“Russia’s attack on Ukraine has faltered. The looming energy crisis that could yet devastate Europe. NATO and Europe will be wise to have patience, avoid self-righteousness and assist Putin to “save face” and de-escalate”

Summary

It is evident to everyone in Russia (and around the world) that Russia’s attack on Ukraine has faltered. Russian men, long extolled for their macho culture and patriotism, ready to defend and die for Mother Russia – are seen running for the nearest border. Russia is in a bind. Russian President Vladimir Putin knows full well that he can’t win this war. The West also wants the war to end and deal with the looming energy crisis that could yet devastate Europe, if not this winter then in 2023. The ongoing referendum in the four regions of Eastern Ukraine – offers a ray of hope, even though the referendum itself is a sham.

As the four regions become part of Russia, Putin will move troops and heavy weapons into his new “Russian provinces” and an attack on them would be an attack on Russia. Ukraine President Volodymyr Zelensky’s promise to regain these territories becomes a tricky one for the North Atlantic Treaty Organization (NATO) and the West to support, as it would mean confrontation, possibly even a nuclear one with Russia. Europe and NATO will be wise to have patience, avoid self-righteousness and assist Putin to “save face” and de-escalate.

I suppose with the nuclear threat, this will be the path to peace by Christmas. Ukraine may be offered something akin to the “Marshall Plan,” to bring it to the table for a deal.

The UK is becoming the petri-dish for “structural change” that is so badly needed across the Western world – more growth, fewer taxes, lower deficits, sustainable debt, and fiscal rectitude. UK Chancellor Kwasi Kwarteng’s mini-budget and his “plan for growth” announced last week, however, have gone down like a lead balloon. The currency is trading close to parity against the US dollar and the Bank of England (BoE) has started buying UK Gilts again to rein in yields. If it’s any consolation, the economic woe isn’t just being felt in Britain. The Chinese Yuan has tumbled to its lowest level on record, as the US dollar continues to gain ground. The US Federal Reserve (Fed) has raised interest rates dramatically and more hikes are priced in.

However, US financial conditions have tightened a lot and various forward-looking indicators are orange, and ready to start flashing red. It would therefore make a lot of sense for the Fed to take a break and see how the economic situation unfolds in the coming months before hiking rates again. When the readjustment comes, you will be surprised at how quick it will happen. Bonds therefore do offer a very attractive investment opportunity at the current elevated yields.

Peace by Christmas?

Former Soviet Premier Vladimir Lenin once said: “There are decades where nothing happens, and there are weeks where decades happen.”

The retreat of the Russian armed forces from Kharkiv in Ukraine, Russian men (of fighting age) fleeing conscription, Iran’s largest anti-government protests since 2009 led by brave Iranian women, a new King and a new Prime Minister in the United Kingdom, Italy set to get its first women Prime Minister in Giorgia Meloni, Germany’s Green party accepting nuclear power is here to stay, and after 12 years of a Conservative government in the UK finally a Conservative budget but a near run on the Pound sterling … all these things happened in just the last ten days or so!

Staying with Russia, it is evident to everyone in Russia (and around the world) that Russia’s attack on Ukraine has faltered.

Advanced weaponry from the US, superior military intelligence from the UK and the bravery of the Ukrainian fighters, all have damaged irretrievably Russian President Vladimir Putin’s plan to take Ukraine. The Ukrainians have been wonderfully supported by the US, the UK and Poland – to name but a few.

After seven months of war, and not much to show by way of victory, Russia announced the mobilization of a quarter of a million men for a renewed attack on Ukraine.

Russian men (of fighting age) were mobilized and headed for airports, train stations, borders or wherever they could find flights at exorbitant prices – to get out of town. Long lines stretching for many kilometres were seen on the Russia-Georgia border.

Russian men long extolled for their macho culture, and patriotism, ready to defend and die for Mother Russia are running for the nearest border. This is probably the first instance in history of a country “where people flee not because someone invaded their country, but because they invaded another country” as was eloquently shared by exiled Russian businessman Mikhail Khodorkovsky recently on Twitter.

