What’s bond yields got to do with Die Hard, Trading Places ? read in. The disinflationary impact of the two secular forces – demographics and technology – will continue to prevail, as we progress through this decade.

Summary

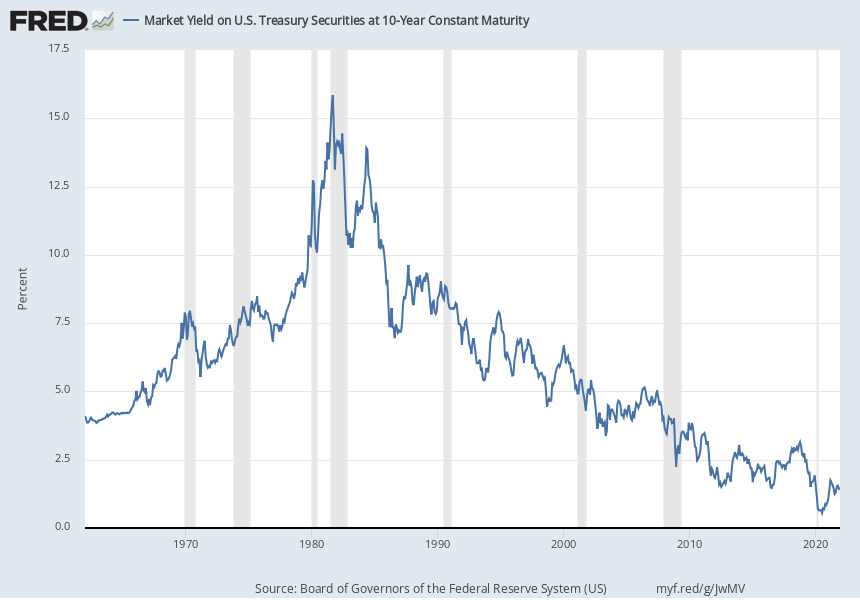

If you were to watch the movie Die Hard this Christmas, just remember that the plot wouldn’t likely exist (or it would be vastly different) if bond yields in the 1980s were not very high. Hans Gruber, the legendary villain in Die Hard, dreams of earning a bond yield of +20%, as he and his accomplices attempt to steal $640 million in bearer bonds. Bond yields have been trending down over the last four decades. In Q1 2000, the US 10Y Treasury yield stood at +6%. That was then. The US 10Y yield currently stands at +1.4% despite the US Federal Reserve (Fed) starting to taper its asset purchases and inflation beginning to cause some consternation. Whilst many would like to blame central banks for the low yields – and Quantitative Easing (QE) has certainly been a contributing factor over the last decade, but the downtrend in bond yields predates QE. Often, a more powerful secular force, greater than the ebb and flow of financial cycles, underpins such long term multi-decade trends. I believe the disinflation trend is not over yet and will reassert itself soon enough. I ardently believe that the disinflationary impact of the two secular forces – demographics and technology – will continue to prevail, as we progress through this decade.

The equity markets are not concerned about the Fed reducing its asset purchases and the bond market is indicating that the Fed will not be raising interest rates anytime soon. It’s also worth noting, that during the most recent tightening period (November 2016 – July 2019), the US economy didn’t enter into recession and neither did equities sell-off. Although, the Fed Funds Rate over the period went from +0.5% to +2.5%, the S&P 500 rose by over +44%. For 2022, I therefore see equities continuing to inch higher in a very benign environment, as Covid finally takes a back seat (let’s hope), and economic growth gets a leg up from a boom in the services sector.

What would Hans Gruber and Ophelia make of current bond yields?

It’s December. Another year has gone by and very soon we will find ourselves sprawled on the couch after a big Christmas lunch (or dinner), working down the list of Christmas movies. For every person who believes Frank Capra’s classic It’s a Wonderful Life is the best Christmas film, there’s another who ranks Miracle on the 34th Street as the true number one. Then there are other favourites such as Home Alone, Bad Santa, Love Actually, Trading Places, Die Hard, and the list goes on…

If you were to watch Die Hard this Christmas, just remember that the movie plot wouldn’t likely exist (or it would be vastly different) if bond yields in the 1980s were not very high. In the movie Die Hard, Hans Gruber (played by Alan Rickman), the meticulous mastermind behind the Christmas Eve Nakatomi Tower heist, is nonchalantly dreaming of earning a bond yield of +20% as he and his accomplices attempt to steal $640 million in bearer bonds of the Japanese firm Nakatomi Corporation.

