“AI isn’t just about technological advancement; it’s a revolution in productivity and economic prosperity. Nvidia is at the heart of it.”

Summary

Nvidia (NVDA) is on the brink of becoming a colossus in the stock market, potentially eclipsing Microsoft with its staggering growth trajectory. In a whirlwind of financial success, Nvidia’s market cap recently skyrocketed to $2 trillion, a huge leap from its $1 trillion milestone just months ago in June. This surge is fuelled by back-to-back quarters of stellar revenue and earnings growth, that have the potential to double, treble or more from here.

At the heart of Nvidia’s meteoric rise is the transformative power of Artificial Intelligence (AI). AI isn’t just a buzzword; it’s the backbone of a new era, poised to reshape our future and redefine success for those ready to harness its potential. The next generation will grow up in a world built on AI, benefiting from the unprecedented democratization of data through large language models (LLMs). This isn’t just about technological advancement; it’s a revolution in productivity and economic prosperity.

While some draw parallels between the Crypto frenzy and Nvidia’s ascent, the comparison falls short. Crypto is based on nothing, but Nvidia stands on solid ground with $22 billion in quarterly revenues —a figure that’s only expected to soar.

On the macroeconomic front, the US Federal Reserve (the Fed) finds itself navigating the complexities of the AI-driven boom. This surge in AI investment is stoking demand and fostering a buoyant financial landscape, making it unlikely for the Fed to cut interest rates soon. Yet, the stock market doesn’t need to pin its hopes on rate cuts to climb. With US GDP growing at a robust +3% per annum and inflation in check, the stage is set for earnings growth to propel the S&P 500 beyond its current level.

Nvidia: The “Taylor Swift” of the stock market

In terms of popularity over the past year, only Nvidia (NVDA) and its Chief Executive Jensen Huang, can rival Taylor Swift. Just like Ms. Swift, NVDA keeps dropping banger after banger.

In just over a year, Nvidia has gone from being a company that got most of its business from chips designed for high-end videogaming, to an Artificial Intelligence (AI) powerhouse, valued at more than US$2 trillion.

In March of last year, while Taylor Swift embarked on her “The Eras Tour,” NVDA was embarking on its own journey – a rapid surge in sales of its semiconductor chips. NVDA’s stock began trading at $228 at the start of March; today, it sits at nearly $800.

Huang had a better year than Swift (if that’s possible!) While Swift reportedly earned around $1 billion, Huang, with his 3.5% stake in NVDA, raked in at least 40 times that amount.

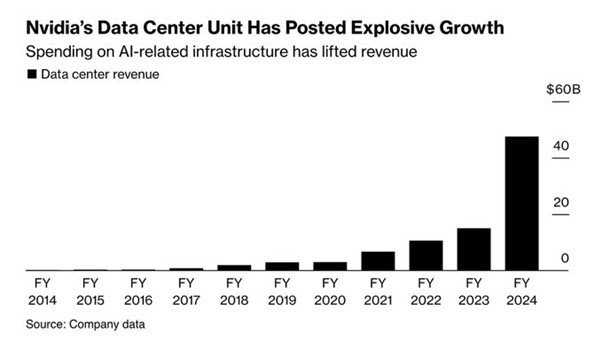

Nvidia’s quarterly revenue in Q1 2024 stood at $7.2 billion, a figure that soared to $22 billion in Q4 2024. Analysts are forecasting Nvidia’s annual revenue to jump to $110 billion by 2026, up from $59 billion in the fiscal year that just ended.

Not just the revenue, Nvidia’s profitability rates are outstanding too. At 50% for the year as a whole and nearly 58% on a quarterly basis, it’s a substantial leap from a 10% rate in 2022. For comparison, even in its prosperous years, Intel (INTC) typically achieved a profitability rate of around 30%.

Last week, Nvidia’s market capitalisation soared to $2 trillion, driven by yet another exceptional quarter of revenue and earnings growth. This achievement comes on the heels of Nvidia surpassing the $1 trillion valuation mark just last June.

Analysts are playing catch up, as they keep updating their 12-month target price on the stock of NVDA, every time it delivers stellar sales and earnings growth.

Back in 1993, at Denny’s Diner in San Jose, California, Huang, along with his co-founders Chris Malachowsky and Curtis Priem, laid out the plan for Nvidia. When Jensen told his mother he was making graphics cards for videogames, she asked him to get a real job. Fortunately, Jensen persisted in the hardware business, focusing on building Graphics Processing Units (GPUs), a decision that wasn’t without its challenges.