A much-weakened Russia is treading on thin ice here. In the past, “mobilisation” hasn’t worked out well for Russia. The first mobilization in 1914 ended the reign of Tsar Nicholas II. The second mobilisation during WWII was a success due to massive direct military aid from the US. Even before the US entered World War II in December 1941, America sent arms and equipment to the Soviet Union to help it defeat the Nazi invasion. The 1941 US Lend-Lease Act totalling $11.3 billion (or $180 billion in today’s currency), supplied needed goods to the Soviet Union from 1941 to 1945 in support of what then Soviet Leader Josef Stalin described to then US President Franklin Roosevelt as the “enormous and difficult fight against the common enemy – bloodthirsty Hitlerism.”

This third mobilisation today has Russia as an outcast of the world community, with no ally or military aid to show for it. Besides Russian supply lines to its forces in Ukraine have been mostly destroyed.

If the war continues into the winter, Russian forces will face the same dilemma as faced by German forces invading Russia in 1941, that is, do you deliver ammunition and fuel or will it be food and clothes? On present showing, the Russian Federation risks disintegration in the not-so-distant future.

Russian winter landscape

Source: Pixaby

Yet in all this doom, there seems to be a ray of hope.

Russia is in a bind. Putin knows full well that he can’t win this war. Now that the war is not going Putin’s way, he needs a face-saver and a way out.

The West also wants the war to end and deal with the looming energy crisis that could yet devastate Europe, if not this winter, then in 2023.

Germany and Europe may have an adequate supply of natural gas to tide them over this winter, but the energy crisis is not a blip. If the energy supply for industry is not sorted soon enough, Europe faces de-industrialization and crippling stagflation. Energy is not just needed for heating homes in winter. It is also needed throughout the year for industrial production. The cost of production will remain high and that will lead to a loss of production, and factory closures as demand is destroyed and exports become uncompetitive.

On Tuesday this week, we learnt that the Nord Stream 1 and Nord Stream 2 pipelines are both leaking gas into the Baltic Sea, after severe damage that will scupper any remaining hopes of Nord Stream 1 returning to service this winter. Neither Nord Stream pipeline was pumping gas to Europe at the time of the leaks. However, both pipelines were full of pressurised gas and footage showed it bubbling to the surface in the Baltic Sea, causing safety hazards for shipping and aircraft. Gas prices in Europe are still around five times higher than the historical average.

The ongoing referendum in the four regions of Eastern Ukraine – Donetsk, Luhansk, Zaporizhia and Kherson, is Putin’s attempt to not only justify the “special military operation” but also to use it as an opportunity to draw a line, offer spurious negotiations and plead for peace. The results of the referendum have started pouring in and I’m going out on a limb here in saying that when the final results are in, the percentage in favour of joining the Russian Federation will be 95%, if not more. The numbers are already in a file somewhere waiting to be published as the official result.

As Stalin said – “It’s not who votes that counts, it’s who counts the votes.” Donetsk, Luhansk, Zaporizhia and Kherson people’s republics will therefore join the Russian Federation.

Yes, the referendum is a sham, vote but a significant one. As the four regions become part of Russia, Putin will move troops and heavy weapons into his new “Russian provinces” and an attack on them would be an attack on Russia. Denouncing the referendum won’t make any difference. Ukraine President Volodymyr Zelensky’s promise to regain these territories becomes a tricky one for the North Atlantic Treaty Organization (NATO) and the West to support, as it would mean confrontation, possibly even a nuclear one with Russia.

At the time of the Cuban crisis, then US President John F. Kennedy wisely said “Keep strong, if possible. In any case, keep cool. Have unlimited patience. Never corner an opponent, and always assist him to save face. Put yourself in his shoes – so as to see things through his eyes. Avoid self-righteousness like the devil – nothing is so self-blinding.“

Europe and NATO will be wise to have patience, avoid self-righteousness and assist Putin to “save face” and de-escalate.

I suppose with the nuclear threat, this will be the path to peace by Christmas. Ukraine may be offered something akin to the “Marshall Plan,” to bring it to the table for a deal.

Let’s hope calmer heads prevail, the suffering of Ukrainians ends and a solution to Europe’s energy crisis consequently emerges.

Markets and the Economy

The United Kingdom is in the news. We have a new King; a new government and it would seem a new radical fiscal policy, that is causing somewhat of a stir – to put it mildly.

The UK is becoming the petri dish for “structural change” that is so badly needed across the Western world – more growth, fewer taxes, lower deficits, sustainable debt, and fiscal rectitude.