To quote Gruber – “by the time they figure out what went wrong, we’d be sitting on the beach earning 20%”

Alan Rickman as the villain Hans Gruber in the movie Die Hard (1988)

Source: AF archive / Alamy Stock Photo

In Trading Places, Jamie Lee Curtis’ character Ophelia reveals that she has $42,000 in the bank “in T-bills earning interest” and that she could retire in “two-three more years.”

Being invested in T-bills (a loan to the US government with a maturity of one year or less) and thinking of retiring in 2-3 years, will come as a shock to almost anyone, but particularly shocking to those under the age of 35, who have seen a near-zero yield throughout their adult life.

Yet in 1983, when Trading Places was released, the 3-month T-bill yield was around +9%. You would agree that this is somewhat higher than the measly +0.5% average of the past decade, or even today’s rate of +0.06%? To put it in context, a sum invested in 1980’s-era T-bills would double in eight years. At a yield of +0.5% and +0.06%, the same sum invested in 3-months T-bills, would double in over 130 years and over one thousand years respectively.

Bond yields have been trending down over the last four decades (as the chart below indicates). In Q1 2000, the US 10Y Treasury yield stood at +6%. A decade later, it had halved to +3% and a decade after that, it had halved again to +1.5% by Q1 2021. The yield currently stands at +1.4% despite the US Federal Reserve (Fed) starting to taper its asset purchases and inflation causing some consternation.

While many would like to blame central banks for low yields – and Quantitative Easing (QE) has certainly been a contributing factor over the last decade – the downtrend in bond yield predates QE.

Often a more powerful secular force, greater than the ebb and flow of financial cycles, underpins such long term multi-decade trends.. So, are we now at an inflexion point, as inflation chatter grows? Are bond yields going to reverse course and uptrend? These are trillion-dollar questions, with no quick and easy answers. I believe the disinflation trend is not over yet and it will reassert itself soon enough.

I am not convinced that inflation will be a problem in the medium and long term, as I ardently believe that the disinflationary impact of two secular forces – demographics and technology – will continue to prevail, as we progress through this decade. By demographics, I mean both a low birth rate and people living longer.

A very low birth rate puts downward pressure on demand and technological innovation puts downward pressure on prices. Better technology leads to better supply, as hindrances to increasing supply gets removed at a rapid pace. The post-Covid world is showing no signs of reversal in the falling birth rate and if anything, technological innovations have only accelerated in the wake of the pandemic.

Also, we have seen that people will save even at negative interest rates. Increasing life span probably necessitates it. A savings glut exerts downward pressure on interest rates, keeps the cost of capital down, fuelling further enterprise and technological innovations, which in turn exert further disinflationary pressure on the economy.

Economics is an art and not a science, and so far economists have been shockingly poor in studying the impact of technology on the economy. It’s no wonder economists have got their inflation forecasts wrong consistently over the last decade or so. Disinflation due to technology trends goes unnoticed as the debate gets combined with – “but have you seen the cost of a college education?” or “the cost of healthcare” … et al. Such news items dominate reports, become political pinata to beat the government of the day and colour the newswires. It keeps us distracted and we fail miserably to see secular trends working behind the scenes.

2021 was the year when many expected bond yields to go higher, or to be precise, real bond yields (nominal rate minus inflation) to go higher, as central banks tapered their asset purchases. This didn’t happen.

In 2013, when Fed Chairman Ben Bernanke hinted that the Fed would soon begin to taper its asset purchases, real yields on the 10-year US Treasurys promptly jumped, rising from around –1% back into positive territory. This time around, tapering has started, but the real yields continue to fall, as the chart below indicates.

