The AUKUS defence is a disaster for France and it has reduced the EU to the status of a paper tiger now that the UK has left the EU. The geopolitics and economic centre of the world is fast shifting eastwards. US-China relation in the Indo-Pacific will be the defining issue of the 21st century.

Summary

America’s withdrawal from Afghanistan, the Quad partnership (US, Japan, Australia, India), the Five Eyes Alliance (US, UK, Canada, Australia, New Zealand), and now the AUKUS pact (Australia, UK, US) all indicate that the defining issue of the 21st Century will be the strategic rivalry in the Indo-Pacific region – between the United States and China.

The AUKUS defence pact however, is not only a commercial disaster for France, it also deals a body blow to France’s ambitions in the Indo-Pacific region. European leaders ought to be thinking if the US and the UK can do this to France, what chance does the rest of the EU stand against the ambitions and self-interest of the Anglo-Saxon alliance? It suddenly highlights to the EU how weak they are now that the UK has left the EU. You can’t fault French President Emmanuel Macron for wanting an EU army. However, to have an EU army or not seems to be an intractable problem. Germany, the most important member of the EU, is largely a pacifist state and only too happy to piggyback off NATO for its security and, it would seem very few others in the EU, want to be led by the French. With so many differing views by the time the politicians of the 27 member states decided there was a viable military threat and mobilised an EU Army, Europe would have fallen.

No “tapering” was announced at the September meeting of the US Federal Reserve. However, I expect the Fed to announce a gradual taper in November, that wraps up by mid-June 2022. There’s a lot of talk right now about the global supply chain crisis and I am afraid we will hear more of it over the next few months. Factory shutdowns (particularly in Asia as they manage and contain outbreaks of Covid-19), port closures in China, commercial flight reductions and container ships challenges globally – are hampering supplies. Lingering growth concerns mean that monetary policy is not going to tighten much anytime soon – even as bond yields and inflation rise temporarily. “Tapering” will not imperil the Bull run in equities as the market fully expects the Fed to taper and eventually stop asset purchases. Even if asset purchases end, the Fed is a long way off from raising interest rates. Equites are still a good place to be.

The AUKUS ruckus

France is livid at Australia’s decision to cancel a $90 billion contract it signed with the French company Naval Group in 2016, for a fleet of 12 diesel-electric submarines and replace it with the AUKUS defence pact – a new three-way strategic defence alliance between Australia, the UK and US. This new alliance, will see the UK and the US jointly build eight nuclear-powered submarine for the Royal Australian Navy. Nuclear-propelled submarines are stealthier and faster than conventional diesel-powered boats, and can deploy for long periods, far from home. The US and UK will also provide Australia long-range cruise missiles and other defence technologies, including cybersecurity and artificial intelligence.

The AUKUS deal is not only a commercial disaster for France, it also deals a body blow to France’s ambitions in the Indo-Pacific region. France is a resident player in the region via its overseas territories and 93% of its Exclusive Economic Zone (EEZ) is located in the Indian and Pacific Oceans. The region is home to 1.5 million French people, as well as 8,000 French troops stationed in the region. France’s Indo-Pacific strategy announced in 2019 was, based in part on its emerging partnership with Australia. That relationship now lies in tatters. A humiliated France called the AUKUS deal a “stab in the back.”

The deal announced two weeks ago and signed in Washington last week with all three leaders – UK Prime Minister Boris Johnson, US President Joseph Biden and Australian Prime Minister Scott Morrison – present, has caused a major diplomatic ruckus and, at one point, threatened to plunge the western world into an unprecedented diplomatic crisis as France recalled its Ambassadors to the United States and to Australia. The French Ambassadors have since returned to their respective postings. It’s the first time since the American Revolutionary War (1775-1783), that France has felt the need to recall its Ambassador to the US, such is the French anger at the “betrayal.”

America’s withdrawal from Afghanistan, the Quad partnership (US, Japan, Australia, India), the Five Eyes Alliance (US, UK, Canada, Australia, New Zealand), and now the AUKUS pact (Australian, UK, US) all indicate that the US is stitching together a robust coalition to contain China’s rise and its influence in the Indo-Pacific region. The US security network also stretches into the Association of Southeast Asian Nations (ASEAN), where Singapore, Malaysia, Thailand and the Philippines, each host US troops from time to time.

It is now beyond doubt that the defining issue of the 21st Century will be the strategic rivalry in the Indo-Pacific region between the United States and China. In this respect, the US pivot to Asia-Pacific, risks deepening fractures in the North Atlantic Treaty Organization (NATO) – the bulwark of guaranteeing peace in Europe.