UK Chancellor Kwasi Kwarteng’s mini-budget (which was anything but mini) in this respect and his “plan for growth” announced last week have gone down like a lead balloon. The currency slumped close to parity against the US dollar. Kwarteng’s plan – £45 billion of tax cuts and an estimated £60 billion of spending to cap energy prices – is seen not as a plan but as an audacious political and economic gamble that challenges the Treasury “orthodoxy.” It has made many experts and commentators very unhappy.

On Wednesday, The Bank of England (BoE) stepped into the bond markets amid the market turmoil that has sent government borrowing costs soaring. The BoE said it would postpone Quantitative Tightening (QT) – the process of selling government bonds and would start buying bonds again. This brings me to a comment I often use – the Japanification of the Western world is in progress i.e. none of the major central banks in the Western world will be able to shrink their balance sheets just like the Bank of Japan (BOJ) hasn’t been able to, despite decades of trying. Every time they try, bond yields rise, sending fiscal balances into a tailspin and the central bank is forced to buy bonds again.

There is growing pressure on Kwarteng to reverse some of the measures he announced, particularly the abolition of the 45% rate of income tax on high earners which very curiously only costs £2bn out of the total of over £100bn of new spending i.e., less than a 2% impact on the budget.

If it’s any consolation, the economic woe isn’t just being felt in Britain. China’s internationally traded Yuan has tumbled to its lowest level on record as the US dollar continues to gain ground. However, such is the political charged atmosphere in the UK, that everything is being blamed on the policies of the four-week-old government of new PM Liz Truss.

Truss and Kwarteng shouldn’t buckle and draw inspiration from the experience of PM Margaret Thatcher, when she set about to change the UK economy structurally.

In 1981, Britain was at an economic crossroads. Policies that the Thatcher government, elected in 1979, had been implementing to deal with accelerating inflation and a spiralling national debt were not working. Thatcher and her Chancellor, Sir Geoffrey Howe, changed tack. The 1981 Budget increased taxes by £4 billion – an enormous sum in 1981 prices. Thatcher and Howe faced stiff opposition to this Budget, not just from the Labour and Liberal parties, but also from their own back benches.

In March 1981, 364 eminent British economists published a letter to Margaret Thatcher in The Times of London condemning Howe’s budget plans to hike taxes in midst of a recession saying that there was “no basis in economic theory or supporting evidence” for the policy that the Budget was seeking to implement, that it threatened Britain’s “social and political stability”, and that an alternative course must be pursued.

UK Quarterly GDP growth (1978-84)

Source: Bloomberg

It is said that Thatcher was asked in a heated debate in the House of Commons whether she could even name two economists who agreed with her. She replied that she could: Patrick Minford and Alan Walters. As the story continues, her civil servant said to her when she returned to Downing Street: “It is a good job he did not ask you to name three.”

On the face of it, the 364 economists were wrong. The economic recovery that they said would not happen began more or less as soon as the letter appeared (chart above).

A YouGov poll for The Times this week indicates that the Labour party has a 17-point lead over the Tories, the biggest since the company began polling in 2001.

Well, polls can be very misleading when a general election is almost 2 years away. In Feb 1981, Labour, with Michael Foot as its leader, had a 16-point lead. Yet, in the 1983 election, Labour lost badly as Thatcher won a stonking victory. She won the largest majority since that of the Labour Party in 1945, with a majority of 144 seats.

Will Truss and Kwarteng hold the line that they have set and see their structural change through? Only time will tell, but there is an illustrious precedent to follow.

Exciting times are ahead politically and economically in the UK. GBP/USD is likely to remain in the parity to 1.05 range for the rest of the year.

Let’s now turn our attention to the United States.

“Treasury securities are considered a safe and secure investment option” says www.treasurydirect.gov

The over -20% decline in long-dated US Treasury bonds (over -30% for iShares Long term Treasury ETF (TLT)) has only happened twice before – in 1931 and 1937. We are witnessing history now.

Everyone tells you bonds are the safest investment. If you are a pensioner who put your money in a long-dated bond with the hope of clipping coupons and selling part of it as the need arose, you are now stuck with a bond you won’t sell due to capital loss.

There’s no such thing as a “safe asset.” In the financial world, it’s all relative i.e. safe with respect to what?

Having said that, I do repeat what I have said before – the inflation problem is always “man-made” and thus the redemption from it will also be “man-made.” As we now know – Covid led to the shutdown and disruption to the supply chain. Excessive (and reckless) fiscal spending followed and caused inflation.

The US Federal Reserve (Fed) has raised interest rates dramatically – a third straight +0.75% raise earlier this month, with the Fed Fund Rate (FFR) now at +3.25%. Additional a +1.25% increase is being priced in over the next three months. Not surprising then that the Fed forecasts the US unemployment rate to rise to 4.4% next year, from 3.7% today — a number that implies an additional 1.2 million people losing their jobs.

- Deflation is already setting in for some parts of US economy – consumer electronics’ prices within CPI have tanked lately, with some (like TVs) with double-digit year/year percentage declines

- The Richmond Fed manufacturing Index has fallen swiftly and is now in contraction

- Say goodbye to the liquidity tide. Growth in M2 money supply (which had reached +26.8% in Feb 2021 and averages +8% typically ) is now at +4.1%, slowest since April 2019

- The Atlanta Fed’s GDPNow model, now forecasts US GDP growth of +0.3% (q/q ann.) for the third quarter 2022. This is far cry from the over +2% growth expectation less than 12 months ago

- Commodity pressure has intensified. The Bloomberg Commodity Spot Index is now off its peak by -21.7% (worst drawdown since April 2020)

- US Financial conditions have tightened at a pace last seen during the Great Financial Crisis (GFC) of 2008/09, at least when looking at year/year % change

- US Mortgage rates have hit the highest levels since 2002, as a 30y fixed rate loan costs 7% on average. Mortgage costs are soaring and as Doubline founder Jeffrey Gundlach put it – “Thanks to 40% median home price increases over the past two years and the massive increase in mortgage interest rates the monthly payment on the median priced US home is already up about 100% vs. two years ago.”

- The S&P 500 has finished in the red on 56% of 184 US trading days YTD. It is on track to have the second-highest annual proportion of loss-producing trading days since modern inception in 1957. The “top” spot belongs to 1974 with 57.7%

Therefore, it makes a lot of sense for the Fed to take a break and see how the economic situation unfolds in the coming months, before hiking rates again.

In my opinion, interest rate rises from here on will be very damaging to the US economy and circumstances will force the Fed to stop or change the narrative to a more dovish stance.

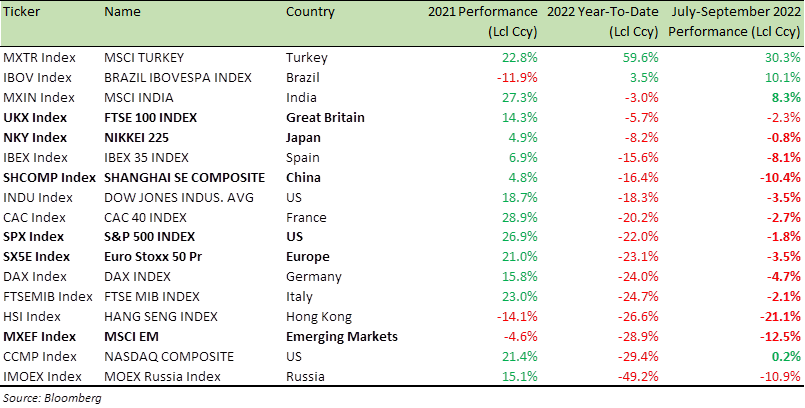

Benchmark Global Equity Index Performance (2021 and 2022 YTD)

Rising rates will kill demand and it will kill inflation with it. Structural forces – technology and innovation and bad demographics are going to continue to reassert. When the readjustment comes, you will be surprised at how quick it will be. The cycle works like this inflation shock -> demand collapse -> new disinflation.

Therefore, bonds do offer a very attractive investment opportunity at these levels. You could pick +5% to 6% on investment-grade names in the US these days, without going out too long on duration.

The weakness in bond markets puts the weakness in equity markets in perspective. Some bond holdings are down over -20% and so are equity holdings. For most of our entire investment careers (certainly mine), when markets hit turmoil, market commentary would include something like “investors rotated into the safety and security of bonds”. This time around there is no such rotation to do and if you did, you didn’t come out well.

You were and are much better off staying in equities and accumulating positions at lower levels.