The bond market is clearly indicating that it doesn’t buy the – inflation is going to be a problem – story. It is perhaps more concerned that when the temporary bout in inflation subsides, growth will be a problem again and as the disinflation trend reasserts, financial repression will resume and US Treasurys will remain bid.

That’s all good news for growth stocks, which have been battered over the last couple of months. As I wrote in the May Market Viewpoints – “Japanification” of the western world is in progress and nothing I have seen, or continue to see, tells me it’s going to stop. Low bond yields are a reality that we will have to live with. The Fed may raise interest rates a couple of times over the next two years, but I suspect the European Central Bank (ECB) will not be so lucky, and it may stay on hold until 2025, if growth doesn’t change dramatically in the Eurozone over the next 12-24 months.

What would Hans Gruber make of the low bond yields now? Would he risk his life over such a feeble yield, let alone get excited about negative real yield bonds? Maybe a discussion to be had over Christmas dinner. Perhaps a remake of Die Hard in a deflationary environment would lead to Hans Gruber fighting to return the stolen bonds to Nakatomi Corporation?

Markets and the Economy

In the markets, all the chatter is about the Omicron variant. So, let’s deal with that right away.

Earlier this week, the first study on vaccine effectiveness versus the Omicron variant was released in South Africa. The research head of a lab at South Africa’s Health Research Institute, released results that showed the impact of antibodies in blood plasma from individuals vaccinated with Pfizer (PFE) – led to a 40 times reduction in the neutralization capacity against Omicron.

This does not mean that vaccines won’t help protect against Omicron’s hit to vaccinated immune systems, and it also does not rule out Omicron leading to fewer deaths or hospitalizations relative to other variants. What it does suggest is that Omicron is very easy to spread and will do so even amongst vaccinated people.

A report in The New York Times on Monday, indicated that researchers at a major hospital complex in Pretoria have reported that their patients with coronavirus were much less sick than those they have treated before, and that other hospitals are seeing the same trends. They said that most of their infected patients were admitted for other reasons and had no Covid symptoms.

So, the early signs seem to indicate that the Omicron variant may be “manageable” and thus – we saw the relief rally in the equity markets on Tuesday.

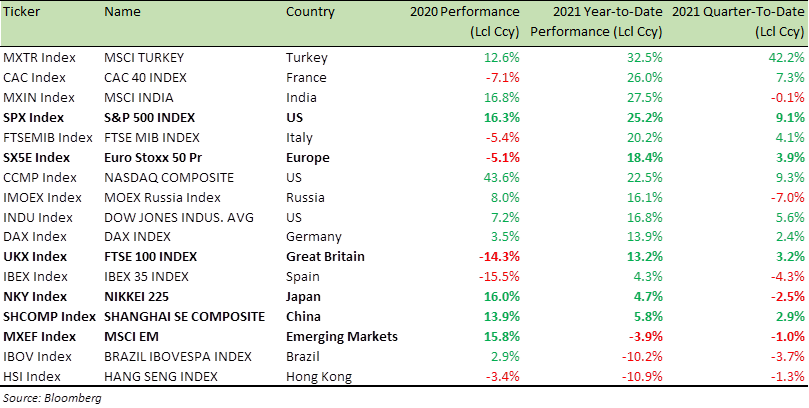

The S&P 500 (SPX) Index may be up over +20% for the year (see table below) but it hasn’t been a smooth ride. We have seen four -4% to -5% dips during the year. The last one came only ten days ago and the most sustained one was in September, when it looked like we may see a bigger move down.

The Omicron variant was discovered only last month, and more study is clearly needed before one can judge, with any degree of confidence, its true impact.

As we know from the Delta variant, the effect of coronavirus is not always felt immediately, with hospitalizations and deaths often lagging considerably behind initial outbreaks.

Let’s hope vaccines, masks and safety measures do their job and we can put Covid behind us once and for all. Make no mistake, there will be more variants. There are more viruses than stars in the universe. An estimated 10 nonillion (10 to the 31st power) individual viruses exist on our planet—enough to assign one to every star in the universe 100 million times over, but most are not poised to hop into humans, let alone infect us. Mammals and birds alone are thought to host about 1.7 million undiscovered types of viruses.