European Union (EU) leaders couldn’t contain their excitement when Biden was elected President of the United States. The Financial Times declared – “The Grown Ups are Back in Charge in Washington.” The AUKUS deal is an astonishing lesson in realpolitik for the French who like to describe themselves as America’s oldest ally. The AUKUS nations didn’t even see it fit to inform the French ahead of the announcement, let alone discuss it with them constructively and yet, for decades, France has been the only EU nation to provide direct military support to the US-led actions globally. The EU leaders ought to be thinking if the US and the UK can do this to France, what chance does the EU stand against the ambitions and self-interest of the Anglo-Saxon alliance? It suddenly highlights to the EU how weak they are now that the UK has left the EU.

A US Virginia-class (also known as the SSN-774 class), is a class of nuclear-powered cruise missile fast-attack submarine

Source: General Dynamics/US Navy

An incandescent French President Emmanuel Macron is now doubly determined to build a 5,000-strong EU army, with France playing a leading role in it to restore some of the lost French pride.

Is it a good idea? Will there be an EU army?

You can’t fault Macron for wanting an EU army. A nation or a bloc (as the EU is) can’t have a foreign policy without an army, just as it can’t have monetary union without political union. The EU is a half-way house and risks irrelevance if it can’t make up its mind on what sort of entity it wants to be.

Having said that, to have an EU army or not seems to be an intractable problem. At least nine of the 27 EU countries have neutrality written into their constitutions. Germany the most important member of the EU is largely a pacifist state and only too happy to piggyback off NATO for its security.

Germany is not keen to maintain a standing army, let alone create and lead the EU army. One recent report indicated that the Bundeswehr (Military of Germany) was so under-resourced that one tank unit was forced to use a broomstick painted black to simulate a missing gun on a Boxer armoured fighting vehicle. The German Luftwaffe had only four combat-ready Eurofighter jets out of 128, because of missile shortages and a problem with coolants and all six German submarines had to be put out of service for repairs.

France on the other hand is militarily capable and wants to lead the EU army. However, it would seem very few in the EU want to be led by the French. Particularly, the Eastern European members like Poland and the Baltics nations have more trust in the NATO and the Anglo-Saxon nations than France or Germany. Who can blame them given their experience of two world wars?

Over the past 2 years, UK armed forces have been deployed in Estonia, Romania and Lithuania. It is the inescapable reality that the overwhelming majority of the power of NATO is delivered by the Anglo-Saxon nations.

I am very sceptical of an EU army. The EU’s handling of the vaccine procurement programme told you all you need to know about them working together over globally important matters. In my opinion, an EU army would be doomed to failure. In the EU, decisions are made by unanimity.

How you get 27 governments to agree to attack or even defend a target in the brief time available for such decisions, is highly questionable. With so many differing views by the time the politicians of 27 member states decided there was a viable military threat and mobilised the EU Army, Europe would have fallen. However, if the EU does set up an army of 5,000, it will be the only brigade in the world with 27 Generals – one for each member nation. Whoever supplies the gold braid for them (and inevitable layers of Colonels and Major Generals) is going to make a lot of money.

Markets and the Economy

Last week, the AAII US Investor Sentiment Survey, which had been as high as 43.4 at the beginning of September, plunged to a new 12-month low of 22.4, before bouncing back slightly to 29.9 this week. The survey is a weekly measure of American Association of Individual Investors (AAII) members, which asks them if they are “Bullish,” “Bearish,” or “Neutral” on the stock market over the next six months.

The overly bearish sentiment, was largely driven by the anticipation that the US Federal Reserve (the Fed) was set to announce “tapering” (reducing) its asset purchase program at the Federal Open Market Committee (FOMC) meeting held last week. The Fed is currently purchasing $80 billion in US Treasuries and $40 billion in mortgage backed securities (MBS) every month.

In the end, no tapering was announced at the September meeting, but it’s very likely that the Fed will start to reduce, or taper, its $120 billion in monthly asset purchases as soon as its next scheduled meeting in November.