As a major player in AI chip technology, Nvidia stands as one of the largest stocks globally, benefitting from an unprecedented surge in demand for its graphics processing units (GPUs), crucial for training Artificial Intelligence (AI) models. The company’s fourth-quarter results underscored the ongoing robust spending on AI systems, as Nvidia races to keep pace with demand.

During the recent earnings call, Huang also mentioned that NVIDIA’s latest products will continue to be in high demand for the remainder of the year. He noted that despite the increasing supply, the demand has not shown any signs of slowing down. “Generative AI has initiated a new investment cycle and continued.” “The scale of future data centre infrastructure will double in five years, representing a market opportunity of hundreds of billions of dollars annually.”

We are still in the early days in AI.

Below is a comparison of Google search interest (the number of times people search for specific words or terms) for ChatGPT, AI, and Bitcoin. As shown in the chart, search interest for AI is still making new highs, so there’s no slowdown yet, but it hasn’t quite hit the fever pitch that Bitcoin hit around November 2017.

Source: Bespoke Invest

In my view, AI represents the next major trend in hardware, with the potential to generate substantial demand for years to come. Most software companies currently do not manufacture their own hardware, relying instead on large-scale hardware vendors like Nvidia to spearhead this revolution.

The advancements in AI-generated videos AI Generated Videos Just Changed Forever exemplified on platforms like YouTube, showcase the immense potential of AI. Nvidia benefits from both the AI used to create the videos and the image processing required to generate them.

Also, those comparing the Crypto craze to Nvidia, ought to bear this in mind – Crypto is based on nothing. Nvidia is based on $22 billion/quarterly revenues that have the potential to double, treble or more from here. While stock prices may outpace earnings, Nvidia’s products will continue to evolve and expand.

Huang is definitely one of the true geniuses of his generation. Jensen’s mastery in monetizing software for Nvidia’s GPUs has propelled the company way ahead of competition, perhaps beyond the comprehension of most investors. Therefore, NVIDIA’s constant focus on maintaining strong chip and software performance to further solidify its position in the market. Jensen likes to say – “You’re always on the way to going out of business. If you don’t internalize that sensibility, you will go out of business.” Nvidia’s continued success rests on its visionary leader who no doubt applies the advice of Intel’s former boss Andy Grove – “Only the paranoid survive.”

NVDA has the potential to be the largest stock overtaking Microsoft and I suspect we will be talking about a $3 trillion market cap by mid-2025 (if not before).

Even savvy investors can become side tracked by fixating too heavily on Nvidia’s ban from selling chips to China.

Nvidia’s potential and runway in ex-China market, particularly in the realm of enterprise AI and related services is immense and dominant. Eventually the Chinese will get into high end chip production and will do to chip prices what they did to steel prices and solar panel – significant reduction in prices. Nevertheless, the demand for high performance chips is only set to accelerate.

Personally, I’m eagerly awaiting the advent of a personal AI robot outfitted with Nvidia chips. I envision being able to input a variety of data and receive answers to complex questions such as:

“It’s Sunday, I’ve got the children ready, is it safe to order Uber now? Or will my wife take another 30 minutes to get ready for lunch?”

“What do the children want for dinner tonight, considering they’ve already had spaghetti twice this week and declined pizza or chicken nuggets at lunchtime?” (It’s often challenging to get clear responses from them beyond “I don’t know” or “I’m not sure, Daddy.”)

I am hoping Nvidia will be able to help.

Markets and the Economy

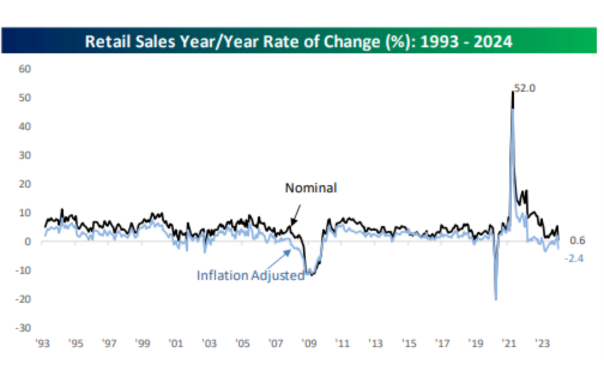

After a record six straight better than expected reports, US Retail Sales for January, came up short relative to consensus forecasts. While economists were already expecting a modest decline in the headline report, the actual reading showed a decline of -0.8% relative to December.

Stripping out Autos and Gas, the results weren’t quite as weak, but they were still down. In terms of revisions, December’s headline reading was taken down to +0.4% from +0.6%, but there was no change to the ex-Autos and ex-Gas readings.

Although the January report was weaker than expected and a broad disappointment, heading into the report, the last six reports were all better than expected, which is a record, dating back to 1992.

Additionally, there have been some big swings in the January readings in the post-COVID period. The data shows that the consumer took a breather in January, but seasonal adjustments could have also exaggerated the weakness.

One notable trend, impacting the headline figures of Retail Sales in the post-Covid era, is inflation.

Illustrated in the chart below is the year-on-year change in Retail Sales, presented in both nominal and inflation-adjusted terms since 1993.

- Following the peak of the COVID pandemic, both nominal and inflation-adjusted sales have experienced a decline, with the latter showing a more pronounced drop, even entering negative territory at one point in early 2023

- After reaching a low point of -3.5% last April, inflation-adjusted sales saw a significant rebound to +1.9% in December. However, the January report reversed this momentum, indicating a decline of -2.4%

Source: Bespoke Invest

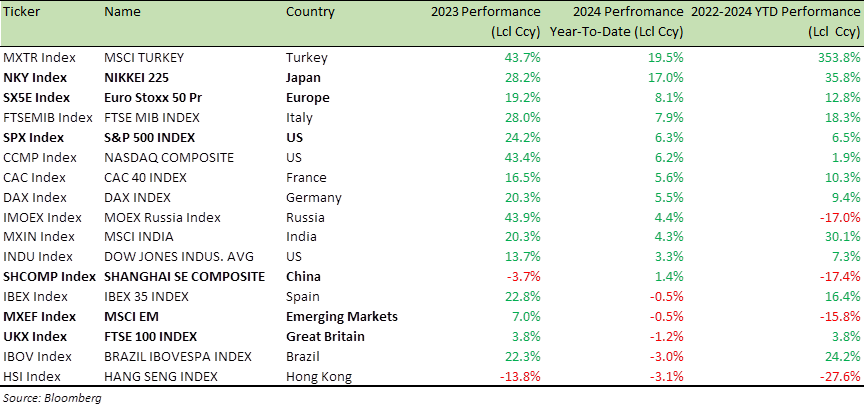

The Tech heavy NASDAQ index has continued where it finished last year. After a stellar +44% performance in 2023 (see table below), the index continues to move higher.

Last Thursday, the Nasdaq 100 gained more than +3% and closed at an all-time high. That hasn’t happened since March 22, 2000. Similarly, the S&P 500 (SPX) gained just over +2% and also closed at an all-time high. That hasn’t happened since March 21, 2000.

Benchmark Global Equity Index Performance (2023; 2024 YTD and 2022-2024 YTD)

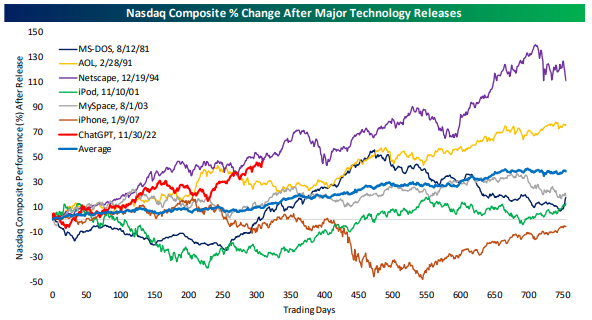

Given the significant and expanding popularity of AI and the performance of AI stocks overall, since the release of ChatGPT in late 2022, it’s natural to seek historical comparisons.

One emerging question among analysts, is whether the current trend resembles the early to mid-90s, during the infancy of the Internet boom, or the late 1990s, nearing the peak of the Dot-Com bubble. The chart below from Bespoke Invest, our research provider, examines the performance of the NASDAQ in the years following several major technological releases in modern history.

These include:

- The debut of the first MS-DOS operating system for PCs in August 1981

- The launch of America Online (AOL) in February 1991

- The introduction of the Netscape web browser in December 1994

- The unveiling of the iPod in November 2001

- The emergence of MySpace in August 2003, and

- The iPhone in January 2007

These milestones represented key advancements in personal computing, the internet, web browsing, digital media/smartphones, and social media.

Interestingly, the NASDAQ rally since the release of ChatGPT in November 2022, closely resembles the surge observed after the introduction of Netscape in December 1994.

As of now, we are 309 trading days after the release of ChatGPT, and the Nasdaq has risen by +46.07% during this period. Comparatively, in the 309 trading days following the launch of Netscape, the Nasdaq experienced a similar gain of +45.9%. The resemblance is strikingly similar.

Furthermore, the NASDAQ ‘s performance in the first 309 days after the release of AOL in 1991, also bears resemblance to the current trend since ChatGPT’s release.

In hindsight, the rally in the NASDAQ continued to gain momentum after the launch of AOL and Netscape, fuelling speculation that we might still be in the early stages of the AI boom. Time will tell.

Source: Bespoke Invest

In the earnings call last week, Nvidia Chief Executive Huang described AI as hitting “the tipping point” and indicated demand for the computing power that underlies AI remained astronomical. “Demand is surging worldwide across companies, industries and nations,” he said.

In my view, the current AI growth differs from the internet bubble era. With the abundance of data since the internet’s inception, we are witnessing the democratization of data and information through large language models (LLM), leading to improvements in productivity and economic growth.

AI is a very powerful technology, which will change the fortunes of those who set themselves up to benefit from it. AI will be what the next generation is raised on.

While AI will replace many jobs, humans will still be necessary for numerous tasks, ultimately leading to increased productivity and GDP.

AI has the potential to remove barriers to learning programming, potentially leading to a surge in productivity. Instead of mastering programming languages or relying on costly programmers, individuals can simply input text instructions and data into AI systems, which will then provide answers in plain English and develop software and applications tailored to specific industry need.

Meanwhile, the US Federal Reserve’s Federal Open Market Committee (FOMC) faces a significant and immediate macroeconomic challenge posed by AI – The speculative investment and AI boom are driving aggregate demand and creating highly accommodative financial conditions.

Consequently, the Federal Reserve (the Fed) is unlikely to further ease conditions by cutting interest rates soon.

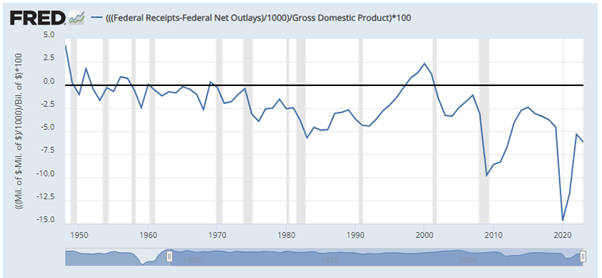

The US Federal budget balance as a fraction of GDP (1948-present)

Source: OMB; St. Louis Fed

Furthermore, with the economy currently experiencing robust growth (GDP growth of over +3%) and inflation remaining at +3%, the Fed could opt to delay a rate cut to the second half of the year.

It’s important to highlight that the US Government is currently in a phase of increased spending, which is contributing to economic growth. However, running a budget deficit of over 6.5% of GDP during peacetime (as indicated in the chart above) is a significant concern, albeit one to address later.

Below is the 18-month price chart for the S&P 500 (SPX), which traces back to the beginning of the current bull market in October 2022.

Whether you adhere to the principle of “the trend is your friend” or “don’t fight the tape” in trading, they essentially convey the same message. Presently, the directional trend in SPX continues to point upwards (see chart below).

18-month price chart: S&P 500 Index

Source: Bloomberg

It’s been a while since we discussed Crypto, so let’s take a look at how things are shaping up.

When the Bitcoin ETFs were initially launched on January 11 earlier this year, prices immediately dropped by more than -20%, resembling another sell-the-news event surrounding a Bitcoin milestone. However, in the past month alone, the largest cryptocurrency has surged by more than +40% (and +55% from the January sell-off lows, as shown in the chart below).

Bitcoin (XBT) is now just a little over 10% away from its previous all-time high. Could 2024 be the year for a new high in Bitcoin?

Even more remarkable than Bitcoin’s recent rally is Ethereum’s (XET) ascent. In the last month alone, the second-largest crypto has surged by +47%, surpassing even Nvidia Despite this impressive surge, Ethereum remains -30% below its November 2021 high of $4,800.

In a “gold rush,” selling “shovels” can be a profitable venture. Coinbase, an exchange for buying and selling cryptocurrencies, serves as a “shovel” in the Crypto “gold rush” and has experienced an impressive +55% rally over the last four weeks.

1-Year price chart: Bitcoin (XBT), Ethereum (XET) and Coinbase (COIN)

Source: Bloomberg

When considering the broader market, it’s essential to bear in mind the historical context referenced in last month’s Market Viewpoints, which I’m reiterating below.

“Looking to the Median: Post-WWII, the median bull market experienced a surge of +83.1% over 1,418 days. If we apply these medians to the current bull run, we could anticipate an SPX target of approximately 6,700 by late May 2026.”

Market volatility is a regular feature and should be expected. Short-term predictions for market movements can be notably challenging. Therefore, I emphasize the value of equity structured products as a highly effective way to invest in equities, serving to navigate and potentially benefit from heightened market volatility.

These products provide a certain level of capital protection, all the while aiding in the identification of favourable entry points in the market and offering opportunities to generate returns, even in a flat or negative market environment.

For specific stock recommendations and insights related to structured products, please don’t hesitate to reach out to me or your dedicated relationship manager.

Best wishes,

Manish Singh, CFA