Benchmark Global Equity Index Performance (2020, 2021 YTD and QTD)

Having discussed in the section above – why I don’t believe inflation will be a problem in the medium term, I have just read a news article in The Financial Times entitled “Yellen Says Supply-Chain Shift May Need Protectionist-Like Steps.”

In this article, US Treasury Secretary Janet Yellen says – “It’s possible that policies that people will describe as protectionist are going to be necessary in order to create the appropriate incentives to produce things at home.” Yellen adds – “I don’t think this is just about the United States making everything at home, but in some cases that may be part of the answer.”

Protectionist measures have a history of leading to higher prices and ending in tears for the consumers. So, this is one policy error I would be very wary of, if the US were to go down the path of protectionism and overdo it. This could change the inflation narrative very quickly and is one to keep a watchful eye on during 2022.

Fears of a Russian invasion of Ukraine grew last week, with US officials citing new intelligence reports about a troop build-up at the border. The expected 175,000 troops Russia is planning to assemble at the border, would be roughly twice the size of the build-up in the Spring. This is another development that could upend things in Q1.

Energy exports are the lifeblood of Russia and anything that threatens these will get a big response from them. Eastern Europe could become collateral damage (yet again). Politics will surely dominate economics again next year, as it has for quite some time now.

Last week US Fed Chair Jerome Powell announced the Fed will speed up its taper program and added “it’s time to retire the word transitory regarding inflation.”

Well played Sir! Powell stuck to “transitory” when inflation was rising through to +6%, and now decides to catapult “transitory” when it’s very likely that inflation has peaked. We shall find out when we get the next monthly inflation print in January.

The equity markets are not concerned about the Fed reducing its asset purchases and the bond market is indicating the Fed will not be raising interest rates anytime soon. I see equities continuing to inch higher in a very benign environment, as Covid finally takes a back seat (let’s hope), and economic growth gets a leg up from a boom in the services sector.

It’s also worth noting, that during the most recent tightening period (November 2016 – July 2019) the US economy didn’t enter into recession and neither did equities sell-off. The Fed Funds Rate over the period went from +0.5% to +2.5%, and the SPX rose by over +44%.

The external shock of Covid did cause a recession and a market sell-off, but that had nothing to do with Fed policy. Therefore it’s worth giving credit to the Fed for pulling off a tightening cycle without inducing a recession. Hopefully, the Federal Open Market Committee (FOMC) can do it again.

However, the unpredictability over how long the supply chain issues will last, the macro risk from a Russia-Ukraine escalation leading to higher energy price means policy error risks are more pronounced now than they were in the last cycle. Nevertheless, equities is the asset class I feel most comfortable holding.

With US inflation hitting +6.2%, a level not seen since 1990, many economists and market commentators seem baffled and some even angry, about how equities keep hitting new highs.

Well, the US 10y bond yield is remaining stable in a narrow range of +1.25% to +1.75%, despite the inflation scare. The bond market doesn’t buy the inflation story and therefore equities are a good hold.

Chinese equities are particularly undervalued and they trade at an almost -40% discount to their US counterparts. China sentiment is overly bearish. As China’s credit impulse picks up, Chinese equities will close the valuation gap to US equities. China’s recent cut to its reserve-requirement ratio is another signal that policymakers will deal with a sharp slowdown in growth directly and firmly, no matter what is said or written about the rising debt in the Chinese economy.

Sector-wise, I prefer the Consumer Staples Select (XLP) Discretionary (XLY), Technology (XLK) and Communication (XLC) sectors.

For specific stock recommendations, please do not hesitate to get in touch.

Benchmark US equity sector performance (2020, 2021 YTD)

Anyway, all that is left for me to say this year is thank you for your time and attention. I also wish you and your family all the best for this holiday season as well as a very Happy New Year. And if you celebrate Christmas – hope you have a great one – and watch Die Hard!

Best wishes,

Manish Singh, CFA