The key story of the year has been the Fed’s determination to crush inflation at home by raising interest rates and this has inflicted profound pain at home and across the world – pushing up prices, ballooning the size of interest payments on debt, increasing the risk of a deep recession.

The energy crisis in Europe continues to be a concern.

According to a report in Reuters, in Germany, one in ten mid-sized companies, which provide nearly two-thirds of German jobs, have cut or halted production, because of gas prices reducing demand.

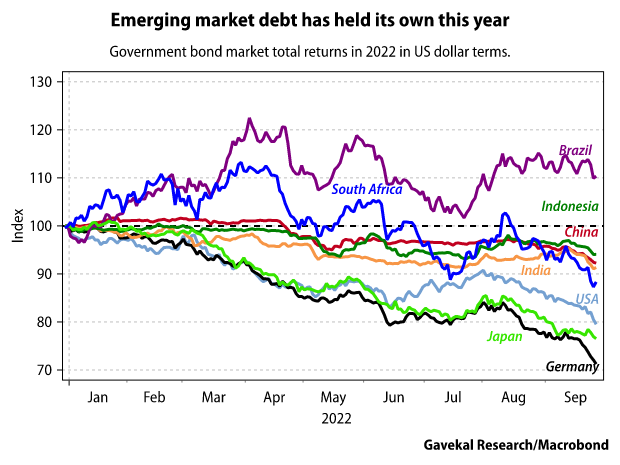

One interesting development this year has been the impressive outperformance of some of the larger Emerging Market bond markets, and even equity markets, despite the Fed’s hawkishness and the rise in the US dollar.

Historically, whenever a liquidity crisis occurred, Emerging Markets proved to be the ones that investors rushed to get out. Not this time. Singapore, India, Indonesia and Brazil are all flat or up year-to-date in local currency terms.

This points to an ongoing structural changes in the global economy. A welcome change that gives investors more avenues to invest.

How is it that we are at the lowest unemployment levels yet worried about a recession?

The US dollar is at a very strong level, the US should be having disinflation, yet the inflation in the US is at record levels. All prior models are broken as “supply side” issues have eclipsed everything else. In these circumstances, the Fed continues to hike rates. The Fed is making a mistake.

Inflation has peaked in the US and I suspect we have also seen a peak in the US Dollar too. That said, EUR/USD is unlikely to stay above parity and any relief of Fed stopping to hike will be replaced by worries about Europe’s energy crisis and the stagnation it will lead to in the Eurozone.

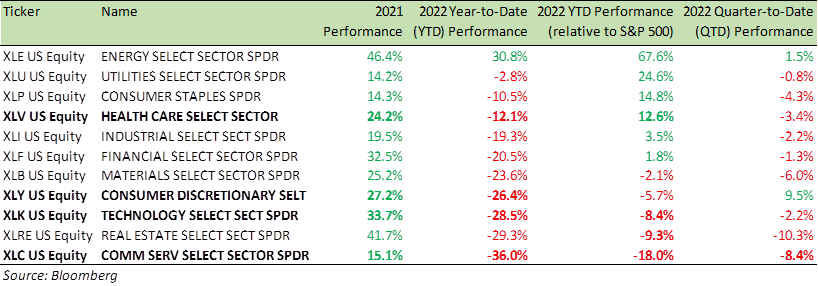

Benchmark US equity sector performance (2021, 2022 YTD)

There’s one more “redemption” to look forward to and a crucial one at that. Please mark October 16, 2022, in your calendar.

The 20th Chinese Communist Party (CCP) National Congress opens on October 16. President Xi Jinping is expected to embark on his third term as general secretary, and I suspect is the day when stringent “Covid lockdown” policies in China will start coming off. China will “re-open” and with that the global supply chain will improve very quickly.

It may still not be enough to stop the US economy from going into a recession, however, supply chain improvement will be a tremendous boost to the US and global economy.

The October seasonality I mentioned in last month’s Market Viewpoints is about to kick in soon too. Historically it has led to a nice rally starting in October that lasts until the end of the year. It might dovetail nicely with any signs of dovishness from the US Fed. So, please bear that in mind.

There are plenty of high-quality stocks in the Consumer, Technology, Industrial and Healthcare sectors that are trading at -20% to -25% on a YTD basis, and present a good opportunity to invest in, be it directly or via Structured Products.

For specific stock recommendations and Structured Product ideas please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA