The US has played the role of global cop, answering 911 calls. Captain America is homeward bound. Sometimes getting out of a needless war is the best thing to do. Focusing on home, spending money domestically will serve the US interest well.

Summary

Over the last 70 years, rightly or wrongly, US allies have counted on the US – “Captain America”- to come to the rescue when needed. The US has played the role of global cop, answering 911 calls from nations near and far, sometimes at great personal cost. The US has come to the rescue of foreign nations, foreign nationals and its own citizens stuck in foreign nations and warzones. Captain America is now calling time. Captain America is homeward bound. The political will and the political capital in the White House (be it a Republican or a Democrat White House) to fight a war in a foreign land is greatly reduced and continues to wear thin. In 1975, the loss in Vietnam was seen as the final humiliation of the “spent hegemon” – the US, yet its GDP is now 12 times bigger. Sometimes getting out of a needless war is the best thing to do. In the post-Saigon era, Japan was seen as the rising economic power, and for two decades (1975-95), it was. Japan’s GDP in 1995 reached $5 trillion. Japan’s GDP today still stands at $5 trillion. Japan atrophied and the US’ economic and technological power came through. US GDP, over the same time period, nearly tripled from $7.6 trillion in 1995 to $21 trillion today. Focusing on what needs to be done at home and spending money domestically, instead of waging wars abroad, will serve the US agenda and the US economy well.

US Real personal income received a big boost over the last 12 months. It increased due to transfer receipts – benefits received by people where no current services are performed i.e. Social Security, unemployment insurance, and Covid relief payments. If you strip out these transfer receipts, it becomes quite clear that US Real personal income has actually not improved much. Transfer receipts are set to end soon and I fail to see how the consumer will continue to feel cheerful and chase products, if prices were to increase. Besides, technology has ensured that the pricing power for average or easily produced goods has shifted and continues to shift in favour of consumers and not producers. Inflation will not be a problem for a long time yet and this is good news for equities. The US Federal Reserve’s tapering of asset purchases is coming, but a rebound in bond yields will not kill the Bull Run in equities. Of course, there will be volatility, but the uptrend in equities isn’t about to end.

“Captain America” – homeward bound

“A Fish Called Wanda” is one of the funniest movies I have ever seen. If you’ve seen the movie, you will recall the scene on the tarmac as the movie comes to an end. Archie Leach (played by John Cleese – who also wrote the screenplay) – taunts former CIA agent and Anglophobe Otto West (played by Kevin Kline) about Vietnam.

Otto: You know your problem? You don’t like winners

Archie: Winners?

Otto: Yeah, winners.

Archie: Winners, like North Vietnam?

Otto: Shut up! We didn’t lose Vietnam! It was a tie!

“It [Vietnam] was a tie” shows how difficult it is for those who are used to winning, to accept defeat.

Wars rarely have a good outcome. Whether the withdrawal from Afghanistan is the United States’ Saigon or its Suez moment – will be debated for generations to come, and I will spare you my commentary in this newsletter.

Over the last 70 years, rightly or wrongly, US allies have counted on the US – “Captain America”- – to come to the rescue when needed. The US has played the role of global cop, answering 911 calls from nations near and far, sometimes at a great personal cost.

Very egregiously, some like the EU nations who now criticise the US, have for years benefited from US defence preparedness, without paying their stipulated budgetary contribution for membership of the North Atlantic Treaty Organization (NATO). Captain America has come to the rescue of foreign nations, foreign nationals and its own citizens stuck in foreign nations and warzones. Captain America is now calling time.

Captain America is homeward bound.

The truth is that successive US Presidents starting with President Barrack Obama no longer saw the Middle East region as central to US national interests. What you see in Afghanistan, I suspect, will repeat throughout the Middle East, as the US continues to pull away and concentrate on matters at home.

Except for “Dunkirk”, I fail to think of any retreat that has not embarrassed the withdrawing forces. Therefore, yes, America will be embarrassed and it will lose significant “soft power” due to its chaotic Afghan withdrawal. The consequences of it will be felt for years to come. After Dunkirk, Britain stayed in the war to finish off (with the help of the allies) Nazi Germany – otherwise the Dunkirk retreat would have been the greatest embarrassment for Britain. I frankly don’t see the US returning to Afghanistan with a large army!