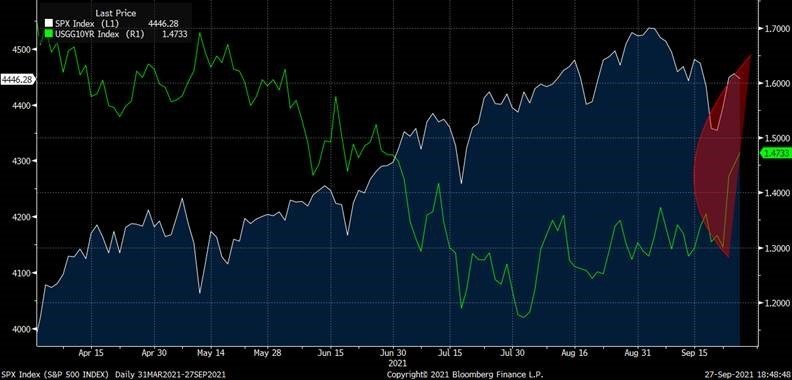

The US 10y Treasury yield has risen in anticipation rising from +1.3% to +1.5% (chart below), yet barring a couple of volatile sessions, the S&P 500 index has held up well and risen. This however, hasn’t stopped the “permabears” from calling an end to the Bull-run in equities which started in March last year.

S&P 500 Index, 10 year US Treasury yield – 6 month price chart

Source: Bloomberg

In my nearly 17 years in this profession, I have never seen a Bull market that has been viewed with such cynicism and scepticism. Every 1-2% correction is followed by a dire prognosis by the usual permabears. Red lights start flashing on CNBC and the parade of the bears ensues. Every short pull-back is met with more rash predictions of a disaster ahead.

In my opinion, Bull markets don’t end when there is still is so much scepticism. Bull markets end when there is all around euphoria and everyone is all-in at the top. The bearish sentiment remains high and it tells me that this Bull Run in equities has more room to run. Ignore the noise and instead focus on long term economic trends, secular policy or market structure changes.

As for short term pullbacks, these can happen even in healthy markets with strong economies. In fact, the S&P 500 has dealt with 32 pullbacks of -10% or more since 1950. Data crunched by Callie Cox of Ally Invest, shows that of those pullbacks, just 11 took place during economic recessions. The other 21 were quick storms, rebounding to new highs in an average of five months.

Here is another statistic tallied by investment blogger Brian Feroldi:

2011: Europe debt crisis

2012: Fiscal cliff

2013: US Government shutdown

2014: Ebola

2015: Brexit

2016: U.S. Election

2017: Harvey/Irma/Maria storms

2018: 2 US Government shutdowns

2019: US Impeachment inquiry

2020: COVID-19

2021: US Capitol Attack

During the above period 2011-2021, what was the total return of the S&P 500? Well, a staggering +375%!

The message is simple – stay invested if you believe the growth outlook over the medium to long-term remains positive. The conditions that have boosted equities – accommodative fiscal and monetary policies, very low to zero yields on cash and the low yields on bonds, growth upturn, and no inflationary concerns over the medium term – all still prevail.

Long-time readers of this newsletter will know that I do not believe in timing the market. Timing the market and getting it right is a matter of luck. In my opinion, one has to be either conceited or not understand probability and chance, to think that one can time the market.

Yes, there will be market corrections but “Time in the market” holding assets you have researched well will always beat “Timing the market”.

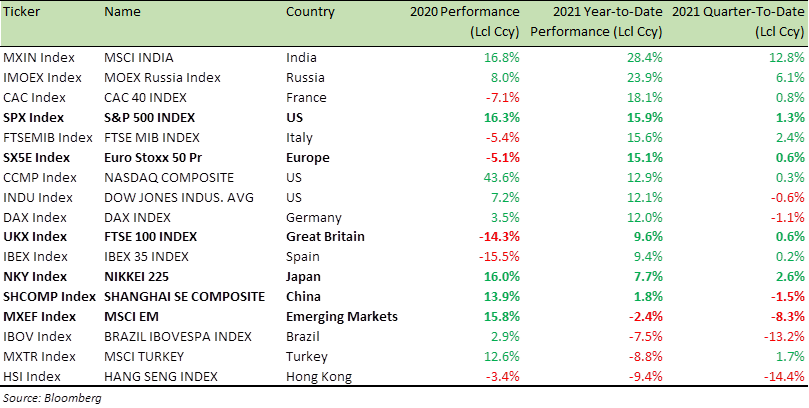

Benchmark Global Equity Index Performance (2020, 2021 YTD)

One other issue that has consumed the markets of late is – Evergrande.

No, it’s not the new size of pumpkin spice latte at Starbucks and nor is it a new lipstick line by Ariana Grande. Evergrande is the second-largest property developer in China by sales and it is in distress.

Is this China’s “Lehman moment?”

No, it isn’t.

