation relaxes borrowing rules and rolls back the “debt brake” imposed after the 2008 financial crisis.

Soon after, the newly convened Bundestag saw Bernd Baumann, chief whip of the far-right AfD, accuse the centrist parties of “gigantic electoral fraud” for pushing through constitutional changes in the last days of the previous parliament. Baumann declared, “We from the AfD are stronger than ever before.” With 152 MPs, the AfD is now the second-largest party in the Bundestag, holding nearly a quarter of the seats. The party’s influence has grown significantly, securing key committee positions and increasing its ability to challenge the ruling coalition.

Meanwhile, AfD support continues to climb, polling at a record 23.5%—three points higher than its election result and edging closer to becoming Germany’s most popular party. As its influence grows, so too does its potential to create obstacles for the government, reshaping the political landscape in ways that many find deeply unsettling.

So, do not be lured into European equities based on Germany’s spending plans alone for that may be delayed if not scuppered partly.

Global Equity Index Performance (2025 YTD, 2022-2025 YTD and 2024 Performance)

Meanwhile, in the US, the Fed is waiting to cut rates, if only President Trump took a step back from his “tariff war.”

Small businesses are stalling as combination of economic slowdown, tariff scare, business anxiety starts percolating through.

Momentum from the pandemic recovery has stalled for most small-business owners, presenting potential challenges for the broader US economy.

Small businesses employ nearly half of the nation’s workforce and contribute over 43% to the country’s economic growth. However, according to the Fed’s latest small business credit survey, more businesses are reporting revenue declines, stagnant employment growth, rising debt levels, and a drop in optimism.

In 2024, 41% of small businesses reported a decrease in revenues, while only 38% saw an increase. This marks the first time since 2021 that more businesses experienced revenue declines than growth.

It’s inevitable that Trump will need to shift focus to the domestic economy, which will likely mean scaling back the trade war, as it’s affecting the very people he aims to support.

Sentiment towards US equities remains very bearish, as shown in the AAII sentiment chart in the section above.

This combination of relief on the trade war front and potential Fed rate cuts is likely to benefit US equities more than European ones.

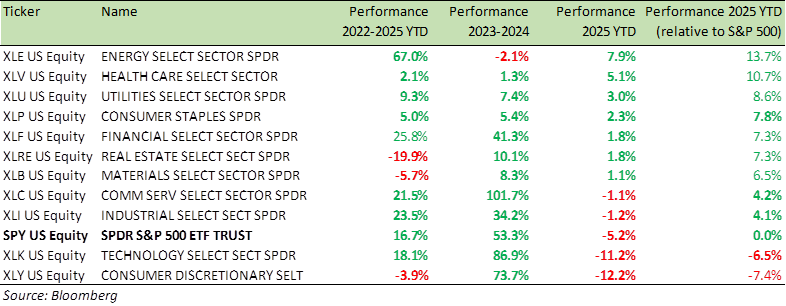

Benchmark US equity sector performance (2022-2025 YTD, 2023-24, 2025 YTD, and 2025 YTD relative to the S&P 500 Index)

On Monday, Trump nominated Michelle Bowman as the next Federal Reserve Vice Chair for Supervision, signalling a shift toward lighter banking regulations. As a known advocate of less stringent oversight, Bowman’s confirmation is expected to lead to the following key changes:

- Lighter Capital Buffer Requirements: Bowman’s leadership will continue the rollback of strict capital requirements. Banks will retain flexibility in using proprietary risk models, reducing capital burdens

- More Coordinated, Business-Friendly Regulation: With Trump’s executive order consolidating regulatory control under Treasury Secretary Scott Bessent, financial regulators will align for more industry-friendly oversight, aiming to reduce compliance costs and burdens

- Boost for Bank Mergers & Acquisitions (M&A): A more lenient regulatory environment is expected to revive US bank M&A activity, which slowed under Biden. Bowman’s support for regulatory transparency could help accelerate deals, like Trump’s first term, where M&A activity was robust

Early signs show an improvement in bank lending, as commercial banks ease lending standards, with small businesses benefiting from improved loan availability. If this trend continues, private sector re-leveraging could accelerate, benefiting US bank stocks and sectors reliant on commercial bank financing.

Deregulation will also support bank buybacks, as lower capital buffer requirements allow banks to return more capital to shareholders, further boosting financial stock valuations.

In summary, Bowman’s appointment paves the way for a more favourable environment for banks, with lower capital requirements, increased M&A activity, and potential for higher buybacks driving positive momentum in the financial sector.

This will be good news for US economy as a whole.

Here’s an interesting chart for those growing sceptical about Nvidia (NVDA) and tech stocks, thinking Deepseek’s success might burst the tech stock bubble.

Take a look at how closely the release of ChatGPT mirrors the release of Netscape, with both events tracking the Nasdaq’s performance.

If history is any guide to innovation and its impact on productivity gains and GDP growth, then enduring the volatility could lead to significant long-term gains in both NVDA and tech stocks.

Source: Bespoke Invest

Given the US’s growing debt, budget deficit, and widening trade deficit, it’s not an exaggeration to say that the US economy is heavily reliant on printing dollars to purchase goods.

However, this system only functions effectively if allies are willing to buy, save, invest, and trade in those US dollars.

President Trump’s ambition to remake America is noble, but intent alone doesn’t guarantee results.

There are many things the US simply can’t undo—China’s rise as a manufacturing giant, its highly skilled STEM graduates, and its growing drive for innovation are just a few of them.

The real issue is the lack of global demand—debt-fuelled consumption can’t sustain itself forever.

For demand to grow, we need higher productivity—and trade wars won’t achieve that. A “trade deal” would benefit all nations and particularly the US and China.

Without one, we’re back to the same cycle—disinflation and low rates—as China continues ramping up supply and exporting it to the US and Europe. Just look at the US trade deficit with China—it’s only getting worse.

I suspect a US-China deal is already being shaped behind the scenes, and the sabre rattling of announcements we’re seeing, are all part of the “tariff show.”

Come May, I suspect President Trump will strike a broad deal with China, take a victory lap, and we all can take respite that we survived the trade war.

Best wishes,

Manish Singh, CFA