In fact, the US may not return to Asia for a military conflict in the foreseeable future, and that must worry US allies there, particularly Taiwan, Korea and Japan. The political will and the political capital in the White House (be it a Republican or a Democrat White House) to fight a war in a foreign land is greatly reduced and continues to wear thin. It would also seem, that Pax Americana (Latin for “American Peace”, the US playing the cop to maintain peace) is over. A world in which the global economic leader is not prepared to act as a cop, leaves the world open to many risks that will manifest over time. The UK responded to the US decision to withdraw from Afghanistan by cobbling together an alternative coalition, but it was impossible without the vital logistical support of the US. It is abundantly clear now, that without the US there is no hope of a coalition of the West in the future.

US Marine Corps infantry force in training in Afghanistan

Source: Pixabay

Having said all that, the US withdrawal from Afghanistan is the right thing for the US to do, distasteful as it may be. As an investor in US equities and therefore someone with a vested interest in the US economy and the US dollar, the events of last week haven’t made me overly gloomy about the US economy. The withdrawal is chaotic but not a disaster. I am more concerned about US President Joe Biden’s policy with respect to the Ribbentrop-Molotov (German-Russia) Nordstream 2 pipeline treaty. I believe that will have calamitous ramifications in the future. The chaotic Afghanistan withdrawal will be quickly forgotten.

The US pulling out of expensive wars in faraway lands is good for the US economy and is US dollar positive. The UK suffered a bloody nose in the Suez crisis in 1956, yet it has prospered since. In 1975, the loss in Vietnam was seen as the final humiliation of the “spent hegemon” – the US, yet its GDP is now 12 times bigger. The US is more prosperous and much better off since the “Saigon” moment. Sometimes getting out of a needless war is the best thing to do, and it can stop the bleeding of the economy.

In the post-Saigon era, Japan was seen as the rising economic power, and for two decades (1975-95) it was. Japan’s GDP in 1995 reached $5 trillion. Japan’s GDP today still stands at $5 trillion. Japan atrophied and the US’ economic and technological power came through. The US GDP over the same time period nearly tripled from $7.6 trillion in 1995 to $21 trillion today.

The United States is still a military superpower, the US dollar still is the world’s currency and will be for the foreseeable future. Focusing on what needs to be done at home and spending domestically instead of waging wars abroad, will serve the US agenda and economy well. In 1975, the US had a major oil dependency, today the US is an energy exporter.

China is a clear beneficiary of the US’ withdrawal, but Afghanistan will not be a cakewalk even for them, as they go about extracting minerals and trading with the tribal Taliban government.

In the movie, as Archie continues to taunt Otto, Ken (played by Michael Palin) arrives on the tarmac driving a steamroller, seeking vengeance for his pet fish that Otto had eaten. Otto too busy arguing with Archie finds he has stepped on wet concrete and cannot move. He is run over, but survives. Will the US, stuck in the Afghanistan quagmire have such a lucky escape? Or will it be more damaged than Otto coming out from under the steamroller? Not even John Cleese would like to write a screenplay for it. Only time will tell.

Markets and the Economy

The S&P 500 index (SPX) has made over 50 all-time highs this year and is up +19% year-to-date. It is up over +100% since the Covid-19 pandemic induced lows of March 2020. It took less than 17 months to double, the fastest Bull market to double since WWII.

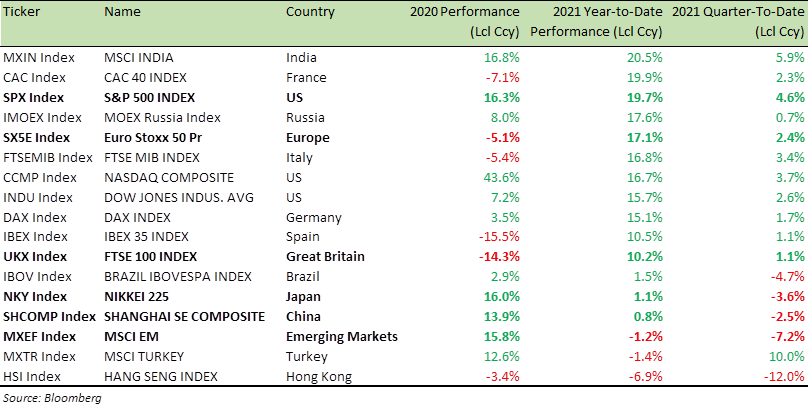

As the table below indicates, while US and European equities have thrived, Emerging Market equities, particularly China, have not just lagged, but gone into reverse.. Policy uncertainty in China is a key reason for this..