“Lehman moments” are always a policy choice. The US Treasury made a conscious decision to let Lehman go bust. They regretted it later. Such monumental events don’t happen by chance but by choice.

China will not make that choice. China doesn’t want a systemic crisis. It doesn’t want a “Lehman moment.”

My understanding of China, its culture and psyche tells me Evergrande will “not get a bailout” but that retail investors who have bought the property from Evergrande will be protected and “made whole.” Other Chinese developers will be asked to take over Evergrande’s unfinished projects, complete them and deliver the properties to the rightful owners, who have already paid for them. China via its central bank People’s Bank of China (PBoC) will always protect the Chinese consumers. It’s a matter of existential importance for the Chinese Communist Party (CCP).

Also, bear in mind Lehman was an investment-grade credit, and the Lehman bonds were held by mom and pop investors via money market funds. Evergrande has been rated junk for a long time now. Therefore, expect an upturn in Chinese equities and Emerging Market equities as soon as the Evergrande issue is resolved or there is more clarity from the PBoC.

Over in Europe, the German elections are over. The Social Democrats (SPD) led by the current Finance Minister Olaf Scholz won 25.8% of the vote, while Chancellor Angela Merkel’s Christian Democrats (CDU) and its Bavarian sister party, the Christian Social Union (CSU), received a combined 24.1%, down from 32.9% at the last general election in 2017. The Green party came third, on 14.6%, followed by the Free Democrats (FDP) with 11.5% and the right-wing populist Alternative for Germany (AfD) with 10.4%.

Germany’s proportional electoral system makes it difficult for parties to have absolute control over parliament and hence the government. This time, with the largest party (SPD) only getting a quarter of the votes, the race is now on to form Germany’s first three-party ruling coalition since the early 1950s. The SPD and the Greens governed Germany together from 1998 to 2005. The CDU-CSU and the FDP are old allies and last ran Germany in a coalition government under Merkel from 2009 to 2013.

The SPD and the Greens would like to raise income tax on higher earners and bring back Germany’s wealth tax, which was abolished in 1997. The Greens would also like Germany to take on €500 billion of public debt for investment and give Berlin’s blessing to a permanent mechanism for the EU to borrow money in its own right.

The FDP much like the CDU-CSU promises not to raise taxes. It also pledges to reduce the burden of tax and bureaucracy on businesses. The FDP also want to reduce the total burden of business tax from 31% to 25%, create tax breaks for private investment, and take Germany back to the “Black Zero”, the stringently balanced budget it maintained before the pandemic.

I suspect we will see a Grand coalition of SPD-CDU/CSU and FDP with SPD’s Scholz as the new Chancellor.

In 2017, it took six months to form a new government. I do not expect the new coalition government to be in place this side of Christmas. A Chancellor Scholz on the margins would be fiscally loose, but in no way a game-changer for EU politics, as some expect or make it out to be.

Benchmark US equity sector performance (2020, 2021 YTD)

There’s a lot of talks right now about the global supply chain crisis and I am afraid we will hear more of it over the next few months.

Product delays, product shortages and rampant freight costs, will all weigh on growth in Q4 and possibly Q1. The supply concerns are also magnified as demand is running very high. Consumers flush with cash from personal savings and payment support from the government are not afraid to spend.

However, factory shutdowns (particularly in Asia as they manage and contain outbreaks of Covid-19), port closures in China, commercial flight reductions and container ships challenges globally -are hampering supplies.

Did you know that approximately 50% of air cargo is transported on passenger flights?

It’s a great revenue stream for passenger airlines. With travel, particularly international travel still much reduced, there is a significant reduction in air cargo capacity causing further supply issues.

All this means, the monetary policy is not going to tighten anytime soon even as bond yields and inflation rise temporarily.

Equites are still a good place to be. I expect the Fed to announce a gradual taper in November that wraps by mid-June 2022. Tapering will not impact the equity market a great deal, as the market fully expects the Fed to taper and eventually stop asset purchases. Even if asset purchases end, the Fed is a long way off from raising interest rates.

As the table above indicates, Consumer stocks (XLY, XLP) have taken a beating and present a very good buying opportunity. Industrial (XLI) and Material (XLB) sector stocks should also benefit from the cyclical upturn when growth picks up again. Energy stocks are flying and it may be a good idea to trim them in your portfolio. There’s is no shortage of oil and gas in this world. It’s just a matter of supplying them adequately and in time to meet demand.

For specific stock recommendations, please do not hesitate to get in touch.

Best wishes,

Manish Singh, CFA