At the current levels, Chinese equities are greatly undervalued. For example, the combined market capitalisation of the four Chinese tech giants – Alibaba, Tencent, Baidu, and JD.com – is a quarter less than the market capitalisation of Amazon (AMZN), yet their combined Free Cash Flow (FCF – refers to the amount by which a business’s operating cash flow exceeds its working capital needs and expenditures on fixed assets) is nearly double that of Amazon.

“Whether a country is strong or not cannot be determined by the size of the economy alone, nor the size of the population or the size of the territory. In modern history, one of the roots of China’s fall and defeat was our backwardness in science and technology.” – wrote President Xi Jinping of China in this 2018 article. Please bear this in mind when analysing China technology and that would include internet, blockchain and digital currencies. China doesn’t want to be backwards in technology ever again i.e. China technology stocks are unlikely to remain undervalued for too long..

Benchmark Equity Index Performance (2020, 2021 YTD)

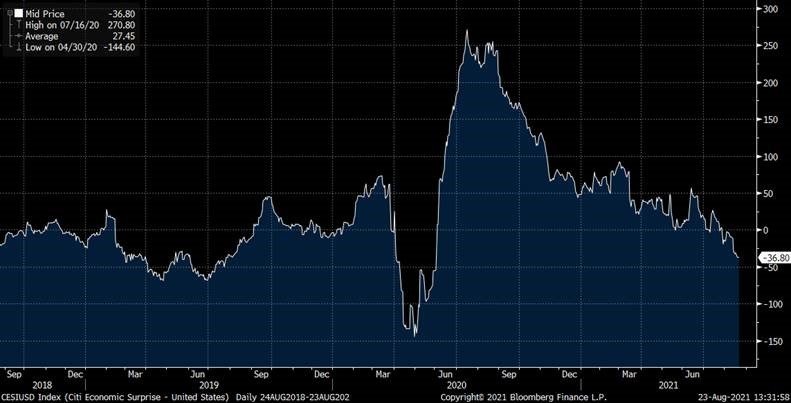

The economists who wildly underestimated the strength of the post-COVID re-opening, only to be surprised by it, may now have gone in the opposite direction. The Citi Economic Surprise Index (graph below) which measures how economic indicators are coming in relative to expectations, has recently ticked into negative territory for the first time since the early days of the pandemic in 2020. There is no doubt that eventually, economists will overshoot to the downside just like they usually overshoot to the upside.

The focus however will squarely be on the inflation, “tapering” of asset purchase by the US Federal Reserve (Fed) and their upcoming annual economic symposium in Jackson Hole, Wyoming.

The US unemployment rate fell from +5.9% in June to +5.4% in July. The jobs lost in pandemic have been recovered in no time. To put it in perspective, following the 2008 recession it took 7 years for the jobless rate to fall back to +5.4%!

Citi Economic Surprise – United States (2018-2021)

Source: Bloomberg

On inflation, as I have written in the last few newsletters, I continue to believe inflation will not be a problem in the medium term and inflationary bets will start coming off soon. With it, you are likely to see a new rally in Emerging Market equities and perhaps Chinese equities too.

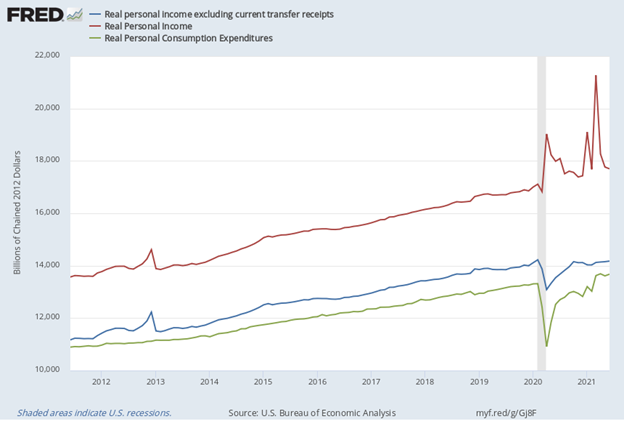

Why do I think inflation is “transitory”? Please take a look at the chart below. US Real personal income (the red line) got a big boost over the last 12 months. It was boosted by transfer receipts – benefits received by people where no current services are performed i.e. Social Security, Unemployment insurance, and Covid relief payments.

If you strip out the transfer receipts, US Real personal income excluding transfer receipts, (the blue line), you will notice that US real personal income has not actually improved much. Transfer receipts are set to stop soon and I fail to see how the consumer will continue to feel cheerful and chase products if prices were to increase.

In my opinion, inflation will not be a problem for a long time and it’s because neither President Obama nor President Donald Trump in the past or President Biden today have done or are doing anything to better the plight of the middle class American (let alone poor Americans). The real adjusted median US household income is flat over the last two decades. Over the last few decades, in the US, the giant portion of the economic benefits have continued to accrue to wealthy Americans, while 90% of Americans continue to suffer from pre-existing economic, wage and labour challenges. Record low unemployment since the 1960s make for a good statistics and political points, but on the ground, it has not done much to improve the balance sheet of the average American.

US Real personal consumer income and expenditure

Remember, inflation will be driven by demand for average daily consumer goods by average American consumer and not by the wealthy re-stocking their freezer with delicacies – like House Speaker Nancy Pelosi and her $24,000 freezer full of $12-a-pint luxury ice cream. (If you think I made this part up about Nancy Pelosi, please see the video evidence here)

Besides, technology has ensured that the pricing power for average or easily produced goods has shifted and continues to shift in favour of consumers and not producers. Price discovery using the internet is a kid’s job. Run a search for any item on Amazon and you have a plethora of suppliers. The producers are compelled to compete on price and this isn’t going to change. Global trade and supply chains, with the help of technology are so well ironed out, that demand shocks will be dealt with promptly and easily and price increases will be arbitraged away in a short time.

In Germany where national elections are due in less than a month, over the last two weeks, the Social Democrats (SPD) have not only overtaken the Greens in the opinion polls but the SPD is also polling marginally ahead of the Christian Democratic Union (CDU) – Christian Social Union (CSU) faction. If this trend continues, an SPD-led government is more likely than another CDU-led coalition. That will mean more fiscal spending within Germany and greater economic cooperation at the level of the European Union (EU) and perhaps a more lax debt and deficit targets for the EU nations. This would be positive for European equities.

The Fed’s tapering of asset purchase is coming but a rebound in bond yields will not kill the Bull Run in equities. Of course, there will be volatility, but I don’t see the uptrend in equities breaking down.

The market is primed to see the Fed reduce and eventually pause bond buying. I say pause because I fervently believe that the “Japanification” of the western world bond market is in progress. When you know – if needed – the Fed will buy bonds again – it doesn’t matter if the Fed stops now, buys later so long as the Fed indicates it is there to “help” which they always have and continue to. They have no other option.

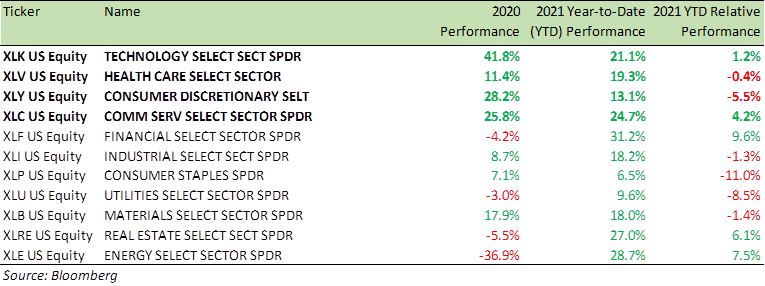

Benchmark US equity sector performance (2020, 2021 YTD)

Post “taper” we will some rates rises in 2022/23 but the Fed and other central banks buying bonds will go on for a very long time (if not forever). I continue to be bullish on growth and equities and I do not see inflation as a major medium term concern as outlined above. I see central banks pulling away support in a very steady manner and interest rate rises, when they come, will be very gradual and hit a low plateau soon.

As the table above indicates, Consumer Discretionary (XLY) and Consumer Staples (XLP) sectors have taken a hit in last few weeks, as the Delta variant has spread and the re-opening trade has paused. Once those concerns settle, and they will, consumer stocks will bounce back. Those two sector present good opportunities to stock pick.

For specific stock recommendations, please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA